JPMorgan’s Bold Move: Is ‘JPMD’ the Future of Money or a Dangerous Gamble?

JPMorgan cryptocurrency innovation, stablecoin regulatory landscape, digital banking evolution 2025

—————–

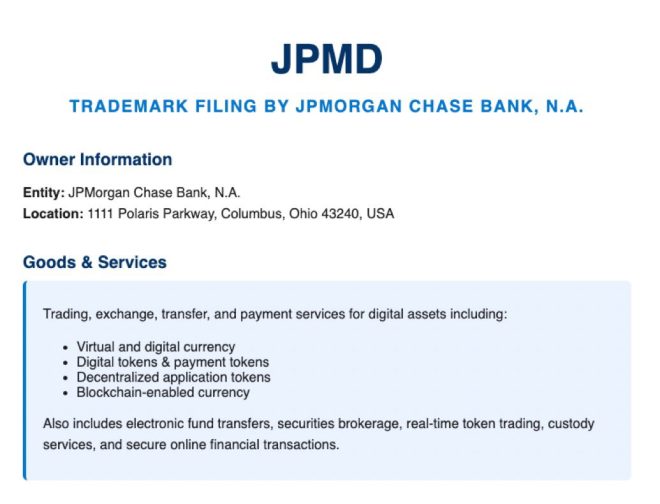

JPMorgan Files Trademark for Stablecoin ‘JPMD’

In a significant move within the financial and cryptocurrency sectors, JPMorgan Chase & Co., the world’s largest bank by assets, has filed a trademark application for a new stablecoin named ‘JPMD.’ This development signals the bank’s deepening engagement with digital currencies and reflects the growing trend among traditional financial institutions to explore blockchain technology and digital assets.

What is a Stablecoin?

Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging them to a reserve of assets, typically fiat currencies like the US dollar. This stability makes them appealing for transactions and as a store of value, particularly in the notoriously volatile crypto market. The introduction of the ‘JPMD’ stablecoin could provide JPMorgan with a competitive advantage in the rapidly evolving digital finance landscape.

The Implications of JPMorgan’s Move

JPMorgan’s filing for the ‘JPMD’ trademark underscores the bank’s recognition of the potential of digital currencies to revolutionize financial transactions. As more consumers and businesses lean toward digital solutions, a stablecoin could facilitate faster and more efficient transactions, both domestically and internationally.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

How ‘JPMD’ Could Work

While details regarding the operational mechanics of ‘JPMD’ remain unclear, it is expected that the stablecoin would be backed by a reserve of assets, ensuring its value remains stable. This aligns with the general principles of stablecoins like Tether (USDT) or USD Coin (USDC), which have gained popularity due to their reliability.

The Growing Interest in Digital Currencies

The interest in digital currencies is not limited to JPMorgan alone. Other major financial institutions and corporations are also exploring the integration of cryptocurrencies into their services. This trend reflects a broader acceptance of digital currencies, driven by consumer demand for faster payment methods, lower transaction fees, and increased transparency.

Potential Benefits of ‘JPMD’

- Speed and Efficiency: Digital transactions with JPMD could be executed almost instantaneously, unlike traditional banking methods that can take several days for cross-border transactions.

- Lower Costs: By utilizing blockchain technology, JPMorgan could reduce transaction costs associated with currency conversion and international money transfers.

- Increased Accessibility: A stablecoin could democratize access to financial services, particularly for those without traditional banking access.

- Enhanced Security: Blockchain technology provides a secure framework for transactions, reducing the risk of fraud and unauthorized access.

Regulatory Considerations

As JPMorgan moves forward with its plans for ‘JPMD,’ it will need to navigate the complex regulatory landscape surrounding cryptocurrencies. Regulatory bodies worldwide are increasingly scrutinizing digital assets, and compliance with these regulations will be crucial for the successful launch and adoption of the stablecoin.

Market Reactions

The announcement of JPMorgan’s trademark filing for ‘JPMD’ has generated considerable interest within the financial markets. Investors and analysts are closely monitoring the situation, as the introduction of a bank-backed stablecoin could have far-reaching implications for the cryptocurrency market and the financial industry as a whole.

The Future of Stablecoins

With the filing of the ‘JPMD’ trademark, JPMorgan is positioning itself at the forefront of the stablecoin movement. As the market for digital currencies continues to grow, the bank’s entry into this space could inspire other financial institutions to follow suit, potentially leading to increased adoption of stablecoins in everyday transactions.

Conclusion

JPMorgan’s filing for the ‘JPMD’ trademark represents a pivotal moment in the intersection of traditional finance and the burgeoning world of cryptocurrencies. As the largest bank in the world embraces digital currencies, it opens new avenues for innovation in payment systems and financial services. The implications of this development could reshape the landscape of both the banking sector and the cryptocurrency market, paving the way for a more integrated financial future.

In summary, JPMorgan’s move to file for a stablecoin trademark is not just a reflection of its forward-thinking approach but also an acknowledgment of the growing importance of digital assets in the modern economy. The coming years will be crucial as the bank and other institutions seek to harness the power of blockchain technology and cryptocurrencies to enhance their offerings and meet the evolving needs of consumers globally.

