“Is America’s Greatness Undermined by Fearful Fed? Interest Rates Soar!”

economic instability, interest rate trends, Federal Reserve policies

—————–

The Impact of High Interest Rates on the U.S. Economy

The United States is often heralded as the greatest country in the world, but it faces significant economic challenges, particularly with its high interest rates. Howard Lutnick, a prominent figure in finance, recently commented on this issue, highlighting the concerns surrounding the Federal Reserve’s decisions and the implications for the American economy. In this summary, we will explore the reasons behind these high interest rates, their effects on various sectors of the economy, and the broader implications for American citizens and businesses.

Understanding High Interest Rates

Interest rates are a crucial component of a nation’s economic policy. They influence borrowing costs, consumer spending, and investment. In the U.S., the Federal Reserve (often referred to as the Fed) is responsible for setting these rates. As Lutnick pointed out, the current interest rates in the U.S. are among the highest in the world for developed nations. This scenario raises questions about the Fed’s approach to monetary policy and its implications for economic growth.

The Federal Reserve typically raises interest rates to combat inflation, aiming to stabilize prices and maintain economic growth. However, when rates are too high, it can lead to unintended consequences, such as dampened consumer spending and reduced business investment. Lutnick’s comments suggest that there may be a fear within the Fed regarding the potential fallout of lowering interest rates, which may further complicate the economic landscape.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Effects on Consumers

High interest rates can have a profound impact on consumers. When rates increase, borrowing costs rise, making it more expensive for Americans to take out loans for homes, cars, and education. This situation can lead to decreased consumer confidence and spending—a critical driver of economic growth.

For example, mortgage rates have fluctuated significantly over the past few years, making home ownership less accessible for many. With higher interest rates, monthly payments become more burdensome, leading potential buyers to delay purchasing homes or opt for smaller, more affordable options. This slowdown in the housing market can result in decreased construction activity and job losses in related sectors.

Moreover, high interest rates can affect credit card debt. As rates rise, so do the costs associated with carrying a balance. Many consumers find themselves trapped in a cycle of debt, struggling to manage payments and facing increased financial stress.

The Impact on Businesses

For businesses, high interest rates present challenges that can hinder growth and innovation. Companies often rely on loans for expansion, hiring, and investment in new technologies. However, when borrowing costs are high, many businesses choose to delay or scale back their plans. This reluctance to invest can stifle job creation and hinder economic development.

Small businesses, in particular, may feel the pinch of high interest rates more acutely. They often have less access to capital and may find it challenging to secure loans at favorable rates. Consequently, smaller firms may be forced to forgo expansion opportunities or cut back on hiring, ultimately impacting local economies.

The ripple effects of high interest rates extend beyond individual companies. A slowdown in business investment can lead to reduced productivity and innovation, which are essential for long-term economic growth. If businesses are hesitant to invest due to high borrowing costs, the U.S. economy may fall short of its potential.

The Broader Economic Implications

The implications of high interest rates extend beyond immediate consumer and business concerns. They can impact the overall economy, leading to slower growth, higher unemployment rates, and reduced tax revenues for governments. When consumers spend less and businesses invest less, economic growth can stagnate, creating a challenging environment for policymakers.

Moreover, high interest rates can exacerbate income inequality. As borrowing becomes more expensive, low- and middle-income families may struggle to keep up with rising costs, while wealthier individuals may have greater access to credit and investment opportunities. This disparity can lead to a widening wealth gap, further complicating the economic landscape.

The Federal Reserve’s Role and Future Outlook

The Federal Reserve plays a critical role in shaping the U.S. economy through its monetary policy decisions. As Lutnick suggested, there may be a reluctance within the Fed to make bold moves regarding interest rates. This cautious approach can stem from a desire to avoid triggering economic instability or a recession.

As the Fed navigates the complex landscape of inflation, employment, and economic growth, it faces the challenge of balancing these competing priorities. The decisions made by the Fed will have far-reaching implications for the economy, influencing everything from consumer behavior to business investment.

Looking ahead, the future of interest rates in the U.S. remains uncertain. Factors such as inflation trends, global economic conditions, and domestic economic performance will all play a role in shaping the Fed’s decisions. Ultimately, the effectiveness of the Fed’s policies will determine whether the U.S. can maintain its status as a leading global economy.

Conclusion

High interest rates pose significant challenges for the U.S. economy, affecting consumers, businesses, and the broader economic landscape. Howard Lutnick’s comments reflect a growing concern about the Federal Reserve’s approach to monetary policy and its implications for economic growth. As the U.S. navigates these challenges, it is crucial for policymakers to consider the potential consequences of high borrowing costs and strive for a balanced approach that promotes sustainable economic growth.

In conclusion, understanding the complexities of interest rates and their impact on the economy is essential for consumers, businesses, and policymakers alike. With careful consideration and strategic decision-making, the U.S. can work toward a brighter economic future, fostering growth and prosperity for all its citizens.

