Trump’s Scathing Attack on Powell: “The Most Destructive Force in Government!”

Trump Powell criticism, Federal Reserve controversy, economic policy backlash

—————–

Trump Criticizes Jerome Powell: A Look at the Controversial Statement

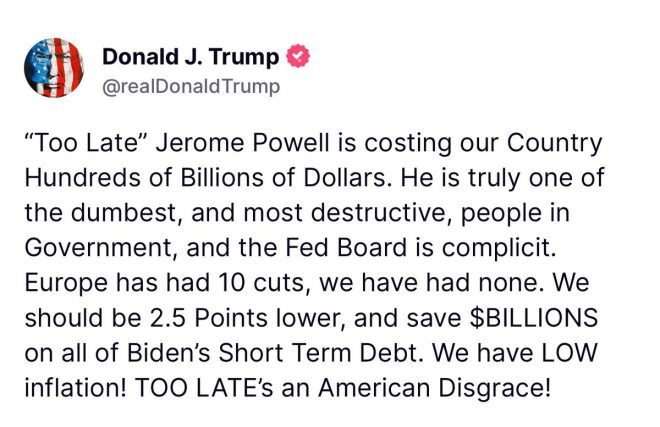

On June 19, 2025, former President Donald trump made headlines with a provocative statement aimed at Jerome Powell, the Chairman of the Federal Reserve. In a tweet, Trump referred to Powell as “one of the dumbest, and most destructive, people in government.” This comment has sparked a wave of discussions and debates across various media platforms, highlighting the ongoing tension between the former president and the central bank’s leadership.

The Context of Trump’s Statement

Trump’s criticism of Powell is not new; it reflects a long-standing tension that has existed since Powell took the helm of the Federal Reserve. During Trump’s presidency, he frequently expressed dissatisfaction with Powell’s monetary policy, especially regarding interest rates and quantitative easing measures. Trump’s economic policies were heavily focused on stimulating growth through low-interest rates, which he believed were essential for the recovery of the economy.

In the years following his presidency, Trump’s criticisms have only intensified. His latest remarks come amid rising inflation rates and economic uncertainties that have led many to question the effectiveness of the Federal Reserve’s policies. Trump’s assertion that Powell is “dumb and destructive” suggests his belief that Powell’s actions have contributed to economic challenges faced by the country.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of Trump’s Remarks

Trump’s comments have significant implications for both the political landscape and the financial markets. By publicly disparaging Powell, Trump is reigniting the ongoing debate about the independence of the Federal Reserve. Many economists and policymakers argue that the central bank should operate free from political influence to maintain its credibility and effectiveness. Trump’s remarks may undermine that independence, especially if they resonate with his supporters who may view Powell’s decisions as politically motivated.

Furthermore, such a statement from a former president could influence market sentiments. Investors often react to comments made by influential figures, and Trump’s critiques may lead to increased volatility in financial markets, particularly in sectors sensitive to interest rate changes. If investors perceive Powell’s leadership as under threat, it might affect their confidence in the Federal Reserve’s ability to manage monetary policy effectively.

The Response from Economists and Analysts

In the wake of Trump’s remarks, economists and financial analysts have weighed in on the implications of such statements. Many have pointed out that while criticism of the Federal Reserve is not uncommon, personal attacks on its leadership can have far-reaching consequences. Economists have expressed concern that such comments could create a perception of instability within the central bank, potentially affecting its decision-making processes.

Moreover, analysts have emphasized the importance of maintaining a dialogue between political leaders and financial institutions. Constructive criticism can lead to better policy outcomes, but when it devolves into personal insults, it can hinder productive discussions. Trump’s comments, while reflective of his personal views, may detract from the essential conversations needed to address the economic issues at hand.

Historical Context of Trump’s Criticism

Trump’s relationship with the Federal Reserve has been tumultuous throughout his presidency and beyond. He appointed Powell to lead the central bank in 2018, believing that his experience would help bolster the economy. However, as the economic landscape shifted, particularly with the COVID-19 pandemic, Trump’s expectations clashed with Powell’s cautious approach to monetary policy.

Powell has often prioritized long-term economic stability over short-term political pressures. This approach has sometimes put him at odds with Trump’s push for aggressive economic stimulus measures. The tension reached a peak when Trump publicly criticized Powell for raising interest rates in 2018, which he believed was detrimental to the stock market and economic growth.

The Broader Impact of Trump’s Comments

The broader impact of Trump’s remarks extends beyond the immediate political implications. They touch on the fundamental issue of how monetary policy is conducted and the factors influencing these decisions. Trump’s emphasis on personal attacks raises questions about the role of politics in economic governance. As the political landscape continues to evolve, the relationship between the executive branch and the Federal Reserve will remain a critical area of focus.

Additionally, Trump’s comments highlight the ongoing polarization in American politics. Supporters of Trump may rally around his criticisms of Powell, viewing them as a reflection of their frustrations with the current economic conditions. Conversely, critics of Trump may see his remarks as irresponsible and damaging to the integrity of economic institutions. This division underscores the challenges faced by policymakers as they navigate a complex economic environment amid political pressures.

Conclusion

Former President Donald Trump’s scathing remarks about Jerome Powell have reignited discussions about the Federal Reserve’s role and its leadership. As the economy grapples with inflation and uncertainty, Trump’s characterization of Powell as “one of the dumbest, and most destructive, people in government” serves as a reminder of the contentious relationship between politics and economic policy.

