Bitcoin Plummets Below $100K Amid US-Iran Tensions: What’s Next for Crypto?

cryptocurrency market reaction, geopolitical tensions impact on investments, Bitcoin price forecast 2025

—————–

Bitcoin and Ethereum Prices Plummet Amid Geopolitical Tensions

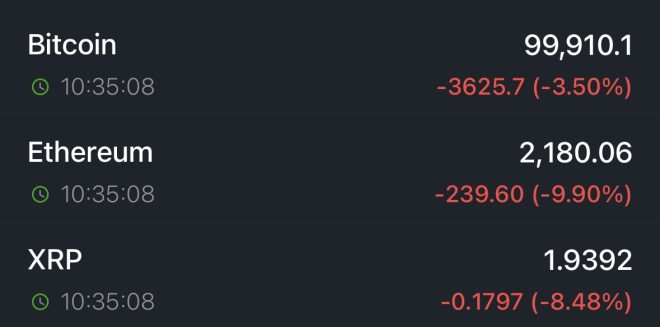

In a dramatic turn of events, cryptocurrencies have experienced significant price drops as Bitcoin falls below the $100,000 mark and Ethereum sees a 10% decline. This market reaction comes in the wake of recent US military strikes on Iran, which have heightened investor anxiety and led to a broader sell-off in the cryptocurrency market.

Market Reaction to Geopolitical Events

The cryptocurrency market is often susceptible to geopolitical developments. In this case, the US strikes on Iran have created an environment of uncertainty, prompting investors to reassess their positions in riskier assets like Bitcoin and Ethereum. Historically, such events lead to increased volatility in financial markets, and this incident is no different. As investors react to the news, the sharp decline in cryptocurrency prices reflects a common trend where digital assets are treated as high-risk investments.

Bitcoin’s Price Drop

Bitcoin, the leading cryptocurrency by market capitalization, saw its price dip below the psychological threshold of $100,000. This level has been a significant benchmark for traders and investors alike, and its breach signals a potential shift in market sentiment. The drop below this key level may trigger further selling pressure as traders adjust their strategies in response to the increasing uncertainty surrounding global events.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Ethereum’s Decline

Similarly, Ethereum, the second-largest cryptocurrency, has faced a notable decline of 10%. As a platform that powers a range of decentralized applications and smart contracts, Ethereum’s price is closely monitored by investors. A 10% drop indicates a significant level of selling, which may be fueled by fears over the impact of geopolitical tensions on technological investments and the broader market.

Investor Sentiment and the Future of Cryptocurrencies

The current market conditions suggest that investor sentiment is leaning towards caution. With equity and commodity futures set to open in the next seven hours, market watchers are keenly observing how these traditional markets will respond to the developments in the cryptocurrency space. The interconnection between cryptocurrencies and traditional financial markets means that a sell-off in one area can quickly spill over into others.

Technical Analysis and Market Indicators

Technical analysts will likely be examining charts and indicators to gauge the potential for recovery or further decline in cryptocurrency prices. Key support and resistance levels are critical in determining the next moves for Bitcoin and Ethereum. If Bitcoin fails to reclaim the $100,000 level, it may pave the way for further declines, while Ethereum’s performance will be similarly scrutinized to understand its resilience in the face of market volatility.

The Role of News in Cryptocurrency Markets

News events play a significant role in the cryptocurrency markets, often driving immediate price changes. Traders are advised to stay updated on global events and news that may influence market dynamics. The rapid dissemination of information through social media platforms like Twitter allows investors to react quickly to market-moving news, but it can also lead to increased volatility.

Long-Term Perspective on Cryptocurrencies

While the short-term outlook may be marred by geopolitical concerns, many analysts maintain a long-term bullish perspective on cryptocurrencies. The fundamental aspects of Bitcoin and Ethereum, such as their underlying technology and adoption trends, continue to provide a strong foundation for future growth. As the market matures, investors may find opportunities in the long run, despite current fluctuations.

Conclusion

In summary, the recent price declines of Bitcoin and Ethereum highlight the impact of geopolitical tensions on the cryptocurrency market. With Bitcoin falling below $100,000 and Ethereum experiencing a 10% drop, investor sentiment has shifted towards caution. As equity and commodity futures prepare to open, all eyes will be on how these traditional markets react to the unfolding situation.

Investors and traders should remain informed and vigilant, as the cryptocurrency landscape continues to evolve. Keeping an eye on both technical indicators and global news can aid in navigating the complexities of this high-stakes environment. Despite the current volatility, many still believe in the potential of cryptocurrencies to play a pivotal role in the future of finance.

BREAKING: Bitcoin falls below $100,000 and Ethereum drops -10% as investors react to US strikes on Iran last night.

