Iran’s Parliament Shocks World by Voting to Block Critical Oil Route!

Iranian oil route disruption, Strait of Hormuz blockade impact, global oil market reaction

—————–

Iranian Parliament Approves Closure of the Strait of Hormuz

In a significant development that has sent shockwaves through global markets, the Iranian Parliament has officially approved the closure of the Strait of Hormuz. This pivotal maritime passage is recognized as one of the world’s most critical oil routes, through which a substantial portion of the world’s oil supply transits. The implications of this decision are profound, not just for Iran and its immediate neighbors, but for the entire global economy.

The Strait of Hormuz: A Vital Waterway

The Strait of Hormuz is a narrow opening between the Persian Gulf and the Gulf of Oman, bordered by Iran to the north and the United Arab Emirates and Oman to the south. It serves as a crucial chokepoint for maritime oil and gas shipments, with approximately 20% of the world’s oil supply passing through its waters daily. The closure of this strait could lead to significant disruptions in oil supply chains and could potentially trigger a spike in oil prices worldwide.

Immediate Economic Impact

The Iranian Parliament’s decision to close the Strait of Hormuz is expected to have immediate repercussions on global oil markets. Analysts predict that oil prices will surge as supply becomes constrained. In a market already sensitive to geopolitical tensions, this move could exacerbate inflationary pressures and impact economies that rely heavily on oil imports.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Global markets typically react swiftly to such news, with stock prices of oil companies likely to rise as they adjust to the new supply dynamics. Conversely, industries reliant on oil, such as transportation and manufacturing, may face increased costs, leading to a ripple effect throughout various sectors of the economy.

Geopolitical Ramifications

The closure of the Strait of Hormuz is not just an economic issue; it is also a geopolitical one. This action could heighten tensions in the region, leading to potential military confrontations. Countries dependent on oil imports from the Gulf may seek diplomatic solutions to ensure the safe passage of their vessels, while others may consider military options to protect their interests.

The international community, particularly the United States and European nations, will likely respond with a mix of condemnation and strategic planning. The U.S. has previously conducted naval operations in the region to ensure freedom of navigation, and a similar response can be anticipated in light of this latest development.

Iran’s Motivations

Understanding Iran’s motivations behind the closure is crucial. The Iranian government may view this action as a means to assert its influence in the region and respond to perceived threats from rival nations. By controlling this critical passage, Iran aims to leverage its strategic position and negotiate from a place of strength.

Furthermore, the closure could be perceived as a reaction to sanctions that have crippled Iran’s economy. By creating a new source of tension, Iran might be attempting to shift the focus away from its internal issues and rally nationalist sentiments among its population.

The Role of Social Media

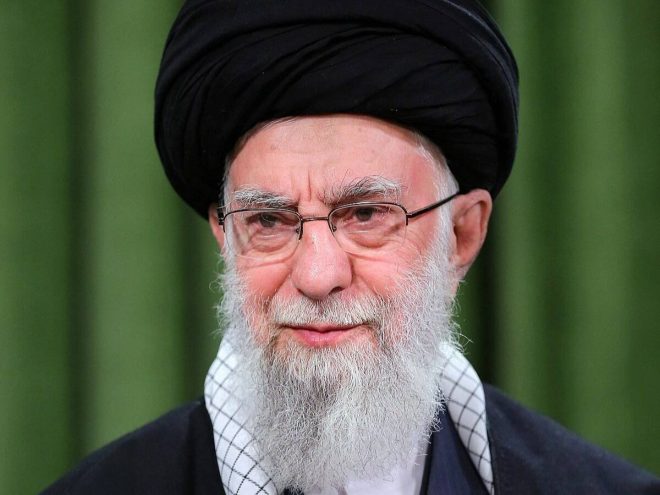

The announcement of the closure was disseminated rapidly through social media platforms like Twitter, where users and analysts alike shared their thoughts and predictions on the potential fallout. The speed at which information spreads on social media underscores the importance of real-time communication in today’s interconnected world. The tweet from Sahar Emami, which included an image and a brief message about the development, exemplifies how social media can influence public perception and market reactions.

Long-Term Consequences

In the long run, the closure of the Strait of Hormuz could lead to a reevaluation of global energy strategies. Countries may seek to diversify their energy sources or increase their investments in alternative energy technologies to reduce dependence on oil from the Gulf. This shift could have lasting implications for the global energy landscape, potentially accelerating the transition to renewable energy.

Additionally, if tensions continue to escalate, we may see a reconfiguration of alliances in the region. Countries that rely heavily on oil imports may strengthen ties with other oil-producing nations, while those with strategic interests in the region may increase their military presence.

Conclusion

The Iranian Parliament’s approval of the closure of the Strait of Hormuz marks a critical moment in geopolitics and global economics. The immediate effects on oil prices and market stability are likely to be felt worldwide, with implications extending far beyond the region. As the international community grapples with this new reality, the long-term consequences will shape the future of energy policy, international relations, and economic stability.

As developments unfold, stakeholders across various sectors must remain vigilant and adapt to the rapidly changing landscape. The situation highlights the interconnectedness of global markets and the profound impact that geopolitical decisions can have on everyday life. Whether through increased energy prices or shifts in diplomatic relations, the closure of the Strait of Hormuz will undoubtedly be a topic of discussion for policymakers and analysts alike in the months and years to come.

