Metaplanet’s Shocking Bitcoin Buy: Is This the Next Big Crypto Gamble?

Bitcoin investment strategies, cryptocurrency portfolio management, blockchain technology adoption

—————–

Metaplanet’s Impressive Bitcoin Acquisition: A New Player in the Crypto Space

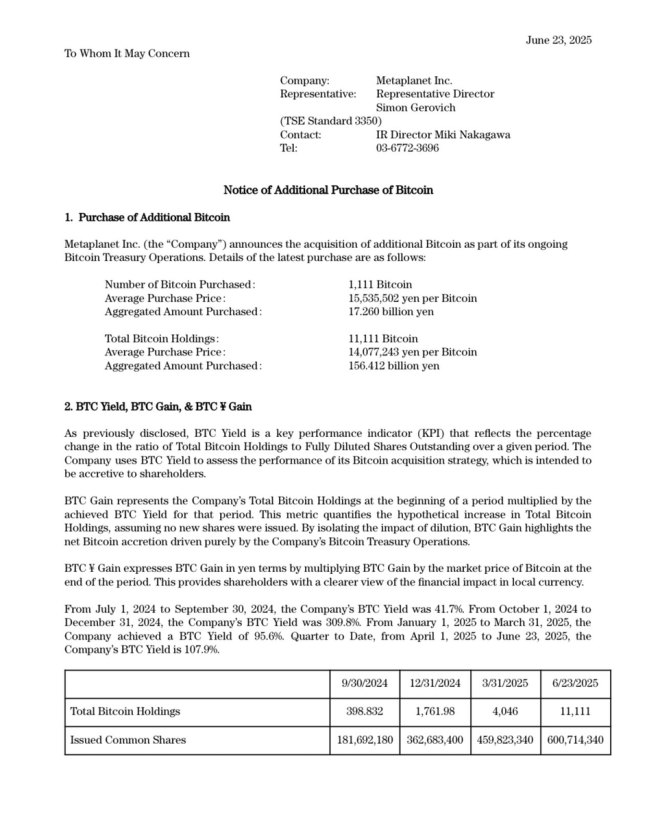

In a significant development within the cryptocurrency market, Metaplanet has made headlines by acquiring an additional 1,111 BTC, bringing its total holdings to an impressive 11,111 BTC. This latest acquisition is valued at approximately $1.1 billion, showcasing Metaplanet’s commitment to Bitcoin as a central asset in its investment strategy. This move has drawn comparisons to MicroStrategy, a well-known player in the Bitcoin acquisition arena, earning Metaplanet the moniker of the "Japanese MicroStrategy."

Understanding Metaplanet’s Strategy

Metaplanet’s strategy involves leveraging Bitcoin as a primary reserve asset, a tactic reminiscent of MicroStrategy’s approach. MicroStrategy, a business intelligence firm, has famously invested billions in Bitcoin, viewing it as a hedge against inflation and a long-term store of value. By adopting a similar strategy, Metaplanet positions itself as a forward-thinking company that recognizes the potential of cryptocurrencies in today’s digital economy.

The Rise of Bitcoin as a Corporate Asset

Bitcoin’s ascent as a corporate asset class has gained significant traction over the past few years. Major corporations and institutional investors are increasingly turning to Bitcoin to diversify their portfolios and protect against economic uncertainty. Metaplanet’s acquisition adds to this trend, highlighting the growing acceptance of Bitcoin among Japanese firms and the broader Asian market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact of Metaplanet’s Acquisition

With this latest purchase, Metaplanet has solidified its status in the cryptocurrency market. Holding 11,111 BTC not only represents a substantial financial investment but also signals a strong belief in Bitcoin’s long-term value. As the cryptocurrency market continues to evolve, Metaplanet’s actions may inspire other companies in Japan and beyond to consider similar investments in digital assets.

Market Reactions and Future Implications

The announcement of Metaplanet’s acquisition has sparked interest and speculation within the crypto community. Investors are closely monitoring the impact of corporate investments on Bitcoin’s price and overall market dynamics. Metaplanet’s bold move could potentially influence market sentiment, encouraging more companies to follow suit and invest in Bitcoin.

Comparing Metaplanet to MicroStrategy

While both Metaplanet and MicroStrategy share a common goal of accumulating Bitcoin, their operational styles and market environments differ. MicroStrategy, based in the United States, has been a pioneer in the corporate adoption of Bitcoin, setting a precedent for others to follow. In contrast, Metaplanet is navigating the unique landscape of Japan’s regulatory and economic environment, which may present different challenges and opportunities.

The Future of Cryptocurrency in Japan

As Metaplanet leads the charge in corporate Bitcoin adoption in Japan, it raises important questions about the future of cryptocurrency in the region. Japan has long been recognized as a hub for technological innovation and has a favorable regulatory framework for cryptocurrency businesses. The actions of companies like Metaplanet could pave the way for increased institutional involvement and more widespread acceptance of digital assets in Japanese society.

Conclusion

Metaplanet’s recent acquisition of 1,111 BTC marks a significant milestone in the company’s journey and the broader narrative of Bitcoin adoption among corporations. By amassing a total of 11,111 BTC, Metaplanet not only positions itself as a key player in the cryptocurrency space but also serves as an example for other companies considering similar investments. As the cryptocurrency market continues to mature, the actions of firms like Metaplanet will play a crucial role in shaping the future of digital assets, particularly in Japan and across Asia.

In summary, Metaplanet’s strategy aligns with the growing trend of corporate investment in Bitcoin, highlighting the potential for cryptocurrencies to become integral components of corporate financial strategies. As we observe the unfolding developments in this space, it is clear that Metaplanet is set to make waves in the cryptocurrency market, positioning itself as a significant player alongside established giants like MicroStrategy.

