US senate Passes Controversial GENIUS Act: Crypto Revolution or Risky Gamble?

stablecoin regulation, cryptocurrency legislation, US Senate crypto bill

—————–

US Senate Passes the GENIUS Act: A Milestone for Cryptocurrency Regulation

On June 18, 2025, the U.S. Senate made headlines by voting to pass the GENIUS Act, a significant piece of legislation that has been dubbed the "stablecoin bill." This act marks a watershed moment in the realm of cryptocurrency regulation, as it represents the most comprehensive crypto legislation to date in the United States. The passage of this bill signals a crucial step towards the establishment of regulatory frameworks that aim to foster innovation while ensuring consumer protection in the burgeoning digital asset space.

What is the GENIUS Act?

The GENIUS Act, an acronym for "Guiding Efficient and Necessary Investment in U.S. Stablecoins," aims to provide a clear regulatory framework for the issuance and management of stablecoins. Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to traditional fiat currencies like the U.S. dollar. They have gained immense popularity due to their ability to mitigate the volatility typically associated with cryptocurrencies like Bitcoin and Ethereum.

The act addresses various facets of stablecoin regulation, including the requirements for stablecoin issuers, the rights of consumers, and the responsibilities of financial institutions. By providing clarity on these issues, the GENIUS Act seeks to create a safer environment for both consumers and businesses engaging in the digital asset market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Key Features of the GENIUS Act

The GENIUS Act encompasses several vital components that aim to enhance the regulatory landscape for stablecoins and cryptocurrency in general:

1. Regulatory Framework for Stablecoin Issuers

One of the most critical aspects of the GENIUS Act is the establishment of a regulatory framework for stablecoin issuers. The act outlines the necessary requirements that these issuers must adhere to, which include maintaining adequate reserves to back their stablecoins, regular audits, and transparency in operations. This framework is designed to instill trust in consumers and investors, thereby encouraging broader adoption of stablecoins.

2. Consumer Protection Measures

Consumer protection is at the heart of the GENIUS Act. The legislation introduces measures to safeguard consumers from fraud and mismanagement of funds. This includes clear guidelines on disclosures that stablecoin issuers must provide, enabling consumers to make informed decisions. Additionally, the act mandates that issuers have robust risk management processes in place to protect consumers’ interests.

3. Collaboration with Financial Institutions

The GENIUS Act promotes collaboration between stablecoin issuers and traditional financial institutions. By fostering partnerships, the act aims to integrate stablecoins into the existing financial ecosystem. This collaboration could lead to increased liquidity and efficiency in financial transactions, further enhancing the utility of stablecoins.

4. Innovation and Research

Recognizing the rapid evolution of the cryptocurrency landscape, the GENIUS Act allocates resources for research and development in the field of digital assets. This provision encourages innovation within the industry while ensuring that regulatory bodies stay updated on emerging trends and technologies. By promoting research, the act aims to position the U.S. as a leader in cryptocurrency innovation.

The Implications of the GENIUS Act

The passage of the GENIUS Act has far-reaching implications for the cryptocurrency industry and its participants:

1. Increased Legitimacy for Stablecoins

With the introduction of a regulatory framework, stablecoins are likely to gain increased legitimacy in the eyes of both consumers and investors. The clarity provided by the GENIUS Act could lead to greater confidence in using stablecoins for transactions, investment, and other financial activities.

2. Attracting Investment

As the regulatory uncertainty surrounding cryptocurrencies diminishes, the U.S. could become a more attractive destination for cryptocurrency investment. Investors often seek clear and stable regulatory environments, and the GENIUS Act aims to provide just that. This may result in increased capital inflows into the U.S. crypto market, spurring innovation and growth.

3. Impact on Global Regulatory Trends

The passage of the GENIUS Act may set a precedent for other countries considering cryptocurrency regulation. As the U.S. takes a proactive approach to stablecoin legislation, other jurisdictions may follow suit, leading to a more harmonized global regulatory landscape for digital assets.

Challenges Ahead

Despite the positive outlook surrounding the GENIUS Act, challenges remain. The rapid pace of technological advancements in the cryptocurrency space means that regulators must continually adapt to stay relevant. Moreover, striking a balance between innovation and regulation will be crucial to ensuring that the U.S. remains a leader in the global cryptocurrency landscape.

Conclusion

The passage of the GENIUS Act is a monumental step towards establishing a comprehensive regulatory framework for stablecoins and cryptocurrency in the United States. By addressing key issues such as consumer protection, issuer requirements, and collaboration with financial institutions, the act aims to create a safer and more transparent environment for all participants in the digital asset market. As the cryptocurrency industry continues to evolve, the GENIUS Act stands as a testament to the U.S. commitment to fostering innovation while safeguarding the interests of consumers and investors alike. The implications of this legislation are expected to resonate well beyond U.S. borders, potentially influencing global regulatory trends in the cryptocurrency arena.

With the GENIUS Act now in effect, stakeholders, including investors, issuers, and consumers, are poised to navigate a new era of cryptocurrency regulation that promises both opportunities and challenges in equal measure.

