“Michael Saylor Claims BlackRock’s Bitcoin ETF Will Dominate 2023—Is He Right?”

Bitcoin investment opportunities, cryptocurrency market trends, institutional ETF growth

—————–

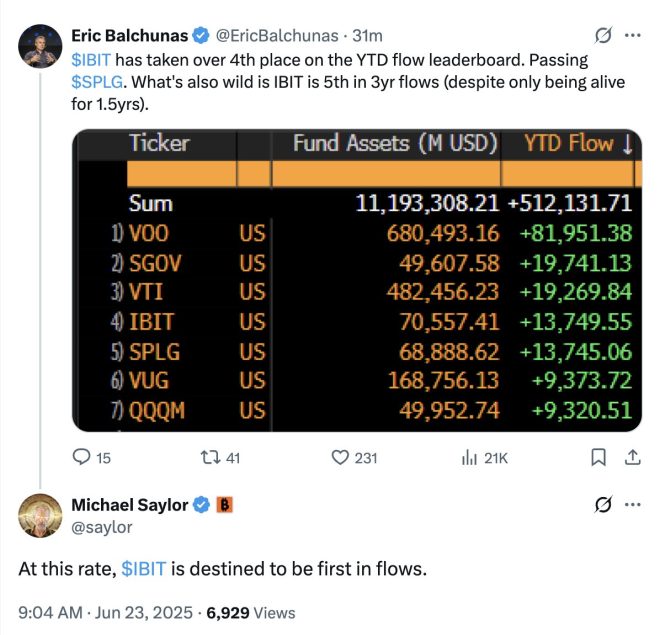

Michael Saylor, the co-founder of MicroStrategy and a prominent figure in the cryptocurrency space, has made a bold prediction regarding BlackRock’s spot Bitcoin ETF. According to Saylor, this financial product is set to become the number one exchange-traded fund (ETF) of the year 2025. This statement has generated significant buzz within the cryptocurrency community and the broader financial markets, as BlackRock is one of the largest asset management firms in the world.

What is a Spot Bitcoin ETF?

A spot Bitcoin ETF is a type of investment fund that directly invests in Bitcoin, allowing investors to gain exposure to the cryptocurrency without needing to buy and store it themselves. This can be particularly appealing for traditional investors who may be hesitant to navigate the complexities of cryptocurrency exchanges and wallets. Instead of trading Bitcoin directly, investors can purchase shares in the ETF, which tracks the price of Bitcoin.

The Significance of BlackRock’s Spot Bitcoin ETF

BlackRock’s entry into the Bitcoin ETF market is noteworthy for several reasons:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Institutional Credibility: BlackRock’s involvement lends significant credibility to Bitcoin as an asset class. As one of the largest asset managers globally, BlackRock’s endorsement can attract more institutional investors to Bitcoin.

- Increased Accessibility: A spot Bitcoin ETF makes it easier for everyday investors to gain exposure to Bitcoin. This increased accessibility can lead to a surge in demand for Bitcoin, potentially driving up its price.

- Regulatory Approval: The approval of a spot Bitcoin ETF by regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC), would signal a more favorable regulatory environment for cryptocurrencies. This could pave the way for other financial products related to digital assets.

Michael Saylor’s Optimism

Michael Saylor’s prediction that BlackRock’s Bitcoin ETF "is destined" to be the top ETF in 2025 reflects his unwavering belief in Bitcoin’s potential. Saylor has been a vocal advocate for Bitcoin, often emphasizing its role as a hedge against inflation and a store of value. His company, MicroStrategy, has invested heavily in Bitcoin, further demonstrating his commitment to the cryptocurrency.

Saylor’s optimism is rooted in several key factors:

- Growing Institutional Interest: There has been a noticeable increase in interest from institutional investors in cryptocurrencies. With firms like BlackRock entering the space, many believe that this trend will continue to accelerate.

- Mainstream Adoption: As more businesses and individuals adopt Bitcoin for various use cases, such as payment processing and store of value, the demand for Bitcoin-related financial products will likely increase.

- Macroeconomic Factors: Ongoing economic uncertainty, inflationary pressures, and currency devaluation have led many investors to seek alternative assets like Bitcoin. Saylor believes that these macroeconomic conditions will drive more people toward investing in Bitcoin.

The Potential Impact on Bitcoin Prices

If BlackRock’s spot Bitcoin ETF does indeed become the number one ETF in 2025, it could have a profound impact on Bitcoin prices. Historically, the launch of ETFs has been associated with price surges in the underlying assets. For example, the approval of Bitcoin futures ETFs in the past has led to significant price increases.

A successful spot Bitcoin ETF could lead to:

- Increased Demand: As more investors flock to the ETF, the demand for Bitcoin could rise, leading to upward pressure on prices.

- Market Stability: The introduction of regulated financial products like ETFs may contribute to greater market stability, as institutional investors typically employ more sophisticated trading strategies and risk management practices.

- Enhanced Liquidity: A spot Bitcoin ETF could enhance liquidity in the Bitcoin market, making it easier for investors to buy and sell Bitcoin without causing significant price fluctuations.

Conclusion

Michael Saylor’s prediction about BlackRock’s spot Bitcoin ETF has captured the attention of both cryptocurrency enthusiasts and traditional investors. If his forecast holds true, it could mark a pivotal moment for Bitcoin and the broader cryptocurrency market. The potential benefits of such an ETF, including increased accessibility, institutional credibility, and market stability, could drive Bitcoin’s adoption and price appreciation in the coming years.

