“Congress’ Reckless Spending: Is It Time to End the Fed for Good?”

End Federal Reserve, U.S. Treasury yields 2025, government debt crisis

—————–

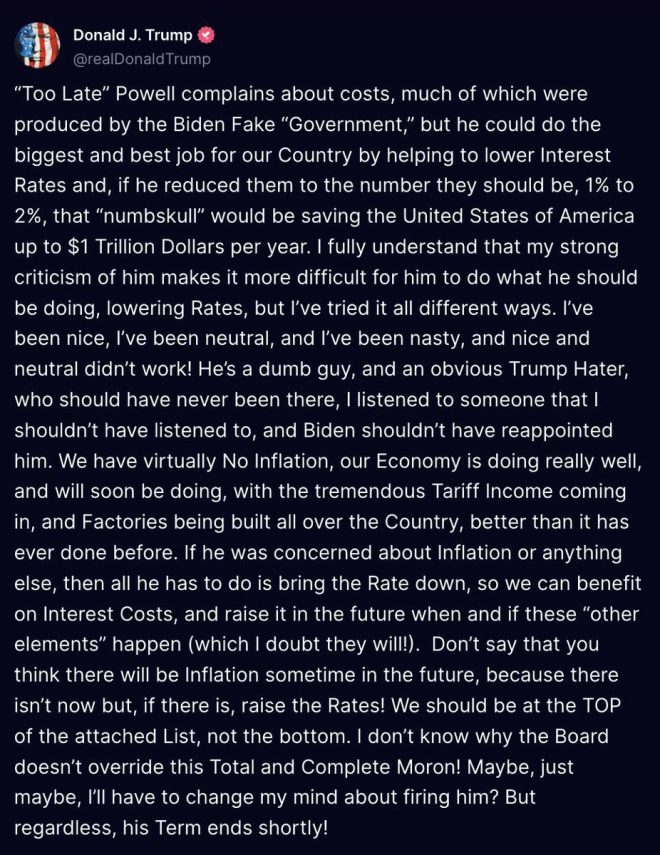

The tweet from Congressman Thomas Massie highlights a critical perspective on the current state of the U.S. economy, particularly regarding government spending, the role of the Federal Reserve, and the implications for interest rates. This summary will delve into the key points raised in the tweet, providing context and analysis while optimizing for search engines to ensure visibility on the internet.

### Understanding the Federal Reserve’s Role

The Federal Reserve, often referred to as the Fed, plays a crucial role in the U.S. economy by controlling monetary policy, which includes setting interest rates, regulating banks, and managing inflation. In recent years, the Fed has faced challenges in exerting control over interest rates due to unprecedented levels of government spending and borrowing. The assertion that the Fed has “lost its ability to set rates” underscores a growing concern among economists and policymakers about the efficacy of traditional monetary policy tools.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### The Impact of Government Spending

Congress has been accused of excessive spending, which has led to an increase in the national debt. This situation complicates the Fed’s ability to influence interest rates effectively. When the government borrows heavily, it competes for funds in the financial markets, driving up the yield on U.S. Treasury securities. As highlighted in the tweet, banks and foreign governments are now demanding a return of more than 4.5% on 10-year U.S. Treasuries, indicating a shift in investor sentiment and expectations regarding economic stability.

### Rising Interest Rates and Economic Consequences

The demand for higher returns on government bonds can lead to an increase in interest rates across the economy. Higher interest rates make borrowing more expensive for consumers and businesses, potentially slowing down economic growth. This creates a challenging environment for the Fed, which must balance inflation control with the need to foster economic growth.

### The Role of BBB Ratings

The reference to “BBB” in the tweet alludes to credit ratings assigned to corporate and government debt. A BBB rating is considered the lowest tier of investment-grade ratings, which can signal increased risk to investors. If government debt is perceived as more risky, it can exacerbate the demand for higher yields, further complicating the Fed’s efforts to manage interest rates.

### Calls to Action: Ending the Federal Reserve?

The tweet concludes with a provocative call to action: the idea of ending the Federal Reserve. This suggestion stems from a growing sentiment among some politicians and economists who believe that the Fed’s policies contribute to economic instability and inflation. Critics argue that a central bank can lead to misallocation of resources, asset bubbles, and long-term economic distortions.

### The Broader Economic Context

The concerns raised in the tweet reflect a broader debate about fiscal responsibility and monetary policy in the United States. With the national debt reaching historic levels, the sustainability of government spending is under scrutiny. Policymakers must consider the long-term implications of current fiscal policies, especially as they relate to inflation, economic growth, and the overall health of the financial system.

### Conclusion

In summary, Congressman Thomas Massie’s tweet encapsulates significant economic concerns regarding government spending, the Federal Reserve’s ability to influence interest rates, and the implications of rising yields on U.S. Treasury securities. By examining these issues, we can gain a clearer understanding of the challenges facing the U.S. economy today. As discussions around the efficacy of the Fed and the sustainability of government debt continue, it is essential for policymakers to navigate these complexities carefully to ensure a stable economic future.

