BlackRock’s Shocking $266.6M Bitcoin Buy: Are Whales Preparing for war?

Bitcoin investment trends, institutional cryptocurrency adoption, large-scale Bitcoin purchases

—————–

BlackRock’s Massive Bitcoin Investment: A Game Changer for Cryptocurrency

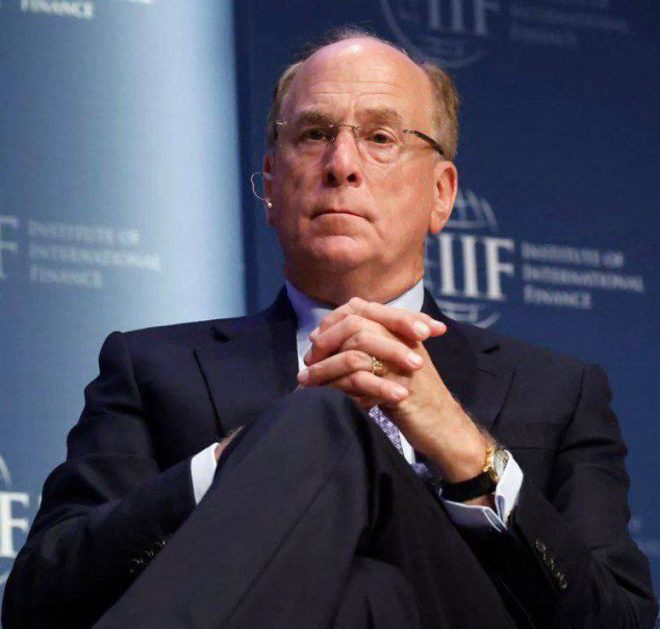

In a significant move that has sent shockwaves through the crypto world, BlackRock, one of the largest asset management firms globally, has acquired an astounding $266.6 million worth of Bitcoin. This monumental purchase highlights the growing acceptance of cryptocurrencies in mainstream finance and signals a bullish trend among institutional investors. This article delves into the implications of BlackRock’s investment, the role of institutional investors in the cryptocurrency market, and what this means for the future of Bitcoin.

The Significance of BlackRock’s Investment

BlackRock’s recent foray into Bitcoin is particularly noteworthy due to the firm’s massive influence in global finance. With assets under management exceeding $9 trillion, BlackRock’s investment strategies can significantly impact market trends. The purchase of such a substantial amount of Bitcoin underscores a growing confidence among institutional investors in the digital asset space.

Institutional Adoption of Cryptocurrencies

The cryptocurrency market has witnessed a paradigm shift over the past few years, with more institutional players entering the arena. Initially viewed with skepticism, cryptocurrencies like Bitcoin are now being recognized as viable investment assets. BlackRock’s bold move is further evidence of this trend. As more large financial institutions allocate portions of their portfolios to digital assets, the legitimacy of cryptocurrencies continues to grow.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Whales Are Loading Up

The term "whales" refers to individuals or entities that hold large quantities of cryptocurrencies. BlackRock’s investment is a clear signal that these whales are loading up on Bitcoin, anticipating future price increases. The term "loading" in this context indicates that these investors are not just making one-time purchases but are strategically accumulating assets in preparation for a potential bull market.

Market Reactions and Implications

Following the announcement of BlackRock’s Bitcoin purchase, the cryptocurrency market experienced a surge in activity. Traders and investors alike reacted to the news, leading to increased trading volumes and price fluctuations. The immediate impact of BlackRock’s investment was evident as Bitcoin prices spiked, attracting attention from both seasoned investors and newcomers to the cryptocurrency landscape.

The Future of Bitcoin and Institutional Investment

As more institutional investors like BlackRock enter the cryptocurrency market, the future of Bitcoin and other digital assets looks promising. Institutional adoption can lead to increased liquidity, reduced volatility, and ultimately, higher prices. The confidence that comes from large-scale investment can also attract retail investors, further bolstering the market.

Conclusion

BlackRock’s $266.6 million investment in Bitcoin marks a pivotal moment in the evolution of cryptocurrency. As the lines between traditional finance and digital assets continue to blur, the significance of institutional involvement cannot be overstated. With whales like BlackRock loading up on Bitcoin, the future of this digital asset appears bright. Investors should keep a close eye on these developments, as the landscape of cryptocurrency is rapidly changing, presenting both challenges and opportunities.

This groundbreaking event not only underscores the growing legitimacy of Bitcoin but also sets the stage for an exciting new chapter in the world of finance. As the cryptocurrency market matures, the influence of institutional investors will likely shape its trajectory, leading to a more robust and stable environment for both institutional and retail investors alike.

BREAKING:

BLACKROCK JUST BOUGHT $266.6M WORTH OF BITCOIN.

