“One Bill, Two Futures: Historic Tax Cuts or Unprecedented Hikes Await!”

tax policy 2025, economic impact analysis, federal budget reform

—————–

The One Big Beautiful Bill: A Historic Choice for American Taxpayers

In a recent tweet from Rapid Response 47, the stakes surrounding the passage of a significant legislative proposal known as the One Big Beautiful Bill have been starkly outlined. The tweet emphasizes a critical choice facing American taxpayers: the potential for the largest tax cut in history versus the looming threat of the most substantial tax hike if the bill fails to pass. This summary delves into the implications of this legislation, its anticipated effects on the economy, and the broader context of tax reform in the United States.

Understanding the One Big Beautiful Bill

The One Big Beautiful Bill represents a comprehensive approach to tax reform aimed at alleviating the financial burden on American families and businesses. Advocates argue that the bill is designed to stimulate economic growth by providing tax relief, which could foster increased consumer spending and investment. The potential tax cut is framed as a historic opportunity that would benefit a wide range of taxpayers, from low-income families to small business owners.

The Case for the Tax Cut

Supporters of the bill assert that passing the One Big Beautiful Bill would lead to the largest tax cut in American history. This substantial reduction in tax liability is expected to have several positive effects:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Disposable Income: By reducing tax rates, families will have more disposable income, allowing them to spend more on goods and services. This increase in consumer spending is crucial for economic growth, particularly in the aftermath of economic downturns.

- Boosting Small Businesses: The bill is likely to provide relief for small businesses, which are often the backbone of the economy. Lower tax rates can enable these businesses to reinvest in their operations, hire more employees, and contribute to job creation.

- Encouraging Investments: With lower taxes on capital gains and corporate profits, businesses may be more inclined to invest in new projects and technologies, leading to innovation and long-term economic growth.

The Consequences of Inaction

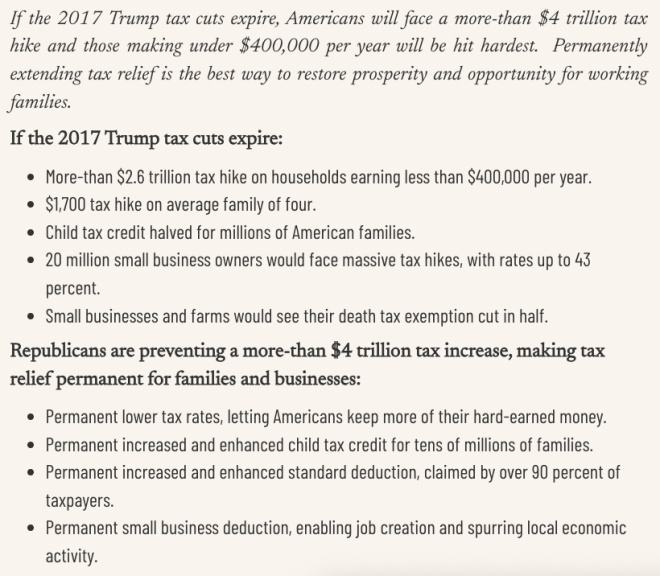

Conversely, the tweet warns of the dire consequences that could arise if the One Big Beautiful Bill does not pass. The prospect of the largest tax hike in history looms over American taxpayers, which could have several negative impacts:

- Reduced Consumer Spending: A significant tax increase would reduce disposable income for families, leading to decreased consumer spending. This could stall economic growth and negatively impact businesses that rely on consumer purchases.

- Job Losses: Higher taxes on businesses may result in layoffs or reduced hiring, as companies struggle to maintain profitability in the face of increased tax burdens. This could lead to higher unemployment rates and economic instability.

- Stagnation of Economic Growth: The potential for higher taxes may deter investments in the economy, leading to stagnation. When businesses face higher tax rates, they may be less likely to expand or invest in new initiatives, ultimately hindering economic progress.

The Broader Context of Tax Reform

The discussion surrounding the One Big Beautiful Bill is part of a larger narrative regarding tax reform in the United States. Over the years, tax policies have evolved, often reflecting the political climate and economic conditions of the time. The current debate highlights a fundamental divide between those who advocate for lower taxes as a means of stimulating growth and those who believe that higher taxes on the wealthy are necessary to fund public services and reduce income inequality.

Public Sentiment and Political Implications

As the One Big Beautiful Bill garners attention, public sentiment will play a crucial role in its fate. Voter opinions on tax cuts versus tax hikes are often influenced by personal experiences and broader economic trends. Politicians will likely be keenly aware of how their constituents feel about potential tax changes, particularly in the context of upcoming elections.

Conclusion: The Choice Ahead

The tweet from Rapid Response 47 encapsulates a critical moment in American fiscal policy. The One Big Beautiful Bill presents a clear choice for taxpayers: embrace the potential for historic tax cuts or face the reality of unprecedented tax increases. As the debate continues, it is essential for citizens to engage with the issues at stake, understand the implications of the proposed legislation, and make their voices heard.

In summary, the One Big Beautiful Bill could reshape the financial landscape for millions of Americans. The promise of tax relief stands in stark contrast to the potential consequences of inaction, making the upcoming decisions surrounding this bill all the more significant. Whether viewed as a beacon of hope or a harbinger of economic uncertainty, the choice before American taxpayers is undoubtedly profound.

