U.S. National Debt Hits $37 Trillion: A Milestone or a Ticking Time Bomb?

U.S. fiscal responsibility, national debt implications, economic growth challenges

—————–

U.S. National Debt Exceeds $37 Trillion: A Historic Milestone

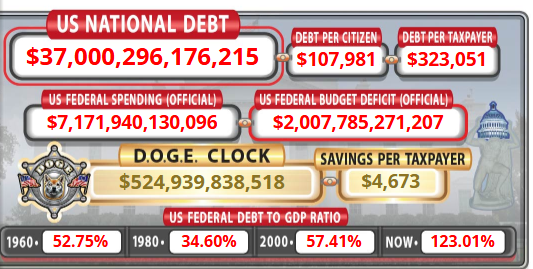

In a significant development for the U.S. economy, the national debt has officially surpassed the $37 trillion mark for the first time in history. This milestone, announced on June 20, 2025, has sparked widespread discussion and concern among economists, policymakers, and the public alike. The rapidly increasing national debt raises critical questions about fiscal responsibility, economic stability, and the long-term implications for future generations.

Understanding the National Debt

The national debt represents the total amount of money that the U.S. government owes to its creditors. It consists of both public debt (money borrowed from the public through the issuance of government bonds) and intragovernmental debt (money owed to various government agencies). The national debt can be influenced by various factors, including government spending, tax revenues, economic growth, and interest rates.

Historical Context

To understand the significance of surpassing the $37 trillion threshold, it is crucial to consider the historical context of the national debt. Over the past few decades, the U.S. debt has seen exponential growth, particularly following significant economic events such as the 2008 financial crisis and the COVID-19 pandemic. The government has often resorted to borrowing to stimulate the economy, fund social programs, and manage crises, contributing to the soaring debt levels.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications of Rising National Debt

- Economic Growth: High levels of national debt can potentially hinder economic growth. As the government allocates a larger portion of its budget to interest payments, less funding may be available for essential services, infrastructure, and investments in the economy.

- Interest Rates: An increasing national debt may lead to higher interest rates. When the government borrows extensively, it can crowd out private investment, leading to increased borrowing costs for individuals and businesses.

- Inflation Concerns: Some economists warn that excessive borrowing and spending could lead to inflationary pressures. If the government prints more money to finance its debt, it could devalue the currency, eroding purchasing power for consumers.

- Future Generations: The growing national debt raises concerns about the financial burden placed on future generations. With each passing year, the government must pay off its debt while also addressing the needs of a changing population, which could lead to higher taxes or reduced services in the future.

Public Reaction and Political Landscape

The announcement of the national debt exceeding $37 trillion has triggered varied reactions from the public and politicians. Some view it as a cause for celebration, highlighting the resilience of the U.S. economy in the face of challenges. Others express alarm, warning that the unsustainable debt levels could lead to a fiscal crisis if not addressed.

Political leaders are divided on potential solutions. Some advocate for increased government spending to stimulate growth, while others call for austerity measures and spending cuts to rein in the debt. The debate over how to manage the national debt is expected to dominate political discourse in the coming years, especially as the U.S. approaches the next election cycle.

Strategies for Managing National Debt

To address the challenges posed by a rising national debt, various strategies can be considered:

1. Tax Reform

Implementing tax reforms could help increase government revenue and reduce the deficit. This may involve revising tax rates, closing loopholes, and enhancing tax compliance to ensure that all individuals and corporations contribute their fair share.

2. Spending Cuts

Identifying areas for potential spending cuts can help alleviate the national debt. This could involve reevaluating discretionary spending programs, streamlining government operations, and prioritizing essential services.

3. Economic Growth Promotion

Fostering economic growth is crucial for reducing the debt-to-GDP ratio. Policies that encourage investment, innovation, and job creation can enhance tax revenues and improve the overall economic outlook.

4. Debt Management Strategies

The government could explore various debt management strategies, such as refinancing existing debt at lower interest rates or issuing long-term bonds to lock in favorable borrowing costs.

Conclusion

The surpassing of the $37 trillion mark in U.S. national debt signifies a momentous occasion in the nation’s economic history. It highlights the ongoing challenges of fiscal policy and the need for a balanced approach to managing government finances. As discussions surrounding the national debt continue, it is crucial for policymakers, economists, and citizens to engage in constructive dialogue to identify sustainable solutions that ensure economic stability for current and future generations.

In summary, while the growth of the national debt has implications for economic stability and fiscal responsibility, it also presents an opportunity to re-evaluate government spending, tax policies, and economic strategies. The path forward will require careful consideration and collaboration among stakeholders to navigate the complexities of managing the nation’s finances effectively.