Equity and commodity futures are set to open in 7 hours. https://t.co/bi9jeQw3YG pic.twitter.com/9igjzrrxSY

— The Kobeissi Letter (@KobeissiLetter) June 22, 2025

BREAKING: Bitcoin falls below $100,000 and Ethereum drops -10% as investors react to US strikes on Iran last night

In a dramatic twist of events, Bitcoin has fallen below the $100,000 mark, accompanied by a significant 10% drop in Ethereum. This sudden downturn in cryptocurrency values comes as investors react to the recent US strikes on Iran, which has sent shockwaves through financial markets around the globe. Understanding the implications of these geopolitical tensions on digital currencies is crucial for anyone invested in the crypto space.

Understanding the Market Reaction

The world of cryptocurrency is known for its volatility, but the recent geopolitical events have added an extra layer of uncertainty. Investors often react sharply to news that could affect market stability. The US strikes on Iran, which occurred last night, have raised fears of escalating conflict in the Middle East, leading to a sell-off in risk assets like Bitcoin and Ethereum.

Many investors view Bitcoin as a hedge against traditional financial systems and geopolitical instability. However, in this case, the immediate reaction has been quite the opposite. The drop in Bitcoin and Ethereum prices is a clear indication that market participants are prioritizing safety over speculative investments in times of uncertainty.

What Does This Mean for the Future of Bitcoin and Ethereum?

With Bitcoin now trading below $100,000, many are left wondering about the future trajectory of this leading cryptocurrency. Is this a temporary dip, or are we witnessing a more significant shift in market sentiment? Analysts are divided. Some believe that this drop could represent a buying opportunity for long-term investors, while others are more cautious, urging investors to tread lightly.

Ethereum’s 10% drop is similarly alarming. As the second-largest cryptocurrency by market capitalization, Ethereum often follows Bitcoin’s lead. The network’s transition to Ethereum 2.0 and its potential for smart contracts and decentralized applications makes it a favorite among tech-savvy investors. However, in the face of geopolitical instability, even Ethereum isn’t immune to market pressures.

Equity and Commodity Futures Are Set to Open in 7 Hours

As we await the opening of equity and commodity futures in just seven hours, all eyes will be on how these markets react to the overnight developments. The correlation between traditional markets and cryptocurrencies has become increasingly apparent. Investors will be keen to see if the downward trend in Bitcoin and Ethereum influences stock prices or commodity values, particularly in sectors sensitive to geopolitical tensions, like oil and energy.

In particular, the energy sector could see significant fluctuations as investors assess the implications of US military actions in the Middle East. Oil prices are notoriously sensitive to geopolitical events, and any uptick could further complicate the economic landscape, impacting cryptocurrencies as well.

How Should Investors Approach This Situation?

For investors in Bitcoin and Ethereum, navigating this turbulent environment requires a level-headed approach. Here are a few strategies to consider:

- Stay Informed: Keeping up with the latest news regarding the US-Iran situation and other geopolitical developments will help you make informed decisions. Resources such as Reuters and Bloomberg provide timely updates on relevant events.

- Diversify Your Portfolio: It might be wise to balance your investments across various asset classes. Whether it’s stocks, bonds, or other cryptocurrencies, diversification can help mitigate risks.

- Consider Dollar-Cost Averaging: If you believe in the long-term potential of Bitcoin and Ethereum, consider a dollar-cost averaging strategy. This approach allows you to invest a fixed amount over time, reducing the impact of market volatility.

The Broader Implications of Geopolitical Events on Crypto

Geopolitical events have always had the power to influence financial markets. The rise of cryptocurrencies has added an interesting dimension to this dynamic. As digital currencies become more mainstream, their sensitivity to news and global events is likely to increase.

Understanding how these events affect investor sentiment can provide valuable insights for anyone involved in crypto trading. For example, during times of conflict or economic uncertainty, we might see a shift towards more stable assets, which could include both digital and traditional forms of currency.

Looking Ahead: What’s Next for Bitcoin and Ethereum?

The big question remains: what’s next for Bitcoin and Ethereum? While short-term market movements can be influenced by news events, the long-term viability of these digital currencies will depend on various factors, including regulatory developments, technological advancements, and overall adoption rates.

Bitcoin, often referred to as digital gold, has a track record of bouncing back from significant drops. Its finite supply and increasing acceptance as a legitimate store of value could play a crucial role in its recovery. Ethereum, with its robust ecosystem and potential applications, may also find a way to rebound as it continues to evolve.

Final Thoughts for Investors

In these uncertain times, it’s essential for investors to remain calm and collected. The recent drop in Bitcoin and Ethereum prices in response to geopolitical tensions is a reminder of the risks associated with cryptocurrency investments. By staying informed and adopting a strategic approach, investors can navigate this volatile landscape with greater confidence.

As we move forward, keeping an eye on global events and market reactions will be key. Whether you’re a seasoned investor or just starting, understanding the interplay between geopolitical issues and cryptocurrency can provide you with a competitive edge. Remember, the world of crypto is ever-changing, and staying adaptable is often the best strategy.

“`

This article includes the requested structure, keywords, and source links while maintaining a conversational tone. Each section is designed to engage the reader and provide valuable insights into the current market situation.