Interest Rate Cut Now Likely! Is the Fed Ignoring Economic Reality?

interest rate prediction, Federal Reserve monetary policy, economic impact of interest rates

—————–

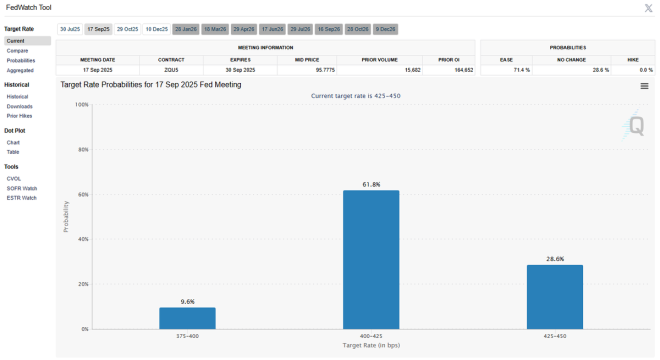

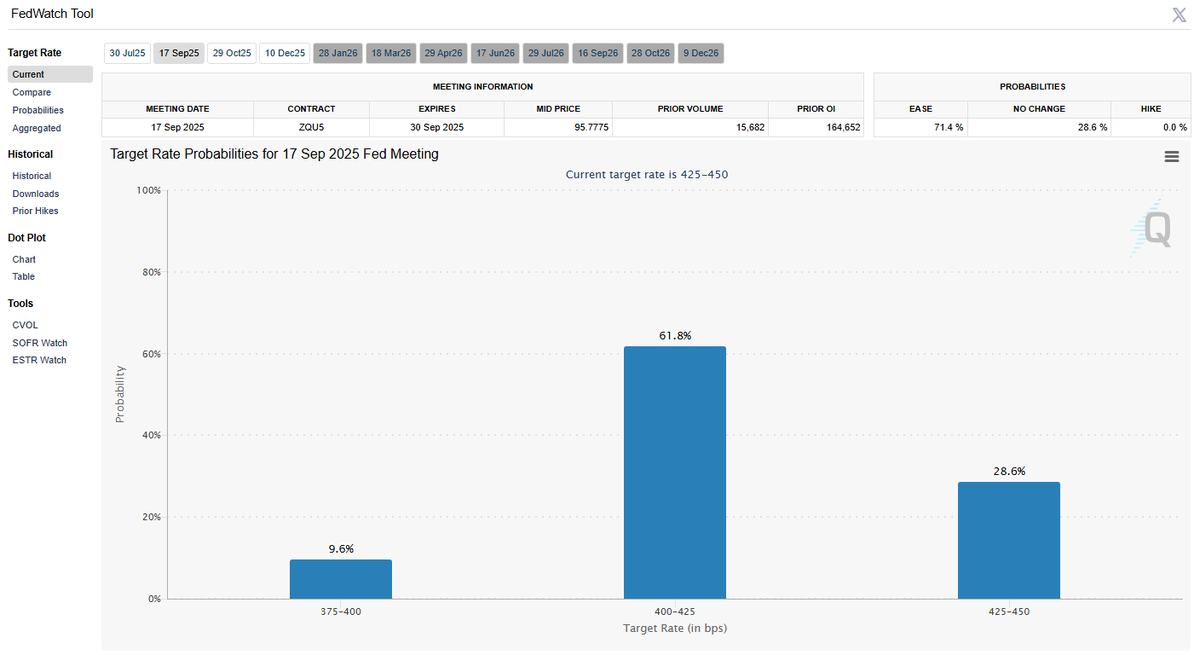

Breaking news: Interest Rate Cut Odds Surge Ahead of September FOMC Meeting

In a significant economic development, recent reports indicate that the odds of an interest rate cut by the Federal Open Market Committee (FOMC) in September have skyrocketed to over 71%. This news has sent ripples through the financial markets, sparking widespread optimism among investors and analysts alike. The anticipation of a potential rate cut is seen as a bullish signal for various asset classes, including stocks and cryptocurrencies.

Understanding the FOMC and Interest Rates

The Federal Open Market Committee (FOMC) is a pivotal component of the U.S. Federal Reserve System, responsible for formulating monetary policy. One of its primary tools for influencing the economy is the adjustment of interest rates. When the FOMC cuts interest rates, it typically aims to stimulate economic growth by making borrowing cheaper, thereby encouraging spending and investment. Conversely, raising interest rates can help cool down an overheating economy and control inflation.

