Iran’s Parliament Votes to Close Strait of Hormuz: Global Oil Crisis Ahead?

oil market volatility, global energy security, inflation impact on consumers

—————–

Iranian Parliament Votes to Close the Strait of Hormuz: Economic Implications

In a significant geopolitical move, the Iranian parliament has voted to close the Strait of Hormuz, a crucial maritime passage that facilitates the transit of approximately 20% of the world’s oil supply. This decision could have far-reaching consequences not only for global oil markets but also for inflation rates and gas prices in the United States. This article explores the potential economic fallout that could arise from this controversial decision.

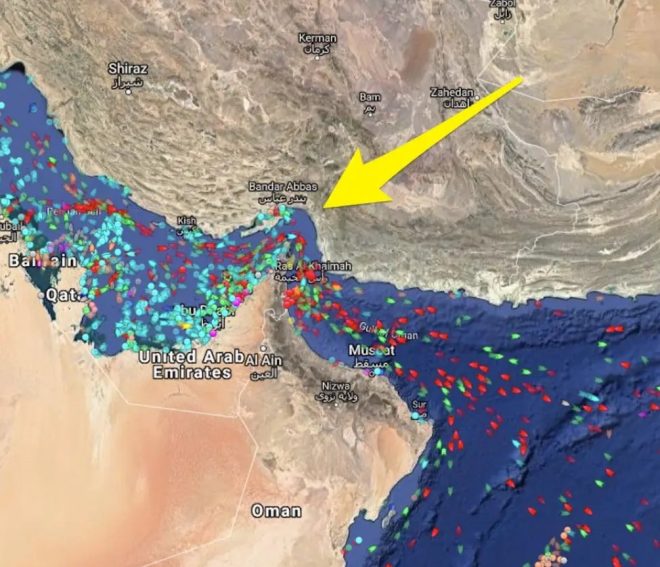

Understanding the Strait of Hormuz

The Strait of Hormuz is a narrow waterway located between Oman and Iran, connecting the Persian Gulf with the Arabian Sea. It serves as a vital chokepoint for international shipping, particularly for the oil and gas industry. Given that around 20% of the world’s oil supply passes through this strait, any disruption to this route can have immediate and severe implications for global oil markets.

Immediate Impact on Oil Prices

If the Iranian parliament’s decision to close the Strait of Hormuz is fully executed, one of the most immediate consequences would likely be a spike in oil prices. Experts predict that prices could surge by 30% to 50% or even more almost instantaneously. Such a dramatic increase would not only affect oil markets but would ripple through the entire global economy, impacting everything from transportation costs to the price of consumer goods.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Global Inflation Likely to Rise

As oil prices rise, so too would inflation rates around the globe. Oil is a fundamental commodity that underpins much of the world’s economic activity. Higher oil prices generally translate into increased costs for transportation and manufacturing, which are often passed on to consumers in the form of higher prices. This could lead to a significant rise in global inflation, affecting purchasing power and economic stability in various countries.

Implications for U.S. Gas Prices

In the United States, rising oil prices would likely have a direct impact on gas prices. As crude oil becomes more expensive, the cost of gasoline at the pump would also increase. This could lead to a significant burden on American consumers, particularly those who rely on their vehicles for daily commutes and other essential travel. The potential for higher gas prices could dampen consumer spending, further affecting the economy.

Geopolitical Tensions Escalate

The decision to close the Strait of Hormuz could also exacerbate geopolitical tensions in the region. The United States and its allies have significant interests in ensuring the free flow of oil through this critical waterway. Any attempts by Iran to enforce a closure could provoke military responses or sanctions from Western nations, potentially escalating into broader conflicts.

Alternatives and Adaptations

In response to a potential closure of the Strait of Hormuz, countries and companies may begin to explore alternative routes for oil transportation. This could involve utilizing land-based pipelines or increasing shipments through other maritime routes, albeit these alternatives may be less efficient and more costly. Additionally, countries heavily reliant on oil imports may begin to accelerate investments in renewable energy sources to mitigate their dependence on oil.

The Role of OPEC

The Organization of the Petroleum Exporting Countries (OPEC) would also play a critical role in the aftermath of a closure of the Strait of Hormuz. OPEC nations may need to adjust their production levels to stabilize the market. However, the effectiveness of such measures would depend on the cooperation of all member states, which can be challenging given differing national interests.

Conclusion

The Iranian parliament’s vote to close the Strait of Hormuz represents a significant escalation in the ongoing geopolitical tensions in the Middle East. The potential economic implications are profound, with predictions of substantial spikes in oil prices and subsequent rises in global inflation. The United States and other nations may face rising gas prices, straining consumer budgets and impacting economic growth.

As the situation develops, it will be essential for global leaders and economic stakeholders to remain vigilant and prepared for the potential fallout. Strategies must be formulated to address both immediate and long-term consequences, including the exploration of alternative energy sources and trade routes. The world is undoubtedly at a critical juncture, and the decisions made in the coming days and weeks could reshape the global economic landscape for years to come.