JUST IN : U.S. National Debt surpasses $37 Trillion for the first time in history Congrats everyone, we did it pic.twitter.com/WXvi2GRFDA

— Barchart (@Barchart) June 20, 2025

JUST IN : U.S. National Debt surpasses $37 Trillion for the first time in history Congrats everyone, we did it

The news is out, and it’s monumental! The U.S. National Debt has officially surpassed $37 trillion for the first time ever. This milestone isn’t just a number; it’s a reflection of our country’s financial health and a topic that affects all of us. So, let’s dive into what this means, how we got here, and what might lie ahead.

Understanding the U.S. National Debt

First off, what exactly is the national debt? In simple terms, it’s the total amount of money that the U.S. government owes its creditors. This includes public debt (money borrowed from investors, banks, and foreign governments) and intra-governmental holdings (money borrowed from various government accounts, like Social Security). As of now, the debt has climbed to an astounding $37 trillion, making it a staggering figure that can be hard to wrap your head around.

But why should you care about this number? Well, the national debt impacts everything from interest rates and inflation to government spending and your personal finances. When the government borrows money, it often has to pay interest on that debt, which can lead to increased taxes or cuts in public services.

How Did We Get Here?

The journey to $37 trillion has been long and winding. Over the past few decades, factors like tax cuts, wars, economic bailouts, and the COVID-19 pandemic have all contributed to the rising debt. During the pandemic, for instance, the government passed massive stimulus packages to support individuals and businesses, significantly increasing the debt.

You might wonder, “Isn’t all this borrowing unsustainable?” While it’s a valid question, the situation is more complex. The U.S. has the unique ability to borrow in its own currency, which gives it more leeway than other countries. But that doesn’t mean we should ignore the risks associated with such high levels of debt.

The Economic Implications

So, what does this mean for the economy? Some experts argue that high national debt can lead to higher interest rates, making it more expensive for individuals to borrow money for things like homes and cars. On the flip side, others suggest that as long as the economy continues to grow, some level of debt can be manageable.

When the national debt rises, it can also affect the government’s ability to respond to future crises. Just imagine if we hit another recession while already deep in debt; the government might struggle to provide the necessary support.

What Are the Reactions to This Milestone?

When the news broke about surpassing $37 trillion, reactions varied widely. Some people celebrated it as a sign of economic growth and resilience, while others expressed concern over the implications for future generations. Social media was buzzing with comments ranging from sarcastic celebrations to serious discussions about fiscal responsibility.

For many, it feels like a bittersweet victory. Sure, the economy has shown signs of recovery post-pandemic, but at what cost? The national debt is a reflection of the choices we’ve made as a society, and it’s essential to have open conversations about how we want to move forward.

Future Considerations

Looking ahead, the question remains: What does the future hold? Will we continue to see this upward trend in national debt, or will there be significant changes in policy to address it? The answers lie in the hands of policymakers, economists, and, of course, the American public.

Discussions about tackling the national debt often center around a few key strategies: increasing taxes, cutting spending, or a mix of both. Each option comes with its set of pros and cons. Increasing taxes could generate revenue to pay down the debt, but it might also slow economic growth. On the other hand, cutting spending could lead to essential services being reduced, which could hurt those who rely on government support.

Personal Impact of National Debt

You might be wondering how all this affects you personally. Well, it’s more connected than you might think. Interest rates, inflation, and even job growth can all be influenced by the national debt. If the government raises interest rates to manage the debt, it could impact your mortgage rate or loan terms.

Moreover, if the government decides to cut spending, it could affect public services, education, healthcare, and social security benefits. It’s a cycle that ultimately impacts your wallet, your job, and your quality of life.

The Role of Public Engagement

As citizens, it’s crucial to stay informed and engaged in discussions about the national debt. Public opinion can shape policy decisions, and your voice matters. Whether it’s through voting, advocating for responsible spending, or simply having conversations with friends and family, every little bit helps.

So, what can you do? Start by educating yourself on the issues surrounding the national debt. Follow reputable news sources, engage in discussions, and consider reaching out to your local representatives to express your views on fiscal responsibility.

Conclusion

Surpassing $37 trillion in national debt is more than just a headline; it’s a reflection of our times and the choices we make as a society. While the implications can seem daunting, it’s essential to keep the conversation going and to explore solutions that can lead us toward a more sustainable financial future.

Remember, we all play a part in shaping this narrative, so let’s stay informed, engaged, and proactive. It’s our country and our future at stake, after all!