U.S. Treasury Chief Sparks Outrage: Is China’s Manufacturing Dominance a Threat?

global manufacturing dynamics, US-China economic relations, manufacturing industry dependency

—————–

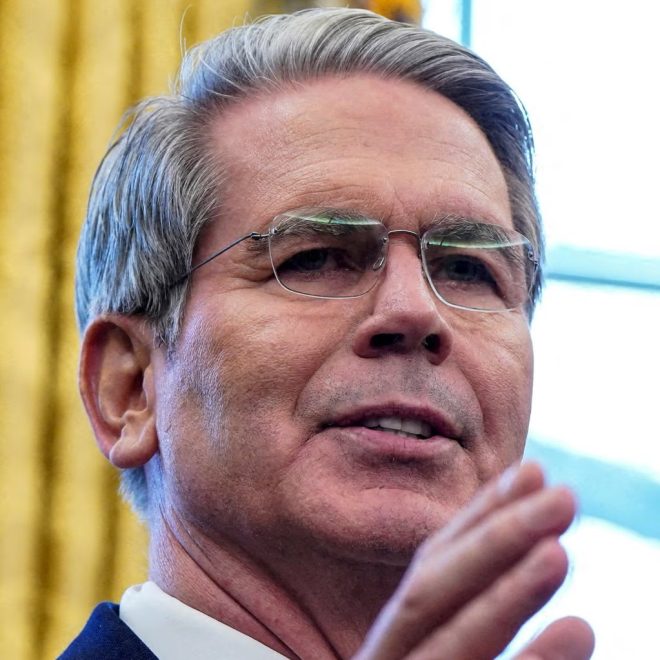

Summary of U.S. Treasury Secretary Scott Bessent’s Remarks on China’s Manufacturing Dominance

In a recent tweet by Whale Insider, U.S. Treasury Secretary Scott Bessent expressed concern over China’s significant share of global manufacturing, which currently stands at 30%. This statement has sparked discussions about the implications of China’s manufacturing dominance on the global economy.

Understanding China’s Manufacturing Share

China’s manufacturing sector has grown exponentially over the past few decades. As of now, it accounts for 30% of the global manufacturing output. This dominance is attributed to various factors, including lower labor costs, advanced production technologies, and robust supply chain infrastructures. However, this overwhelming share raises questions about economic balance and competition in the global market.

Implications of China’s Manufacturing Share

Bessent’s assertion that China’s 30% stake is "too high" reflects broader concerns within the U.S. government regarding economic competition and national security. The reliance on China for manufactured goods has implications for supply chain vulnerabilities, trade deficits, and job creation in the United States.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Competition

The dominance of Chinese manufacturing has led to increased competition, which can be detrimental for American manufacturers. Companies in the U.S. often struggle to compete with China’s lower production costs, leading to a decline in domestic manufacturing jobs. This situation raises critical questions about the long-term viability of U.S. manufacturing and the potential need for policy changes to support local industries.

Trade Deficits

The trade relationship between the United States and China has been a point of contention for years. With such a high percentage of global manufacturing attributed to China, the U.S. faces significant trade deficits. This imbalance can lead to economic challenges, including inflation and reduced economic growth, as domestic companies may find it difficult to sustain operations amidst cheaper imports.

National Security Concerns

From a national security perspective, reliance on a single country for a substantial portion of manufactured goods poses risks. In times of geopolitical tension, supply chain disruptions can occur, impacting critical industries such as healthcare, technology, and defense. Bessent’s comments may signal a push towards diversifying supply chains and reducing dependency on China.

Potential Solutions and Strategies

In light of these concerns, various strategies can be considered to mitigate the risks associated with China’s manufacturing dominance:

Strengthening Domestic Manufacturing

Investing in domestic manufacturing capabilities is crucial. This can involve government incentives for companies to bring production back to the U.S. or invest in advanced manufacturing technologies. By fostering a more robust manufacturing sector, the U.S. can reduce reliance on foreign goods and stimulate job creation.

Promoting Trade Partnerships

The U.S. can also explore trade agreements with other countries to diversify its sources of manufactured goods. By strengthening partnerships with nations that have emerging manufacturing capabilities, the U.S. can mitigate the risks associated with its current dependency on China.

Encouraging Innovation

Innovation is key to maintaining competitiveness in the global market. By investing in research and development, U.S. companies can develop new technologies and processes that increase efficiency and reduce costs. This can help level the playing field against cheaper foreign competitors.

Conclusion

Scott Bessent’s remarks highlight a critical issue in the global economy: the implications of China’s 30% share of global manufacturing. As the U.S. navigates this landscape, it must consider the economic, trade, and national security ramifications of such dependency. By strengthening domestic manufacturing, promoting trade partnerships, and encouraging innovation, the U.S. can work towards a more balanced and secure economic future.

As the global economic landscape continues to evolve, these discussions will be vital in shaping policies that foster sustainable growth and competitive advantage in the manufacturing sector. The importance of addressing these challenges cannot be overstated, as they will have lasting impacts on the U.S. economy and its role in the world.

In summary, Bessent’s comments serve as a wake-up call for policymakers and business leaders alike, urging a reevaluation of the current manufacturing landscape and the need for strategic action to ensure a balanced and resilient economy.

