“Trump’s Shocking Call to Work Until death: A republican Plot Unveiled!”

retirement age policy, tax breaks for the wealthy, workers’ rights and benefits

—————–

Summary of trump‘s Retirement Policy Perspective: A Critical Analysis

In a recent tweet, Liberal Lisa from Oklahoma has highlighted a controversial stance taken by former President Donald Trump regarding retirement age and benefits. The tweet, shared on Truth Social, implies that Trump advocates for working individuals to labor until they can no longer continue, raising significant concerns about the implications of such a policy. This summary aims to delve into the political context, the proposed changes to retirement age, and the potential effects on American workers, while optimizing for SEO to ensure visibility and engagement.

The Context of Trump’s Remarks

Donald Trump, known for his assertive communication style, has been vocal about various economic policies since his presidency. His latest comments, as relayed by Liberal Lisa, suggest a push towards increasing the retirement age to 70. This proposal is accompanied by a narrative that portrays Republicans as prioritizing the wealth of the affluent over the welfare of average American workers. Such statements resonate deeply in an era where economic disparities are a hot topic of debate.

Increasing Retirement Age: What It Means

The proposal to raise the retirement age to 70 is contentious. Currently, the full retirement age for Social Security benefits hovers around 66 to 67, depending on birth year. By suggesting an increase, Trump’s policy could significantly alter the financial landscape for many Americans, particularly those in physically demanding jobs or those who may not have the means to work longer due to health issues.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Raising the retirement age may seem like a strategy to bolster Social Security funds, but it also raises ethical questions. Many workers may be forced to remain in the workforce longer than they are physically capable, leading to a potential increase in workplace injuries and health problems. The concern is that such a policy could disproportionately affect lower-income workers who often have less job flexibility and fewer resources.

Cutting Benefits: A Double Whammy for Workers

In conjunction with raising the retirement age, the tweet claims that Republicans are looking to cut benefits. This dual approach, raising the age while simultaneously reducing benefits, poses a significant threat to the financial security of retirees. With rising living costs and healthcare expenditures, the prospect of receiving diminished benefits at a later age could leave many individuals in precarious situations.

The implications are clear: if individuals are expected to work longer while receiving less support, the risk of poverty among the elderly could increase. This is particularly alarming given that many retirees rely heavily on Social Security as their primary source of income.

The Wealthy Get a Tax Break: Economic Inequality

Liberal Lisa’s tweet also identifies a critical point regarding the interests of wealthier Americans. The notion that these proposed policies serve to benefit the rich at the expense of the working class is a recurring theme in contemporary political discourse. Critics argue that raising the retirement age and cutting benefits are tactics designed to provide further tax breaks to the wealthy, creating a system that favors the affluent while neglecting the needs of average citizens.

This argument is not unfounded; many policies introduced by the Republican Party in recent years have been criticized for disproportionately benefiting higher-income individuals. As economic inequality continues to widen, the potential ramifications of these retirement policy changes could exacerbate existing disparities.

The Broader Political Landscape

The conversation surrounding retirement age and benefits is not merely about economic policy; it reflects broader ideological divisions in American politics. The Democratic and Republican parties often have fundamentally different views on the role of government in providing for its citizens. Democrats typically advocate for expanded social safety nets, while Republicans often emphasize personal responsibility and reduced government intervention.

Trump’s remarks, as conveyed by Liberal Lisa, can be seen as part of a larger Republican strategy to reshape the social welfare system. By framing the discussion around work ethic and personal responsibility, the party seeks to appeal to a base that values hard work but may overlook the systemic barriers many individuals face in achieving economic stability.

Implications for Future Generations

As we look to the future, the proposed changes to retirement age and benefits will have lasting implications for younger generations. Many millennials and Gen Z individuals are already facing significant challenges in the job market, student debt, and housing affordability. The prospect of a higher retirement age and reduced benefits adds another layer of complexity to their financial planning.

