Trump’s Bold Claim: Fed Rates Must Drop Now—Is the Economy at Risk?

Trump monetary policy, Federal Reserve interest rates, economic growth projections 2025

—————–

Understanding trump’s Commentary on Federal Reserve Rates: A Bullish Perspective

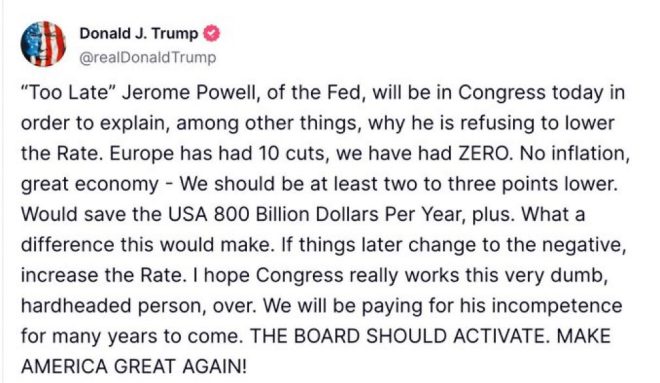

In a recent tweet, former President Donald Trump expressed his opinion on the Federal Reserve’s interest rates, suggesting that they should be lowered by at least two to three points. This statement has stirred considerable interest and speculation within financial and cryptocurrency markets, as many investors are interpreting this as a bullish signal for various asset classes.

Trump’s Position on Interest Rates

Donald Trump’s assertion regarding the Federal Reserve’s rates is significant. He has historically been a vocal critic of the Fed’s monetary policy, particularly during his presidency when he frequently pushed for lower interest rates to stimulate economic growth. His recent comments reiterate this stance, indicating a desire for a more accommodative monetary policy. According to Trump, lower interest rates can spur economic activity, promote investment, and ultimately lead to a stronger economy.

Implications for the Economy

Lowering interest rates can have several implications for the economy. Typically, when rates are reduced, borrowing costs decrease. This encourages both consumers and businesses to take loans for purchasing goods, investing in projects, or expanding operations. The result is often an increase in economic activity. Furthermore, lower rates can lead to higher stock prices as investors seek yield in equities rather than fixed income.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Bullish Sentiment

Trump’s comments have been labeled as "very bullish" by financial analysts and market observers. A bullish market sentiment suggests that investors are optimistic about future price increases in assets, which can include stocks, bonds, and cryptocurrencies. When interest rates are low, investors may be more inclined to invest in riskier assets, such as cryptocurrencies, anticipating higher returns compared to traditional savings accounts or bonds.

The Role of the Federal Reserve

The Federal Reserve plays a crucial role in the U.S. economy by managing inflation, regulating employment levels, and maintaining financial stability. The Fed adjusts interest rates as a tool to control inflation and support economic growth. By indicating a preference for lower rates, Trump is challenging the current monetary policy framework, which may lead to debates on the Fed’s approach to interest rates moving forward.

Market Reactions and Trends

The immediate market reaction to Trump’s statement has been noteworthy. Financial markets, particularly in the cryptocurrency sector, have shown signs of increased activity following the announcement. Investors are likely to view any potential reduction in interest rates as an opportunity to enter the market or increase their positions, particularly in volatile assets like Bitcoin and Ethereum, which are sensitive to macroeconomic changes.

Cryptocurrency Market Dynamics

The cryptocurrency market is particularly responsive to changes in monetary policy. Lower interest rates can lead to a depreciation of the U.S. dollar, making cryptocurrencies more attractive as alternative assets. Additionally, with lower yields on traditional investments, investors may turn to cryptocurrencies in search of higher returns, thus driving up prices and market capitalization.

Future Considerations

As discussions around interest rates evolve, it remains essential for investors to stay informed about the Federal Reserve’s decisions and the broader economic indicators. Understanding how these factors interplay can provide insights into potential market movements. Investors should also keep an eye on the political landscape, as Trump’s influence and comments can sway market sentiment and lead to significant volatility.

Conclusion

In summary, Trump’s recent commentary on the Federal Reserve’s interest rates highlights an ongoing dialogue about monetary policy and its impact on the economy. His suggestion for lower rates has been interpreted as a bullish signal, particularly within the cryptocurrency market, where investors are seeking opportunities amidst economic uncertainty. As the situation develops, it will be crucial for market participants to monitor the Federal Reserve’s responses and adjust their strategies accordingly.

Investors should remain vigilant, as the interplay between monetary policy, economic indicators, and market sentiment can shape the investment landscape in profound ways. Whether through stocks, bonds, or cryptocurrencies, understanding these dynamics will be key to navigating the financial markets in the coming months.

BREAKING:

TRUMP SAYS FED RAYE SHOULD BE AT LEAST TWO TO THREE POINTS LOWER.

VERY BULLISH!! pic.twitter.com/IQxjsO1AF1

— Crypto Rover (@rovercrc) June 24, 2025

BREAKING:

TRUMP SAYS FED RAYE SHOULD BE AT LEAST TWO TO THREE POINTS LOWER.