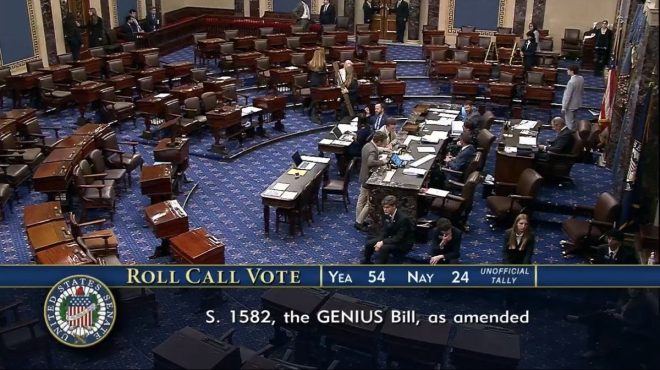

JUST IN: The US Senate has voted to pass the GENIUS Act.

The so called “stablecoin bill” is the most comprehensive crypto legislation passed in the US to date. pic.twitter.com/ZwZ3JR0Jwj

— Coin Bureau (@coinbureau) June 18, 2025

JUST IN: The US Senate has voted to pass the GENIUS Act

In a major development for the cryptocurrency landscape in the United States, the US Senate has officially voted to pass the GENIUS Act. This legislation, often referred to as the “stablecoin bill,” is hailed as the most comprehensive piece of crypto legislation to date. With its passage, the GENIUS Act aims to provide a regulatory framework that could potentially shape the future of digital currencies and stablecoins in the country.

The Significance of the GENIUS Act

The GENIUS Act is not just another piece of legislation; it’s a landmark bill that seeks to address the growing concerns surrounding the stability, security, and regulation of cryptocurrencies, particularly stablecoins. Stablecoins are digital currencies designed to maintain a stable value by pegging them to a reserve of assets, such as fiat currency. This makes them a popular choice for transactions within the crypto ecosystem, offering a less volatile alternative to traditional cryptocurrencies like Bitcoin and Ethereum.

By passing the GENIUS Act, the Senate recognizes the importance of providing clear and consistent regulations that can foster innovation while protecting consumers. The bill aims to create a framework that encourages responsible growth in the crypto sector, ensuring that investors and users have the necessary protections in place.

What the Bill Entails

The GENIUS Act outlines several key provisions that are designed to regulate stablecoins and the entities that issue them. It introduces a licensing system for stablecoin issuers, requiring them to meet certain standards to ensure the stability and security of the coins they offer. This includes maintaining sufficient reserves and conducting regular audits to verify their backing.

Moreover, the bill emphasizes transparency, mandating that issuers disclose relevant information about their operations, reserves, and any potential risks associated with their stablecoins. This level of transparency is crucial for building trust among users and investors, as it allows them to make informed decisions about their involvement in the crypto market.

Consumer Protection Measures

One of the most notable aspects of the GENIUS Act is its focus on consumer protection. The bill aims to establish clear guidelines for how stablecoins can be used, addressing issues such as fraud and misuse. By implementing strict regulations, the Act seeks to safeguard users against potential scams or losses associated with unregulated stablecoins.

The GENIUS Act also aims to protect users’ rights when it comes to data privacy and security. As the crypto landscape continues to evolve, ensuring that consumers’ personal information is safe and secure is of utmost importance. The legislation addresses these concerns head-on, ensuring that users can engage in crypto transactions with confidence.

Impact on the Cryptocurrency Market

The passage of the GENIUS Act is expected to have significant implications for the broader cryptocurrency market. By providing a regulatory framework for stablecoins, the bill could encourage more traditional financial institutions to enter the crypto space. This influx of institutional investment could lead to increased stability and maturity within the market, making cryptocurrencies more accessible to everyday users.

Furthermore, the clarity provided by the GENIUS Act could help alleviate some of the uncertainty that has hindered the growth of the crypto industry. With clear regulations in place, businesses and investors may feel more comfortable engaging with cryptocurrencies, leading to further innovation and development in this rapidly evolving sector.

Challenges Ahead

While the passage of the GENIUS Act is a significant milestone, it also presents challenges that will need to be addressed. As with any new legislation, the implementation process will be critical. Regulatory bodies will need to establish clear guidelines and procedures to ensure that the bill’s provisions are effectively enforced.

Moreover, there may be pushback from certain segments of the crypto community that advocate for less regulation. Some argue that excessive regulation could stifle innovation and limit the potential of cryptocurrencies. Balancing the need for regulation with the desire for a free and open market will be a delicate task for lawmakers and regulators.

The Future of Stablecoins

As the GENIUS Act sets the stage for a more regulated future for stablecoins, it raises important questions about the direction of the cryptocurrency ecosystem. Will other countries follow suit and implement similar regulations? How will this impact the global competitiveness of the US crypto market?

Investors and users alike will be watching closely to see how the passage of the GENIUS Act influences the development of new stablecoins and the evolution of existing ones. As the landscape changes, it’s essential for participants in the crypto market to stay informed and adapt to new regulations and market dynamics.

Conclusion

The passage of the GENIUS Act by the US Senate is a momentous occasion for the cryptocurrency industry. As the most comprehensive crypto legislation to date, it sets a precedent for future regulatory efforts and highlights the importance of balancing innovation with consumer protection. With clear guidelines in place, the GENIUS Act has the potential to foster a more secure and sustainable crypto ecosystem, paving the way for the continued growth of digital currencies in the United States.

As we move forward, it will be crucial to monitor the implementation of the GENIUS Act and its impact on the cryptocurrency market. The future of stablecoins and the broader crypto landscape will depend on how effectively regulators can create an environment that fosters innovation while ensuring the protection of consumers and investors.