Barclays Shocks Customers: Total Ban on All Cryptocurrency Card Transactions!

Barclays cryptocurrency policy, UK banks crypto transaction ban, impact of crypto restrictions 2025

—————–

Barclays Bans Cryptocurrency Transactions: What This Means for Customers and the Market

In a significant move that has sent ripples through the financial and cryptocurrency sectors, Barclays, one of the UK’s leading banks, has announced a ban on customers using their cards for any cryptocurrency transactions. This decision was revealed through a tweet from Bitcoin Archive on June 25, 2025, which highlighted Barclays’ stance against cryptocurrency transactions. As cryptocurrency continues to gain traction globally, this development raises questions about the future of digital currencies and the regulatory environment surrounding them.

Understanding Barclays’ Decision

Barclays’ ban on cryptocurrency transactions comes amid growing concerns about the risks associated with cryptocurrencies. These risks include volatility, fraud, and regulatory scrutiny. By prohibiting card transactions related to cryptocurrencies, Barclays aims to protect its customers from potential financial losses and to align itself with regulatory guidelines that are tightening around digital currencies.

The decision reflects a broader trend among traditional financial institutions that are increasingly wary of the cryptocurrency market’s unpredictable nature. Many banks are adopting a cautious approach to cryptocurrency, opting to either restrict transactions or impose stricter regulations to mitigate risks.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Impacts on Customers

For Barclays customers, this ban means that they will no longer be able to use their debit or credit cards for any transactions involving cryptocurrencies like Bitcoin, Ethereum, and others. Customers who engage in trading, purchasing, or investing in cryptocurrencies will need to seek alternative payment methods, such as bank transfers or using other financial services that allow for crypto transactions.

This decision may lead to frustration among customers who are keen on investing in cryptocurrencies. As digital currencies become more mainstream, many consumers are looking for ways to integrate their investments into their daily financial activities. The ban could push some customers to consider switching banks that offer more favorable policies towards cryptocurrency transactions.

The Broader Cryptocurrency Landscape

Barclays’ ban is part of a larger trend where financial institutions are reevaluating their policies on cryptocurrency transactions. As cryptocurrencies have gained popularity, they have also attracted the attention of regulators worldwide. Governments and financial authorities are increasingly focusing on creating frameworks to regulate cryptocurrency transactions, aiming to protect consumers and ensure market stability.

The Financial Conduct Authority (FCA) in the UK, for instance, has been actively working to regulate the cryptocurrency market. They have implemented measures to ensure that cryptocurrency businesses adhere to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Barclays’ decision may be a proactive measure to comply with these evolving regulations and to avoid potential penalties associated with non-compliance.

Market Reactions

The immediate market reaction to Barclays’ announcement has been mixed. While some investors and analysts express concern over the implications of such a ban, others believe that it could lead to a more stable cryptocurrency market in the long run. The ban may discourage speculative trading and promote a more responsible approach to cryptocurrency investment.

Additionally, the news has sparked discussions about the role of traditional banks in the evolving digital currency landscape. Some argue that banks should embrace cryptocurrencies and find ways to integrate them into their services, while others believe that caution is warranted given the market’s volatility and associated risks.

Alternatives for Cryptocurrency Transactions

With Barclays’ ban in place, customers may need to explore alternative methods for conducting cryptocurrency transactions. Here are a few options that customers can consider:

- Cryptocurrency Exchanges: Many exchanges allow users to buy, sell, and trade cryptocurrencies using bank transfers or other payment methods. Customers can link their bank accounts to these platforms to facilitate transactions.

- Peer-to-Peer (P2P) Platforms: P2P platforms enable users to trade cryptocurrencies directly with one another. These platforms often offer various payment methods, including bank transfers and cash transactions, allowing for greater flexibility.

- Digital Wallets: Customers can use digital wallets to store their cryptocurrencies securely. These wallets often provide options for transactions and can be linked to other payment methods outside of traditional banking systems.

