“Is Crypto the Key to Saving America? Treasury Chief Claims Stablecoins Can Slash Debt!”

stablecoin market growth, government debt reduction strategies, US Treasury demand surge

—————–

The Impact of Stablecoins on Government Borrowing Costs and National Debt

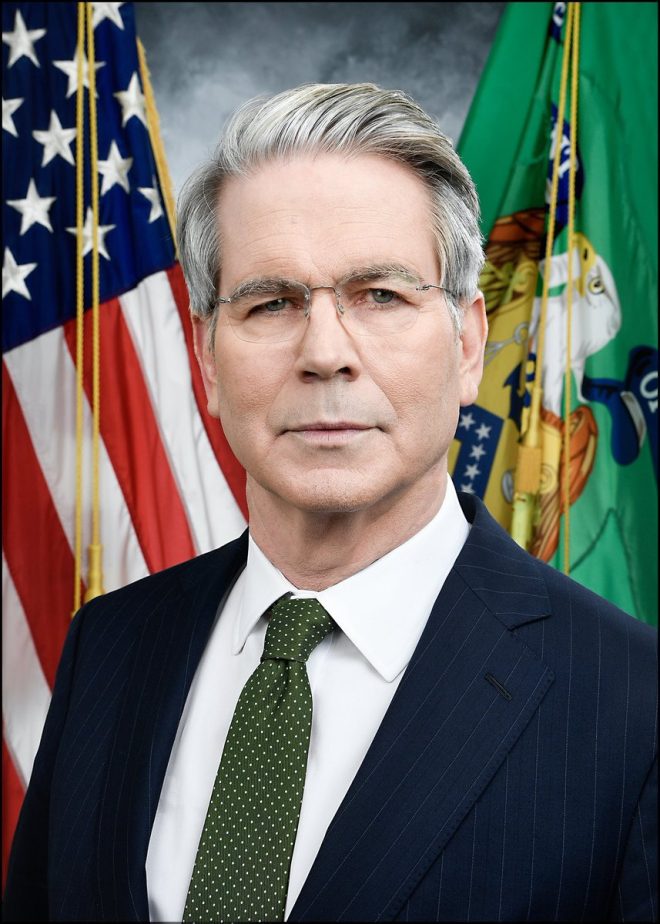

In a recent announcement, U.S. Treasury Secretary Bessent highlighted the potential benefits of cryptocurrency stablecoins in reducing government borrowing costs and addressing the national debt. This groundbreaking perspective positions stablecoins as not just a digital currency alternative, but also as a viable financial tool that could enhance fiscal stability and attract private sector investments in U.S. Treasuries.

Understanding Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to a reserve of assets, such as fiat currency or commodities. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which are known for their volatility, stablecoins aim to provide a reliable medium of exchange, making them more appealing for everyday transactions and as a store of value.

The Role of Stablecoins in the Financial Ecosystem

The potential for stablecoins to thrive is closely linked to their backing by U.S. Treasuries, which are seen as one of the safest investments. As Secretary Bessent pointed out, a flourishing stablecoin ecosystem could significantly drive demand for these government securities, ultimately benefiting the national economy.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Lowering Government Borrowing Costs

When demand for U.S. Treasuries increases, it can lead to lower interest rates. This is due to the inverse relationship between bond prices and yields: when demand for Treasuries goes up, their prices rise, causing yields (or interest rates) to fall. Lower borrowing costs for the government could translate into savings on interest payments, allowing more flexibility in fiscal policy.

Reducing National Debt

A reduction in interest rates can also contribute to a decrease in national debt over time. The U.S. government has to pay interest on its debt, and when these rates are lower, it can manage its obligations more easily. In turn, this can lead to a more sustainable economic environment, fostering growth and stability.

Advantages of a Thriving Stablecoin Ecosystem

- Increased Demand for U.S. Treasuries: A robust stablecoin market will encourage institutional investors and private sectors to invest in U.S. Treasuries, increasing their value and decreasing yields.

- Enhanced Liquidity: Stablecoins can improve market liquidity, making it easier for individuals and businesses to transact without the volatility associated with traditional cryptocurrencies.

- Financial Inclusion: By facilitating easier access to financial services, stablecoins can help underbanked populations participate in the economy.

- Innovative Financial Products: A thriving stablecoin ecosystem can lead to the development of new financial products and services that could further attract investment.

Challenges Ahead

While the prospects of stablecoins appear promising, there are several challenges that need to be addressed to realize their full potential:

- Regulatory Framework: There is a need for clear regulations governing stablecoins to ensure consumer protection and maintain financial stability. The lack of a cohesive regulatory approach could hinder the growth of the market.

- Market Volatility: Although stablecoins are designed to be stable, they are not immune to market forces. Events that disrupt the backing assets can lead to fluctuations in value, undermining investor confidence.

- Trust and Transparency: For stablecoins to gain widespread acceptance, issuers must ensure transparency regarding their asset reserves and maintain trust with users.

Conclusion

The statement by Treasury Secretary Bessent presents a transformative view of stablecoins in the financial landscape. By driving demand for U.S. Treasuries, a thriving stablecoin ecosystem could contribute to lowering government borrowing costs and reducing national debt. As the cryptocurrency market continues to evolve, it will be crucial for regulators, financial institutions, and private sector stakeholders to collaborate in creating an environment that fosters innovation while ensuring stability and trust.

In summary, the intersection of stablecoins and government finance presents an unprecedented opportunity to reshape the fiscal landscape. Embracing this digital evolution could lead to a more resilient economy, benefiting all stakeholders involved. As we look to the future, the developments surrounding stablecoins will be pivotal in shaping the interaction between cryptocurrencies and traditional financial systems.