By optimizing this summary with relevant keywords and phrases, such as “Federal Reserve,” “government spending,” “interest rates,” and “economic stability,” it enhances its visibility on search engines, making it easier for readers to find insightful analysis on these critical topics.

Dose of reality: Congress is spending, printing, and borrowing so much that the Fed has lost its ability to “set rates.” Banks and foreign governments who buy our 10 year U.S. treasuries are demanding more than 4.5% return. BBB makes it worse. Would be a great time to #EndTheFed pic.twitter.com/5G8ZUIsn6d

— Thomas Massie (@RepThomasMassie) June 21, 2025

Dose of Reality: Congress is Spending, Printing, and Borrowing So Much That the Fed Has Lost Its Ability to “Set Rates”

It’s becoming increasingly clear that the economic landscape is shifting in ways that many of us may not fully comprehend. When we talk about Congress spending, printing, and borrowing at unprecedented levels, we’re not just throwing around buzzwords; we’re discussing a reality that affects every aspect of our financial lives. The Federal Reserve, the institution that’s supposed to help manage the economy, seems to be losing its grip on one of its primary functions: setting interest rates. This isn’t just a dry economic theory; it’s a reality that has real-world implications for all of us.

Banks and Foreign Governments Buying Our 10-Year U.S. Treasuries Are Demanding More Than 4.5% Return

Let’s break this down a bit. When banks and foreign governments invest in U.S. treasuries, they’re essentially lending money to the government in exchange for interest payments. Recently, these investors have started demanding returns of over 4.5%. That’s a significant jump compared to what we’ve seen in previous years. This change indicates a lack of confidence in the government’s fiscal policies and highlights the risks involved in lending to an increasingly indebted nation. For a more detailed look at the current treasury yields, check out the U.S. Treasury website.

BBB Makes It Worse

The acronym “BBB” might not mean much to everyone, but in financial circles, it refers to a “Big Bad Borrower”—a term that emphasizes the risks associated with high levels of borrowing. When Congress is racking up debt without a clear plan for repayment, it raises eyebrows not only at home but also abroad. Investors start to question whether the U.S. will be able to honor its debts, and that’s when we see demand for higher returns. The situation becomes a vicious cycle where high borrowing costs make it even harder for the government to manage its debt, further exacerbating the problem.

It Would Be a Great Time to End the Fed

This brings us to a provocative suggestion that echoes in certain economic discussions: maybe it’s time to consider ending the Federal Reserve. Advocates for this idea argue that the Fed’s policies have led us down a path of excessive spending and borrowing, contributing to the very problems we’re facing today. The Fed was created to stabilize the economy, but when it loses its ability to set rates, it raises questions about its effectiveness. Some people feel that abolishing the Fed and returning to a more market-driven approach could restore balance in our financial system. If you want to dive deeper into this perspective, check out the ongoing debate on this topic on platforms like Cato Institute.

Understanding the Bigger Picture

When we discuss the intricate relationship between Congress, the Federal Reserve, and the economy, it’s crucial to understand the bigger picture. The implications of excessive government spending extend beyond just rising interest rates. They can lead to inflation, devaluation of currency, and a loss of confidence from international investors. Each of these factors can have a cascading effect on our daily lives—think about rising prices at the grocery store or higher mortgage rates. It’s all interconnected, and that’s what makes this discussion so vital.

So, What Can We Do?

It’s easy to feel helpless when faced with such large-scale financial issues, but there are ways you can stay informed and proactive. Start by educating yourself about these economic principles. Follow reliable news sources and financial experts who break down complex topics into digestible information. Engage in discussions within your community about fiscal responsibility and the role of government in the economy. The more we talk about these issues, the more pressure we can put on our representatives to make responsible decisions.

The Role of Public Awareness

Public awareness is crucial in holding Congress accountable for its spending habits. When citizens are informed about how government decisions impact their lives, they can advocate for change. Whether it’s by voting for representatives who prioritize responsible fiscal policies or participating in grassroots movements that push for economic reform, every action counts. Engaging with local and national organizations that focus on economic issues can amplify your voice and bring attention to these pressing concerns.

Looking Ahead

While the current economic situation may seem daunting, it’s essential to stay optimistic and proactive. Understanding the dynamics between Congress, the Federal Reserve, and the economy can empower you to make informed decisions about your financial future. Whether it’s adjusting your investments, saving for a rainy day, or even advocating for economic reform, every little bit helps. Remember, you’re not just a passive observer in this economic landscape; you have the power to influence change.

In Summary

As we navigate through these tumultuous economic times, it’s crucial to grasp the reality of Congress’s spending, printing, and borrowing habits. The Fed’s diminishing ability to set rates, rising demands for higher returns on treasuries, and the implications of being a “Big Bad Borrower” all paint a concerning picture. Yet, amid these challenges, there’s a call to action—whether it’s reconsidering the role of the Federal Reserve or advocating for responsible fiscal policies, we all have a part to play in shaping our economic future. Stay informed, stay engaged, and let’s work together towards a more sustainable financial landscape.