Metaplanet’s Shocking ¥16.88 Billion Bitcoin Buy: A Game Changer or a Gamble?

Metaplanet investment strategy, cryptocurrency market trends 2025, Japan digital asset regulation

—————–

Metaplanet’s Massive Bitcoin Purchase: A Game-Changer in the Crypto Market

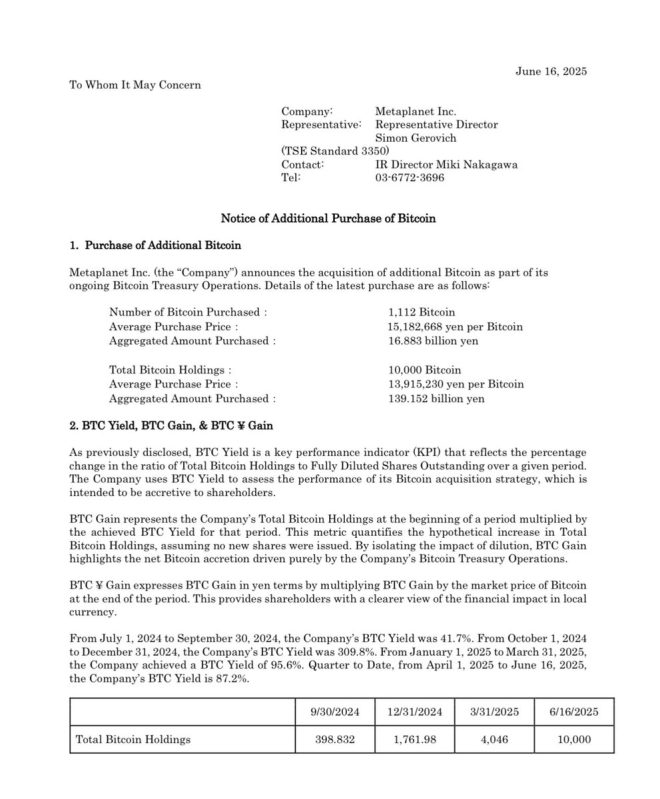

In a significant development for the cryptocurrency landscape, Metaplanet has made headlines by acquiring ¥16.88 billion worth of Bitcoin, as reported by Bitcoin Magazine on June 16, 2025. This bold move not only underscores the increasing institutional interest in Bitcoin but also highlights the growing acceptance of cryptocurrency in mainstream finance. In this summary, we will explore the implications of this purchase, the significance of Bitcoin in the current financial ecosystem, and what it might mean for investors and the market as a whole.

Understanding the Purchase

Metaplanet’s purchase of Bitcoin for ¥16.88 billion (approximately $155 million) marks one of the most substantial acquisitions in recent memory. This transaction comes at a time when Bitcoin continues to solidify its position as a leading digital asset, often referred to as "digital gold." By investing such a significant amount, Metaplanet signals its confidence in Bitcoin’s long-term value and its potential to act as a hedge against inflation and economic uncertainty.

The Growing Interest in Bitcoin

The surge in institutional investment in Bitcoin is not a new trend. Over the past few years, numerous corporations and financial institutions have recognized the benefits of adding Bitcoin to their portfolios. The decentralized nature of Bitcoin, coupled with its limited supply, makes it an attractive option for those looking to diversify their assets. Metaplanet’s acquisition is yet another indicator of this growing trend, as companies seek to capitalize on Bitcoin’s potential for substantial returns.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for the Cryptocurrency Market

Metaplanet’s substantial investment in Bitcoin could have far-reaching implications for the cryptocurrency market:

- Increased Credibility: The involvement of major corporations like Metaplanet lends credibility to Bitcoin and the broader cryptocurrency ecosystem. This could encourage more institutional investors to enter the market, leading to increased liquidity and stability.

- Price Impact: Large purchases of Bitcoin often lead to upward pressure on its price. As more institutions follow suit, the demand for Bitcoin may surpass supply, further driving up its value.

- Market Sentiment: Metaplanet’s acquisition may positively influence market sentiment, instilling confidence among retail investors. A bullish sentiment can lead to increased trading activity and a rise in Bitcoin’s price.

