Whale Shocks Crypto World: $4.28M USDC Bet Sparks $101M ETH Long Debate!

whale crypto investment strategies, leveraging Ethereum trading, HyperLiquid platform features

—————–

Whale Activity in Cryptocurrency: A $4.28 Million USDC Deposit and a $101 Million ETH Long Position

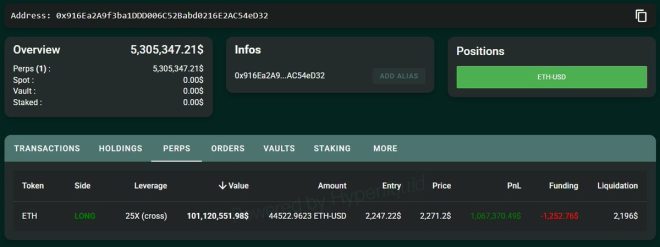

In a significant development in the cryptocurrency market, a prominent whale recently made headlines by depositing $4.28 million USDC into HyperLiquid, a decentralized exchange platform. This transaction was followed by the opening of a substantial long position on Ethereum (ETH) valued at $101 million, employing a striking 25x leverage. This move has sparked interest among traders and investors alike, shedding light on the increasing influence of large holders in the crypto ecosystem.

Understanding Whale Transactions

Whales are individuals or entities that hold large amounts of cryptocurrencies, often enough to influence market prices through their trading activities. Their transactions can lead to significant price movements, making them a focal point for traders looking to gauge market sentiment. The recent whale activity involving USDC and ETH reflects a strategic approach that could signal bullish trends in the cryptocurrency market.

The Significance of USDC

USDC, or USD Coin, is a stablecoin pegged to the US dollar, providing a stable and secure way for investors to transact in the volatile world of cryptocurrencies. By depositing $4.28 million in USDC, the whale is likely positioning itself for further investment in the crypto market. Such deposits are often seen as a precursor to larger trading activities, indicating confidence in future price movements.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

HyperLiquid: A Decentralized Exchange

HyperLiquid is gaining traction as a decentralized exchange (DEX) platform that allows users to trade cryptocurrencies without the need for a centralized authority. This platform offers various features, including high liquidity, low fees, and advanced trading options. The whale’s decision to deposit USDC into HyperLiquid suggests that the platform is becoming increasingly popular among large traders, possibly due to its favorable trading conditions.

The Implications of a $101 Million ETH Long Position

Opening a long position on Ethereum worth $101 million with 25x leverage is a bold move that reflects the whale’s confidence in the future price of ETH. Leverage trading allows traders to control larger positions with a smaller amount of capital, amplifying both potential gains and potential losses. This position indicates a strong bullish sentiment towards Ethereum, especially given the current market dynamics.

Market Reaction to Whale Activity

The cryptocurrency market is highly sensitive to whale activity, and significant transactions often lead to increased volatility. As news of this whale’s actions spreads, traders may react by adjusting their positions, leading to potential price fluctuations in both USDC and ETH. Understanding the motivations behind such whale transactions can provide valuable insights for retail traders looking to navigate the market effectively.

The Future of Ethereum

Ethereum has been a leading player in the cryptocurrency space, known for its smart contract functionality and decentralized applications (dApps). With the upcoming Ethereum 2.0 upgrade and increased institutional interest, many analysts predict a bullish outlook for ETH. The whale’s substantial long position aligns with this optimistic sentiment, suggesting that larger players are positioning themselves to capitalize on Ethereum’s potential growth.

The Role of Leverage in Cryptocurrency Trading

Leverage can significantly amplify profits, but it also comes with increased risk. A 25x leverage position means that for every dollar the price of ETH increases, the gains are magnified by 25 times. Conversely, if the price declines, losses can be equally severe. This high-risk strategy is generally pursued by experienced traders who are comfortable navigating the volatility of the crypto market.

Conclusion

The recent whale activity involving a $4.28 million USDC deposit and a $101 million ETH long position on HyperLiquid underscores the dynamic nature of the cryptocurrency market. As large holders continue to make significant moves, the impact on market sentiment and pricing is undeniable. Traders and investors should closely monitor these developments, as they can provide critical insights into market trends and potential investment opportunities.

In summary, the cryptocurrency market remains a complex and rapidly evolving landscape. Whale transactions, such as this recent deposit and long position, serve as a reminder of the influence that large holders wield and the importance of staying informed. As Ethereum and other cryptocurrencies continue to gain traction, understanding the implications of such moves will be essential for anyone looking to navigate this exciting and often unpredictable market.