- Alternative Banks and Fintech Solutions: Some digital banks and fintech companies provide services that cater specifically to cryptocurrency users. These institutions may offer more favorable terms for cryptocurrency transactions, making them attractive alternatives for customers seeking to invest in digital currencies.

Conclusion

Barclays’ decision to ban cryptocurrency transactions marks a significant moment in the ongoing relationship between traditional banking and the evolving cryptocurrency market. As regulatory scrutiny intensifies, financial institutions will likely continue to adapt their policies regarding digital currencies.

For customers, this change presents both challenges and opportunities. While it may limit their ability to transact easily with cryptocurrencies, it also encourages them to explore alternative methods and platforms for their investments. As the cryptocurrency landscape continues to evolve, the future may hold more integrated solutions that bridge the gap between traditional finance and digital currencies.

In conclusion, Barclays’ ban is a reflection of the cautious approach many institutions are taking in response to the complexities of the cryptocurrency market. As regulations continue to develop and customer preferences change, the financial industry will need to navigate this dynamic environment carefully to balance innovation with risk management.

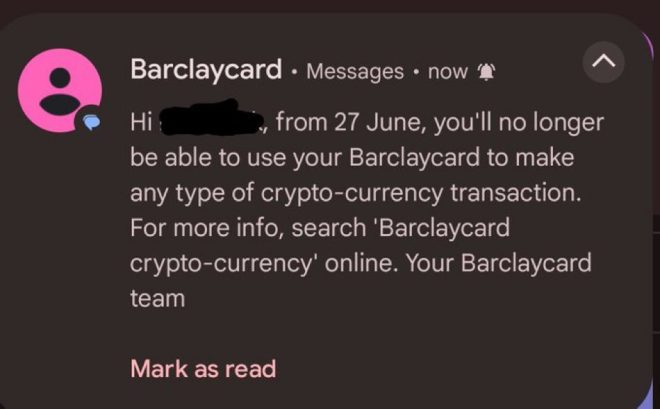

JUST IN: Barclays is banning customers from using their card to make “any type of cryptocurrency transaction” pic.twitter.com/RENDw3gS0p

— Bitcoin Archive (@BTC_Archive) June 25, 2025

JUST IN: Barclays is banning customers from using their card to make “any type of cryptocurrency transaction”

Just recently, news broke about Barclays, one of the UK’s leading banks, taking a significant step in the world of finance. They’ve decided to ban their customers from using their cards for any cryptocurrency transactions. This is a major development that has sent ripples through the crypto community and the banking sector alike. So, what does this mean for customers and the broader cryptocurrency landscape? Let’s dive into it!

What Does the Ban Mean for Barclays Customers?

For those who hold a Barclays account, this ban is quite a shock. Customers will no longer be able to use their debit or credit cards to purchase cryptocurrencies such as Bitcoin, Ethereum, or any other digital asset. This decision aligns with a growing trend among banks wary of the volatility and regulatory risks associated with cryptocurrencies. If you’re a Barclays customer who dabbled in crypto, this new policy might feel like a huge setback.

But why has Barclays made this decision? There’s a mix of regulatory pressure and concerns about fraud and money laundering. Banks are increasingly cautious about the potential risks involved in transactions tied to digital currencies. Additionally, the rapid fluctuations in cryptocurrency values make it a risky venture for financial institutions. If you’re looking for a way to buy crypto, you might have to explore other options or platforms that accept different payment methods.

The Growing Trend of Banks Restricting Crypto Transactions

Barclays isn’t the only bank tightening its grip on cryptocurrency transactions. Several other financial institutions have taken similar measures over the past few years. For example, banks like JPMorgan and Bank of America have also restricted their customers’ ability to purchase cryptocurrencies directly with their cards. This trend showcases how traditional banking systems are grappling with the rise of digital currencies and their implications for financial stability.

As cryptocurrencies gain more traction, the regulatory landscape is becoming increasingly complex. Governments around the world are working to establish frameworks that could govern crypto transactions, which could lead to more restrictions from banks that want to ensure compliance. This situation creates a challenging environment for both financial institutions and consumers who are eager to explore the world of digital currencies.

