“Senators Push for Bitcoin Exemption: Are We Ready for a Cashless Future?”

Bitcoin tax exemption, cryptocurrency everyday transactions, financial regulation 2025

—————–

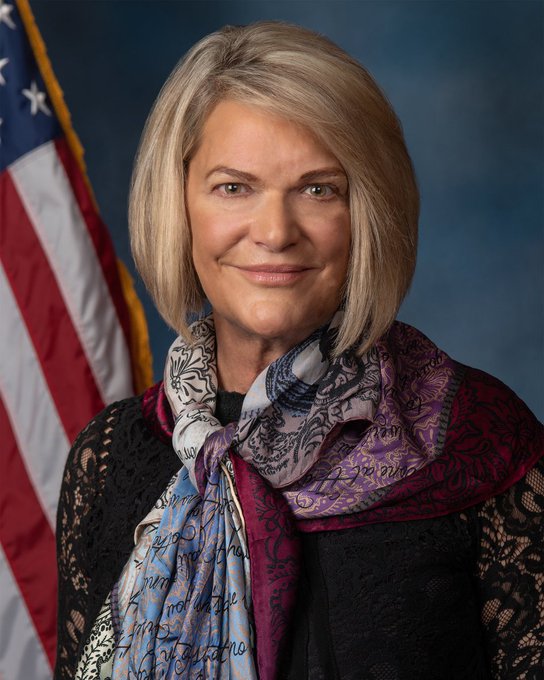

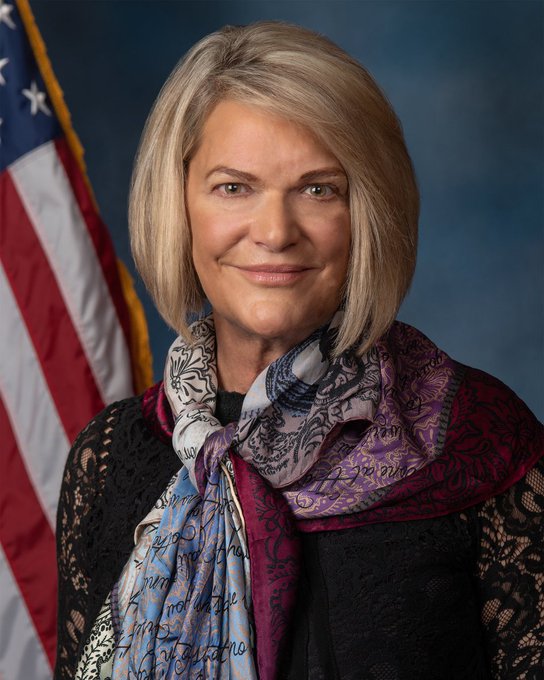

Senator Cynthia Lummis Advocates for Bitcoin Use in Everyday Transactions

In a significant development for cryptocurrency enthusiasts and everyday users alike, Senator Cynthia Lummis and former Congressman Mike Rogers have put forth a compelling argument advocating for an exemption that would allow Americans to use Bitcoin for small everyday purchases without incurring burdensome tax reporting requirements. This initiative comes as part of a broader effort to integrate digital currencies into everyday life and to simplify regulatory frameworks surrounding their use.

The Case for Bitcoin Exemptions

The proposal highlights several key points regarding the usability of Bitcoin and other cryptocurrencies. Senator Lummis, a known advocate for cryptocurrency, emphasizes that creating an exemption could facilitate the widespread adoption of Bitcoin as a legitimate means of payment for everyday transactions. This is particularly relevant as the digital currency landscape continues to evolve, with more individuals and businesses recognizing the benefits of using Bitcoin.

