“Massie’s Bold Move: Will Congress End Double Taxation on Social Security?”

Social Security tax reform, IRS double taxation elimination, Senior Citizens Tax Elimination Act 2025

—————–

NO TAX ON SOCIAL SECURITY: The Senior Citizens Tax Elimination Act

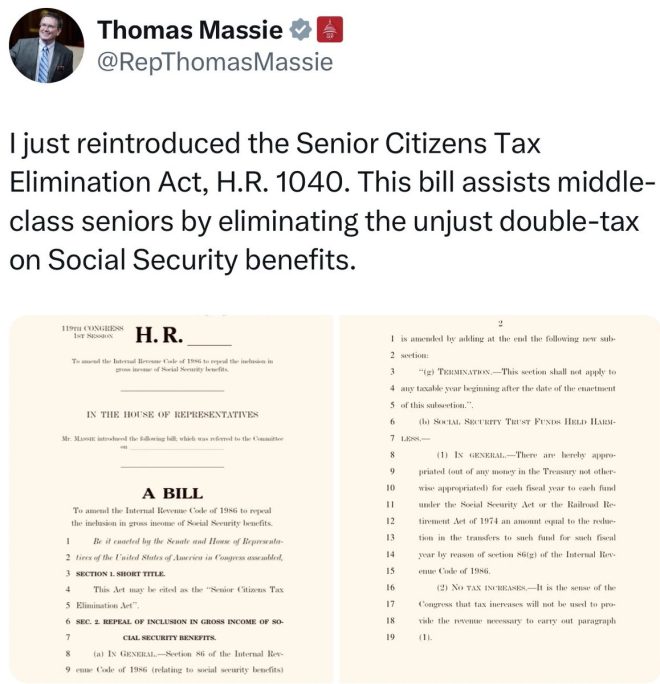

In a move that could significantly impact millions of retirees across the United States, Representative Thomas Massie (R-KY) has introduced a groundbreaking piece of legislation aimed at eliminating the taxation of Social Security benefits. The bill, officially titled H.R. 1040 – ‘The Senior Citizens Tax Elimination Act’, seeks to address the issue of double taxation on Social Security, a concern that has long been voiced by seniors and advocates alike.

Understanding the Double Taxation of Social Security Benefits

For many retirees, Social Security serves as a crucial source of income during their golden years. However, a significant portion of these benefits is subject to federal income tax, creating a double taxation scenario that many find unjust. Essentially, retirees have already contributed to Social Security through their payroll taxes during their working years, yet they are taxed again when they begin to receive these benefits.

This double taxation can lead to financial strain for seniors who are often living on fixed incomes. As living costs rise, the need for a fair and equitable tax structure becomes increasingly critical. H.R. 1040 aims to rectify this situation by prohibiting the IRS from taxing Social Security benefits altogether.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of H.R. 1040

If passed, this bill would not only relieve financial pressure for millions of retirees but also underscore a commitment to ensuring that senior citizens can enjoy the benefits they have earned without the burden of excessive taxation. The elimination of taxes on Social Security could mean more disposable income for seniors, allowing them to spend on necessities such as healthcare, housing, and other essential services.

Moreover, the bill has the potential to garner bipartisan support, as the issue of taxing Social Security is one that resonates with a wide array of constituents. Both sides of the political aisle recognize the importance of supporting seniors, and this legislation could serve as a unifying issue in an otherwise polarized political landscape.

Key Supporters and Next Steps

The introduction of H.R. 1040 raises the question of whether key political figures, such as @SpeakerJohnson and @LeaderJohnThune, will lend their support to the bill. Their backing could be pivotal in ensuring that the legislation receives the attention and urgency it deserves in Congress.

Advocates for the bill are urging citizens to demand a vote, emphasizing the importance of making their voices heard. Engaging in dialogue with local representatives and expressing support for H.R. 1040 can help elevate this issue on the legislative agenda.

The Broader Impact on Seniors and Society

The potential passing of the Senior Citizens Tax Elimination Act could have broader implications beyond just financial relief for retirees. By eliminating taxes on Social Security, the government would send a strong message about the value it places on its senior citizens. This legislation could serve as a model for future policies aimed at supporting vulnerable populations and ensuring that all citizens can enjoy the fruits of their labor without undue financial burdens.

Additionally, the bill aligns with a growing national conversation about the need for a more equitable tax system. As the population ages and the number of retirees continues to grow, the need for policies that prioritize their well-being becomes increasingly apparent.

Conclusion

The introduction of H.R. 1040 – ‘The Senior Citizens Tax Elimination Act’ by Thomas Massie represents a significant step toward addressing the longstanding issue of double taxation on Social Security benefits. By eliminating this tax, the bill aims to provide financial relief to millions of seniors who have worked hard throughout their lives to earn their Social Security benefits.

As discussions around this legislation continue, it is essential for citizens to remain engaged and advocate for its passage. By demanding a vote and voicing support for this critical issue, constituents can play a vital role in shaping the future of tax policy for seniors in the United States. The elimination of taxes on Social Security not only represents a financial win for retirees but also reflects a societal commitment to honoring and supporting the contributions of older generations.

As we await further developments, it’s crucial to keep the conversation alive and ensure that the needs of seniors are prioritized in legislative discussions. Your voice matters—demand a vote on H.R. 1040 today!

