“Metaplanet’s Bold Bitcoin Haul: Is Japan’s ‘Microstrategy’ Shaking Markets?”

Bitcoin accumulation strategies, Japanese cryptocurrency investments, Metaplanet financial milestones

—————–

Metaplanet Acquires Additional Bitcoin: A Milestone Achievement

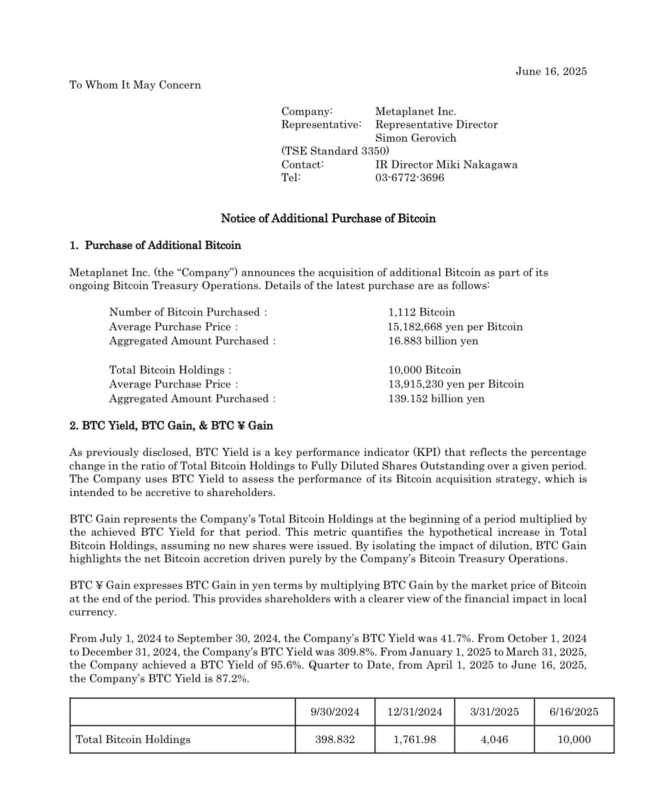

In a significant development in the cryptocurrency market, Metaplanet has just announced the acquisition of an additional 1,112 Bitcoin, solidifying its reputation as the "Microstrategy of Japan." With this latest purchase, Metaplanet has reached a remarkable milestone, accumulating over 10,000 BTC, which is valued at over $1 billion. This acquisition not only underscores Metaplanet’s strategic investment approach but also highlights the growing trend of institutional investment in Bitcoin.

Metaplanet: The Microstrategy of Japan

Metaplanet has emerged as a formidable player in the cryptocurrency landscape, often drawing comparisons to Microstrategy, a prominent business intelligence firm known for its substantial Bitcoin holdings. Founded with the vision of leveraging cutting-edge technology and innovative investment strategies, Metaplanet has successfully established itself as a leader in the digital asset space.

The company’s recent acquisition of Bitcoin has garnered significant attention, as it reflects a broader trend among institutional investors to diversify their portfolios with digital assets. By amassing over 10,000 BTC, Metaplanet not only enhances its balance sheet but also positions itself as a pioneer in the Japanese market for cryptocurrency investments.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Importance of Bitcoin Accumulation

Bitcoin has long been considered a digital gold, serving as a store of value and a hedge against inflation. As global economic uncertainties continue to rise, more companies are recognizing the potential of Bitcoin as an asset class. Metaplanet’s strategic accumulation of Bitcoin is indicative of a larger shift in investment paradigms, where traditional assets are increasingly complemented by cryptocurrencies.

The decision to acquire over 10,000 BTC underscores Metaplanet’s confidence in Bitcoin’s long-term value proposition. By holding a significant amount of Bitcoin, the company not only diversifies its investment portfolio but also positions itself to benefit from potential future price appreciation.

Institutional Investment Trends

The cryptocurrency market has witnessed a surge in institutional interest over the past few years, with companies like Tesla, Square, and Microstrategy leading the charge. Metaplanet’s recent acquisition further cements this trend, showcasing the appetite for digital assets among institutional investors in Japan.

As more companies embrace Bitcoin as a legitimate investment vehicle, the overall market dynamics are changing. Institutional investors bring with them a level of credibility and stability that can positively impact the cryptocurrency market. Their participation can lead to increased liquidity, reduced volatility, and greater acceptance of Bitcoin as a mainstream asset.

The Future of Bitcoin and Cryptocurrency

As Metaplanet continues to accumulate Bitcoin, the future of cryptocurrency investment looks promising. With advancements in technology, regulatory clarity, and growing acceptance among mainstream financial institutions, Bitcoin is poised for continued growth.

Investors are increasingly recognizing the potential of Bitcoin to serve as a hedge against inflation and economic uncertainty. As central banks around the world engage in unprecedented monetary policies, the demand for alternative assets like Bitcoin is likely to rise.

Moreover, the global adoption of cryptocurrencies is gaining momentum. Businesses and consumers alike are beginning to recognize the utility of digital currencies for transactions and investments. As infrastructure improves and regulatory frameworks evolve, Bitcoin may become more accessible to a wider audience.

Conclusion

Metaplanet’s recent acquisition of 1,112 Bitcoin marks a significant milestone in its journey within the cryptocurrency space. By accumulating over 10,000 BTC, the company not only solidifies its position as a key player in the market but also exemplifies the growing trend of institutional investment in digital assets.

As the cryptocurrency landscape continues to evolve, the importance of Bitcoin as a store of value and investment vehicle will likely persist. With the backing of institutions like Metaplanet, Bitcoin is set to gain further legitimacy and acceptance in the financial world.