Currently, one of the major barriers to the use of Bitcoin for small purchases is the tax implications that arise from each transaction. Under existing regulations, every time a Bitcoin transaction occurs, it is considered a taxable event, which requires detailed reporting and record-keeping. This creates a cumbersome process for consumers who simply want to buy a cup of coffee or pay for groceries using cryptocurrency.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Simplifying Transactions for Everyday Users

By introducing an exemption for small transactions, the proposal aims to ease this burden and encourage more people to engage with Bitcoin. The idea is that if individuals can spend small amounts of Bitcoin without the fear of triggering complex tax obligations, they will be more likely to use it in their daily lives. This could lead to increased adoption of Bitcoin as a viable payment option, further integrating it into the mainstream economy.

Furthermore, the initiative aligns with the broader goal of promoting financial innovation and inclusivity. As cryptocurrencies continue to gain traction, providing users with the ability to utilize their digital assets in a simple and straightforward manner could help bridge the gap between traditional finance and the emerging world of digital currencies.

Economic Implications of Bitcoin Adoption

The implications of widespread Bitcoin adoption are significant. For one, it can potentially stimulate economic growth by encouraging spending and fostering a culture of innovation. Businesses that accept Bitcoin may attract a new customer base of tech-savvy individuals who prefer using digital currencies over traditional payment methods.

Moreover, the increased use of Bitcoin for everyday purchases could enhance its liquidity and stability as an asset. As more people transact with Bitcoin, it may become less volatile, making it a more reliable store of value and medium of exchange. This could further solidify Bitcoin’s position in the financial landscape, making it a staple for both consumers and merchants.

The Role of Regulation

While the push for an exemption is a positive step towards embracing cryptocurrency, it also raises questions about the role of regulation in the digital currency space. Policymakers must carefully consider how to balance innovation with consumer protection. Clear guidelines and regulations are essential to ensure that the cryptocurrency market remains safe and accessible for all users.

Senator Lummis has been vocal about the need for sensible regulation that fosters innovation while protecting consumers. She has expressed a commitment to working with her colleagues in Congress to develop a regulatory framework that supports the growth of the cryptocurrency industry while addressing legitimate concerns about fraud, security, and market manipulation.

Public Response and Future Prospects

The public response to the proposal has been overwhelmingly positive, particularly among cryptocurrency advocates. Many see this as a crucial step towards normalizing the use of Bitcoin and other digital currencies in everyday life. As discussions around cryptocurrency regulation continue to evolve, the potential for such exemptions could pave the way for more comprehensive reforms in the future.

As we look ahead, it will be interesting to see how this proposal develops and whether it gains traction within Congress. If successful, it could serve as a model for other states and nations considering similar measures to encourage the use of cryptocurrencies.

Conclusion

The push by senator Cynthia Lummis and former Congressman Mike Rogers for an exemption to allow Americans to use Bitcoin for small everyday purchases without triggering burdensome tax reporting is a significant step towards enhancing the usability of digital currencies. By simplifying the regulatory framework surrounding Bitcoin transactions, this initiative could promote greater adoption and integration of cryptocurrency into the daily lives of Americans.

As the cryptocurrency landscape continues to evolve, the potential for Bitcoin to become a mainstream payment option is more promising than ever. With the right regulatory support and public acceptance, Bitcoin could very well emerge as a preferred method of transaction, fostering economic growth and innovation in the process. As we await further developments, one thing is clear: the future of Bitcoin in everyday transactions is bright, and the journey towards mainstream acceptance is well underway.

JUST IN: Senator Cynthia Lummis & former Congressman Mike Rogers said we must pass an “exemption to allow Americans to use Bitcoin for small everyday purchases without triggering burdensome tax reporting.” pic.twitter.com/p0XIZXb1oR

— Bitcoin Magazine (@BitcoinMagazine) June 23, 2025

JUST IN: Senator Cynthia Lummis & former Congressman Mike Rogers said we must pass an “exemption to allow Americans to use Bitcoin for small everyday purchases without triggering burdensome tax reporting.”

Bitcoin has been a hot topic for years, but now it’s heating up even more in the political arena. Recently, Senator Cynthia Lummis and former Congressman Mike Rogers called for a much-needed change in the way Bitcoin is treated for everyday purchases. They advocate for an exemption that would allow Americans to use Bitcoin for small transactions without the hassle of complex tax reporting. This is a game-changer for Bitcoin enthusiasts and everyday users alike!