Understanding the Impact on Cryptocurrency Markets

So, how does this ban affect the broader cryptocurrency markets? Well, the immediate reaction from the market could be quite volatile. News like this often triggers swings in prices as traders react to changes in sentiment. When a significant bank like Barclays makes such a decision, it may lead to increased skepticism among investors. If more banks follow suit, we could see a broader decline in cryptocurrency adoption.

However, it’s not all doom and gloom. While traditional banks may impose restrictions, new platforms that cater specifically to cryptocurrency transactions are emerging. These platforms often provide easier access to digital currencies without the need for traditional banking systems. So, if you’re determined to invest in cryptocurrencies, there are still plenty of avenues available to you.

Alternatives for Cryptocurrency Transactions

If you’re a Barclays customer and feel limited by this new ban, don’t worry! There are plenty of alternatives you can explore. Many cryptocurrency exchanges allow users to purchase digital currencies using bank transfers or alternative payment methods. Platforms like Coinbase, Binance, and Kraken are popular among investors and offer a range of options for buying and trading cryptocurrencies.

Another option is to look into peer-to-peer (P2P) platforms that allow users to buy cryptocurrencies directly from one another. These platforms often provide various payment methods that can bypass bank restrictions altogether. Just make sure to do your due diligence and choose reputable platforms to avoid scams.

The Future of Cryptocurrency and Banking

The relationship between cryptocurrency and traditional banking is evolving rapidly. As digital currencies gain popularity, banks are faced with a choice: adapt to the new landscape or risk becoming obsolete. While Barclays’ decision to ban crypto transactions may seem like a step backward, it also highlights the need for banks to innovate and find ways to integrate cryptocurrency into their services safely.

Some banks are already exploring how to offer cryptocurrency services, such as custody solutions and trading options, in response to customer demand. As regulations become clearer, we may see more banks embracing cryptocurrency, leading to a more integrated financial ecosystem. The future may not be as bleak as it seems, especially for those willing to adapt and explore new opportunities.

The Role of Regulation in Cryptocurrency Transactions

Regulation plays a critical role in shaping the future of cryptocurrency transactions. As governments and financial authorities around the world work to establish guidelines for digital currencies, banks are left navigating a complex legal landscape. This uncertainty often leads to conservative approaches, like the one taken by Barclays.

However, as regulations become more defined, banks may find themselves with clearer pathways to engage with cryptocurrencies. This could lead to a more stable environment for both banks and customers interested in digital assets. In the end, the push for regulation is not necessarily a bad thing; it can help legitimize the cryptocurrency space and build trust among consumers.

How to Stay Informed About Cryptocurrency Developments

Staying informed about developments in the cryptocurrency world is essential, especially in light of changes like Barclays’ recent ban. Following credible news sources, joining online communities, and keeping an eye on regulatory updates can help you navigate this ever-evolving landscape. Social media platforms like Twitter and financial news websites are great resources for real-time updates.

Additionally, consider subscribing to cryptocurrency-focused newsletters or joining forums where enthusiasts discuss market trends and regulatory changes. Being part of a community can provide valuable insights and keep you informed about the latest happenings in the crypto space. Remember, the more informed you are, the better equipped you’ll be to make decisions about your investments.

Conclusion: Adapting to Change in the Cryptocurrency Space

The news of Barclays banning customers from using their cards for cryptocurrency transactions is a reflection of the challenges facing traditional banks as they navigate the rise of digital currencies. While this may seem like a setback for crypto enthusiasts, it also presents an opportunity for innovation and growth within the cryptocurrency space.

As we move forward, it’s crucial for both consumers and financial institutions to adapt to the changing landscape. Whether you’re a seasoned investor or just starting, staying informed and exploring alternative methods for cryptocurrency transactions can help you thrive in this dynamic environment. Embrace the change, and who knows what opportunities may lie ahead in the world of cryptocurrency!