BREAKING: Iranian parliament has just voted to close the Strait of Hormuz.

– 20% of global oil passes through the Strait

HERE’s what to expect if successful:

– Oil Prices could spike by 30–50%+ almost immediately

– Global Inflation likely Rises

– U.S. Gas Prices likely… pic.twitter.com/WC4dmeagRE

— Brian Krassenstein (@krassenstein) June 22, 2025

BREAKING: Iranian Parliament Has Just Voted to Close the Strait of Hormuz

The news is out: the Iranian parliament has voted to close the Strait of Hormuz, a pivotal waterway for global oil transport. This development is significant, considering that about 20% of the world’s oil passes through this narrow channel. So, what does this mean for the global economy and your wallet? Let’s dive in and explore the potential implications of this bold move.

– Oil Prices Could Spike by 30–50%+ Almost Immediately

If the closure goes into effect, experts predict that oil prices could surge by as much as 30% to 50% or even more. This dramatic increase would be triggered by immediate supply fears, as the Strait of Hormuz is a crucial chokepoint for oil tankers. Many countries, especially those heavily reliant on oil imports, would feel the pinch in their economies.

Imagine heading to the gas station and seeing prices skyrocketing overnight. It’s not just a distant worry; it could become a reality for millions. Why? Because when oil prices rise, gas prices do too. As consumers, we’re often left holding the bag when geopolitical tensions affect the market.

– Global Inflation Likely Rises

When the cost of oil increases, it doesn’t just affect fuel at the pump. Everything from transportation to the price of goods and services is influenced by oil prices. It’s a domino effect that can lead to rising global inflation. In fact, analysts are already sounding the alarm about the potential for widespread inflationary pressures if the Strait remains closed.

Higher oil prices mean that manufacturers face increased costs to transport raw materials and finished products. These costs are typically passed down to consumers, leading to higher prices on everything from groceries to electronics. In an already struggling global economy, this situation could exacerbate existing inflationary trends and put additional pressure on households.

– U.S. Gas Prices Likely to Surge

For those living in the United States, the implications are even more direct. If oil prices spike, you can expect U.S. gas prices to follow suit. According to the U.S. Government Accountability Office, the correlation between oil prices and gas prices is undeniable. A sudden increase in oil costs impacts how much we pay at the pump.

As a result, families might find themselves budgeting more for gas, which can lead to difficult choices when it comes to spending on other essentials. Commutes may become more expensive, and people might reconsider travel plans. It’s a ripple effect that can touch everyone’s daily life.

The Broader Economic Impact

So, what else can we expect if the closure of the Strait of Hormuz becomes a reality? The broader economic implications could be staggering. Countries that depend heavily on oil imports could see their trade balances shift dramatically. This could lead to increased tensions between nations, as countries scramble to secure alternative oil supplies.

For instance, nations in Europe and Asia that rely on Middle Eastern oil might look to other regions, potentially driving up demand and prices elsewhere. The global oil market is interconnected, and a crisis in one area can have far-reaching consequences.

The Political Landscape

The decision to close the Strait of Hormuz won’t just shake up the economic landscape; it will also affect international relations. Countries like the United States, which have strategic interests in the region, may respond with diplomatic or military measures. The U.S. has historically kept a close eye on the Strait, and any significant disruption could lead to a realignment of foreign policy strategies.

Moreover, this decision by Iran can be seen as a power play in the ongoing geopolitical chess game involving oil-rich nations. The stakes are high, and the potential for conflict increases when vital resources are at risk. As tensions rise, it becomes crucial for all parties involved to tread carefully.

Preparing for Uncertainty

As we digest this news, it’s essential to consider how we can prepare for potential economic fallout. Here are a few tips to help you navigate through uncertain times:

- Budget Wisely: With gas prices likely to rise, revisit your budget. Consider cutting back on non-essential spending to accommodate potential increases in fuel costs.

- Explore Alternatives: If possible, look into carpooling, public transportation, or even working from home to reduce your reliance on gas.

- Stay Informed: Follow reliable news sources to stay updated on the situation. Understanding the geopolitical landscape can help you make informed decisions.

What to Watch For

In the coming days and weeks, keep an eye on several key indicators that will give you a clearer picture of how this situation unfolds. Watch for:

- News updates regarding the status of the Strait of Hormuz and any official announcements from Iran.

- Movements in oil prices, particularly on futures markets, which can give early signals of shifts.

- Responses from major oil-producing nations and how they choose to navigate this new landscape.

Conclusion

The closure of the Strait of Hormuz by the Iranian parliament is more than just a headline; it represents a potential turning point in global oil markets and economic stability. With significant oil price increases, rising inflation, and surging U.S. gas prices, the implications are vast and complex. As we brace for the potential fallout, it’s essential to stay informed and prepared for the challenges that lie ahead. The interconnected nature of our global economy means that what happens in one part of the world can affect us all, so let’s keep a close watch on this evolving situation.

“`