JUST IN: Metaplanet has just acquired 1,111 BTC to bring their total holdings to 11,1111 BTC (worth $1.1bn).

Metaplanet is the “Japanese Microstrategy” pic.twitter.com/nz6FGZlGnM

— Coin Bureau (@coinbureau) June 23, 2025

JUST IN: Metaplanet has just acquired 1,111 BTC to bring their total holdings to 11,1111 BTC (worth $1.1bn)

In a significant move that has sent ripples through the crypto community, Metaplanet has just acquired 1,111 BTC, bringing their total Bitcoin holdings to a staggering 11,111 BTC. This massive acquisition is valued at around $1.1 billion, positioning Metaplanet as a formidable player in the world of cryptocurrency. Often dubbed the “Japanese Microstrategy,” this company is quickly becoming a beacon for institutional Bitcoin investment.

What Makes Metaplanet Stand Out?

So what exactly is Metaplanet, and why are they being compared to Microstrategy? Founded with the vision of leveraging Bitcoin as a treasury reserve asset, Metaplanet has taken a proactive approach by accumulating large amounts of Bitcoin. This strategy mirrors that of Microstrategy, which has famously adopted Bitcoin as a key component of its financial strategy under CEO Michael Saylor’s leadership.

Metaplanet’s recent acquisition of 1,111 BTC illustrates the company’s commitment to building its Bitcoin portfolio. By holding a total of 11,111 BTC, Metaplanet is not just following a trend but is setting one for other companies in Japan and beyond.

The Implications of This Acquisition

The purchase of 1,111 BTC represents more than just a numerical increase in their holdings. It reflects a broader trend where companies are increasingly viewing Bitcoin as a legitimate asset class. As institutional interest in Bitcoin grows, Metaplanet’s bold moves could incentivize other corporations to consider Bitcoin in their financial strategies.

In terms of market reactions, such acquisitions can lead to increased confidence in Bitcoin’s long-term viability. When companies like Metaplanet make significant investments in Bitcoin, it sends a strong message to the market that they believe in the digital asset’s future. This also contributes to the growing narrative that Bitcoin is not just a speculative asset but a store of value akin to gold.

Who is Behind Metaplanet?

The driving force behind Metaplanet is a team of visionary leaders who understand the potential of blockchain technology and cryptocurrency. While specific details about the founders might not be widely publicized, the company’s strategy indicates a deep understanding of market dynamics and a commitment to long-term growth. Their ability to accumulate such a substantial Bitcoin reserve showcases their financial acumen and forward-thinking approach.

Comparing Metaplanet to Microstrategy

Microstrategy, founded by Michael Saylor, became a household name in the crypto community after making headlines for its large Bitcoin purchases. Saylor has been vocal about his belief that Bitcoin is a superior asset for wealth preservation. Similarly, Metaplanet seems to be adopting this mindset, aiming to solidify its financial foundation through Bitcoin investments.

What makes this comparison even more interesting is how each company navigates its local market. While Microstrategy has been a pioneer in the U.S., Metaplanet is making waves in Japan, a country known for its tech-savvy population and evolving economic landscape. This geographical positioning allows Metaplanet to tap into unique opportunities in the Asian market, potentially leading to increased adoption of Bitcoin.

The Future of Bitcoin Investments

As more companies like Metaplanet dive into Bitcoin acquisitions, the landscape of corporate investment in cryptocurrencies will likely shift. Increased institutional investment could lead to greater price stability and legitimacy for Bitcoin, encouraging even more companies to enter the fray.

Moreover, this trend could have implications for financial regulations surrounding cryptocurrencies. As institutional investments grow, regulators may need to create frameworks that ensure both investor protection and innovation in the crypto space. Metaplanet’s significant holdings could put them at the forefront of discussions about regulations in Japan and beyond.

What This Means for Retail Investors

For retail investors, the actions of companies like Metaplanet can serve as a barometer for the health of the cryptocurrency market. When institutional players invest heavily in Bitcoin, it often signals confidence and can lead to bullish trends in the market. Retail investors should pay close attention to these developments, as they can impact overall market sentiment.

Additionally, the increasing presence of institutional investors may lead to improved infrastructure in the crypto space, making it easier for everyday users to buy, sell, and hold Bitcoin. As these companies pave the way, we might see more user-friendly platforms and services emerging, ultimately benefiting retail investors.

Metaplanet’s Strategic Vision Going Forward

With their recent acquisition, Metaplanet is set to continue its aggressive Bitcoin strategy. The company’s leadership likely understands the importance of not only holding Bitcoin but also advocating for its use and acceptance within the business community. By positioning themselves as a leader in this space, they could influence other businesses to follow suit.

Moreover, as Bitcoin continues to gain traction globally, Metaplanet’s strategy may evolve beyond simple accumulation. They may explore innovative ways to integrate Bitcoin into their business models, whether through partnerships, payment solutions, or even educational initiatives aimed at demystifying cryptocurrencies for the broader public.

Conclusion: The Rising Tide of Bitcoin Adoption

The acquisition of 1,111 BTC by Metaplanet is more than just a strategic financial decision; it’s a testament to the rising tide of Bitcoin adoption among major corporations. As the “Japanese Microstrategy,” Metaplanet is not only securing its financial future but is also playing a pivotal role in shaping the future of Bitcoin in Asia.

As we look ahead, the excitement surrounding Metaplanet and its ambitious plans invites us all to consider the potential of Bitcoin as a transformative asset. With institutional players leading the charge, the future of cryptocurrency looks promising.