“Metaplanet’s BTC Surge: 1,112 Coins Bought for 16.88 Billion Yen – Game Changer?”

Metaplanet acquisition strategy, Bitcoin investment trends, cryptocurrency market analysis

—————–

Metaplanet Acquires 1,112 BTC, Reaches 10,000 BTC Holdings

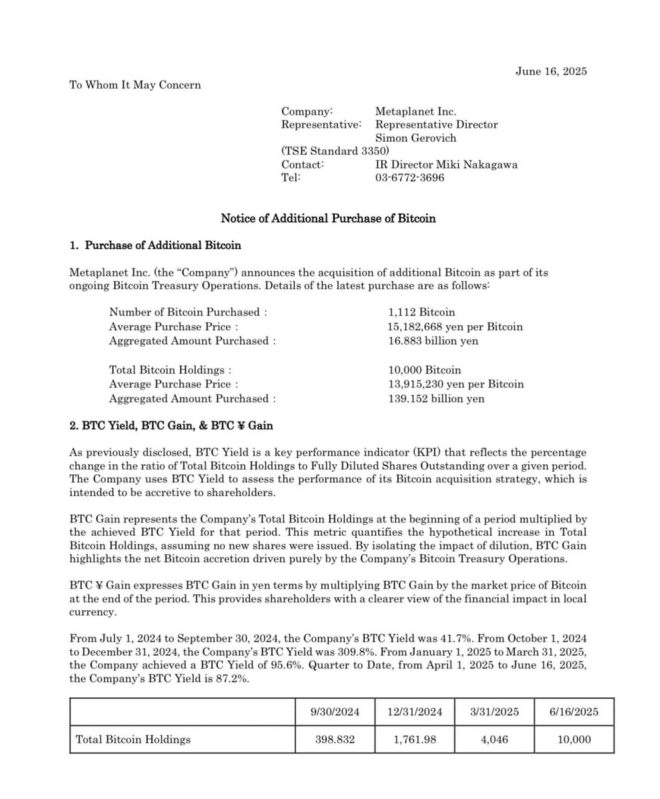

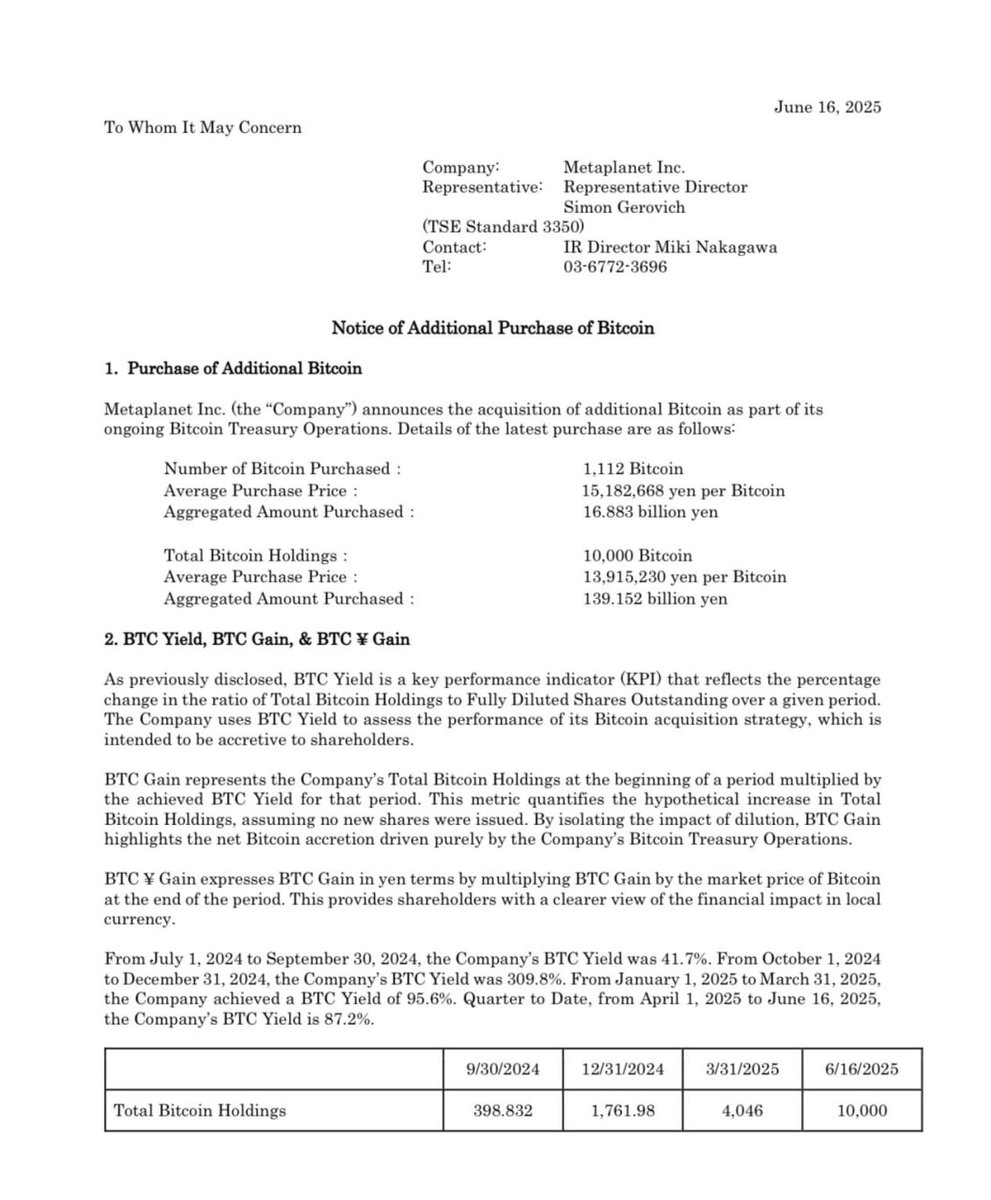

In a significant development within the cryptocurrency landscape, Metaplanet, a prominent player in the Bitcoin investment arena, has announced a major acquisition. The company revealed that it has added 1,112 BTC to its portfolio, bringing its total Bitcoin holdings to an impressive 10,000 BTC. This acquisition, valued at approximately 16.88 billion yen, signals Metaplanet’s strong commitment to Bitcoin as a key asset in its investment strategy.

Metaplanet’s Strategic Move

The decision to acquire 1,112 BTC comes at a pivotal time in the cryptocurrency market. As institutional interest in Bitcoin continues to rise, Metaplanet is positioning itself as a significant player, akin to MicroStrategy, known for its aggressive Bitcoin acquisition strategy. By diversifying its portfolio with such a substantial Bitcoin holding, Metaplanet is signaling confidence in the long-term value proposition of Bitcoin as a digital asset.

The Significance of 10,000 BTC Holdings

Reaching 10,000 BTC is a noteworthy milestone for Metaplanet. This level of holding not only enhances the company’s balance sheet but also reflects a growing trend among institutional investors to embrace Bitcoin as a store of value. With Bitcoin’s reputation as "digital gold" continuing to solidify, companies like Metaplanet are recognizing the potential for significant returns in an increasingly uncertain economic environment.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Comparisons to MicroStrategy

The announcement has drawn comparisons to MicroStrategy, a company that has made headlines for its bold investments in Bitcoin. MicroStrategy’s CEO, Michael Saylor, has been a vocal advocate for Bitcoin, often discussing its merits as a hedge against inflation and a superior asset class. As Metaplanet embarks on a similar path, it will be interesting to observe how their strategies evolve and the impact on the broader cryptocurrency market.