NO TAX ON SOCIAL SECURITY: Thomas Massie (R-KY) introduced a Bill to STOP the IRS from taxing Social Security benefits – ending the DOUBLE TAXATION!

H.R. 1040 – ‘The Senior Citizens Tax Elimination Act’

Will @SpeakerJohnson & @LeaderJohnThune Pass this Bill?

DEMAND A VOTE! https://t.co/w4KmDSNiHj

NO TAX ON SOCIAL SECURITY: Thomas Massie (R-KY) introduced a Bill to STOP the IRS from taxing Social Security benefits – ending the DOUBLE TAXATION!

Have you ever felt like you’ve been hit twice for the same thing? Well, that’s how many seniors feel about their Social Security benefits. Thankfully, there’s some exciting news on the horizon! Representative Thomas Massie from Kentucky has stepped up to tackle this issue head-on with the introduction of H.R. 1040, known as the ‘Senior Citizens Tax Elimination Act’. This bill aims to put an end to the IRS taxing Social Security benefits, effectively ending what many see as unfair double taxation.

What’s the Big Deal About H.R. 1040?

So, what exactly does H.R. 1040 entail? In simple terms, this legislation seeks to amend the Internal Revenue Code to ensure that Social Security benefits are not subject to federal income tax. It’s a move that could significantly ease the financial burden on millions of American retirees who depend on these benefits for their livelihoods. After all, these benefits are earned through years of hard work and contributions to the Social Security system.

Currently, depending on your income level, a portion of your Social Security benefits can be taxed, leading to frustration among seniors who feel that they are being taxed on money they’ve already contributed. With H.R. 1040, the aim is to eliminate this tax, allowing seniors to keep more of their hard-earned money in their pockets.

Why Is This Legislation Important?

For many retirees, Social Security benefits are a crucial part of their financial stability. According to the Social Security Administration, about 40% of all retirees rely on their benefits for at least 90% of their income. Given the rising cost of living and healthcare, every dollar counts.

Ending the double taxation on Social Security benefits could mean a significant boost in disposable income for seniors. This could lead to improved quality of life, reduced financial stress, and even increased spending in local economies as retirees feel more secure in their financial situations. It’s about more than just tax relief; it’s about supporting our aging population and showing that we value their contributions to society.

Who Supports This Bill?

Support for H.R. 1040 is gaining traction. Both seniors and advocacy groups are rallying behind this initiative, urging lawmakers to take action. But the big question remains: Will key players like @SpeakerJohnson and @LeaderJohnThune step up to pass this bill?

Public sentiment is crucial here. The more voices that are heard demanding a vote, the more likely it is that lawmakers will feel the pressure to act. Advocates are calling on everyone concerned about the financial well-being of seniors to make their voices heard. If you believe in the importance of this bill, consider reaching out to your representatives and letting them know!

What Are the Implications of Not Passing This Bill?

If H.R. 1040 does not pass, seniors will continue to face the burden of double taxation on their Social Security benefits. This could lead to a ripple effect, where retirees struggle to make ends meet, affecting their ability to pay for essentials like healthcare, housing, and food. The lack of financial security could push many seniors into poverty, which is a concerning thought, especially in a nation that prides itself on supporting its citizens.

Furthermore, failing to address this issue could signal to future generations that their contributions to the Social Security system might not be respected, leading to distrust in government programs designed to assist those in need.

How Can You Get Involved?

It’s clear that H.R. 1040 is a significant step in the right direction, but it needs your support to gain momentum. One of the simplest ways to get involved is by contacting your local representatives. You can express your support for the bill and encourage them to vote in favor of it. Many representatives have contact forms on their websites that make it easy to send a message.

Additionally, sharing information about the bill on social media platforms or in community groups can help raise awareness. Use the hashtag #NoTaxOnSocialSecurity to join the conversation and encourage others to advocate for this critical change.

The Bigger Picture

While H.R. 1040 focuses on one aspect of taxation, it opens up a broader conversation about how we treat our seniors in society. Taxation policies can impact their quality of life and overall well-being. By supporting measures that alleviate financial strain, we can foster a more equitable society where everyone, especially our elders, can thrive.

Moreover, this bill could serve as a catalyst for further reforms in the tax system that prioritize the needs of vulnerable populations. It’s a reminder that advocacy matters, and your voice can lead to real change.

What’s Next?

As the bill progresses through Congress, it will be essential to keep an eye on its developments. The more the public engages with their representatives and demands a vote, the greater the chances of passing H.R. 1040. Make sure to stay informed about any updates regarding the bill, and don’t hesitate to share your opinions and thoughts with others. The fight against double taxation on Social Security benefits is just beginning, and every effort counts.

In the meantime, let’s keep the conversation going. Talk to your friends and family about the importance of supporting H.R. 1040, and encourage them to take action. Together, we can push for a future where seniors are no longer burdened by unfair taxation on their benefits.

Final Thoughts

In a world where financial security can feel elusive, H.R. 1040 represents a beacon of hope for many seniors. The potential to eliminate taxation on Social Security benefits is a significant step toward ensuring that retirees can enjoy their golden years without the worry of financial strain. Let’s rally behind this bill, demand a vote, and advocate for the rights of our seniors. They’ve earned it!

For more information about H.R. 1040 and how you can get involved, visit the official Thomas Massie website and stay updated on the latest news.