The conversation initiated by Trump and echoed by voices like Liberal Lisa’s serves as a crucial reminder of the importance of advocating for equitable economic policies. Future generations will be impacted by decisions made today, and it is imperative that policymakers consider the long-term consequences of their proposals.

Conclusion

In summary, the recent tweet from Liberal Lisa encapsulates a significant concern regarding Trump’s stance on retirement policies. The proposal to raise the retirement age to 70 while cutting benefits poses serious risks to American workers, particularly those from lower-income backgrounds. The potential for exacerbating economic inequality, coupled with the already challenging landscape for younger generations, underscores the importance of thoughtful discourse on this issue. As the political landscape evolves, ongoing discussions around retirement age and benefits will remain critical in shaping the economic future of the United States.

By engaging in these conversations and advocating for fair policies, we can work towards a future where all Americans can enjoy a secure and dignified retirement, free from the burdens of excessive labor and inadequate support.

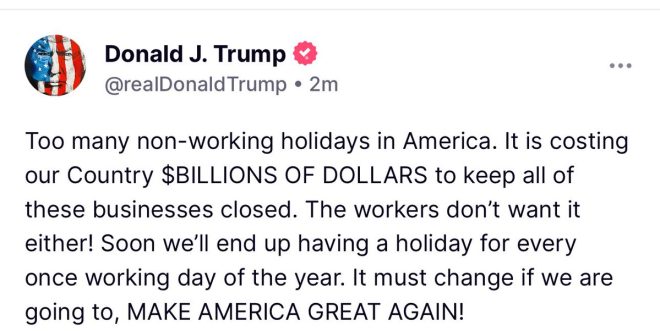

This was JUST “truthed” by the president of the U.S. on Truth Social.

Trump wants everyone to work every day, until you drop dead. That’s why Republicans want to raise the age of retirement to 70 while simultaneously cutting your benefits, so the wealthy get another tax break. pic.twitter.com/TztsO77nDo— Liberal Lisa in Oklahoma (@lisa_liberal) June 19, 2025

This was JUST “truthed” by the president of the U.S. on Truth Social.

Recently, a tweet from Liberal Lisa in Oklahoma surfaced, drawing attention to a bold statement made by the former president regarding work and retirement in America. This particular tweet highlighted a pressing concern for many Americans: the ongoing debate about retirement age and benefits. The assertion that “Trump wants everyone to work every day, until you drop dead” is not just a provocative comment; it reflects a growing unease regarding labor policies and economic inequality.

Understanding the Context of Retirement Age Discussions

As the political landscape shifts, so do the conversations around social security and retirement benefits. In the past few decades, there has been a continuous push from some Republican leaders to raise the retirement age to 70. Why? Well, it’s often framed as a necessary response to the increasing lifespan of Americans and the need to keep social security sustainable. However, critics argue that this proposal is more about benefiting the wealthy than genuinely supporting working-class Americans. This sentiment echoes through Lisa’s tweet, suggesting that the wealthy are looking for ways to save on taxes at the expense of the average worker. For a deeper dive into the implications of raising retirement age, check out [this analysis from the Center on Budget and Policy Priorities](https://www.cbpp.org/research/social-security/raising-the-retirement-age-would-hurt-lower-income-workers).

Trump Wants Everyone to Work Every Day, Until You Drop Dead

This phrase captures the frustration many feel about the current economic climate. The idea that individuals should work longer without adequate benefits or support can be disheartening. With rising living costs and stagnant wages, many people are already feeling the crunch. The notion that work should be a never-ending cycle, pushing individuals to their limits, resonates with those experiencing burnout and job insecurity.