Bitcoin’s Market Dynamics

Bitcoin has experienced significant volatility over the years, yet its overall trajectory has been upward, attracting both retail and institutional investors. The cryptocurrency has become increasingly mainstream, with many seeing it as a hedge against inflation and currency devaluation. As more companies like Metaplanet enter the Bitcoin market, they contribute to its legitimacy and stability, potentially influencing price dynamics.

Future Implications for Metaplanet

As Metaplanet expands its Bitcoin holdings, several implications arise for the company and the cryptocurrency market at large. Firstly, this acquisition may lead to increased scrutiny from regulators as institutional involvement in cryptocurrencies grows. Additionally, Metaplanet’s actions could inspire other companies to follow suit, potentially catalyzing a wave of institutional investment in Bitcoin.

Furthermore, by holding a significant amount of Bitcoin, Metaplanet may benefit from potential price appreciation as demand for Bitcoin continues to rise. Should Bitcoin experience a bull market, the company’s valuation could see a substantial increase, making it a noteworthy player in the investment community.

Conclusion

Metaplanet’s recent acquisition of 1,112 BTC, bringing its total holdings to 10,000 BTC, is a clear indicator of the company’s strategic focus on Bitcoin as a long-term investment. As the cryptocurrency market continues to evolve, Metaplanet’s actions will likely influence other institutional investors and shape the future landscape of Bitcoin investments. With comparisons to MicroStrategy drawing attention, the cryptocurrency community will be watching closely to see how Metaplanet navigates this dynamic environment. The move reinforces the growing acceptance of Bitcoin as a legitimate asset class, paving the way for further institutional participation and potentially higher valuations in the future.

Breaking

Metaplanet BTC holdings have hit 10,000.

Today, it announced the acquisition of 1,112 BTC for 16.88 billion yen.

