Canada Shocks Wall Street: First $XRP Spot ETF Launch Ignites Crypto Debate!

XRP investment opportunities, Toronto Stock Exchange cryptocurrency, first spot ETF launch 2025

—————–

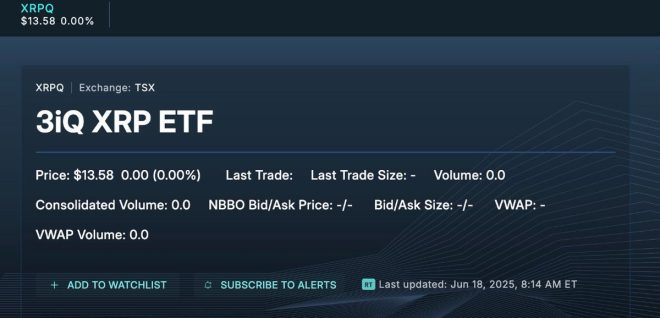

Canada’s First XRP Spot ETF Launches on the Toronto Stock Exchange

In a significant development for the cryptocurrency market, Canada has officially launched its first XRP Spot Exchange-Traded Fund (ETF) on the Toronto Stock Exchange (TSE). This groundbreaking event, reported by Cointelegraph on June 18, 2025, marks an important milestone not only for XRP but also for the broader acceptance and integration of cryptocurrencies into mainstream financial markets.

Understanding XRP and Its Importance

XRP is a digital asset created by Ripple Labs, designed to facilitate fast and cost-effective cross-border transactions. It has been widely recognized for its potential to revolutionize the financial landscape by enabling quicker and cheaper international money transfers compared to traditional banking systems. The launch of an XRP Spot ETF signifies increased institutional interest in the asset and provides a regulated avenue for investors to gain exposure to XRP without having to directly buy and store the cryptocurrency.

The Significance of the ETF Launch

An ETF allows investors to buy shares that represent a collection of assets—in this case, XRP—without the need for direct ownership. This structure can attract a broader range of investors, including those who may be hesitant to dive into the complexities of cryptocurrency wallets and exchanges. By launching the ETF on the TSE, Canadian regulators have demonstrated their commitment to fostering an environment conducive to innovation while ensuring investor protection.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This ETF launch could serve as a precedent for other countries considering similar products, potentially paving the way for a global increase in cryptocurrency ETFs. The growing acceptance of digital assets is a clear indicator that cryptocurrencies are becoming an integral part of the investment landscape.

Regulatory Landscape for Cryptocurrency ETFs

The regulatory environment surrounding cryptocurrency ETFs has been complex and often contentious. In many jurisdictions, regulatory bodies have expressed caution regarding the approval of cryptocurrency ETFs, citing concerns over market volatility, investor protection, and the potential for fraud. However, Canada has taken a more progressive stance, having already approved several cryptocurrency ETFs in the past, making it a leader in the space.

The approval of the XRP Spot ETF is particularly notable given the legal challenges that Ripple Labs has faced. The U.S. Securities and Exchange Commission (SEC) has been engaged in an ongoing lawsuit against Ripple, arguing that XRP should be classified as a security. This controversy has cast a shadow over XRP’s future in the U.S. market, making the Canadian launch even more significant for investors looking for clarity and opportunity.

Investor Implications

For investors, the launch of the XRP Spot ETF could open new doors. Those interested in diversifying their portfolios with cryptocurrency assets now have a regulated option that mitigates some of the risks associated with direct cryptocurrency investments. The ETF structure provides liquidity, allowing investors to buy and sell shares easily during trading hours, similar to traditional stocks.

Moreover, the ETF could attract institutional investors who have been waiting for a more regulated way to invest in cryptocurrencies. The participation of institutional investors is often seen as a sign of legitimacy and stability in the market, potentially leading to increased demand for XRP and a positive impact on its price.

Market Reaction and Future Outlook

The launch of the XRP Spot ETF has already begun to generate buzz in the cryptocurrency community and among traditional investors. Market analysts speculate that this move could lead to increased trading volume for XRP and potentially elevate its status in the digital asset space. As more investors gain access to XRP through the ETF, the overall market capitalization of the asset might see a significant increase.

Looking ahead, the success of the XRP Spot ETF could inspire other cryptocurrency projects to pursue similar paths. As more countries evaluate the feasibility of cryptocurrency ETFs, the landscape of digital assets could evolve dramatically. Investors should stay informed about regulatory developments and market trends to navigate this rapidly changing environment effectively.

Conclusion

The launch of the first XRP Spot ETF on the Toronto Stock Exchange is a landmark event in the cryptocurrency world, reflecting the increasing acceptance and integration of digital assets into mainstream finance. This ETF provides a new avenue for investors to gain exposure to XRP while navigating the complexities of the cryptocurrency market.

As regulatory frameworks continue to evolve and more countries consider similar products, the potential for growth in the cryptocurrency sector is substantial. Investors and stakeholders in the financial industry should keep a close eye on these developments, as they could shape the future of investment in digital assets for years to come.