JUST IN: Iranian Parliament APPROVES closure of the Strait of Hormuz

One of the world’s most critical oil routes is now BLOCKED.

Global markets will feel this in hours pic.twitter.com/tlZwj7382q— Sahar Emami (@iamSaharEmami) June 22, 2025

JUST IN: Iranian Parliament APPROVES closure of the Strait of Hormuz

The announcement from the Iranian Parliament regarding the closure of the Strait of Hormuz is shocking news that has sent ripples through global markets. This vital waterway, which plays a crucial role in international oil transportation, is now officially BLOCKED. The implications of this closure are profound, impacting not just Iran but economies around the world.

The Strait of Hormuz is renowned for being one of the most critical oil routes globally, accounting for approximately 20% of the world’s oil trade. This strategic passage connects the Persian Gulf to the Arabian Sea and is a lifeline for oil tankers transporting oil from countries like Saudi Arabia, Iraq, and the United Arab Emirates to global markets. With Iran’s recent decision, the global oil supply chain is on the brink of chaos, and market analysts anticipate significant fallout within just hours of this announcement by the Iranian Parliament.

One of the world’s most critical oil routes is now BLOCKED.

So, what does this mean for the world? The closure of the Strait of Hormuz poses a direct threat to the flow of oil, potentially leading to shortages and skyrocketing prices. Oil prices have historically responded sharply to geopolitical tensions in this region. For context, back in 2019, tensions between the U.S. and Iran led to fears of a closure, causing oil prices to surge by nearly 20% in just days. With the Iranian Parliament’s decision now a reality, we can expect similar volatility in the markets.

The immediate reaction from traders and analysts has been one of concern. As news spreads, we can expect to see fluctuations in oil prices, likely leading to increased costs for consumers and businesses alike. Gasoline prices may rise, impacting transportation costs and, by extension, the prices of goods and services. The effects of this blockade will likely be felt worldwide, influencing everything from inflation rates to economic growth forecasts.

Global markets will feel this in hours

It’s not just oil prices that will be affected; the global economy is intricately intertwined with energy prices. The ripple effect of a closure like this can lead to wider economic instability. Countries dependent on oil imports will be scrambling to secure alternative supplies, and nations that rely heavily on oil revenues, such as Saudi Arabia and Russia, will also feel the pinch. This situation could lead to diplomatic tensions, trade disruptions, and even military escalations in an already volatile region.

The closure may also provoke responses from other nations, including the United States, which has significant interests in ensuring the free flow of oil through this critical passage. Historically, the U.S. has taken actions to protect its interests in the region, and we may see similar responses in the coming days.

The Strategic Importance of the Strait of Hormuz

Understanding the significance of the Strait of Hormuz helps contextualize the gravity of this situation. This narrow waterway, which is only about 21 miles wide at its narrowest point, serves as the transit route for a vast amount of oil and liquefied natural gas. In 2020 alone, over 18 million barrels of oil were transported daily through this strait. It’s a vital choke point, and any disruption has immediate and far-reaching consequences on global energy security.

Additionally, the Strait of Hormuz is not just crucial for oil; it is also essential for global trade. Many shipping routes converge here, making it a strategic military and economic zone. This strategic position means that the motivations behind Iran’s decision may be multi-faceted, encompassing economic, political, and military considerations.

The Geopolitical Landscape

The geopolitical ramifications of Iran’s decision to close the Strait of Hormuz cannot be underestimated. Iran has a history of utilizing its control over this waterway as leverage in international relations, particularly with Western nations. The closure may be a tactic to exert pressure on adversaries, including the United States and its allies, amid ongoing tensions surrounding nuclear negotiations and sanctions.

Historically, Iran’s actions in the Strait have provoked responses from the U.S. Navy, which regularly patrols the area to ensure the freedom of navigation. This closure could escalate existing tensions further, potentially leading to military confrontations in the region.

Moreover, the closure of the Strait of Hormuz could embolden other actors in the region. Countries like Saudi Arabia, which have been at odds with Iran, may feel compelled to increase their military readiness or pursue alternative routes for their oil exports. This dynamic could lead to a cycle of escalation that destabilizes the region even further.

The Future of Energy and Oil Prices

As we look to the future, one thing is clear: the energy market is in for a bumpy ride. Investors and analysts will be closely monitoring the situation, watching for signals from the Iranian government regarding the duration of the closure and any potential resolutions. If the blockade continues for an extended period, we may see a dramatic shift in energy policies worldwide as countries scramble to diversify their energy sources.

Renewable energy may gain traction as countries look to reduce their reliance on oil, particularly if prices surge. This shift could accelerate the transition to greener energy sources, which many nations have already committed to. However, the immediate focus will likely remain on securing oil supplies and stabilizing prices in the short term.

Conclusion

The approval of the closure of the Strait of Hormuz by the Iranian Parliament is a significant geopolitical development with far-reaching implications. As one of the world’s most critical oil routes is now BLOCKED, global markets will feel this in hours. The uncertainty surrounding oil prices, economic stability, and geopolitical relations will dominate discussions in the coming days and weeks.

Whether this closure is a temporary maneuver or a longer-term strategy remains to be seen, but what is clear is that the world is watching closely. The implications of this decision will echo across markets and nations, shaping the future of energy and international relations in ways we are only beginning to understand.