The implications of such statements extend beyond the immediate political sphere, influencing market sentiments and raising questions about the independence of the Federal Reserve. As the economic landscape continues to evolve, the relationship between political leaders and financial institutions will remain a focal point for analysts, economists, and the public alike.

In conclusion, Trump’s remarks may have significant ramifications, and understanding the context and implications of such statements is essential for anyone interested in the intersection of politics and economics. As we move forward, it will be crucial to monitor how these dynamics unfold and their impact on the broader economic landscape.

President Trump cooks Jerome Powell calling him “one of the dumbest, and most destructive, people in government.” pic.twitter.com/xrh4so9fXH

— Benny Johnson (@bennyjohnson) June 19, 2025

President Trump cooks Jerome Powell calling him “one of the dumbest, and most destructive, people in government.”

In a recent tweet that sparked significant conversations across social media, President Trump didn’t hold back in expressing his thoughts on Jerome Powell, the Chairman of the Federal Reserve. The tweet referred to Powell as “one of the dumbest, and most destructive, people in government,” igniting a wave of reactions from both supporters and critics. It’s fascinating how a few words can stir such a passionate response, and Trump’s comments have reignited discussions about Powell’s leadership and the broader economic implications.

Understanding the Context of Trump’s Comments

To fully grasp the impact of Trump’s statement, it’s important to look at the context surrounding it. The Federal Reserve plays a crucial role in the U.S. economy, influencing interest rates and monetary policy. Under Powell’s leadership, the Fed has faced numerous challenges, including managing inflation and responding to the economic fallout from the COVID-19 pandemic. Critics argue that Powell’s policies have contributed to economic instability, while supporters believe he has acted prudently given the circumstances.

Trump’s harsh critique can be seen as part of his ongoing conflict with the Federal Reserve, particularly during his presidency when he frequently expressed dissatisfaction with Powell’s decisions. The tension between Trump and Powell highlights the complexities of economic governance and the challenges leaders face in navigating public perception.

Reactions to Trump’s Statement

The response to Trump’s tweet was immediate and varied. Supporters of the former president applauded his boldness, viewing it as a necessary critique of what they see as ineffective leadership. On the other hand, many financial experts and political commentators criticized Trump’s remarks, arguing that they undermine the independence of the Federal Reserve, which is essential for maintaining economic stability. This dichotomy in reactions illustrates the polarized nature of contemporary American politics.

Many media outlets, including CNN and The New York Times, covered the story extensively, examining both the implications of Trump’s comments and the broader context of Powell’s tenure. The discourse around this topic reflects deeper concerns about economic policy and governance in the U.S.

The Implications of Such Criticism

Criticism directed at powerful figures like Jerome Powell can have significant implications. It can influence public perception and policy direction, potentially affecting market stability. When a former president publicly denounces a sitting Fed Chairman, it raises questions about the Fed’s independence and the potential for political pressure on monetary policy.

The Federal Reserve’s role is fundamentally to operate free from political influence, making decisions based on economic data and analysis rather than public sentiment. However, public statements like Trump’s can complicate this dynamic, leading to increased scrutiny of the Fed’s actions and decisions.

Powell’s Leadership: A Double-Edged Sword

Jerome Powell’s leadership at the Federal Reserve has been characterized by a balancing act between economic growth and inflation control. His tenure has seen unprecedented challenges, including the economic fallout from the pandemic and rising inflation rates. Critics of Powell argue that his policies have led to increased costs for consumers, while supporters highlight the necessity of his actions in stabilizing the economy during turbulent times.

In navigating these challenges, Powell has faced scrutiny not only from political figures like Trump but also from economists and the public. The debate over his effectiveness is ongoing, with opinions often divided along partisan lines. As noted in an article from The Wall Street Journal, the Fed’s decisions under Powell have significant implications for the economy, impacting everything from job growth to consumer spending.

The Broader Economic Landscape

Trump’s remarks also bring attention to the broader economic landscape and the challenges faced by policymakers. The U.S. economy is currently grappling with inflationary pressures, supply chain disruptions, and a labor market that is yet to fully recover from the pandemic. These factors complicate the Fed’s mission, requiring a delicate balance between fostering growth and controlling inflation.

As the economy continues to evolve, the role of the Federal Reserve and its leadership will remain a hot topic. The interplay between political discourse and economic policy will shape the future, making it essential for leaders to communicate effectively and navigate the complexities of public perception.

What This Means for the Future

Looking ahead, Trump’s comments on Powell may have lasting implications for the Federal Reserve’s operations. If political pressure continues to mount, it could lead to shifts in how the Fed approaches monetary policy. The independence of the Fed is crucial for maintaining credibility and ensuring that economic decisions are made based on data rather than political considerations.

As the economic landscape continues to change, the interactions between political leaders and economic policymakers will be crucial. Observers are keen to see how Powell responds to ongoing criticism and whether he will adjust his strategies in light of public sentiment. The future of U.S. monetary policy may very well hinge on these dynamics.

Engaging with the Conversation

The discussion surrounding Trump’s comments on Jerome Powell is just one part of a larger conversation about the relationship between politics and economics. Engaging with these discussions is essential for understanding the complexities of governance and the challenges faced by leaders in both fields.

Whether you agree with Trump’s assessment of Powell or not, it’s critical to stay informed about the economic policies that affect our daily lives. Following credible news sources and engaging in discussions can help foster a more informed public discourse.

In the end, the interplay between leadership, economic policy, and public perception will continue to shape the narrative around the Federal Reserve and its role in the U.S. economy. Understanding these dynamics is essential for anyone looking to navigate the complexities of the current economic climate.