Japanese Firm’s $118M Bitcoin Purchase Raises Questions About Market Ethics!

Japanese cryptocurrency investment, Metaplanet Bitcoin acquisition, 2025 digital asset market trends

—————–

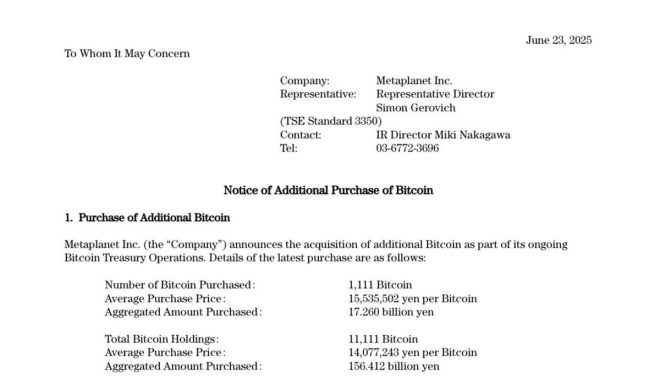

Japanese Company Metaplanet Acquires 1,111 Bitcoin for $118.2 Million

In a groundbreaking move for the cryptocurrency market, Japanese public company Metaplanet has made headlines by purchasing 1,111 Bitcoin for a staggering $118.2 million. This significant acquisition showcases the growing interest and investment in Bitcoin, further solidifying its position as a leading digital asset in the global financial landscape. The news, first reported by Bitcoin Magazine, has sent ripples through the cryptocurrency community, igniting discussions about the implications of such large-scale investments in Bitcoin.

Metaplanet’s Strategic Move

Metaplanet’s acquisition of Bitcoin is a strategic maneuver that highlights the increasing acceptance of cryptocurrencies among institutional investors. The company’s decision to invest a substantial amount in Bitcoin indicates a strong belief in the cryptocurrency’s potential for long-term growth. By purchasing 1,111 Bitcoin, Metaplanet is positioning itself to benefit from Bitcoin’s price appreciation in the future, as more individuals and organizations adopt digital currencies.

The Growing Institutional Interest in Bitcoin

The acquisition by Metaplanet is part of a broader trend of institutional investment in cryptocurrency. Over the past few years, there has been a noticeable increase in the number of public companies and financial institutions investing in Bitcoin and other cryptocurrencies. This trend is driven by several factors, including the desire for portfolio diversification, the potential for high returns, and the increasing recognition of Bitcoin as a digital store of value.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Bitcoin as a Store of Value

Bitcoin’s reputation as a store of value has gained traction, especially in uncertain economic times. Many investors view Bitcoin as "digital gold," a hedge against inflation and a safeguard against currency devaluation. Metaplanet’s investment aligns with this perspective, as the company seeks to secure its financial future by holding a significant amount of Bitcoin. As more companies follow suit, the demand for Bitcoin is likely to increase, potentially driving up its price in the long term.

The Impact of Large-Scale Purchases on Bitcoin’s Market

Large-scale purchases of Bitcoin, such as Metaplanet’s acquisition, can have a significant impact on the cryptocurrency’s market dynamics. When a public company buys a substantial amount of Bitcoin, it can create a sense of urgency among other investors, leading to increased buying pressure and, consequently, a rise in price. This phenomenon has been observed in the past with companies like MicroStrategy and Tesla, which made headlines for their large Bitcoin purchases.

The Future of Bitcoin Investments

As more companies recognize the potential of Bitcoin, we can expect to see a continued trend of institutional investments in the cryptocurrency. The involvement of public companies and institutional investors in Bitcoin not only legitimizes the asset but also brings increased liquidity and stability to the market. As Metaplanet joins the ranks of other institutional investors, it may pave the way for more companies to consider Bitcoin as a viable investment option.

Regulatory Considerations

While the growing interest in Bitcoin presents exciting opportunities, it also raises questions about regulatory considerations. Governments and regulatory bodies around the world are still grappling with how to approach cryptocurrencies. As more companies invest in Bitcoin, it is crucial for regulatory frameworks to evolve to ensure that the market remains fair and transparent. The involvement of public companies like Metaplanet may accelerate discussions surrounding regulation, as stakeholders seek to establish guidelines that promote responsible investment practices.

Conclusion

Metaplanet’s acquisition of 1,111 Bitcoin for $118.2 million is a significant milestone in the evolution of cryptocurrency investments. This strategic move by the Japanese public company underscores the growing institutional interest in Bitcoin and solidifies its status as a digital asset with long-term potential. As more companies and investors recognize the benefits of Bitcoin, the cryptocurrency market is likely to experience continued growth and maturation. With regulatory considerations and market dynamics evolving, the future of Bitcoin investments looks promising, setting the stage for an exciting era in the world of digital finance.

JUST IN: Japanese public company Metaplanet buys 1,111 #bitcoin for $118.2 million. pic.twitter.com/YxR9zCXGRV

— Bitcoin Magazine (@BitcoinMagazine) June 23, 2025

JUST IN: Japanese public company Metaplanet buys 1,111 bitcoin for $118.2 million

In a significant move that’s sending ripples across the cryptocurrency market, the Japanese public company Metaplanet has just acquired 1,111 bitcoins for a whopping $118.2 million. This news, first reported by [Bitcoin Magazine](https://bitcoinmagazine.com/), highlights the growing interest from public companies in investing in digital currencies. As we delve deeper into this development, let’s explore what this purchase means for both Metaplanet and the broader cryptocurrency landscape.