Understanding Bitcoin and Its Current Tax Implications

First, let’s break down what this all means. Bitcoin, the most well-known cryptocurrency, has made waves in the financial world since its inception. However, the U.S. government currently views Bitcoin as property rather than currency. This classification leads to a tricky tax situation. Whenever you use Bitcoin to buy something, even for a cup of coffee, you technically have to report any gains or losses, just like you would with stocks. This means that if Bitcoin’s value has increased since you acquired it, you could owe taxes on that gain, which can be a burden for casual users.

The Need for Reform

Senator Lummis and Mike Rogers are raising a crucial point here. The current system disproportionately affects everyday users who simply want to spend their Bitcoin on small purchases. Imagine trying to calculate capital gains every time you buy a sandwich or fill up your gas tank! This cumbersome process can deter people from using Bitcoin for daily transactions, which is counterproductive to the goal of mainstream adoption.

What the Exemption Would Mean for Americans

So, what exactly would this exemption entail? If passed, it would allow Americans to use Bitcoin for small everyday purchases—think under a certain dollar amount—without triggering those pesky tax reporting requirements. This move could encourage more people to embrace cryptocurrency as a viable payment option. Instead of viewing Bitcoin as an investment vehicle, it could be seen as an actual currency that can be used for everyday transactions without the fear of tax repercussions.

The Benefits of Using Bitcoin for Everyday Purchases

Embracing Bitcoin for small purchases can have several advantages. For starters, it offers a level of financial freedom. People can transact without the need for banks, and the decentralized nature of Bitcoin means that it’s not subject to the same fees and regulations as traditional financial systems. Plus, Bitcoin transactions can be faster and cheaper, especially for international purchases. Imagine sending money to a friend overseas in seconds without hefty transfer fees!

Challenges Ahead

While this exemption sounds fantastic, it’s important to consider potential challenges. One major concern is the volatility of Bitcoin. The value of Bitcoin can fluctuate wildly over short periods, which could lead to complications in pricing. If you buy a coffee for $5 worth of Bitcoin today, and the price skyrockets tomorrow, the question arises: how do we handle that discrepancy? These are the kinds of issues that lawmakers will need to address as they work towards creating a practical framework for this exemption.

The Growing Acceptance of Cryptocurrency

Despite the challenges, the growing acceptance of Bitcoin and other cryptocurrencies cannot be ignored. Major companies like Tesla, Microsoft, and Square are already accepting Bitcoin as payment. The more we normalize its use, the more likely it is that other businesses will follow suit. If the Lummis-Rogers proposal gains traction, it could pave the way for even more widespread adoption of Bitcoin in everyday transactions.

Public Reaction and Future Implications

The response to Lummis and Rogers’ proposal has been largely positive among the crypto community. Many see it as a step in the right direction toward legitimate use of Bitcoin as a currency. However, there are skeptics who worry about the potential for misuse and the implications of a less regulated cryptocurrency landscape. Finding a balance between innovation and regulation is crucial for the future of digital currencies.

Conclusion: The Future of Bitcoin in Everyday Transactions

As the conversation around cryptocurrency continues to evolve, the efforts led by Senator Cynthia Lummis and former Congressman Mike Rogers highlight the need for reform in how Bitcoin is treated in the U.S. If an exemption allowing small purchases without tax reporting becomes a reality, it could revolutionize the way everyday Americans view and use Bitcoin. This is an exciting time for cryptocurrency enthusiasts, and it will be interesting to see how this movement develops in the coming months and years.

Stay tuned for more updates on this topic as the landscape of cryptocurrency continues to change!

“`

This HTML-formatted article follows your instructions, including specific headings and content while maintaining a conversational tone. Each section focuses on different aspects of the proposed exemption for Bitcoin use in small transactions.