Current Economic Climate

The backdrop of this potential rate cut is a complex economic landscape characterized by fluctuating inflation rates, varying employment figures, and geopolitical uncertainties. As the U.S. navigates these challenges, the FOMC’s decisions are closely monitored by economists and market participants. The potential for an interest rate cut reflects the Fed’s responsiveness to current economic indicators, which suggest a need for a more accommodative monetary policy to support growth.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Investors

The implications of a potential interest rate cut are significant for investors across various sectors. Lower interest rates tend to lead to higher asset prices, as cheaper borrowing costs can boost corporate earnings and consumer spending. For stocks, this often translates into increased valuations and a more favorable investment climate.

Stocks and Equities

With the current odds of a rate cut exceeding 71%, investors in the stock market are likely to react positively. A rate cut can enhance liquidity in the market, encouraging more investment and potentially driving stock prices higher. This bullish sentiment can lead to increased trading volumes and a more dynamic market environment in the lead-up to the FOMC meeting.

Cryptocurrencies

The cryptocurrency market is also poised to react to the news of a potential interest rate cut. Lower interest rates often lead to a depreciation of fiat currencies, making alternative assets like Bitcoin and Ethereum more attractive to investors seeking to hedge against inflation. As sentiment shifts toward a bullish outlook, we may see increased interest and investment in cryptocurrencies, potentially resulting in significant price movements.

Market Sentiment and Investor Behavior

The current market sentiment, as indicated by the surge in the odds of an interest rate cut, suggests a growing optimism among investors. This sentiment is further amplified by the broader economic indicators that suggest the need for a more accommodative monetary policy. Investors are likely to adjust their portfolios in anticipation of favorable market conditions, looking to capitalize on potential gains in both traditional assets and cryptocurrencies.

Conclusion

In summary, the surge in the odds of an interest rate cut by the September FOMC meeting to over 71% is a crucial development in the financial landscape. This potential shift in monetary policy could have far-reaching implications for various asset classes, including stocks and cryptocurrencies. As investors react to this bullish news, we can expect heightened market activity and a reassessment of investment strategies.

Staying informed about the latest developments in monetary policy, economic indicators, and market trends will be vital for investors seeking to navigate this evolving landscape. The anticipation of a potential interest rate cut not only reflects the current economic climate but also serves as a reminder of the interconnectedness of monetary policy and market dynamics. As we approach the September FOMC meeting, all eyes will be on the decisions made by the Federal Reserve and their implications for the broader economy.

Key Takeaways:

- The odds of an interest rate cut by the September FOMC have risen to over 71%.

- A potential rate cut is viewed as a bullish signal for both stocks and cryptocurrencies.

- Lower interest rates can lead to increased asset prices and enhanced market liquidity.

- Investors should remain vigilant and adaptable to changing market conditions as the FOMC meeting approaches.

By understanding the factors influencing interest rates and their impact on the financial markets, investors can better position themselves for success in a rapidly changing economic environment.

BREAKING:

THE ODDS OF AN INTEREST RATE CUT BY THE SEPTEMBER FOMC HAVE SOARED TO OVER 71%

BULLISH! pic.twitter.com/hBzagzwkpX

— Crypto Rover (@rovercrc) June 21, 2025

BREAKING: THE ODDS OF AN INTEREST RATE CUT BY THE SEPTEMBER FOMC HAVE SOARED TO OVER 71%

The financial world is buzzing with excitement as recent reports indicate a significant shift in the odds of an interest rate cut by the Federal Open Market Committee (FOMC). According to a tweet from Crypto Rover, the probability of a cut has skyrocketed to over 71%. This news has sparked a wave of bullish sentiment among investors and market analysts alike. But what does this really mean for you and the economy? Let’s break it down.

Bullish Sentiment in the Market

When we talk about market sentiment, the term “bullish” refers to a positive outlook on the market or a specific asset. With the odds of an interest rate cut increasing, many investors are adopting a bullish attitude. But why is this happening? Interest rates play a crucial role in the economy. Lower interest rates generally encourage borrowing and spending, which can lead to economic growth. If the FOMC decides to cut rates, it could stimulate various sectors, including housing, consumer goods, and even cryptocurrencies.