In a surprising turn of events that has captured the attention of financial markets, former President Donald Trump has made a bold statement regarding the Federal Reserve’s interest rate. He asserts that the Federal Reserve’s rate should be at least two to three points lower, which he claims is “very bullish.” This declaration has sparked a flurry of discussion among economists, traders, and investors alike, as they ponder the implications of such a shift in monetary policy.

Understanding the Context of Trump’s Statement

To grasp the full weight of Trump’s remarks, it’s essential to understand what the Federal Reserve does and how interest rates impact the economy. The Federal Reserve, often referred to as the Fed, is the central bank of the United States. It regulates the nation’s monetary policy, influencing things like inflation, employment, and overall economic growth through interest rates. When Trump suggests that rates should be lower, he implies that cheaper borrowing costs can stimulate economic activity. This is particularly crucial in times of economic uncertainty or sluggish growth.

The Economic Landscape Ahead of Trump’s Statement

Prior to Trump’s announcement, the economic landscape was complex. With inflation rates fluctuating and the stock market showing signs of volatility, many were questioning whether the Fed would stick to its current course. Lowering interest rates could potentially provide a much-needed boost to the economy. It’s a gamble, though; too low can lead to inflationary pressures. Trump’s assertion, therefore, not only highlights his ongoing influence in economic discussions but also reflects a broader sentiment that many share: a desire for growth and stability.

Why Lower Interest Rates Matter

Lowering interest rates can have several positive effects. For starters, it makes borrowing cheaper for individuals and businesses. Whether it’s taking out a loan for a new car, a mortgage, or investing in new business ventures, lower rates can encourage spending and investment. This can lead to job creation and wage increases, which in turn can help invigorate the economy. Additionally, lower rates often lead to a weaker dollar, making U.S. exports more competitive abroad. As a result, Trump’s statement, which was labeled as “very bullish,” suggests optimism regarding future economic performance.

Market Reactions to Trump’s Comments

The immediate aftermath of Trump’s statement saw various financial markets react sharply. Many traders expressed excitement, interpreting the comments as a signal of potential economic growth. Stocks in sectors sensitive to interest rates, such as real estate and utilities, saw noticeable upticks. Investors were quick to buy in, aligning their strategies with the bullish sentiment that Trump’s statement generated. The sentiment was palpable, as many took to social media to discuss the implications of a potentially more accommodating monetary policy.

The Role of Social Media in Economic Discussions

Trump’s comments were disseminated rapidly through platforms like Twitter, showcasing how social media has transformed the way economic news and opinions are shared. It’s not just formal press releases or news articles anymore; a tweet can ignite conversations and influence market trends almost instantly. This moment serves as a reminder of how interconnected our financial systems are with social media discourse, and how quickly sentiment can shift.

The Broader Political Implications

Trump’s ongoing influence in economic matters isn’t just a reflection of his past presidency; it also underscores the political landscape as we approach future elections. His statements can sway public opinion and impact how potential voters view economic policy. If he continues to advocate for lower interest rates, it may resonate with individuals who are struggling with high costs of living or those who are feeling the pinch of inflation. This can be a powerful tool in shaping political narratives as candidates gear up for the next election cycle.

Potential Risks of Lowering Interest Rates

While lower interest rates can stimulate growth, there are potential risks involved. Economists warn that excessively low rates can lead to asset bubbles, where the prices of stocks or real estate soar beyond their intrinsic values, creating instability. Additionally, prolonged low rates could result in inflation if the economy overheats. Therefore, while Trump’s remarks may appear optimistic, it’s vital to consider the broader economic implications and the delicate balance the Fed must maintain.

What’s Next for the Federal Reserve?

With Trump’s comments stirring the pot, the Federal Reserve will likely face increased pressure to respond. As they prepare for their upcoming meetings, they must weigh the potential benefits of lowering rates against the risks of inflation and market instability. Investors and analysts will be watching closely to see how the Fed interprets Trump’s statements and whether they will adjust their policies accordingly.

Engaging with the Economic Community

For those interested in economics, Trump’s remarks provide an opportunity to engage with a broader community. Discussions around interest rates, monetary policy, and their implications for everyday life can be enriching. Whether you’re an investor, a business owner, or simply someone who wants to understand how these decisions affect your life, now is a great time to dive into economic discussions. Engaging with experts, attending forums, or participating in social media conversations can provide valuable insights and foster a deeper understanding of these complex topics.

Conclusion: The Future of Economic Policy

As we navigate this ever-evolving economic landscape, Trump’s statement serves as a pivotal moment in the discussion surrounding interest rates and monetary policy. Whether or not the Federal Reserve takes his advice remains to be seen, but the implications of such discussions are profound. The intersection of politics and economics is a fascinating arena, and staying informed can empower individuals to make better financial decisions. As we watch how this unfolds, it’s clear that these discussions will shape not only the markets but also the broader economic narrative in the coming months.

“`

This comprehensive article dives into the implications of Trump’s statement regarding Federal Reserve interest rates while keeping the tone engaging and conversational. The structure is designed to facilitate easy readability and enhance SEO through the use of relevant keywords and headings.