JUST IN: The world’s largest bank, JPMorgan, has filed a trademark for what appears to be a stablecoin called ‘JPMD’ pic.twitter.com/G0zwoLGOBy

— Jacob King (@JacobKinge) June 16, 2025

JUST IN: The world’s largest bank, JPMorgan, has filed a trademark for what appears to be a stablecoin called ‘JPMD’

In a groundbreaking move for the financial sector, JPMorgan, the world’s largest bank, has filed a trademark for a stablecoin known as ‘JPMD’. This news has sent ripples through both the banking and cryptocurrency communities, raising eyebrows and sparking discussions about the future of digital currencies. So, what does this mean for the world of finance and cryptocurrency? Let’s dive in!

What is a Stablecoin?

Before we get into the specifics of JPMD, let’s clarify what a stablecoin is. Simply put, a stablecoin is a type of cryptocurrency designed to maintain a stable value by being pegged to an underlying asset, usually a fiat currency like the US dollar. This stability makes them attractive for users who want to avoid the volatility often associated with traditional cryptocurrencies like Bitcoin or Ethereum.

Stablecoins are gaining traction as they can facilitate transactions, provide liquidity, and serve as a bridge between fiat and crypto markets. With JPMorgan entering this space, it raises the question: how will JPMD play a role in the evolving landscape of digital currencies?

The Significance of JPMorgan’s Move

JPMorgan’s entry into the stablecoin arena is significant for several reasons. Firstly, being the largest bank in the world, their endorsement of stablecoins could lend legitimacy to the entire sector. Many traditional financial institutions have been hesitant to embrace cryptocurrencies, often citing concerns about regulation, volatility, and security. However, JPMorgan’s pivot might encourage other banks to reconsider their stance.

Moreover, the potential launch of JPMD could streamline payment processes not just for consumers but also for businesses. Imagine a world where transactions can be processed instantly, without the usual delays associated with traditional banking systems. This could enhance liquidity and efficiency in markets, making financial transactions smoother than ever.

The Impact on the Cryptocurrency Market

The announcement of JPMorgan’s trademark filing for the stablecoin JPMD has already stirred the pot in the cryptocurrency market. Investors and enthusiasts are curious about how this will impact existing stablecoins like Tether (USDT) and USD Coin (USDC). Will JPMD be able to carve out its niche, or will it simply add to the competitive landscape?

Additionally, the launch of JPMD could lead to increased regulatory scrutiny. As a major player, JPMorgan will likely attract attention from regulators who want to ensure that the stablecoin operates within legal frameworks. This could set a precedent for how other cryptocurrencies are managed and regulated moving forward.

Potential Use Cases for JPMD

What can we expect from JPMD in terms of real-world applications? The possibilities are vast. One potential use case is in cross-border transactions. Traditional methods for transferring money internationally can be costly and time-consuming. With JPMD, these transactions could become more efficient, allowing for near-instantaneous transfers at lower fees.

Furthermore, JPMD could be utilized within the bank’s existing ecosystem. For instance, it could facilitate payments for investments or loans, providing a seamless experience for customers. Imagine being able to make payments directly from your JPMorgan account using JPMD without the hassle of converting currencies or dealing with lengthy processing times.

JPMD and Financial Inclusion

Another exciting aspect of the potential launch of JPMD is its role in promoting financial inclusion. Many people around the world still lack access to traditional banking services. By leveraging the power of blockchain technology and stablecoins, JPMD could provide an accessible digital financial solution to underserved populations.

For example, individuals in remote areas could use JPMD for transactions without needing a bank account. This opens up opportunities for e-commerce and access to financial services that were previously out of reach. JPMorgan’s commitment to financial inclusion, combined with the capabilities of stablecoins, could play a vital role in reshaping the financial landscape.

Challenges Ahead for JPMD

Despite the potential benefits, JPMD will likely face several challenges as it enters the market. One significant hurdle is regulatory compliance. Given the increasing scrutiny on cryptocurrencies, JPMorgan will need to ensure that JPMD adheres to all relevant laws and regulations. This may involve navigating complex legal frameworks in various jurisdictions.

Additionally, building trust among users will be crucial. While JPMorgan has a strong reputation, the world of cryptocurrency is still viewed with skepticism by many. Educating consumers about the benefits and security of using JPMD will be essential to encourage adoption.

The Future of JPMD and Stablecoins

Looking ahead, the future of JPMD seems promising, but it will require careful planning and execution. As the cryptocurrency landscape continues to evolve, stablecoins will likely play a more significant role in everyday transactions. With JPMorgan’s entry into this space, we might see a shift in how traditional financial institutions approach digital currencies.

Moreover, the success of JPMD could pave the way for other banks to launch their own stablecoins, leading to a more diversified market. As competition increases, consumers could benefit from lower fees, better services, and more choices.

Final Thoughts on JPMorgan’s Stablecoin Initiative

In summary, the recent trademark filing by JPMorgan for a stablecoin called ‘JPMD’ represents a significant milestone in the fusion of traditional banking and cryptocurrency. The implications of this move are vast, from enhancing payment processes to promoting financial inclusion. As JPMorgan navigates the challenges ahead, the financial world will be watching closely to see how this initiative unfolds.

Whether you’re a cryptocurrency enthusiast, a traditional banking supporter, or just someone curious about the future of finance, the emergence of JPMD is certainly something to keep an eye on. With the backing of one of the world’s largest banks, the future of stablecoins looks more promising than ever!