Metaplanet’s Shocking Bitcoin Acquisition: Is This the Future of Crypto?

cryptocurrency investment strategies, Bitcoin market trends 2025, institutional Bitcoin purchases

—————–

Metaplanet’s Strategic Bitcoin Acquisition: A Game-Changer in Cryptocurrency Investment

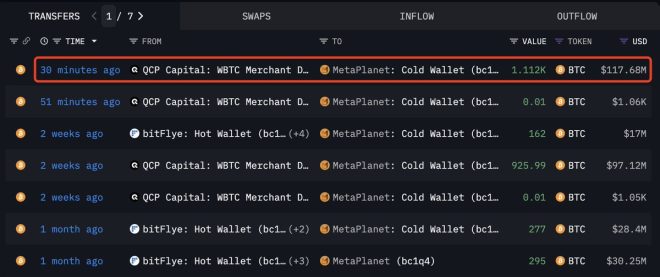

In a significant development in the cryptocurrency world, Metaplanet has made headlines by purchasing 1,112 Bitcoin (BTC) for an impressive total of $116.5 million. This recent acquisition has brought Metaplanet’s total holdings to 10,000 BTC, valued at over $1 billion. As a prominent player in the cryptocurrency market, this move highlights the confidence and strategic foresight of what can be classified as "smart money."

The Influence of Smart Money in the Cryptocurrency Market

The term "smart money" refers to investments made by those with expert knowledge or insights into a particular market. In the context of cryptocurrency, smart money typically involves institutional investors, hedge funds, and sophisticated traders who utilize data analytics and market research to make informed investment decisions. Metaplanet’s acquisition of Bitcoin is a prime example of how these entities are increasingly recognizing the value of Bitcoin as a long-term investment.

Analysis of Metaplanet’s Bitcoin Purchase

The recent purchase of 1,112 BTC by Metaplanet serves as a crucial indicator of the growing trend of institutional adoption of cryptocurrency. As Bitcoin continues to be regarded as a digital gold, investors are increasingly looking to diversify their portfolios with this asset.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Why Bitcoin?

Bitcoin has established itself as the leading cryptocurrency, maintaining a dominant position within the market. Its limited supply capped at 21 million coins, combined with increasing demand, has made it an attractive investment option. Institutional investors like Metaplanet are strategically acquiring Bitcoin to hedge against inflation and economic uncertainty.

Metaplanet’s Focus on Long-Term Gains

Metaplanet’s strategy seems rooted in a long-term vision rather than short-term speculation. By holding 10,000 BTC, the company is placing significant confidence in Bitcoin’s future performance. This aligns with the views of many analysts who believe that Bitcoin’s value will continue to rise as adoption increases and the overall cryptocurrency market matures.

The Broader Implications of Institutional Investment

Metaplanet’s large-scale investment in Bitcoin carries broader implications for the cryptocurrency market and the financial landscape as a whole.

Increased Legitimacy for Cryptocurrencies

As more institutional investors engage with Bitcoin and other cryptocurrencies, the legitimacy of these digital assets grows. This influx of investment not only boosts cryptocurrency prices but also attracts further interest from mainstream finance, leading to more regulatory clarity and acceptance.

Potential Price Impact

Metaplanet’s acquisition of over $116 million worth of Bitcoin is likely to have a considerable impact on the market. Large purchases can create upward pressure on prices, as demand outpaces supply. As more institutions follow suit, we may see continued price appreciation in Bitcoin and other cryptocurrencies.

Market Sentiment and Future Outlook

The sentiment surrounding Bitcoin and the broader cryptocurrency market is currently optimistic. With Metaplanet’s recent purchase, it is clear that institutional investors are not shying away from opportunities in digital assets.

Analysts Predict Continued Growth

Market analysts predict that the trend of institutional investment in Bitcoin will only strengthen in the coming months and years. Factors such as increasing mainstream adoption, technological advancements in blockchain, and growing recognition of the importance of digital assets in a diversified investment portfolio support this outlook.

The Role of Regulatory Developments

As governments and financial institutions worldwide establish clearer regulations surrounding cryptocurrencies, investor confidence will likely increase. Regulatory clarity can lead to more institutional participation, further driving demand for Bitcoin.

Conclusion: The Future of Bitcoin and Institutional Investment

Metaplanet’s recent acquisition of 1,112 BTC is a significant milestone that reinforces the growing trend of institutional investment in cryptocurrencies. As smart money continues to pour into Bitcoin, the market is likely to experience positive sentiment and increased legitimacy.

Investors should closely monitor developments in the cryptocurrency landscape and consider how institutional actions may influence market dynamics. With Metaplanet’s strategic move, the future of Bitcoin looks promising, suggesting that the digital currency will continue to thrive in an evolving financial ecosystem.