Moreover, this perspective ties into broader societal issues. The American Dream, once centered around the idea of hard work leading to prosperity, seems increasingly distant for many. As more individuals find themselves working multiple jobs just to make ends meet, the idea of “working until you drop dead” becomes a harsh reality. It’s crucial to address these concerns to foster a more equitable future. For insights on the impact of job insecurity, consider reading [this report from the Economic Policy Institute](https://www.epi.org/publication/the-impact-of-job-insecurity-on-working-class-americans/).

Why Republicans Want to Raise the Age of Retirement to 70

Raising the retirement age is often justified as a way to ensure the sustainability of social security. However, critics argue that this is a misguided approach. The reality is that not all workers have the same life expectancy or job conditions. For instance, individuals in physically demanding jobs may not be able to work into their late sixties or seventies without risking their health. This disparity raises ethical questions about who benefits from such policies.

Moreover, the push to raise the retirement age often coincides with proposals to cut benefits for those who rely on social security the most. This combination can feel like a double-whammy for the middle and lower classes. The wealthy, who are less reliant on social security, may benefit from tax breaks that result from these changes. For a comprehensive overview of how these policies affect different income groups, explore [this article from the Brookings Institution](https://www.brookings.edu/research/the-impact-of-social-security-reform-on-different-income-groups/).

Simultaneously Cutting Your Benefits

As if raising the retirement age wasn’t enough, there’s the added concern of benefit cuts. Many Americans are understandably worried about the future of their social security benefits. The idea that they might have to work longer and receive less in return strikes a chord with those who have spent decades contributing to the system. This is particularly troubling for those who depend on these benefits to support their families and maintain a decent quality of life in retirement.

The conversation around benefit cuts often centers on the idea of fiscal responsibility. However, many argue that this responsibility should not come at the expense of the most vulnerable in society. Instead of cutting benefits, some advocate for increasing taxes on the wealthy to ensure the social safety net remains intact. This ongoing debate underscores the importance of advocating for policies that prioritize the well-being of all citizens, not just the affluent few. For an analysis of potential solutions to the social security funding crisis, see [this report from the National Academy of Social Insurance](https://www.nasi.org/research/solving-the-social-security-funding-crisis).

So the Wealthy Get Another Tax Break

It’s hard to ignore the perception that policies surrounding retirement age and social security benefits often favor the wealthy. While the average American may struggle to save for retirement, tax breaks and loopholes for the wealthy continue to thrive. This creates a widening gap between the rich and the poor, leading many to feel disillusioned with the American economic system.

Critics of these policies argue that the wealthy have already benefited disproportionately from tax cuts and incentives, which only increases the burden on the working class. This sentiment reflects a broader frustration with a system that seems rigged in favor of those who already have significant financial resources. The challenge lies in advocating for a fairer system that ensures everyone can retire with dignity, regardless of their income level. For more information on wealth inequality and its implications, check out [this research from Oxfam](https://www.oxfam.org/en/research/inequality-is-a-political-choice).

The Importance of Collective Advocacy

In light of these discussions, it’s crucial for individuals to engage in collective advocacy for policies that prioritize the needs of the working class. Whether that means opposing measures to raise the retirement age or advocating for better social security benefits, every voice matters. Grassroots movements and community organizing can play a significant role in pushing for change and holding elected officials accountable.

Additionally, educating ourselves and others about these issues is vital. By sharing information and engaging in conversations, we can raise awareness about the challenges facing retirees and working individuals alike. Social media platforms, like Truth Social, can serve as tools for mobilization and awareness, as evidenced by the discussions sparked by Liberal Lisa’s tweet. Engaging with these platforms can amplify our voices and foster a sense of community around shared concerns.

Conclusion: A Call to Action

As we navigate the complexities of retirement, benefits, and economic inequality, it’s essential to remain informed and engaged. The assertions made by former President Trump and the concerns raised by citizens like Liberal Lisa reflect a broader struggle for fairness in the workplace and society. By advocating for policies that support all Americans, we can work towards a future where everyone can retire with dignity and security. Let’s keep the conversation going and ensure that the voices of the working class are heard loud and clear.