In summary, the XRP Spot ETF launch is not just a win for XRP; it represents a significant step forward for the entire cryptocurrency ecosystem. With the right regulatory support and investor interest, cryptocurrencies may continue to gain traction as a viable investment option, further solidifying their place in the global financial landscape.

BREAKING: The first $XRP Spot ETF launches on the Toronto Stock Exchange. pic.twitter.com/MoDr67S7bS

— Cointelegraph (@Cointelegraph) June 18, 2025

BREAKING: The first $XRP Spot ETF launches on the Toronto Stock Exchange

The crypto world has been buzzing, and for a good reason! The launch of the first $XRP Spot ETF on the Toronto Stock Exchange marks a significant milestone in the investment landscape. This groundbreaking event not only demonstrates the growing acceptance of cryptocurrencies in traditional finance but also opens up new avenues for investors eager to dive into the world of digital assets. So, what does this mean for you and the broader financial ecosystem? Let’s unpack this exciting news.

What is an ETF?

Before we delve deeper into the implications of the $XRP Spot ETF, it’s essential to understand what an ETF (Exchange-Traded Fund) is. An ETF is a type of investment fund that is traded on stock exchanges, similar to stocks. It holds a collection of assets, such as stocks, commodities, or cryptocurrencies, and allows investors to buy shares in the fund without having to purchase the underlying assets directly.

In this case, the $XRP Spot ETF allows investors to gain exposure to the price movements of XRP, the native cryptocurrency of the Ripple network, without having to own the digital currency directly. This simplification can attract a broader range of investors who may be wary of the complexities of buying and storing cryptocurrencies.

Why Is This Significant?

The launch of the first $XRP Spot ETF is a landmark achievement for several reasons. First and foremost, it signifies a growing acceptance of cryptocurrencies in mainstream finance. The approval of such an ETF by regulatory bodies like the Ontario Securities Commission (OSC) highlights a shift in attitude towards digital assets, paving the way for more innovative financial products in the future.

Additionally, having an $XRP Spot ETF can increase liquidity in the market. When investors can purchase shares of an ETF, it provides a more straightforward way to trade XRP, potentially leading to increased trading volumes and price stability. This could be particularly beneficial for XRP, which has faced its share of volatility over the years.

What Does This Mean for XRP?

For XRP holders, the launch of the Spot ETF could mean several things. First, it may lead to an increase in the value of XRP if more institutional and retail investors decide to jump on board. As demand for the ETF rises, so too could the price of XRP, which would benefit existing holders.

Moreover, the ETF could enhance the overall credibility of XRP and the Ripple network. With a regulated financial product available, investors may feel more confident in the long-term viability of XRP, potentially leading to increased adoption in various sectors, including remittances and cross-border payments.

Investor Considerations

While the launch of the $XRP Spot ETF is undoubtedly exciting, investors should approach with caution. The cryptocurrency market remains highly volatile, and past performance is not always indicative of future results. It’s crucial to do your research, understand the risks involved, and consider your investment strategy carefully.

If you’re new to investing in cryptocurrencies or ETFs, consider starting small and gradually increasing your exposure as you become more comfortable with the asset class. Additionally, keeping an eye on market trends, regulatory developments, and the overall economic landscape can help you make informed decisions.

Future of Cryptocurrency ETFs

The introduction of the $XRP Spot ETF could set a precedent for other cryptocurrencies seeking to launch similar products. As regulatory bodies become more familiar with digital assets, we might see more ETFs for leading cryptocurrencies like Bitcoin and Ethereum hitting the markets. This could further legitimize the crypto space and encourage more traditional investors to dip their toes into the water.

Moreover, as more financial products become available, we could see advancements in the way cryptocurrencies are incorporated into investment portfolios. This could lead to a more diversified range of investment options, appealing to various risk appetites and investment goals.

Community Reaction

The crypto community has been buzzing with excitement since the announcement of the $XRP Spot ETF launch. For many, this represents a significant step towards mainstream acceptance of digital assets. Social media platforms, particularly Twitter, have been alive with discussions, debates, and predictions about the potential impact of this ETF on the crypto market.

Prominent figures in the cryptocurrency space have expressed optimism about the ETF’s launch, emphasizing the potential for XRP to gain traction among institutional investors. The sentiment is that this could usher in a new era for XRP and the broader cryptocurrency landscape.

Conclusion: Embracing Change in Finance

The launch of the first $XRP Spot ETF on the Toronto Stock Exchange is more than just a financial product; it represents a paradigm shift in how we view and interact with cryptocurrencies. As the lines between traditional finance and digital assets continue to blur, investors have an unprecedented opportunity to explore new avenues of wealth creation.

Whether you’re a seasoned investor or just starting, the arrival of the $XRP Spot ETF invites everyone to rethink their approach to investing in cryptocurrencies. As always, stay informed, stay engaged, and be ready to adapt to the ever-evolving landscape of finance. The future is bright, and the possibilities are endless!