BlackRock’s Shocking $266.6M Bitcoin Bet: Are We Witnessing a Financial Revolution?

BlackRock Bitcoin investment, cryptocurrency market trends 2025, institutional investors in Bitcoin

—————–

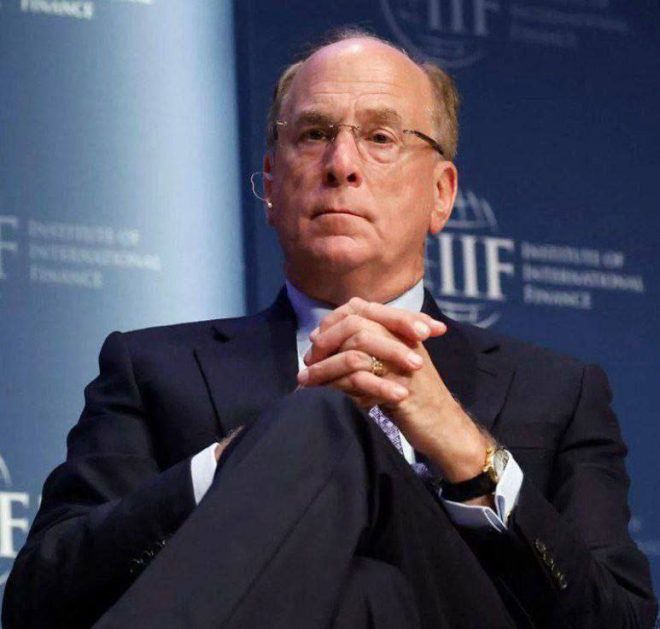

In a significant development for the cryptocurrency market, BlackRock, the world’s largest asset manager, has made headlines by purchasing a staggering $266.6 million worth of Bitcoin. This acquisition not only underscores the growing institutional interest in cryptocurrencies but also serves as a major indicator of market trends and investor confidence. As the cryptocurrency landscape continues to evolve, BlackRock’s move could be a game-changer for Bitcoin and the broader digital asset ecosystem.

### The Context of BlackRock’s Acquisition

BlackRock’s investment comes at a time when Bitcoin is experiencing renewed interest from both retail and institutional investors. The decision to buy such a large amount of Bitcoin reflects a strategic shift towards digital assets, suggesting that major financial institutions are increasingly recognizing the value and potential of cryptocurrencies. This acquisition could also be interpreted as a sign that BlackRock believes in the long-term viability of Bitcoin as an asset class.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### Why Bitcoin?

Bitcoin, often referred to as digital gold, has established itself as a store of value and a hedge against inflation. As traditional markets face uncertainty and economic challenges, many investors are looking to Bitcoin as an alternative investment. BlackRock’s significant purchase could attract further attention from other institutional investors, potentially leading to a surge in demand and price appreciation for Bitcoin.

### The Role of Whales in the Cryptocurrency Market

The term “whales” refers to individuals or entities that hold large amounts of cryptocurrency. When whales, like BlackRock, make significant purchases, it can create ripple effects throughout the market. This kind of buying pressure can lead to increased prices, as retail investors often follow the lead of these large players. The recent announcement of BlackRock’s purchase has already sparked discussions among investors about the potential for Bitcoin to reach new highs.

### Market Reactions

Market reactions to BlackRock’s investment have been overwhelmingly positive. The crypto community is abuzz with excitement, and many analysts believe that this move could signal the beginning of a new bull market for Bitcoin. The positive sentiment is also fueled by the idea that other large financial institutions may follow suit, further legitimizing Bitcoin as an asset class.

### BlackRock’s Influence in the Financial Sector

As one of the largest asset managers globally, BlackRock’s involvement in the cryptocurrency market carries significant weight. The firm manages trillions in assets and has a reputation for being at the forefront of investment trends. By entering the Bitcoin market, BlackRock not only solidifies its position as a leader in the investment space but also encourages other institutions to consider cryptocurrencies as viable investment options.

### The Future of Bitcoin and Institutional Investment

BlackRock’s acquisition of Bitcoin may be a precursor to broader acceptance of cryptocurrencies in traditional finance. As more institutions recognize the merits of digital assets, the landscape of investing could undergo a transformation. The integration of cryptocurrencies into traditional portfolios could lead to increased stability and legitimacy for the market as a whole.

### Conclusion

In conclusion, BlackRock’s purchase of $266.6 million worth of Bitcoin is a significant milestone that underscores the growing interest in cryptocurrencies among institutional investors. This move not only highlights the potential of Bitcoin as an asset class but also sets the stage for future developments in the cryptocurrency market. As the landscape continues to evolve, the implications of BlackRock’s investment may resonate throughout the financial world, encouraging other institutions to explore digital assets and potentially leading to a new era of investment in cryptocurrencies. With the increasing involvement of major players like BlackRock, the future of Bitcoin and the broader cryptocurrency market looks promising, paving the way for more innovations and growth in this dynamic sector.