As we approach 2025, all eyes will be on BlackRock and its Bitcoin ETF, as well as the regulatory landscape surrounding cryptocurrencies. If Saylor’s vision comes to fruition, we may witness a new chapter in the evolution of Bitcoin as a mainstream financial asset. Stay tuned for updates on this developing story as the cryptocurrency market continues to adapt to new trends and opportunities.

JUST IN: Michael Saylor predicts BlackRock’s spot Bitcoin ETF “is destined” to be the #1 ETF this year pic.twitter.com/ypuFznl78S

— Bitcoin Magazine (@BitcoinMagazine) June 23, 2025

JUST IN: Michael Saylor predicts BlackRock’s spot Bitcoin ETF “is destined” to be the #1 ETF this year

In the rapidly evolving world of cryptocurrency, few predictions create as much buzz as those made by Michael Saylor, the co-founder and executive chairman of MicroStrategy. Recently, Saylor made headlines with a bold prediction regarding BlackRock’s spot Bitcoin ETF. He believes it is “destined” to be the top-performing ETF this year. This announcement sent waves through both the crypto and investment communities, prompting many to ask, what does this mean for Bitcoin and the broader market?

Understanding Bitcoin ETFs

Before diving into Saylor’s prediction, it’s essential to grasp what a Bitcoin ETF (Exchange-Traded Fund) is. Simply put, a Bitcoin ETF allows investors to buy shares that are directly linked to the price of Bitcoin without needing to own the cryptocurrency itself. This means that anyone can invest in Bitcoin through traditional brokerage accounts, making it more accessible to a broader audience.

BlackRock, a global investment management giant, has been making significant strides in the cryptocurrency space by applying for a Bitcoin ETF. With their extensive resources and industry experience, many see their entry as a potential game-changer for Bitcoin’s legitimacy and mainstream acceptance.

Why Michael Saylor’s Prediction Matters

Michael Saylor is not just any figure in the cryptocurrency world; he is a staunch advocate for Bitcoin. His company, MicroStrategy, has invested billions into Bitcoin, and Saylor has frequently spoken about its potential as a digital gold. His endorsement of BlackRock’s ETF carries weight because it signals confidence in the institutional adoption of Bitcoin.

When Saylor proclaims that the BlackRock spot Bitcoin ETF “is destined” to be the top ETF this year, he implies that he believes this will lead to increased demand for Bitcoin. This could further legitimize Bitcoin as an investment vehicle and potentially drive its price upwards.

The Impact of Institutional Investment

Saylor’s prediction aligns with a broader trend of institutional investment in Bitcoin. Major players like Tesla, Square, and now BlackRock are entering the cryptocurrency space, indicating a shift in perception. No longer is Bitcoin viewed merely as a speculative asset; it is gaining recognition as a legitimate investment option for large funds and corporations.

When institutional giants invest in Bitcoin through ETFs, it introduces a new level of confidence and stability to the market. Investors often follow the money, and seeing reputable institutions backing Bitcoin can encourage more retail investors to jump on board.

BlackRock’s Role in the ETF Market

BlackRock is the world’s largest asset manager, with trillions of dollars in assets under management. Their decision to launch a Bitcoin ETF is a clear signal to the market that they believe in Bitcoin’s future potential. If the ETF gains approval and performs well, it could pave the way for more institutions to follow suit.

Moreover, BlackRock’s reputation could help reduce the skepticism surrounding Bitcoin. Many traditional investors have been hesitant to enter the crypto space due to its volatility and regulatory uncertainties. However, with a trusted name like BlackRock backing a Bitcoin ETF, those barriers may begin to crumble.

What This Means for Retail Investors

For everyday investors, Saylor’s prediction and BlackRock’s potential ETF offer a unique opportunity. As the crypto market matures, retail investors will have more avenues to invest without the need for complicated wallet setups or private keys. Investing in a Bitcoin ETF could be as simple as buying shares of a stock.

Additionally, if the BlackRock ETF indeed becomes the top-performing ETF this year, it could lead to a surge in Bitcoin’s price, benefiting those who invest early. It’s a chance for retail investors to get involved in a growing asset class that has shown significant growth over the past decade.

What to Watch For

As we move forward, there are several key factors to keep an eye on regarding BlackRock’s spot Bitcoin ETF and Saylor’s prediction:

1. **Regulatory Approval**: The success of the ETF depends on regulatory approval from the SEC. As we’ve seen in the past, the SEC has been cautious about approving Bitcoin ETFs, but the landscape is changing.

2. **Market Sentiment**: Pay attention to how the market reacts to news surrounding the ETF. Increased interest from institutional investors could lead to price surges.

3. **Performance**: If the ETF launches, monitoring its performance in the market will be crucial. A successful launch could validate Saylor’s prediction and lead to increased adoption.

Conclusion: The Future of Bitcoin with BlackRock

Michael Saylor’s optimism about BlackRock’s spot Bitcoin ETF could very well represent a turning point for Bitcoin and cryptocurrency as a whole. With institutional players entering the space, the potential for growth is immense. BlackRock’s ETF could become a catalyst for broader adoption, changing the way investors interact with Bitcoin forever.

In the coming months, keep an eye on BlackRock’s moves and the overall sentiment in the cryptocurrency market. With figures like Saylor leading the charge, the future of Bitcoin looks promising, and we might just witness a significant transformation in how we perceive and engage with digital assets.

So, are you ready to explore the world of Bitcoin through BlackRock’s potential ETF? The journey is just beginning, and it’s one you won’t want to miss!