In summary, the landscape of cryptocurrency investment is changing, and with influential companies like Metaplanet leading the charge, Bitcoin’s status as a valuable asset class is becoming more entrenched. As institutional investment continues to grow, so too does the potential for Bitcoin to reach new heights, offering opportunities for investors who recognize the significance of this digital asset in a diversifying portfolio.

JUST IN:

Metaplanet bought 1,112 BTC worth $116.5M

They now hold 10,000 BTC worth over $1B

Smart money keeps buying pic.twitter.com/crauiw0qhQ

— Jeremy (@Jeremyybtc) June 16, 2025

JUST IN: Metaplanet Bought 1,112 BTC Worth $116.5M

In the ever-evolving world of cryptocurrency, big moves often create ripples that can be felt far and wide. One such move was made by Metaplanet, which recently acquired 1,112 BTC for a staggering $116.5 million. This significant investment highlights a growing trend among institutional investors who are increasingly viewing Bitcoin as a legitimate asset class.

Metaplanet’s decision to buy such a large amount of Bitcoin is not just a random act; it reflects a broader confidence in the digital currency’s potential. As more and more companies and institutions dive into the crypto market, the question arises: what does this mean for the future of Bitcoin and other cryptocurrencies? How does this shift in purchasing power influence market trends and investor sentiment? Let’s break it down.

They Now Hold 10,000 BTC Worth Over $1B

After this latest purchase, Metaplanet’s total Bitcoin holdings have soared to an impressive 10,000 BTC, now valued at over $1 billion. This kind of accumulation by a single entity is something we haven’t seen in a while and could signal more bullish trends ahead. Holding such a substantial amount of Bitcoin not only positions Metaplanet as a major player in the cryptocurrency game but also sets a precedent for other investors looking to secure their stake in Bitcoin.

But what does this mean for the average investor? Well, it’s a clear indication that institutional interest in Bitcoin is not waning. In fact, it seems to be growing stronger, suggesting that these savvy investors believe in Bitcoin’s long-term potential. So, if you’ve been on the fence about investing in Bitcoin, the actions of Metaplanet and others like it could provide the nudge you need to explore this digital asset further.

Smart Money Keeps Buying

One of the most telling phrases in the recent news is “smart money keeps buying.” This suggests that seasoned investors are not just dabbling in Bitcoin; they are making calculated investments based on extensive research and analysis. The influx of ‘smart money’ into the crypto market could mean a few things. For one, it could lead to increased market stability. As more institutions invest, the volatility that has characterized Bitcoin for years may start to diminish.

Moreover, the confidence shown by institutional investors may attract even more retail investors. When everyday people see big names investing in Bitcoin, it can inspire them to join the fray. This could lead to a positive feedback loop where increased demand pushes prices higher, attracting even more investment.

The Bigger Picture: Bitcoin as a Digital Gold

Many investors see Bitcoin as a form of digital gold—a hedge against inflation and economic instability. As traditional markets face uncertainty, assets like Bitcoin become increasingly attractive. Metaplanet’s significant purchase is a testament to this view. They are not just buying Bitcoin for the sake of it; they are positioning themselves to weather financial storms by holding a decentralized asset that exists outside of traditional financial systems.

Additionally, Bitcoin’s limited supply—capped at 21 million coins—adds to its allure. As demand increases and supply remains fixed, basic economic principles suggest that prices will likely rise, making it a potentially lucrative investment. The actions of Metaplanet reinforce this narrative, showing that smart investors are betting on Bitcoin to appreciate in value over time.

What Lies Ahead for Bitcoin?

The future of Bitcoin remains uncertain, but the actions of Metaplanet and other institutional investors suggest a bullish outlook. With major companies pouring money into Bitcoin, we could be on the brink of a new era for cryptocurrencies. As more players enter the market, regulatory clarity may also improve, further legitimizing Bitcoin as an asset class.

For those considering investing in Bitcoin, now might be an opportune time to educate yourself about the market dynamics. Understanding the factors driving institutional investment can provide valuable insights as you navigate your own investment journey. Resources like CoinDesk and CoinTelegraph can offer a wealth of information to help you make informed decisions.

Conclusion: Embracing the Crypto Revolution

Metaplanet’s recent acquisition of 1,112 BTC is more than just a noteworthy headline; it’s a reflection of the changing landscape of finance. As institutional investors continue to view Bitcoin as a valuable asset, the narrative surrounding cryptocurrencies is evolving. Whether you are a seasoned investor or just starting your crypto journey, keeping an eye on these developments can be crucial. The smart money is clearly making moves, and it might just be time for you to consider your own strategy moving forward.

“`