BREAKING

BLACKROCK JUST BOUGHT $266.6M WORTH OF #BITCOIN.

WHALES ARE LOADING! pic.twitter.com/Zy3co2TY2G

— CryptoJack (@cryptojack) June 17, 2025

BREAKING

So, here we go again—another massive move in the cryptocurrency world! Just recently, news broke that BlackRock, the investment giant, made headlines by purchasing a whopping $266.6 million worth of Bitcoin. If you haven’t been following along, this is a significant development that could shake up the market. With major players like BlackRock diving into Bitcoin, it’s clear that the whales are loading up, and this has everyone buzzing!

BLACKROCK JUST BOUGHT $266.6M WORTH OF #BITCOIN

BlackRock’s recent investment is a clear indication that institutional interest in Bitcoin is not just a passing phase; it’s a growing trend. The firm, known for managing trillions in assets, is sending a powerful signal to investors everywhere that Bitcoin is a legitimate asset worth considering. This isn’t just another purchase; it’s a strategic play that many are interpreting as a bullish sign for the entire crypto market.

WHALES ARE LOADING!

When we talk about whales in the cryptocurrency world, we’re referring to those individuals or entities that hold large amounts of cryptocurrency. The fact that BlackRock is stepping into the arena means that other whales might soon follow suit. This could lead to a surge in Bitcoin prices as demand increases. If you’re a crypto enthusiast, you know that when whales start buying, the market often responds dramatically. The sentiment surrounding Bitcoin is shifting, and more investors may want to get in on the action before it’s too late.

What Does This Mean for Bitcoin?

The implications of BlackRock’s investment in Bitcoin are significant. First off, it validates Bitcoin as a legitimate store of value in the eyes of institutional investors. Many traditional finance experts have been skeptical of cryptocurrencies, but moves like this can change perceptions. With BlackRock backing Bitcoin, it opens the door for other financial institutions to reconsider their stance on digital assets.

Furthermore, this investment could spark a wave of new institutional investments in Bitcoin. If other firms see BlackRock jumping in, they might not want to miss out on the potential gains. This could lead to a more robust market and potentially drive the price of Bitcoin higher.

Understanding BlackRock’s Strategy

So, why would a company like BlackRock invest such a hefty sum into Bitcoin? It’s all about diversification and risk management. With inflation concerns and economic uncertainty, many investors are looking for alternatives to traditional assets. Bitcoin, often dubbed “digital gold,” offers a hedge against inflation and currency devaluation. Companies like BlackRock are always looking for ways to diversify their portfolios, and Bitcoin is becoming an attractive option.

The Growing Trend of Institutional Adoption

BlackRock isn’t the only big name getting involved in the crypto space. Firms like Coinbase and Nasdaq have also made significant strides in integrating cryptocurrencies into their services. As more institutions recognize the potential of blockchain technology and cryptocurrencies, we can expect to see more investments from big players in the market.

What’s Next for Bitcoin?

The future of Bitcoin seems promising, especially with major players like BlackRock entering the scene. The question now is how this will affect the overall market. Will we see a surge in prices? Will more institutional investors jump on board? It’s hard to predict, but one thing is for sure: the landscape of cryptocurrency is changing rapidly.

For individual investors, this might be the perfect time to reassess your portfolio. With institutional interest growing, now could be an excellent opportunity to get involved in Bitcoin if you haven’t already. However, always remember to do your own research and consider the risks involved.

The Impact of Regulatory Changes

As Bitcoin gains traction among institutional investors, regulatory scrutiny is also increasing. Governments worldwide are starting to take a closer look at cryptocurrencies and how they fit into existing financial frameworks. While regulations can be a double-edged sword, they can also provide a level of legitimacy that could further attract institutional investors.

For instance, if regulations ease and provide clearer guidelines for trading and investing in cryptocurrencies, more firms might feel comfortable entering the market. This could lead to increased liquidity and stability in the crypto space, making it a more attractive investment option.

Community Reaction

The community reaction to BlackRock’s investment has been overwhelmingly positive. Crypto enthusiasts and investors alike are excited about the potential growth that could follow. Social media platforms are buzzing with discussions about what this means for the future of Bitcoin and other cryptocurrencies. Many are optimistic, believing that this could be the beginning of a new era for digital assets.

However, it’s important to remain cautious. The cryptocurrency market is notoriously volatile, and while institutional investment can drive prices up, it can also lead to sudden drops. Keeping a close eye on market trends and news is essential for anyone looking to navigate this space successfully.

Conclusion

In summary, BlackRock’s recent purchase of $266.6 million in Bitcoin is a game-changer for the cryptocurrency landscape. It signals growing institutional interest and potentially paves the way for a new wave of investments in digital assets. As whales load up on Bitcoin, the future looks bright for this cryptocurrency. Whether you’re a seasoned investor or just starting, staying informed and engaged with the crypto community is key. The world of Bitcoin is evolving, and you don’t want to miss out on what’s next!

“`