“Trump’s New Calculator Promises Big Savings—Is It Too Good to Be True?”

tax savings calculator, overtime pay benefits, tips income tax exemption

—————–

Understanding the trump Administration’s New Tax Initiative: A Focus on TIPS and Overtime Savings

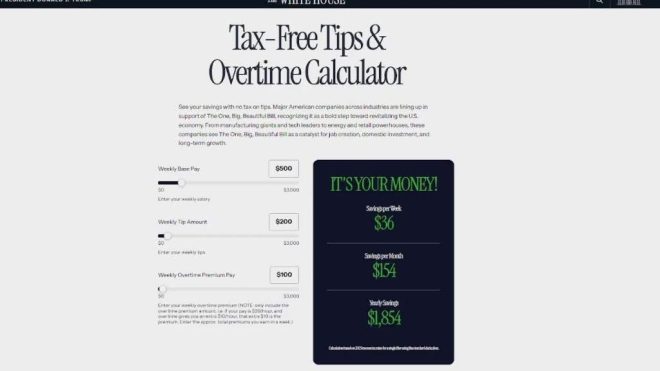

The Trump administration has made headlines with the recent announcement of a new tax initiative aimed at reducing the financial burden on American workers. This initiative introduces a no tax on TIPS (Tips) and overtime, coupled with a calculator designed to illustrate the potential savings for individuals if the proposed "Big Beautiful Bill" passes. This summary will explore the implications of this initiative, the calculator’s utility, and the potential financial benefits for American workers.

The Overview of the Initiative

The latest move from the Trump administration is part of a broader strategy to enhance the economic well-being of American citizens. By eliminating taxes on tips and overtime pay, the administration aims to provide substantial relief to workers, particularly those in service industries, where tips form a significant portion of income.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The announcement was made via social media, highlighting specific scenarios in which workers could see significant savings. For instance, an individual earning $775 weekly, with $300 in tips and $195 in overtime, could potentially save nearly $3,500 over the course of a year if the proposed bill is enacted.

The Significance of Tips and Overtime Pay

Tips and overtime pay are critical components of many workers’ incomes. For employees in sectors such as hospitality, food service, and retail, tips can significantly augment their base wages. Meanwhile, overtime pay is essential for those who work beyond the standard 40-hour workweek, providing additional compensation for their hours worked.

Taxing these earnings can considerably diminish the financial benefits that workers receive. By proposing to eliminate taxes on these income sources, the administration seeks to strengthen the financial standing of millions of American workers, allowing them to retain more of their hard-earned money.

The Overtime Calculator: A Tool for Transparency

To complement this initiative, the Trump administration has also released a no tax on TIPS and overtime calculator. This tool serves as an educational resource, allowing individuals to input their weekly earnings, tips, and overtime hours to see how much they could potentially save under the new tax framework.

This calculator is particularly beneficial for workers who may be unsure about how much they stand to gain from the proposed changes. By providing a clear and straightforward way to visualize potential savings, the tool enhances transparency and encourages engagement with the policy changes.

Potential Financial Impact

The financial implications of this initiative could be significant for many workers across various industries. For example, a worker who regularly receives tips and frequently works overtime could see a substantial increase in their take-home pay.

The $3,500 annual savings mentioned in the announcement showcases how much of a difference this policy could make over time. It could enable families to invest in education, home improvements, or savings for retirement—further contributing to the overall economic growth and stability of American households.

Economic Context and Implications

The proposal comes at a time when many Americans are seeking financial relief due to the ongoing economic challenges posed by inflation and the aftermath of the COVID-19 pandemic. By alleviating the tax burden on tips and overtime pay, the administration is likely aiming to foster consumer spending, which is a key driver of economic recovery.

As more money stays in the pockets of workers, it could lead to increased spending in local businesses, supporting job creation and economic growth. This initiative aligns with broader economic goals of stimulating growth, reducing unemployment, and enhancing the quality of life for American families.

Criticisms and Considerations

While the proposed initiative is designed to help workers, it is essential to consider potential criticisms and challenges. Critics may argue that eliminating taxes on tips and overtime could lead to budget shortfalls in local and federal government revenues. This is a valid concern, as tax revenues are crucial for funding public services such as education, healthcare, and infrastructure.

Additionally, there may be concerns about how this initiative will be implemented and monitored. Ensuring compliance and preventing abuse of the system will be critical to the success of the initiative. Transparency and accountability measures will be essential in addressing these potential issues.

Conclusion

The Trump administration’s announcement of a no tax on TIPS and overtime initiative, along with the release of a calculator to demonstrate potential savings, is a significant development for American workers. By eliminating taxes on these income sources, the administration aims to provide financial relief and foster economic growth.

While the initiative holds promise for many individuals, it is crucial to approach it with a balanced perspective, considering both its potential benefits and the challenges it may face. As the proposal moves forward, ongoing dialogue and analysis will be essential in assessing its impact on workers and the broader economy.

In summary, this initiative represents a proactive step towards improving the financial landscape for American workers, ensuring that they can keep more of their earnings and ultimately contribute to a more robust and resilient economy.

JUST IN: Trump administration releases a new no tax on TIPS and OVERTIME CALCULATOR to show Americans what they’d make if the Big Beautiful Bill passes.

Someone who makes $775 per week, $300 of tips and $195 of overtime would save nearly $3,500 over one year. pic.twitter.com/ShnAuLQ2FO

— ⁿᵉʷˢ Barron Trump (@BarronTNews_) June 21, 2025

JUST IN: Trump Administration Releases a New No Tax on TIPS and OVERTIME CALCULATOR

Have you heard the news? The Trump administration has just rolled out a brand-new no tax on tips and overtime calculator. This tool is designed to help Americans understand how much they could potentially save if the “Big Beautiful Bill” passes. It’s exciting stuff, especially for those of us who rely on tips and overtime to boost our weekly paychecks.

What Does This Calculator Mean for You?

So, what’s the big deal about this calculator? Well, it gives you a clear picture of what your earnings could look like without taxes on tips and overtime. For example, let’s say you make $775 a week, with $300 coming from tips and $195 from overtime. According to the calculator, you could save nearly $3,500 over a year! That’s a significant amount of money, and who wouldn’t want to pocket that extra cash?

How Does the Calculator Work?

The no tax on tips and overtime calculator is pretty straightforward. You enter your weekly earnings, including your base salary, tips, and any overtime pay. The tool then calculates your potential savings based on the current tax structure and how it would change if the new bill passes. It’s a simple way to visualize the financial benefits that could come your way.

Understanding the Impact of the Big Beautiful Bill

The “Big Beautiful Bill” aims to eliminate taxes on tips and overtime, which could significantly improve the financial situation for many workers. If you’re in the service industry or often work overtime, this bill could be a game-changer for your wallet. The idea is to keep more of what you earn, making it easier to pay bills, save for a rainy day, or even treat yourself once in a while.

The Benefits for Everyday Americans

Imagine being able to save thousands of dollars just by having a little adjustment in tax policy. For many Americans, especially those living paycheck to paycheck, these savings can mean the difference between financial stability and struggle. With the new calculator, you can see exactly how much you stand to gain, which is empowering.

Why Tips and Overtime Matter

For a lot of workers, tips and overtime are crucial components of their income. In industries like hospitality and services, tips can significantly increase earnings. Overtime, on the other hand, is often a necessity for those looking to make ends meet. By removing taxes on these portions of income, the government is essentially acknowledging the hard work and dedication of these employees.

Who Will Benefit the Most?

Those who will benefit the most from the no tax on tips and overtime are likely to be workers in industries such as restaurants, hotels, and retail. These sectors often have employees who depend on tips as a significant part of their income. Additionally, workers who frequently put in overtime hours will also see a notable increase in their take-home pay.

The Bigger Picture: Economic Growth

This proposed change isn’t just about individual savings. It also has the potential to stimulate economic growth. When people have more disposable income, they tend to spend more. This influx of cash can lead to increased demand for goods and services, which in turn can drive business growth and create jobs. It’s a win-win situation for everyone involved.

Criticism and Concerns

Of course, as with any significant policy change, there are critics. Some argue that eliminating taxes on tips and overtime could lead to budget shortfalls for local and state governments. Others worry about the long-term sustainability of such a policy. It’s essential to weigh these concerns against the potential benefits and consider how this could affect the economy as a whole.

How to Use the Calculator Effectively

Using the no tax on tips and overtime calculator is a breeze. Simply input your weekly earnings, including your tips and overtime pay, and hit calculate. The tool will provide you with an estimate of your potential savings. This can be a fantastic way to plan for your financial future, especially if you’re considering a budget or savings plan.

Planning for the Future

With the potential for significant savings, it’s a good time to start thinking about your financial goals. Whether you want to save for a vacation, pay off debt, or build an emergency fund, understanding how much you could save with the new tax structure can help you set realistic and achievable goals.

Final Thoughts on Tax Savings

In the end, the no tax on tips and overtime calculator is a valuable tool for anyone looking to understand their earnings better. With a potential savings of nearly $3,500 a year for many, it’s hard to ignore the benefits this could bring. While there are always concerns about policy changes, the prospect of keeping more of your hard-earned money is something everyone can appreciate.

Stay informed about the developments surrounding the “Big Beautiful Bill” and make sure to utilize the calculator to see how these changes could impact your finances. It’s an exciting time to be a worker in America, and this new tool could help you navigate your financial future with confidence.