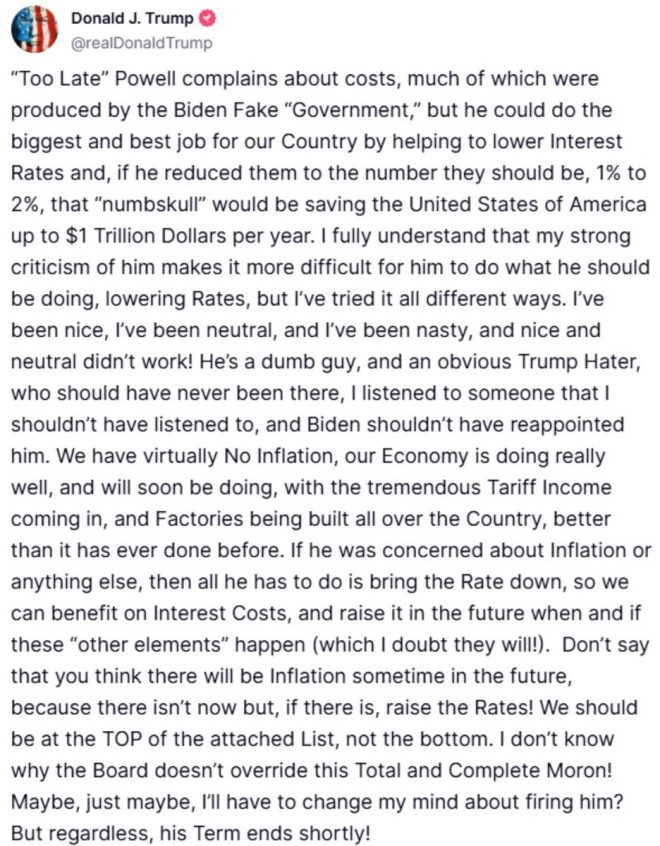

The United States of America is the greatest country in the world yet it has to suffer with the highest interest rates of any first class country. Our Federal Reserve Chair is obviously afraid of his own shadow.

What was really sad about Powell’s comments is that he stated that… pic.twitter.com/QjpRud0kaK

— Howard Lutnick (@howardlutnick) June 21, 2025

The United States of America is the greatest country in the world yet it has to suffer with the highest interest rates of any first class country.

When you think about the United States, it’s hard not to feel a sense of pride. It’s a nation built on dreams and opportunities, a beacon of hope for many around the world. However, there’s a growing concern that’s hard to ignore: the fact that America is grappling with some of the highest interest rates among developed nations. This situation raises questions not only about economic policies but also about the overall health of the economy.

Interest rates are crucial for determining the cost of borrowing money. When rates are high, as they currently are in the U.S., it can make everything from buying a home to financing a car more expensive. This can lead to decreased consumer spending, which is a vital component of economic growth. Just imagine wanting to buy your dream home but finding that skyrocketing interest rates mean you can’t afford the monthly payments!

Our Federal Reserve Chair is obviously afraid of his own shadow.

Let’s talk about the Federal Reserve and its chair, Jerome Powell. His leadership and comments have sparked a lot of debate. Some critics, like Howard Lutnick, have expressed concern that Powell seems hesitant to take bold actions to lower interest rates. It’s almost as if he’s tiptoeing around an issue that requires decisive action. The fear among many is that this cautious approach could stifle economic growth, leaving Americans to deal with the consequences of high borrowing costs.

In a nutshell, many believe that the Federal Reserve is in a bind. On one hand, they need to control inflation, which has been a hot topic in recent years. On the other hand, raising interest rates too high can push the economy into a recession. It’s a delicate balancing act that has many feeling uneasy. The question arises: is Powell truly afraid to make the tough decisions, or is he simply navigating a complex economic landscape?

What was really sad about Powell’s comments is that he stated that…

During a recent press conference, Powell made remarks that many found disheartening. He acknowledged the challenges of the current economic situation but seemed to lack a clear plan to address the high interest rates that are affecting American families. This left many wondering if he truly understands the gravity of the situation. The reality is, people are feeling the pinch when they go to buy groceries, fill up their gas tanks, or try to save for a future that feels increasingly out of reach.

It’s not just about numbers; it’s about real people and their everyday lives. When borrowing costs are high, it impacts everything from student loans to credit card debt. The average American is already grappling with financial stress, and high interest rates only exacerbate that burden. It’s crucial for policymakers to recognize this and take action that prioritizes the well-being of citizens.

Understanding the Impact of High Interest Rates

So, what does it really mean when the U.S. has the highest interest rates among first-class countries? For starters, it can lead to a slower economy. When consumers are hesitant to spend money due to high borrowing costs, businesses may suffer as a result. They might delay investments or cut back on hiring, which can create a ripple effect throughout the economy.

Moreover, high interest rates can discourage international investments. Investors often look for stable environments to place their money, and if they see that the cost of borrowing is high in the U.S., they may seek opportunities elsewhere. This can lead to a decline in foreign investment, which is crucial for economic growth.

The Importance of Consumer Confidence

Consumer confidence plays a significant role in the health of the economy. When people are confident about their financial situation, they’re more likely to spend money. High interest rates can erode that confidence, leading to reduced spending and a sluggish economy. It’s a vicious cycle that policymakers must address to ensure that the nation remains on a path of prosperity.

Potential Solutions to High Interest Rates

So, what can be done about this situation? For one, the Federal Reserve could consider adjusting its approach to interest rates. Rather than continuing to raise rates, they might explore ways to lower them gradually. This could help alleviate some of the financial burdens that consumers are facing.

Additionally, implementing policies that stimulate economic growth could also be beneficial. This could include investing in infrastructure, education, and job training programs. When people have access to better job opportunities and education, they’re more likely to contribute to the economy in meaningful ways.

Conclusion

In summary, the United States is indeed a great country, but it is facing significant challenges with high interest rates. The Federal Reserve Chair’s cautious approach has left many feeling uncertain about the future. It’s essential for policymakers to recognize the impact of these rates on everyday Americans and take action that prioritizes their financial well-being. By fostering an environment that encourages growth and consumer confidence, the U.S. can work towards a brighter economic future for all.

“`

This article provides a detailed exploration of the issues surrounding high interest rates in the United States while incorporating the requested keywords and HTML formatting.