It seems like another MicroStrategy for BTC is emerging. pic.twitter.com/eBAsJA3VNE

— Cas Abbé (@cas_abbe) June 16, 2025

Breaking

In the ever-evolving world of cryptocurrency, significant announcements can shake the market and capture the attention of investors worldwide. Recently, we witnessed one such event: Metaplanet’s BTC holdings have officially hit a monumental milestone of 10,000 BTC. This news is resonating throughout the crypto community, and for good reason. The implications of this move could be far-reaching, especially as it appears that Metaplanet is positioning itself similarly to MicroStrategy, a company renowned for its bold Bitcoin acquisition strategy.

Metaplanet BTC Holdings Have Hit 10,000

Metaplanet’s latest acquisition of 1,112 BTC for 16.88 billion yen is a game-changer. This substantial purchase not only boosts their holdings but also signals a growing trend among corporations and institutions to embrace Bitcoin as a legitimate asset class. With Bitcoin’s price volatility, this kind of investment can be risky, but the potential for high returns often outweighs the risks for companies like Metaplanet.

For those who may not be familiar, Metaplanet has been making waves in the tech and crypto space, and this latest announcement is a testament to its ambition. By acquiring such a significant amount of Bitcoin, Metaplanet is likely looking to hedge against inflation and diversify its investment portfolio. This strategy mirrors what we saw with MicroStrategy, which has famously accumulated over 100,000 BTC to date.

Today, It Announced the Acquisition of 1,112 BTC for 16.88 Billion Yen

The decision to acquire 1,112 BTC is particularly noteworthy when you consider the current market dynamics. Bitcoin has been experiencing fluctuations, and many investors remain cautious. However, Metaplanet’s confidence in Bitcoin suggests that they believe in its long-term potential. At a valuation of 16.88 billion yen, this acquisition is a bold move that could pave the way for more institutional investments in cryptocurrency.

For those keeping score, this acquisition pushes Metaplanet’s total Bitcoin holdings to 10,000 BTC, further solidifying its position as a major player in the crypto market. This milestone will undoubtedly attract the attention of other corporations looking to invest in Bitcoin, potentially leading to a domino effect in the industry.

It Seems Like Another MicroStrategy for BTC is Emerging

When we talk about Bitcoin accumulation strategies, MicroStrategy is often at the forefront of the conversation. The company has become synonymous with Bitcoin investment, and now it seems Metaplanet is following in its footsteps. This is a crucial development as it highlights a trend where tech companies are not just dabbling in cryptocurrencies but are instead committing significant capital to them.

As we observe this shift, it’s essential to consider the broader implications for the cryptocurrency market. With more companies like Metaplanet stepping up to the plate, we might see increased acceptance and integration of Bitcoin into mainstream business practices. This could lead to more stability in Bitcoin’s price and further legitimize it as a digital asset.

The Implications of Institutional Investment in Bitcoin

So, why does all this matter? Institutional investment in Bitcoin signals a shift in how cryptocurrencies are perceived. For years, Bitcoin was seen as a speculative investment, accessible only to individual investors and traders. However, with institutions like Metaplanet and MicroStrategy making substantial purchases, Bitcoin is being recognized as a legitimate asset class.

This recognition could lead to increased demand for Bitcoin, which may drive its price higher. Additionally, as more companies invest in Bitcoin, it could encourage even more institutional investors to enter the market, creating a cycle of growth and acceptance.

The Future of Bitcoin and Institutional Investment

Looking ahead, the trajectory of Bitcoin and its role in the financial system appears promising. With corporations like Metaplanet leading the charge, we could see a future where Bitcoin is a standard part of corporate treasury management. The question remains: will other companies follow suit?

If they do, the landscape of cryptocurrency could change dramatically. We might witness a scenario where Bitcoin becomes a staple in investment portfolios, similar to traditional assets like stocks and bonds. This would not only increase Bitcoin’s legitimacy but also its stability, as it becomes integrated into the broader financial ecosystem.

What This Means for Investors

For individual investors, Metaplanet’s announcement offers valuable insights. It reinforces the idea that Bitcoin is not just a fad but a serious investment opportunity. However, it’s crucial to approach this market with caution. While institutional investments can drive prices up, they can also create volatility, and it’s essential to do thorough research before diving in.

Investors should consider their risk tolerance and investment strategy when contemplating Bitcoin. The market is notorious for its ups and downs, and while the potential for high returns is enticing, it comes with inherent risks. Keeping an eye on institutional movements like Metaplanet’s can provide valuable context for market trends.

Final Thoughts: The Evolving Bitcoin Landscape

In summary, Metaplanet’s recent acquisition and the news of their BTC holdings hitting 10,000 is a significant development in the cryptocurrency space. As we draw parallels to MicroStrategy’s strategy, it’s clear that institutional investment in Bitcoin is gaining traction. This could pave the way for increased acceptance of Bitcoin, making it a central player in the financial world.

As the crypto market continues to evolve, staying informed about these developments is crucial for anyone interested in investing in Bitcoin. Whether you’re a seasoned investor or just getting started, the landscape is changing, and understanding the implications of institutional moves like Metaplanet’s can help you navigate this exciting yet volatile market.