JUST IN: U.S. Treasury Secretary Scott Bessent says China’s 30% share of global manufacturing is too high. pic.twitter.com/f4JLoMKZ11

— Whale Insider (@WhaleInsider) June 18, 2025

JUST IN: U.S. Treasury Secretary Scott Bessent says China’s 30% share of global manufacturing is too high

In a recent statement that has stirred quite a conversation, U.S. Treasury Secretary Scott Bessent expressed concerns about China’s significant role in global manufacturing. With a staggering 30% share, he argues that this level of dominance is excessive. This insight came during a period marked by increasing scrutiny of supply chains and manufacturing dependencies worldwide, especially in light of recent global events. The implications of this statement are profound, touching on the economic dynamics between the U.S. and China, and potentially reshaping the future of global manufacturing.

The Economic Landscape of Global Manufacturing

The manufacturing sector is a crucial component of any nation’s economy. It not only provides jobs but also drives innovation and competitiveness. However, when one country holds such a substantial portion of the manufacturing pie, it raises questions about economic balance and security. According to a report from the Brookings Institution, the concentration of manufacturing in a single economy can lead to vulnerabilities, such as reliance on that economy for essential goods. This reliance was starkly highlighted during the COVID-19 pandemic when supply chains were disrupted globally.

Why Does China’s Manufacturing Share Matter?

China’s 30% share of global manufacturing isn’t just a statistic; it symbolizes a broader economic strategy. Over the past few decades, China has positioned itself as the “world’s factory,” leveraging its vast labor force and strategic investments in technology and infrastructure. This transformation has lifted millions out of poverty and has been a vital driver of global economic growth.

However, as Secretary Bessent pointed out, this level of dominance can lead to significant risks. It raises concerns about supply chain vulnerabilities, especially for critical industries like technology, healthcare, and automotive manufacturing. A report from McKinsey & Company suggests that nations should diversify their manufacturing bases to mitigate risks associated with over-reliance on any single nation.

The U.S.-China Relationship: A Complex Interplay

The relationship between the U.S. and China is multifaceted, filled with cooperation, competition, and conflict. On one hand, China is a critical trading partner for the U.S., providing goods at competitive prices. On the other hand, the U.S. government is increasingly wary of the implications of China’s manufacturing dominance. Secretary Bessent’s comments echo a growing sentiment within the U.S. that it’s time to reassess and possibly recalibrate this relationship.

In recent years, the U.S. has taken steps to bring some manufacturing back home, a trend often referred to as “reshoring.” According to the news-events/news/2021/05/reshoring-what-it-means-and-why-it-matters”>National Institute of Standards and Technology (NIST), reshoring aims to reduce dependency on foreign manufacturing and enhance national security. This movement has gained momentum as companies seek to build more resilient supply chains that can withstand global disruptions.

China’s Response to Criticism

China, in response to such criticisms, has been adamant about its role in global manufacturing. The Chinese government often emphasizes its contributions to global supply chains and economic stability. Furthermore, they have been investing heavily in advanced manufacturing technologies, such as artificial intelligence and automation, to maintain their competitive edge.

Chinese officials argue that a balanced global economy benefits all nations. They advocate for cooperation rather than confrontation, suggesting that the focus should be on collaboration to address common challenges like climate change and economic recovery post-COVID-19. According to an article from Reuters, China’s continued investments in green technologies and sustainable manufacturing practices reflect its commitment to maintaining its role in the global economy while addressing environmental concerns.

The Future of Global Manufacturing

The global manufacturing landscape is undoubtedly changing. As countries reevaluate their supply chains in light of recent disruptions, the dialogue around China’s manufacturing share will likely intensify. Secretary Bessent’s remarks serve as a catalyst for this conversation, urging policymakers and business leaders to consider the implications of concentrated manufacturing power.

Experts believe that the future will see a more diversified manufacturing ecosystem, with companies exploring alternatives to traditional manufacturing hubs. This could lead to increased investment in countries with emerging manufacturing capabilities, thus creating a more balanced global manufacturing environment. According to PwC, a diversified manufacturing base can enhance resilience and mitigate risks associated with geopolitical tensions.

Challenges Ahead

Despite the potential for a more balanced manufacturing landscape, challenges remain. Trade tensions, tariffs, and regulatory hurdles can complicate efforts to diversify manufacturing. Moreover, the ongoing competition for technological supremacy between the U.S. and China adds another layer of complexity. As countries navigate this new reality, they must also consider the implications for their workforce and the skills needed for future industries.

According to a report by the World Economic Forum, the rise of automation and advanced technologies will require a workforce that is adaptable and skilled in new areas. This evolution in skills training and education will be crucial for countries looking to capitalize on new manufacturing opportunities while ensuring their workers are prepared for the jobs of tomorrow.

Conclusion: A Call for Strategic Reevaluation

Secretary Scott Bessent’s assertion regarding China’s 30% share of global manufacturing is a wake-up call for policymakers, businesses, and consumers alike. It emphasizes the need for strategic reevaluation of global manufacturing dependencies and highlights the importance of fostering a competitive yet balanced economic landscape.

As we move forward, embracing innovation, collaboration, and strategic planning will be vital in shaping the future of manufacturing. The dialogue initiated by these recent comments will undoubtedly influence decisions made in boardrooms and government offices around the world. It’s an exciting yet challenging time for global manufacturing, and how nations respond to these challenges will define the economic landscape for years to come.