The Rise of Bitcoin Investments

Bitcoin, the original cryptocurrency, has seen a meteoric rise since its inception in 2009. Its decentralized nature, limited supply, and growing acceptance as a form of payment have made it an attractive investment for individuals and institutions alike. Metaplanet’s recent purchase is just one of many examples of how large organizations are beginning to see Bitcoin as a valuable asset.

Investing in Bitcoin can offer numerous benefits, including diversification of portfolios and a hedge against inflation. With traditional markets becoming increasingly volatile, many investors view Bitcoin as a safe haven. This trend is reflected in the surge of institutional investments in cryptocurrencies over the past few years.

Understanding Metaplanet’s Acquisition

So why did Metaplanet decide to invest such a substantial amount in Bitcoin? For starters, the company could be positioning itself as a forward-thinking entity in a rapidly evolving financial landscape. By acquiring 1,111 bitcoins, Metaplanet is not just buying digital currency; they are embracing a technological innovation that many believe will shape the future of finance.

The decision to invest $118.2 million in Bitcoin is also indicative of the confidence that Metaplanet has in the cryptocurrency’s long-term potential. As more corporations recognize the value of holding Bitcoin as part of their asset allocation, we can expect to see an increasing trend of cryptocurrency investments among public companies.

Metaplanet: A Brief Overview

Before diving deeper into the implications of this acquisition, let’s take a moment to understand who Metaplanet is. This Japanese public company has been making waves in various sectors, including technology and finance. With a commitment to innovation, Metaplanet has been exploring ways to integrate blockchain technology into its operations.

The acquisition of Bitcoin aligns with their vision of harnessing emerging technologies to drive growth and value. By investing in Bitcoin, Metaplanet is not only diversifying its portfolio but also signaling to its stakeholders that it is serious about engaging with the future of finance.

The Impact on the Cryptocurrency Market

Whenever a major purchase like this is made, it has the potential to influence the overall market. Investors often look to such acquisitions as indicators of confidence in Bitcoin’s stability and growth potential. Following news of Metaplanet’s purchase, many analysts are speculating on how this could affect Bitcoin’s price trajectory.

Historically, large purchases of Bitcoin have led to price surges as the market reacts to increased demand. Seeing a respected company like Metaplanet making such a significant investment could inspire other companies to follow suit, further driving up demand and potentially leading to an upward trend in Bitcoin’s value.

What This Means for the Future of Cryptocurrency

The acquisition of 1,111 bitcoins by Metaplanet is more than just a financial transaction; it represents a shift in how public companies perceive cryptocurrencies. As more entities recognize the potential of Bitcoin and other digital currencies, we may witness a broader acceptance of cryptocurrencies in mainstream finance.

This shift could pave the way for greater regulatory clarity and institutional participation in the crypto space. As companies like Metaplanet lead the charge, we can expect to see more innovative financial products and services emerge, all built around the foundation of cryptocurrencies.

Public Companies and Cryptocurrency: A Growing Trend

Metaplanet’s move is part of a larger trend where public companies are increasingly investing in cryptocurrencies. Companies like Tesla, MicroStrategy, and Square have already made headlines for their Bitcoin investments. This growing trend is encouraging more businesses to consider how they can leverage cryptocurrencies in their operations.

The benefits of holding Bitcoin as a corporate asset are becoming more apparent. Companies can not only hedge against inflation but also tap into new revenue streams through blockchain technology. As the landscape continues to evolve, we may see more innovative approaches to cryptocurrency adoption within corporate strategies.

The Regulatory Landscape

As public companies like Metaplanet embrace cryptocurrencies, the regulatory environment will play a crucial role in shaping the future of these investments. Governments around the world are still grappling with how to regulate cryptocurrencies effectively.

Regulatory clarity could enhance the legitimacy of cryptocurrencies, encouraging more companies to enter the space. Conversely, stringent regulations could deter investment and innovation. It’s a delicate balance that will require ongoing dialogue between regulators, businesses, and the cryptocurrency community.

Potential Risks and Considerations

While the acquisition of Bitcoin has many potential benefits, it’s essential to consider the risks involved. The cryptocurrency market is notoriously volatile, and rapid price fluctuations can lead to significant financial losses.

Investors must be aware of the risks associated with holding Bitcoin and ensure they have a well-thought-out strategy in place. For public companies like Metaplanet, transparency and risk management will be critical in navigating this uncharted territory.

The Community Response

The cryptocurrency community has reacted positively to Metaplanet’s announcement. Social media platforms are buzzing with discussions about the implications of this acquisition. Many see it as a validation of Bitcoin’s value and potential.

The growing interest from public companies is fostering a sense of optimism within the community, as more individuals recognize the transformative power of blockchain technology. As a result, there’s a renewed enthusiasm for investing in cryptocurrencies, which could lead to further market growth.

Looking Ahead

As we look to the future, the implications of Metaplanet’s acquisition will continue to unfold. This is just one of many steps toward a more integrated financial system where cryptocurrencies play a central role.

With public companies increasingly participating in the crypto market, we can expect to see ongoing developments that challenge traditional notions of finance. The story of Bitcoin is far from over, and we’re witnessing a pivotal moment in its evolution.

In summary, Metaplanet’s bold move to purchase 1,111 bitcoins for $118.2 million is a significant development in the cryptocurrency world. As more public companies recognize the potential of Bitcoin, we may be on the brink of a new era in finance. The journey is just beginning, and it’s an exciting time to be part of the cryptocurrency revolution.