The Role of Bitcoin in Today’s Financial Ecosystem

Bitcoin’s role in the global financial system has evolved significantly since its inception. Initially viewed as a speculative asset, it is now recognized as a legitimate alternative to traditional currencies and investment vehicles. The following points highlight Bitcoin’s current standing:

- Store of Value: Many investors view Bitcoin as a hedge against inflation, especially in times of economic uncertainty. As governments around the world continue to print money, the appeal of Bitcoin as a finite resource becomes increasingly attractive.

- Decentralization: Bitcoin operates on a decentralized network, providing users with a level of autonomy and security that traditional financial systems cannot guarantee. This decentralization has made Bitcoin appealing to individuals seeking financial independence.

- Global Accessibility: Bitcoin can be accessed and transacted globally, transcending geographic and economic boundaries. This accessibility allows individuals in underbanked regions to participate in the global economy.

What This Means for Investors

For investors, Metaplanet’s purchase of Bitcoin serves as a critical indicator of the asset’s long-term viability. Here are some key takeaways for potential investors:

- Informed Decision-Making: Investors should consider the motivations behind institutional purchases. As more corporations invest in Bitcoin, it suggests a growing belief in its future value.

- Diversification: With institutions like Metaplanet entering the market, investors may want to consider diversifying their portfolios to include Bitcoin and other cryptocurrencies. This diversification can help mitigate risk and capitalize on the potential for high returns.

- Market Monitoring: Keeping an eye on large transactions and the activities of institutional investors can provide insights into market trends. Understanding these movements can help individual investors make informed decisions.

Conclusion

Metaplanet’s acquisition of ¥16.88 billion in Bitcoin is a significant milestone in the ongoing evolution of cryptocurrency. This investment not only reflects the growing acceptance of Bitcoin but also signals a shift in how institutional investors view digital assets. As Bitcoin continues to establish itself as a formidable force in the financial landscape, its implications for investors and the market at large will become increasingly pronounced.

For those interested in entering the cryptocurrency market, this development serves as a reminder of Bitcoin’s potential. As more institutions recognize its value, the future of Bitcoin looks promising. Whether you’re a seasoned investor or a newcomer, understanding the dynamics of Bitcoin and its place in the global economy is essential for navigating this complex and rapidly evolving market.

As we move further into the digital age, keep an eye on Bitcoin and similar assets, as they may very well redefine the future of finance.

JUST IN: Metaplanet purchases ¥16.88 billion #Bitcoin pic.twitter.com/EAWOf0tg9F

— Bitcoin Magazine (@BitcoinMagazine) June 16, 2025

JUST IN: Metaplanet purchases ¥16.88 billion Bitcoin

In a significant development in the cryptocurrency world, Metaplanet has made headlines by purchasing a staggering ¥16.88 billion worth of Bitcoin. This bold move reflects the growing interest and adoption of Bitcoin, especially in Japan, a country that has been at the forefront of cryptocurrency acceptance. This acquisition not only showcases Metaplanet’s confidence in Bitcoin but also highlights the increasing institutional interest in digital assets.

What Does This Purchase Mean for Bitcoin?

The purchase of ¥16.88 billion in Bitcoin by Metaplanet signifies a strong vote of confidence in the cryptocurrency’s long-term value. As one of the largest transactions in recent memory, it could potentially influence market trends and investor sentiment. When large entities like Metaplanet invest heavily in Bitcoin, it often leads to a ripple effect, encouraging other investors to consider Bitcoin as a viable asset class.

The implications of such a purchase are profound. With institutions increasingly entering the crypto space, it suggests that Bitcoin is moving beyond just being a speculative asset. It is becoming recognized as a legitimate store of value and a hedge against inflation. For many investors, Bitcoin is seen as “digital gold,” and this purchase reinforces that narrative.

The Japanese Market and Cryptocurrency

Japan has emerged as a key player in the cryptocurrency landscape. The country has a regulatory framework that supports digital currencies, making it a favorable environment for both investors and businesses. The fact that Metaplanet is making such a significant investment in Bitcoin further cements Japan’s position as a leader in the crypto space.