THE CHOICE IS CLEAR:

If the One Big Beautiful Bill passes, Americans will see the largest tax cut in history.

If the One Big Beautiful Bill does not pass, Americans will see the largest tax hike in history. pic.twitter.com/mQiNRx8e40

— Rapid Response 47 (@RapidResponse47) June 17, 2025

THE CHOICE IS CLEAR:

When it comes to the future of American taxation, the debate surrounding the One Big Beautiful Bill is heating up. This proposed legislation has garnered significant attention, with many claiming that its passage could lead to unprecedented financial relief for millions of citizens. On the flip side, if this bill fails to make it through Congress, we could be staring down the barrel of the largest tax hike in American history. So, what’s at stake here? Let’s break it down.

If the One Big Beautiful Bill passes, Americans will see the largest tax cut in history.

Supporters of the One Big Beautiful Bill are making a bold claim: if this legislation passes, it could deliver the biggest tax cut America has ever seen. Imagine the impact that could have on your paycheck! The proposed cuts aim to lighten the tax burden on individuals and families across the nation, allowing Americans to keep more of their hard-earned money.

The bill outlines several key provisions that could significantly reduce tax rates for various income brackets. For example, lower-income families might see substantial decreases in their tax obligations, which could free up funds for essential expenses like housing, groceries, and education. This kind of relief can be a game-changer, especially for those who are currently struggling to make ends meet.

Moreover, the One Big Beautiful Bill could also streamline the tax code, making it simpler and more accessible for everyone. Many people dread tax season because of the complexities involved in filing, but with a more straightforward system, individuals could save time and reduce the stress that comes with tax preparation. You can read more about the proposed changes and their potential benefits in detail on Forbes.

If the One Big Beautiful Bill does not pass, Americans will see the largest tax hike in history.

On the other hand, the stakes are equally high if the One Big Beautiful Bill fails to pass. Detractors of the bill argue that without these tax cuts, Americans could face significant increases in their tax liabilities. The fear is that if the bill doesn’t move forward, the government may resort to higher taxes as a way to address budget concerns and public spending.

Imagine a scenario where families suddenly find themselves paying more in taxes, making it even tougher to balance their monthly budgets. The implications could be far-reaching, affecting everyone’s ability to save for the future, invest in education, or even just enjoy a little leisure time. The potential for the largest tax hike in history looms large if lawmakers cannot come to a consensus on this critical legislation.

Additionally, the economic impact of such a tax hike could be devastating. Higher taxes could lead to decreased consumer spending, which in turn affects businesses and jobs across the country. A detailed analysis of how tax hikes can impact the economy can be found on The Heritage Foundation.

The Broader Economic Implications

The debate over the One Big Beautiful Bill is not just about tax cuts or hikes; it’s about the broader implications for the economy as a whole. A significant tax cut could stimulate growth, encouraging people to spend more money and invest in their futures. Conversely, a tax hike could lead to a contraction in economic activity, as families tighten their belts in response to higher financial obligations.

It’s a classic case of supply-side economics versus demand-side economics. Proponents of tax cuts argue that when individuals have more money in their pockets, they’re more likely to spend it, which fuels economic growth. On the flip side, those in favor of tax increases often argue that increased revenue is necessary for funding essential services and programs. Understanding these dynamics is crucial for grasping what’s at stake with the One Big Beautiful Bill.

The Political Landscape

The political landscape surrounding the One Big Beautiful Bill is as complex as the bill itself. On one side, you have advocates pushing for tax relief, while on the other, there are voices cautioning against potential revenue shortfalls. This division underscores a larger ideological battle over how to best manage the economy and support American families.

As the debate unfolds, it’s essential for citizens to stay informed and engaged. The decisions made by lawmakers now will have long-lasting effects on the financial well-being of millions. Engaging with local representatives, voicing your opinions, and staying updated on the progress of the One Big Beautiful Bill can help ensure that your voice is heard in this crucial discussion.

What Can You Do?

In times of political uncertainty, it’s easy to feel powerless, but there are steps you can take to make your voice heard. First and foremost, educate yourself about the details of the One Big Beautiful Bill. Understanding its provisions and potential impacts can help you have informed discussions with your friends and family.

Next, consider reaching out to your congressional representatives. Share your thoughts on the bill and express how it could affect your life and the lives of those in your community. Advocacy can take many forms, from writing letters to participating in local town halls. Every voice counts, and lawmakers need to hear from their constituents.

Finally, stay informed. Follow reliable news sources and engage with community organizations that focus on tax issues and economic policy. The more informed you are, the better equipped you’ll be to navigate the complexities of tax legislation and its implications for your family and community.

Final Thoughts

The discussion surrounding the One Big Beautiful Bill is an essential one, with significant implications for the American populace. Whether it leads to the largest tax cut in history or the largest tax hike, the choices made by lawmakers today will shape the economic landscape for years to come. As a citizen, your engagement in this process is crucial. Keep the conversation going, stay informed, and make your voice heard. After all, the choice is clear: financial relief or financial burden. The power to influence this decision is in our hands.