JUST IN: Treasury Secretary Bessent says crypto stablecoins can lower government borrowing costs and reduce national debt.

“A thriving stablecoin ecosystem will drive demand from the private sector for US Treasuries, which back stablecoins. This newfound demand could lower… pic.twitter.com/wcNzj7PgzW

— Watcher.Guru (@WatcherGuru) June 17, 2025

JUST IN: Treasury Secretary Bessent Says Crypto Stablecoins Can Lower Government Borrowing Costs and Reduce National Debt

In a groundbreaking statement, Treasury Secretary Bessent has made waves in the financial sector by asserting that crypto stablecoins could significantly lower government borrowing costs and help reduce the national debt. This perspective offers a fresh lens through which to view the potential of cryptocurrencies, especially stablecoins, in the broader economic landscape. So, what does this mean for the economy, and how could a thriving stablecoin ecosystem reshape our financial future?

A Thriving Stablecoin Ecosystem

Bessent emphasized that a robust stablecoin ecosystem could stimulate demand from the private sector for U.S. Treasuries, which are the backbone of these digital currencies. The concept is fairly straightforward: as stablecoins become increasingly popular, they rely on the stability and security provided by U.S. Treasuries. This relationship could create a ripple effect, driving more private-sector investments into Treasuries, ultimately lowering borrowing costs for the government.

Stablecoins, by their very nature, are designed to maintain a stable value, often pegged to traditional currencies like the U.S. dollar. They blend the advantages of cryptocurrencies, such as quick transactions and lower fees, with the stability typically associated with fiat currencies. This unique position makes them appealing to both consumers and businesses alike, translating into increased usage and demand.

Impact on Government Borrowing Costs

The implications of this statement are far-reaching. Lower government borrowing costs can help alleviate the national debt burden, making it easier for the U.S. government to finance its operations and invest in critical infrastructure and services. When stablecoins drive demand for Treasuries, it could lead to lower interest rates, which means the government can borrow more affordably.

Imagine the possibilities: funds that could have gone toward interest payments on the national debt could instead be allocated toward education, healthcare, or renewable energy projects. As the government spends less on interest, it could directly impact citizens’ lives by improving public services and potentially even lowering taxes.

Reducing National Debt

Bessent’s comments have reignited discussions on how innovative financial instruments can play a role in tackling the national debt. As more individuals and businesses adopt stablecoins, the increased circulation could lead to a more dynamic economy. More dynamic economies often lead to increased tax revenues, which can help chip away at the national debt.

The potential for stablecoins to provide a safety net for investors is also noteworthy. With their value tied to stable assets, they could attract more conservative investors who might otherwise shy away from traditional cryptocurrencies due to their volatility. This influx of capital into stablecoins and, by extension, U.S. Treasuries, could create a more stable investment environment overall.

The Role of U.S. Treasuries

U.S. Treasuries are often viewed as one of the safest investments available. When stablecoins back their value with Treasuries, the perception of safety is amplified. This relationship can encourage more people to engage with stablecoins, knowing their investments are underpinned by government-backed securities.

As Bessent pointed out, a thriving stablecoin ecosystem will drive demand for U.S. Treasuries in ways we haven’t seen before. This increased demand can help keep interest rates low, making it easier for the government to manage its debt. In essence, stablecoins could function as a kind of bridge between the traditional financial system and the emergent world of digital currencies.

The Private Sector’s Role

The private sector’s involvement is crucial in this equation. The economic landscape is shifting rapidly, and businesses are increasingly looking for ways to incorporate digital currencies into their operations. As the demand for stablecoins grows, businesses may start holding Treasuries as part of their asset management strategy, further driving down borrowing costs.

This shift could lead to a more integrated financial system where digital currencies coexist with traditional fiat currencies. Increased adoption of stablecoins could result in greater financial inclusion, allowing individuals and businesses to participate in the economy more easily. The convenience and efficiency of stablecoins can empower people, especially those who may not have had access to traditional banking services.

Challenges Ahead

While the potential benefits of stablecoins are compelling, challenges remain. Regulatory frameworks will need to evolve to keep pace with this rapidly changing environment. The government must strike a balance between fostering innovation and ensuring consumer protection. This might involve creating clear guidelines around the use of stablecoins, their backing by U.S. Treasuries, and the responsibilities of issuers.

Moreover, the technology behind stablecoins must be robust enough to handle increased demand while maintaining security. The risk of hacks and fraud remains a significant concern in the cryptocurrency space. As more investments flow into stablecoins, ensuring that these digital assets are secure and trustworthy will be paramount.

Looking Forward

The vision shared by Treasury Secretary Bessent paints an optimistic picture of the future of stablecoins and their role in the economy. A thriving stablecoin ecosystem could lead to lower government borrowing costs and, ultimately, a reduction in the national debt. The relationships between stablecoins, U.S. Treasuries, and the private sector could create a more dynamic economy where the benefits of financial innovation are felt by all.

As we look ahead, the integration of stablecoins into the financial system may reshape how we think about money, investment, and government debt. The journey may not be without its bumps, but the potential rewards make it a fascinating space to watch. Whether you’re a seasoned investor or just curious about the world of cryptocurrencies, understanding the implications of stablecoins is crucial in today’s evolving financial landscape.

For more insights into the evolving world of cryptocurrencies and their impact on the economy, keep an eye on developments in this space, as they are sure to influence the financial landscape for years to come. You can stay updated on this topic and more by following informative sources such as [Watcher.Guru](https://twitter.com/WatcherGuru/status/1935029522153259107?ref_src=twsrc%5Etfw).