The future of cryptocurrency investment looks bright, and those who recognize the potential of digital assets stand to benefit in the long run. As Metaplanet paves the way for institutional investment in Japan, it serves as a reminder of the transformative power of Bitcoin and its growing role in the global economy.

JUST IN: Metaplanet just acquired an additional 1,112 Bitcoin!

The “Microstrategy of Japan” has now reached an important milestone having accumulated over 10,000 BTC (over $1bn worth)! pic.twitter.com/erUD8FHekH

— Coin Bureau (@coinbureau) June 16, 2025

JUST IN: Metaplanet just acquired an additional 1,112 Bitcoin!

In a significant move in the cryptocurrency world, Metaplanet has just added another 1,112 Bitcoin to its already impressive portfolio. This acquisition marks a pivotal moment for the company, often dubbed the “Microstrategy of Japan.” With this purchase, Metaplanet has surpassed a remarkable milestone of owning over 10,000 BTC, which is valued at over $1 billion! The implications of this acquisition are huge, not just for Metaplanet but for the entire cryptocurrency market.

The Rise of Metaplanet in the Crypto Space

Metaplanet has quickly made a name for itself in the crypto sector, gaining traction for its aggressive Bitcoin buying strategy. Founded with the vision of leveraging blockchain technology and cryptocurrency, this company has positioned itself as one of the leading players in Japan. The recent acquisition of Bitcoin solidifies its reputation and showcases its commitment to accumulating digital assets in a world where volatility and opportunity coexist.

Understanding Bitcoin Accumulation Strategies

So, why is Metaplanet so keen on stacking up Bitcoin? Accumulating Bitcoin can be a strategic move for many reasons. First, Bitcoin is often viewed as a hedge against inflation and economic instability. By holding a significant amount of BTC, Metaplanet can mitigate risks associated with traditional currency fluctuations. Additionally, Bitcoin has proven to be a valuable long-term investment. Many companies see the potential for exponential growth as more people adopt crypto as a means of transaction.

The “Microstrategy of Japan” Comparison

The label “Microstrategy of Japan” wasn’t handed out lightly. Microstrategy, an American company, has famously made headlines for its massive Bitcoin holdings under the leadership of CEO Michael Saylor. By comparing Metaplanet to Microstrategy, it highlights how the company is taking bold steps to integrate Bitcoin into its financial strategy. This kind of comparison sparks curiosity and draws attention, making Metaplanet a company to watch in the cryptocurrency landscape.

Metaplanet’s Future: What Lies Ahead?

With over 10,000 BTC under its belt, the question on everyone’s minds is: what’s next for Metaplanet? The company’s leadership is likely considering various options for utilizing its Bitcoin reserves. This could range from expanding its operations, investing in new technologies, or even diversifying into other cryptocurrencies. The possibilities are endless, and with the growing acceptance of Bitcoin and other digital currencies, Metaplanet is well-positioned to capitalize on future opportunities.

The Broader Implications for the Cryptocurrency Market

Metaplanet’s recent acquisition could have broader implications for the cryptocurrency market as a whole. As more companies like Metaplanet invest heavily in Bitcoin, it signals to investors and the general public that Bitcoin is not just a passing trend but a legitimate asset class. This increased institutional interest could lead to more stability and growth within the crypto space, enticing even more players to join the game.

How Does This Affect Investors?

For investors, Metaplanet’s aggressive Bitcoin accumulation strategy is both inspiring and potentially concerning. On one side, it acts as a beacon of confidence in Bitcoin’s future, encouraging retail investors to follow suit. On the other hand, it raises questions about market manipulation and the influence of large holders, also known as “whales.” As Metaplanet continues to buy Bitcoin, it could impact market prices, making it essential for individual investors to stay informed and cautious.

The Technology Behind Bitcoin Accumulation

Let’s not forget the technology that enables Bitcoin accumulation. Bitcoin operates on a decentralized ledger called blockchain, which allows for secure transactions without the need for intermediaries. This technology is what makes it possible for companies like Metaplanet to buy, hold, and manage Bitcoin with relative ease. As blockchain technology continues to evolve, it’s likely that we’ll see even more innovative ways for companies to engage with cryptocurrency.

Challenges Faced by Metaplanet

While the future looks bright for Metaplanet, the company, like all others in the crypto space, faces its share of challenges. Regulatory hurdles, market volatility, and technological risks are all factors that could impact its operations. Additionally, as competition heats up in the cryptocurrency sector, Metaplanet must find ways to differentiate itself and maintain its edge over rivals. Successfully navigating these challenges will be crucial for the company’s long-term success.

Metaplanet and Community Engagement

Another aspect that adds to Metaplanet’s growing reputation is its engagement with the cryptocurrency community. By actively participating in discussions, hosting events, and supporting educational initiatives, Metaplanet is not just focusing on profit but is also contributing to the overall growth of the crypto ecosystem. This approach can help build trust and loyalty among investors and customers alike.

Final Thoughts on Metaplanet’s Bold Move

Metaplanet’s recent acquisition of 1,112 Bitcoin is more than just a number; it represents a significant commitment to the future of cryptocurrency. As the “Microstrategy of Japan,” Metaplanet is setting a precedent for other companies in the region and beyond. With its growing Bitcoin reserves, innovative strategies, and engagement with the community, it’s clear that Metaplanet is on a path toward becoming a key player in the ever-evolving cryptocurrency landscape.

This exciting development not only enhances Metaplanet’s portfolio but also adds momentum to the broader acceptance of Bitcoin as a legitimate asset class. The future is looking bright, and as we continue to watch Metaplanet’s journey, one thing is for sure: the cryptocurrency space just got a little more interesting!