WHALES ARE LOADING pic.twitter.com/7cXAMeEzV3

— Ash Crypto (@Ashcryptoreal) June 17, 2025

BREAKING:

It’s time to talk about some major movements in the world of cryptocurrency! Recently, a tweet made waves across social media, announcing that BlackRock, the global investment management giant, has just purchased a whopping $266.6 million worth of Bitcoin. This is no small feat and marks a significant moment in the crypto market. With that kind of investment, it’s clear that the whales are loading up, and the market is buzzing with excitement!

BLACKROCK JUST BOUGHT $266.6M WORTH OF BITCOIN.

For those who might not know, BlackRock is a powerhouse in finance, managing trillions of dollars in assets. Their entry into the Bitcoin space signifies a level of institutional interest that could change the landscape of cryptocurrency forever. Many retail investors and crypto enthusiasts are looking at this move as a validation of Bitcoin’s legitimacy and potential for growth.

The question on everyone’s mind is: what does this mean for the future of Bitcoin and the broader cryptocurrency market? When a major player like BlackRock makes such a significant investment, it often leads to increased confidence from other investors. This can potentially drive up the price of Bitcoin and other cryptocurrencies, as more people start to see them as viable investment options.

WHALES ARE LOADING

Now, let’s dive into what it means for the so-called “whales.” In the crypto world, whales are individuals or entities that hold large amounts of cryptocurrency. Their actions can significantly impact the market, and when they start loading up on assets like Bitcoin, it often indicates that they believe the price is going to rise.

With BlackRock’s recent purchase, other whales may feel encouraged to follow suit. The sentiment in the market could shift towards a bullish trend, which is something that Bitcoin enthusiasts have been hoping for. After all, more institutional investment typically leads to higher prices, as demand outstrips supply.

Why This Matters

What’s the big deal about BlackRock buying Bitcoin? Well, for starters, it’s a signal that traditional finance is starting to embrace digital currencies. This can lead to more regulatory clarity and acceptance, which are crucial for the growth of the crypto market. The more mainstream acceptance Bitcoin gets, the more likely it is to become a stable store of value, similar to gold.

Many analysts believe that BlackRock’s investment could be a precursor to a larger trend where more institutions allocate a portion of their portfolios to cryptocurrencies. This could be seen as a hedge against inflation and economic uncertainty, particularly in times where fiat currencies are under pressure.

The Bigger Picture

Looking at the bigger picture, Bitcoin has had its ups and downs over the years. The volatility has scared off some investors, but moves like BlackRock’s can help stabilize the market. When large institutions show confidence in Bitcoin, it encourages retail investors to jump on board as well, further fueling demand.

Moreover, having established financial institutions like BlackRock in the mix can lead to the development of more financial products centered around Bitcoin, such as ETFs (Exchange-Traded Funds) and other investment vehicles. This would provide more opportunities for investors to gain exposure to Bitcoin without having to directly purchase and manage the cryptocurrency themselves.

Market Reactions

In the immediate aftermath of the announcement, Bitcoin’s price experienced some fluctuations, which is typical in such scenarios. Market participants are often quick to react to news, and BlackRock’s purchase did not go unnoticed. Many traders and investors are now closely monitoring Bitcoin’s price action to see if this will lead to a sustained upward trend.

Social media platforms are also abuzz with discussions about what this could mean for the future. Influencers and analysts are weighing in with their thoughts, and sentiment appears to be leaning towards optimism. After all, if a major player like BlackRock sees value in Bitcoin, it’s likely that others will too.

What’s Next for Bitcoin?

As we look ahead, the big question is: what’s next for Bitcoin? Will BlackRock’s investment lead to a new all-time high, or will the market experience more volatility? Investors are on the edge of their seats, waiting to see how the situation unfolds.

One thing is clear: BlackRock’s move could be just the beginning of a wave of institutional investment in Bitcoin. Other financial giants might follow suit, further solidifying Bitcoin’s position as a legitimate asset class. This could lead to increased demand, higher prices, and a more mature market overall.

How to Get Involved

If you’re looking to get involved in the Bitcoin market, now might be a good time to do your research. Understanding the fundamentals and keeping an eye on market trends will be crucial as this space continues to evolve. Whether you’re a seasoned investor or a newcomer, being informed will help you make better decisions.

Consider exploring different platforms for buying and trading Bitcoin, ensuring they are reputable and secure. It’s also wise to stay updated with news and developments in the crypto world, as these can significantly impact market dynamics.

Final Thoughts

In the ever-evolving landscape of cryptocurrency, BlackRock’s recent $266.6 million investment in Bitcoin is a monumental event that underscores the growing acceptance of digital currencies in traditional finance. As whales load up and institutional interest rises, the potential for Bitcoin to reach new heights increases. Whether you’re a long-term holder or just dipping your toes into the crypto waters, keeping an eye on these developments will be vital. Let’s see where this journey takes us!