“The Federal Reserve’s Housing Market Manipulation: Americans Paying Thousands More for Homes”

Federal Reserve interest rates, home buying costs, inflation impact

—————–

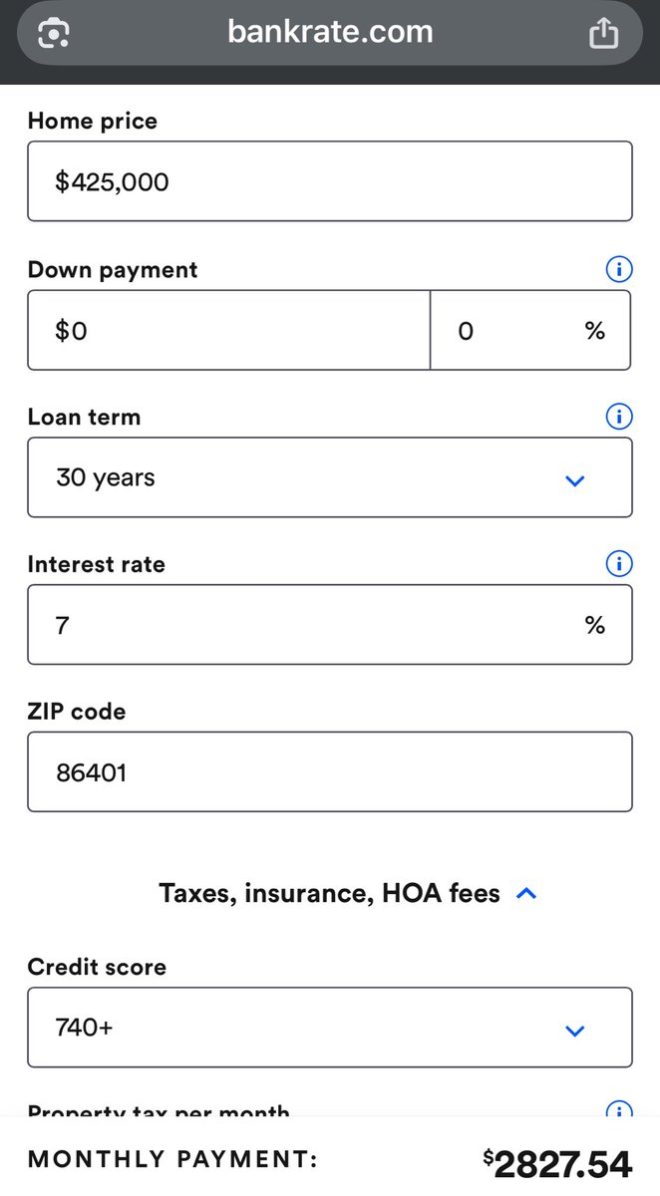

The tweet from Rep. Leo Biasiucci highlights the impact of the Federal Reserve’s decisions on the housing market in America. The comparison between a home loan with 7% interest versus one with 3% interest showcases the significant financial burden that high-interest rates can place on prospective homebuyers. The tweet points out that with inflation at 2%, the Federal Reserve cannot use inflation as an excuse for keeping interest rates high.

The Federal Reserve plays a crucial role in setting interest rates, which in turn affects borrowing costs for consumers. When interest rates are high, it becomes more expensive to borrow money for big-ticket purchases like homes. This can deter potential homebuyers from entering the market or force them to settle for smaller, less expensive homes.

The example provided in the tweet illustrates the stark difference in monthly payments between a home loan with 7% interest and one with 3% interest. At $2827 per month for the higher interest rate loan compared to $1791 per month for the lower interest rate loan, the financial strain on individuals and families trying to purchase a home is clear.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The tweet implies that the Federal Reserve’s policies are hindering the ability of Americans to achieve the dream of homeownership. By keeping interest rates high even as inflation remains relatively low, the Federal Reserve is making it difficult for individuals to afford homes and build wealth through real estate investment.

It is important to note that the Federal Reserve’s decisions are based on a complex set of economic factors and goals, including managing inflation, promoting economic growth, and ensuring financial stability. However, the tweet suggests that the current interest rate environment is disproportionately affecting the housing market and the ability of Americans to buy homes.

In conclusion, Rep. Leo Biasiucci’s tweet sheds light on the challenges faced by homebuyers in America due to the Federal Reserve’s interest rate policies. The stark contrast in monthly payments between high and low-interest rate loans highlights the financial burden placed on individuals and families trying to purchase a home. As the debate over interest rates and their impact on the housing market continues, it is clear that the Federal Reserve’s decisions have far-reaching implications for the American economy and the ability of individuals to achieve homeownership.

The Federal Reserve is screwing every single person trying to buy a home in America right now.

$2827 for a home with 7% interest

vs

$1791 for a home with 3% interestFYI: Inflation is at 2% so they can’t use that excuse anymore. pic.twitter.com/06jd89K0bo

— Rep. Leo Biasiucci (@Leo4AzHouse) June 23, 2025

If you’re in the market to buy a home in America right now, you may have noticed that the Federal Reserve is making it quite challenging for potential homeowners. The current interest rates set by the Federal Reserve are significantly impacting the cost of purchasing a home. Let’s break it down:

$2827 for a home with 7% interest

If you’re looking to buy a home with a 7% interest rate, you could end up paying a hefty sum each month. This high-interest rate can add up quickly, making it difficult for many individuals and families to afford their dream home.

vs

$1791 for a home with 3% interest

On the other hand, a home with a 3% interest rate would result in a much more manageable monthly payment. The lower interest rate can save you thousands of dollars over the life of your mortgage, allowing you to invest in other areas of your life.

It’s important to note that inflation is currently at 2%, which means that the Federal Reserve can no longer use this as an excuse for keeping interest rates high. With inflation at a steady rate, there is no reason for interest rates to remain as high as they are.

So, why is the Federal Reserve keeping interest rates so high? Many believe that the Federal Reserve is prioritizing other economic factors over the well-being of individuals trying to buy a home. This has led to frustration and anger among potential homeowners who are struggling to make ends meet in the current housing market.

It’s crucial for the Federal Reserve to reconsider its approach to interest rates and prioritize the needs of everyday Americans who are simply trying to achieve the dream of homeownership. By lowering interest rates to a more reasonable level, the Federal Reserve can help make homeownership more accessible and affordable for all.

In conclusion, the Federal Reserve’s decision to keep interest rates high is negatively impacting individuals trying to buy a home in America. With the stark contrast between the cost of a home with a 7% interest rate versus a 3% interest rate, it’s clear that something needs to change. By reevaluating its policies and considering the needs of the people, the Federal Reserve can help make homeownership a reality for more Americans.

So, if you’re currently in the market for a home, keep an eye on the Federal Reserve’s interest rate decisions and advocate for policies that support affordable homeownership for all.

Sources: