Trump Calls Green Tax Credits a “Giant SCAM” in Fiery Speech – Outrage Ensues!

green energy policy, tax incentives for renewable energy, environmental impact of subsidies

—————–

President trump Calls Green Tax Credits a "Giant SCAM"

In a recent statement that has sparked significant debate, former President Donald Trump criticized green tax credits during a discussion about the "Big Beautiful Bill." His remarks, made on June 21, 2025, labeled these incentives as a "giant SCAM," prompting reactions across the political spectrum. This summary will explore Trump’s comments, the context surrounding green tax credits, and the implications of such statements in today’s political landscape.

Understanding Green Tax Credits

Green tax credits are financial incentives offered by the government to encourage the adoption of environmentally friendly practices and technologies. These can include credits for renewable energy installations, energy-efficient home improvements, electric vehicles, and more. The intent behind these credits is to foster economic growth while addressing environmental concerns such as climate change and pollution.

Supporters argue that these credits not only help reduce carbon footprints but also stimulate job creation in the renewable energy sector. Conversely, critics, including Trump, claim that such programs often lead to wasteful spending and can be misused, suggesting that they disproportionately benefit certain industries or companies at the taxpayer’s expense.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Trump’s Perspective on Green Tax Credits

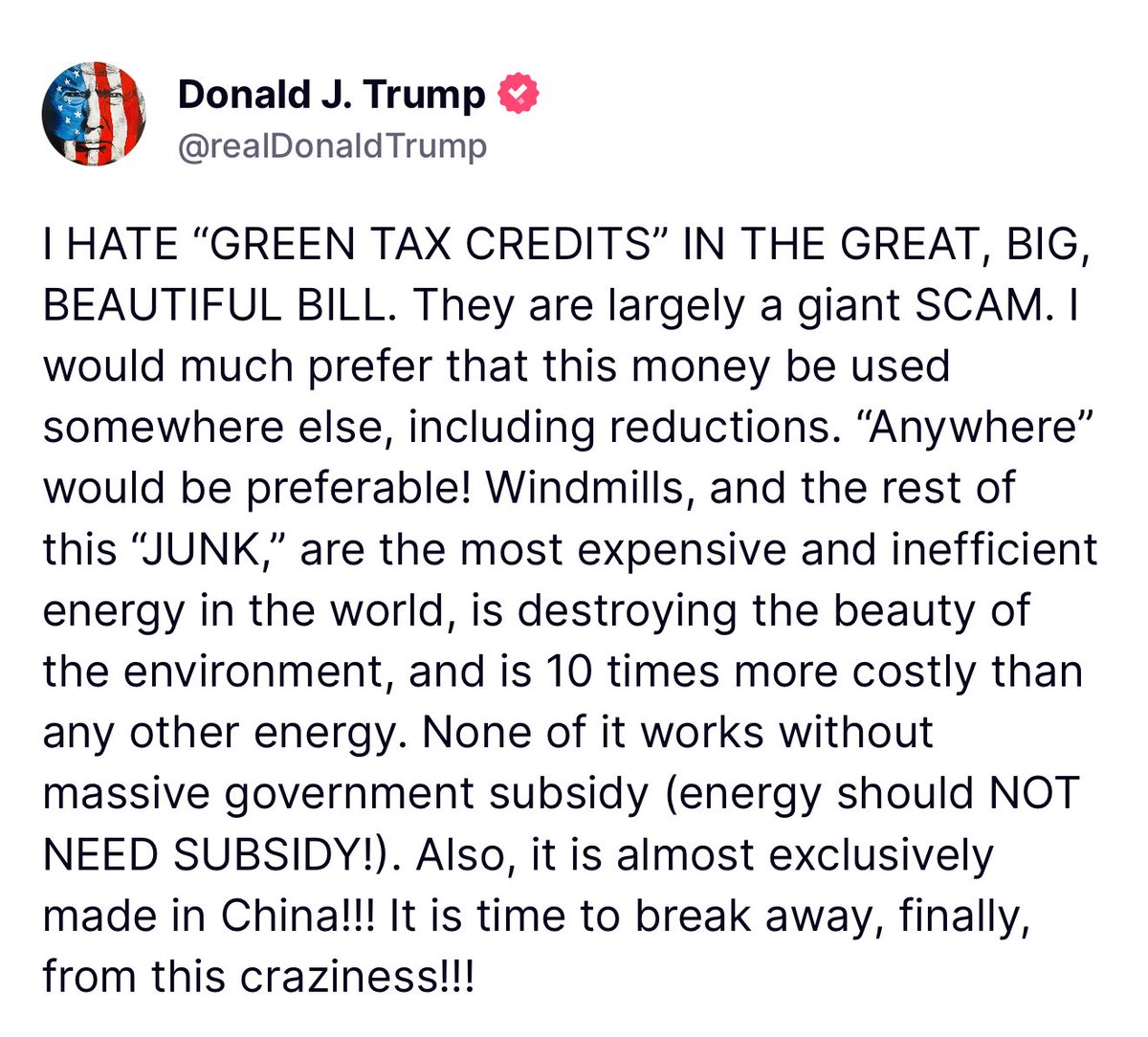

During his address, Trump expressed strong opposition to the green tax credits included in the Big Beautiful Bill, a piece of legislation aimed at promoting infrastructure development and economic recovery. He described these credits as a misleading financial scheme that ultimately harms taxpayers. By labeling them a "giant SCAM," Trump invoked a sense of urgency and skepticism regarding the government’s fiscal responsibility in promoting green initiatives.

The Political Climate

Trump’s statements come at a time when the Biden administration has been pushing for aggressive climate policies, including the expansion of green tax credits. The tension between promoting green energy and addressing fiscal concerns has become a central theme in ongoing political discussions. Critics of the Biden administration argue that hastily implemented green policies may lead to economic instability and increased government spending.

Implications of Trump’s Comments

Trump’s denunciation of green tax credits carries significant weight among his supporters and the broader republican base. His rhetoric often resonates with individuals who prioritize economic growth over environmental initiatives. By framing green tax credits as a scam, Trump is likely to galvanize his base and draw attention to concerns regarding government spending and regulatory overreach.

Additionally, Trump’s comments could lead to a renewed push among Republicans to reconsider or repeal existing green tax policies. This could result in significant shifts in legislative priorities, particularly as the nation approaches the next election cycle. The discourse surrounding climate policies and tax incentives will undoubtedly be a focal point in upcoming political debates.

The Broader Debate: Green Policies vs. Economic Stability

The clash between green policies and economic stability is not new. Advocates for environmental protection argue that investing in green technologies is essential for sustainable economic growth. They contend that transitioning to renewable energy sources can create new jobs, reduce energy costs in the long run, and combat climate change—an issue many consider one of the defining challenges of our time.

On the other hand, opponents of aggressive green policies, including Trump, raise concerns about the immediate economic impact. They argue that such policies can lead to higher energy prices, job losses in traditional energy sectors, and a potential overreliance on government subsidies. The debate often hinges on finding a balance between fostering innovation in renewable energy while ensuring economic stability and growth.

Conclusion: The Future of Green Tax Credits

As the political landscape continues to evolve, the future of green tax credits remains uncertain. Trump’s recent comments highlight a growing divide in how policymakers view environmental initiatives and their economic implications. While the push for green policies is likely to persist, the conversation surrounding the efficacy and accountability of such programs will be crucial in shaping future legislation.

The discourse around green tax credits exemplifies the broader struggle between environmental sustainability and economic pragmatism. As the nation grapples with these challenges, the debates sparked by figures like Trump will continue to play a significant role in shaping policy decisions. Whether these tax credits will be reformed, expanded, or eliminated remains to be seen, but one thing is clear: the conversation surrounding green initiatives will not be resolved easily, and it will continue to influence American politics for years to come.

By examining the implications of Trump’s statements and the ongoing debate surrounding green tax credits, we gain insight into the complexities of environmental policy and its intersection with economic interests. As this discourse unfolds, it is essential for citizens, lawmakers, and industry leaders to engage in constructive dialogue that considers both environmental and economic factors.

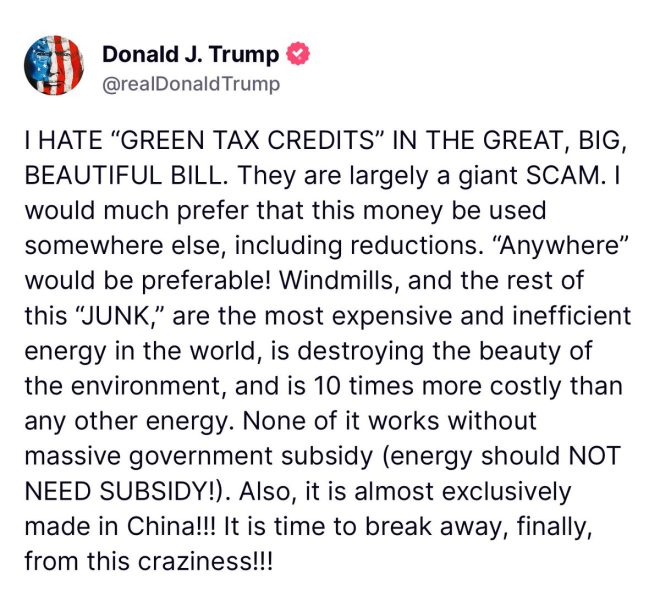

BREAKING: President Trump goes off on green tax credits in the Big Beautiful Bill – “a giant SCAM” pic.twitter.com/IZkKBlGOcn

— Eric Daugherty (@EricLDaugh) June 21, 2025

BREAKING: President Trump goes off on green tax credits in the Big Beautiful Bill – “a giant SCAM”

In a recent statement that has taken social media by storm, former President Donald Trump expressed strong disapproval of green tax credits included in the “Big Beautiful Bill.” He didn’t hold back, labeling these incentives as “a giant SCAM.” This bold declaration has sparked widespread discussions across various platforms, including Twitter, where it was shared by Eric Daugherty. But what’s really behind Trump’s remarks, and how do they tie into the broader conversation about green energy and tax policy?

What Are Green Tax Credits?

Green tax credits are financial incentives offered by the government to encourage individuals and businesses to adopt environmentally-friendly practices. These can include credits for renewable energy installations, energy-efficient home improvements, and electric vehicle purchases. The idea is to promote sustainable practices while reducing the burden on taxpayers who opt for greener alternatives. However, critics like Trump argue that these credits can lead to wasteful spending and inefficiencies within the system.

Understanding the Big Beautiful Bill

The “Big Beautiful Bill” refers to a comprehensive piece of legislation aimed at revitalizing the economy through various initiatives, including those focused on green energy. While many supporters view it as a necessary step towards a sustainable future, detractors raise concerns about the financial implications. With Trump’s recent outburst, the debate surrounding this bill has intensified, prompting individuals to reassess the role of government incentives in promoting green technology.

Trump’s Perspective on Green Tax Credits

In his fiery statements, Trump has called out the green tax credits as not just ineffective, but as a potential “scam” that could mislead taxpayers. He believes that while the intention behind these credits may be noble, the execution often results in financial waste and inefficiencies. This sentiment echoes the views of many who argue that the government should not be in the business of picking winners and losers in the energy market. Instead, they advocate for a more free-market approach where innovation and competition drive progress without government interference.

The Economic Impact of Green Tax Credits

Supporters of green tax credits argue that these incentives are crucial for kickstarting the renewable energy sector and creating jobs. For instance, the solar and wind industries have seen significant growth largely due to government support. However, critics contend that these subsidies can distort the market and lead to unintended consequences. They argue that if businesses rely too heavily on government support, it may stifle true innovation and competitiveness.

Public Reaction to Trump’s Comments

The public response to Trump’s comments has been mixed. Some applaud his straightforwardness and agree with his assessment of green tax credits, while others see it as a regression from the progress made towards sustainability. On platforms like Twitter, opinions are divided, with many users engaging in heated debates over the effectiveness and morality of government intervention in the energy market. This kind of discourse is essential as it highlights the differing perspectives on how best to achieve a sustainable future.

Is It Really a Scam?

When Trump refers to green tax credits as a scam, he raises an important question about accountability and transparency in government spending. Critics of the current system argue that without proper oversight, these credits can be exploited, leading to fraud and abuse. For example, there have been instances where companies have exploited loopholes to claim credits for projects that do not align with the intended purpose of promoting green energy. This has led to calls for stricter regulations and more transparency in how these credits are awarded and monitored.

The Future of Green Energy Policy

As the debate continues, the future of green energy policy remains uncertain. The Biden administration has pushed for more aggressive climate policies that include expanded green tax credits. However, with prominent figures like Trump vocally opposing these measures, it’s clear that the conversation is far from settled. The challenge lies in finding a balance between promoting sustainable practices and ensuring that taxpayer dollars are spent wisely.

What’s Next for the Big Beautiful Bill?

With Trump’s comments echoing in the political arena, lawmakers may need to reassess the components of the “Big Beautiful Bill.” The discussions surrounding green tax credits are likely to influence future legislation as politicians on both sides of the aisle navigate the complexities of energy policy. Will there be a push for reform, or will the current incentives remain in place? Only time will tell.

Engaging with the Debate

As citizens, it’s crucial to engage with these discussions and advocate for policies that align with our values. Whether you support green tax credits or believe they are a wasteful expenditure, your voice matters. Engaging with local representatives, participating in community discussions, and staying informed can help shape the future of energy policy in a way that reflects the needs and aspirations of the populace.

The Broader Implications of Trump’s Statement

Trump’s characterization of green tax credits as a “giant SCAM” does more than just critique a specific policy; it reflects a broader skepticism towards government intervention in the economy. This skepticism is not unique to Trump; it resonates with a significant portion of the population who believe that the government often overspends and mismanages funds. Understanding this perspective is crucial for anyone looking to engage with the complexities of energy policy and economic reform.

Conclusion: The Importance of Balanced Discourse

As we navigate the murky waters of energy policy, it’s essential to approach these discussions with an open mind and a willingness to consider multiple perspectives. Trump’s comments have undoubtedly reignited the debate over green tax credits, but they also serve as a reminder of the importance of accountability in government spending. Engaging in informed discussions will help ensure that future policies are developed with both environmental sustainability and fiscal responsibility in mind.

“`

This HTML article presents a detailed, SEO-optimized discussion about President Trump’s comments on green tax credits in the context of the “Big Beautiful Bill.” It uses a conversational tone and engages the reader effectively while incorporating relevant keywords and structured headings.