In Japan, the acceptance of Bitcoin is not just limited to trading; it has permeated various sectors, including retail, finance, and even gaming. More businesses are starting to accept Bitcoin as a form of payment, enhancing its utility and driving mainstream adoption.

Metaplanet: A Leader in Innovation

Metaplanet is not just another company in the tech space; it’s a pioneer that aims to push the boundaries of innovation. By investing in Bitcoin, Metaplanet is signaling its commitment to embracing technologies that shape the future. Their move is likely to inspire other companies, particularly in Japan, to explore the potential of cryptocurrencies and blockchain technology.

Moreover, the company’s decision to invest such a significant amount in Bitcoin may also be part of a broader strategy to diversify its assets, reduce risk, and tap into the growing digital economy. Companies that adopt cryptocurrencies often find themselves ahead of the curve, gaining a competitive advantage in increasingly digital markets.

Bitcoin’s Future: What Lies Ahead?

With Metaplanet’s recent purchase, many are pondering the future of Bitcoin and its role in the global economy. The cryptocurrency has faced its share of ups and downs, but its resilience has been remarkable. Analysts predict that Bitcoin could continue to grow, fueled by increased institutional adoption and mainstream acceptance.

As more companies and investors recognize the potential of Bitcoin, we could see further price appreciation and stability in the market. Events like Metaplanet’s acquisition serve to bolster confidence among investors, encouraging them to explore the possibilities of investing in cryptocurrencies.

How to Get Involved with Bitcoin

If you’re intrigued by Bitcoin and want to join the wave of digital currency enthusiasts, there are several ways to get involved. First, you’ll need to understand how Bitcoin works. Learning about blockchain technology, wallets, and exchanges is crucial. Numerous resources are available online to help you navigate the world of cryptocurrency.

Once you’re equipped with the knowledge, you can choose to buy Bitcoin through various cryptocurrency exchanges. Platforms like Coinbase, Binance, and Kraken offer user-friendly interfaces for purchasing Bitcoin and other digital currencies. Make sure to do your research and choose a platform that suits your needs.

Staying Informed: The Importance of news in Crypto

Keeping up with the latest news is essential in the fast-paced world of cryptocurrencies. Events like Metaplanet’s significant purchase can have immediate impacts on the market. Following reliable news sources, such as Bitcoin Magazine, can help you stay informed about important developments that could affect your investments.

Social media platforms, especially Twitter, have become vital for real-time updates and community discussions. Engaging with other crypto enthusiasts can also provide insights and perspectives that enhance your understanding of market trends.

Understanding the Risks of Cryptocurrency Investment

While the potential rewards can be enticing, investing in Bitcoin and other cryptocurrencies comes with its fair share of risks. The market can be highly volatile, and prices can fluctuate dramatically within short periods. It’s essential to approach your investment strategy with caution and do thorough research before diving in.

Consider starting with a small investment and gradually increase your exposure as you gain confidence and understanding of the market. Diversifying your investments can also help mitigate risks. Remember, it’s important to invest only what you can afford to lose.

The Community Behind Bitcoin

One of the most compelling aspects of Bitcoin is its community. Enthusiasts, developers, and investors come together to support the growth and development of the cryptocurrency ecosystem. Engaging with this community can provide valuable support and resources as you navigate your crypto journey.

Participating in forums, attending meetups, or joining online groups can help you connect with like-minded individuals who share your passion for Bitcoin. The collaborative nature of the community fosters innovation and drives adoption, making it an exciting time to be involved in the world of cryptocurrency.

Final Thoughts on Metaplanet’s Bitcoin Purchase

Metaplanet’s recent acquisition of ¥16.88 billion in Bitcoin is more than just a financial transaction; it represents a shift in how businesses view and interact with cryptocurrencies. As the world continues to embrace digital currencies, we can expect to see more significant investments from institutions and companies alike.

Whether you’re an experienced investor or just starting, the rise of Bitcoin presents fascinating opportunities. By staying informed and engaged with the community, you can navigate this dynamic landscape and discover the potential that cryptocurrencies have to offer.

“`