JUST IN: Whale deposits $4.28M $USDC into HyperLiquid and opens a $101M $ETH long with 25x leverage. pic.twitter.com/6qDCgQdD98

— Cointelegraph (@Cointelegraph) June 23, 2025

JUST IN: Whale deposits $4.28M $USDC into HyperLiquid and opens a $101M $ETH long with 25x leverage.

If you’re keeping an eye on the cryptocurrency market, you may have noticed some exciting movements lately. One of the most significant developments recently is a recent deposit made by a crypto “whale”—a term used for individuals or entities that hold large amounts of cryptocurrency. This whale has deposited a whopping $4.28 million in $USDC into HyperLiquid, a decentralized trading platform that’s been gaining traction in the crypto space. What’s even more astonishing is that this whale has opened a massive long position worth $101 million in $ETH with a staggering 25x leverage. This news is certainly making waves in the trading community.

Understanding the Whale Deposit

To grasp the significance of this deposit, we should first understand what it means to “deposit” in the context of cryptocurrency trading. When a whale deposits funds into a platform like HyperLiquid, it indicates confidence in that platform and its trading capabilities. Essentially, this whale is putting a substantial amount of money into a decentralized exchange (DEX) to trade various cryptocurrencies.

The $4.28 million in $USDC, a stablecoin pegged to the US dollar, suggests that the whale might be looking for stability in their investments. USDC is often used in trading as it provides a reliable medium for transactions without the volatility that comes with cryptocurrencies like Bitcoin or Ethereum.

What is HyperLiquid?

HyperLiquid is a decentralized exchange that allows users to trade cryptocurrencies with minimal fees and high liquidity. It’s designed to cater to both casual traders and institutional investors, providing tools and features that appeal to a wide audience. With the recent surge in decentralized finance (DeFi), platforms like HyperLiquid have become increasingly popular as they offer users more control over their assets without relying on traditional financial institutions.

The whale’s deposit signifies trust in HyperLiquid’s trading environment, particularly its liquidity and the ability to execute large trades without significantly affecting market prices.

The Significance of $101 Million ETH Long Position

Opening a long position worth $101 million in $ETH with 25x leverage is a bold move. Leverage trading allows traders to amplify their potential returns by borrowing funds to increase their position size. In this case, with a 25x leverage, the whale is essentially betting that the price of Ethereum will rise significantly.

However, leverage trading is a double-edged sword; while it can lead to substantial profits, it also increases the risk of significant losses. If Ethereum’s price does not move in the whale’s favor, they could face liquidation, losing their initial investment. This kind of trading strategy is usually reserved for experienced investors who understand the risks involved.

What Does This Mean for Ethereum and the Crypto Market?

The whale’s significant move could indicate a bullish sentiment toward Ethereum. When large investors make substantial bets on a cryptocurrency, it often influences other traders’ perceptions and can lead to price increases. If more traders see this large position as a signal to buy, it could create a positive feedback loop, driving the price of $ETH even higher.

Additionally, this event could draw attention to the overall crypto market, potentially attracting more investors. Increased interest and investment could lead to a healthier market environment, fostering growth and innovation in the space.

Why Are Whales Important in the Crypto Space?

Whales play a crucial role in the cryptocurrency market. Their actions can significantly impact prices and market trends. Because they hold such large amounts of cryptocurrencies, their buying or selling decisions can lead to price fluctuations. This influence makes them a focal point for market analysis and speculation.

Moreover, whales often have access to advanced trading strategies and insights that can provide clues about market movements. When a whale makes a significant deposit or trade, it can signal to other traders the potential direction of the market, leading to increased trading activity.

The Risks of Following Whale Moves

While it can be tempting to follow the moves of whales, it’s essential to approach this strategy with caution. Just because a whale is making large trades does not guarantee success for other investors. The crypto market is highly volatile, and prices can change rapidly based on a multitude of factors, including market sentiment, news events, and regulatory developments.

Investors should conduct their own research and consider their risk tolerance before making trading decisions based on whale activity. It’s crucial to have a well-thought-out strategy and not to rely solely on the actions of others.

Conclusion: The Future of Crypto Trading

The recent deposit of $4.28 million in $USDC into HyperLiquid and the opening of a $101 million $ETH long position with 25x leverage by a whale is a fascinating development in the world of cryptocurrency. It highlights the growing interest in decentralized exchanges and the potential for significant profits in the crypto space.

As the market continues to evolve, keeping an eye on whale activity can be a valuable part of understanding market dynamics. However, it’s essential to approach trading with caution and a clear strategy. With the right mindset and knowledge, investors can navigate the exciting yet unpredictable world of cryptocurrency trading. Stay informed, stay cautious, and happy trading!