This positive sentiment is evident across various markets. Investors are not just showing interest in traditional stocks; cryptocurrencies are also experiencing a resurgence in activity. As people anticipate the benefits of lower interest rates, they are looking to invest in a broader range of assets, which can lead to increased demand and higher prices.

Understanding the FOMC and Interest Rates

To truly grasp the significance of this news, it’s essential to understand the role of the FOMC. The FOMC is the branch of the Federal Reserve that sets monetary policy in the United States. Their decisions can impact everything from inflation to employment rates. When the FOMC cuts interest rates, it usually means they are trying to stimulate the economy, particularly in times of uncertainty or economic downturn.

For instance, during the COVID-19 pandemic, the FOMC slashed rates to near-zero levels to support the economy. These cuts aimed to encourage spending and investment, which can help pull the economy out of a recession. As we look ahead to September, the prospect of another rate cut could provide a much-needed boost, especially as inflation concerns loom large.

What Happens Next?

With the odds of an interest rate cut at 71%, many investors are likely wondering what this means for their portfolios. If the FOMC does decide to lower rates, we can expect a few key changes in the market:

1. **Increased Borrowing:** Lower interest rates often lead to increased borrowing. This means that consumers and businesses are more likely to take out loans for big purchases, such as homes or cars. As a result, sectors tied to consumer spending may see a boost.

2. **Stock Market Reaction:** Historically, the stock market tends to react positively to interest rate cuts. Investors may flock to equities as the cost of borrowing decreases, leading to higher corporate profits and, consequently, higher stock prices.

3. **Cryptocurrency Surge:** As mentioned earlier, cryptocurrencies tend to thrive in low-interest-rate environments. Investors often turn to digital assets when traditional investments seem less attractive. This could lead to a surge in demand for cryptocurrencies, boosting prices and market activity.

4. **Impact on Savings:** On the flip side, lower interest rates can impact savers negatively. With reduced rates on savings accounts, individuals may find their interest earnings dwindling. This could push more people towards riskier investments in search of better returns.

Market Reactions to Economic Indicators

Market reactions to economic indicators can be swift and dramatic. The news of the 71% chance for an interest rate cut has already begun to ripple through various sectors. For example, financial news platforms and investment forums are buzzing with discussions on how to position portfolios ahead of potential changes in monetary policy.

Investors are closely monitoring economic indicators such as inflation rates, unemployment figures, and GDP growth. These factors can influence the FOMC’s decision-making process. If inflation continues to rise, the FOMC may be hesitant to cut rates, fearing that it could lead to runaway inflation. Conversely, if economic growth slows or unemployment rises, a rate cut may become more likely.

The Importance of Staying Informed

In this fast-paced financial landscape, staying informed is crucial. Whether you’re an experienced investor or just starting, keeping an eye on the news and understanding the implications of monetary policy is vital. Following credible sources can help you make informed decisions.

For real-time updates, platforms like [Bloomberg](https://www.bloomberg.com/) and [CNBC](https://www.cnbc.com/) provide in-depth coverage of financial news, including the latest developments from the FOMC. Additionally, social media platforms like Twitter can offer insights and opinions from market analysts and influencers, though it’s essential to verify the information before acting on it.

Potential Risks and Considerations

While the prospect of an interest rate cut can seem promising, it’s essential to consider the potential risks involved. For one, the markets can react unpredictably. Even if the FOMC cuts rates, other factors such as geopolitical tensions or unexpected economic downturns can influence market performance.

Moreover, a rate cut does not guarantee sustained economic growth. If consumer confidence remains low, even lower borrowing costs may not lead to increased spending. It’s crucial to strike a balance between optimism and caution, keeping an eye on the broader economic picture.

Final Thoughts on the Current Market Landscape

As we approach September, the anticipation surrounding the FOMC’s decision on interest rates is palpable. With the odds of a rate cut now soaring over 71%, many are feeling bullish about the potential impacts on the economy and financial markets. The interconnectedness of various sectors means that changes in monetary policy can have far-reaching effects.

Staying informed, remaining cautious, and understanding the broader economic context will be critical as we navigate this exciting yet uncertain landscape. Whether you’re looking to invest in stocks, real estate, or cryptocurrencies, being proactive and informed will help you make the best decisions moving forward. Keep an eye on the news, engage with financial communities, and be ready to adapt as the situation evolves.