“ETH Whales Go All In: Are We on the Brink of a Crypto Revolution?”

Ethereum market surge, whale investment strategies, cryptocurrency trends 2025

—————–

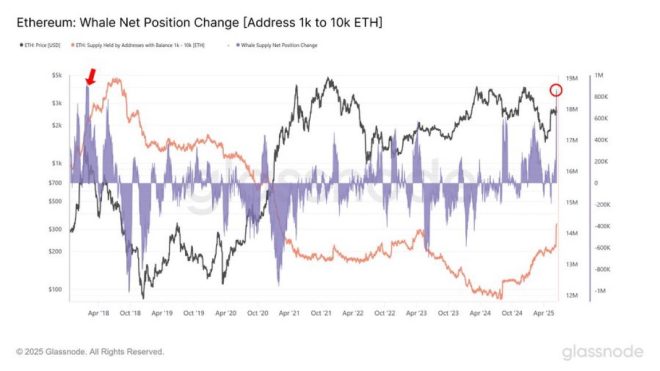

The Surge of Ethereum: Whales Make Historic Buys

In a significant turn of events for the cryptocurrency market, recent reports indicate that Ethereum (ETH) whales have made their largest purchases since 2018. This surge in buying activity has sparked renewed interest and speculation among investors, analysts, and enthusiasts alike. The tweet from CryptoGoos, which highlights this phenomenon, serves as a reminder of the bullish sentiment surrounding Ethereum and the potential implications for the broader crypto market.

Understanding Whale Activity in Cryptocurrency

In the cryptocurrency world, "whales" refer to individuals or entities that hold substantial amounts of a particular cryptocurrency. Their buying or selling actions can significantly influence market prices due to the sheer volume of assets they control. When whales make large purchases, it often signals confidence in the asset’s future performance, prompting other investors to consider entering the market or increasing their holdings.

Historical Context: Why 2018 Matters

The year 2018 is a pivotal point in the cryptocurrency landscape. Following the explosive growth of 2017, the market faced a harsh correction in 2018, leading to a prolonged bear market. During this time, many investors lost faith in cryptocurrencies, and prices plummeted. However, the recent whale activity suggests that some of the most significant players in the market believe that Ethereum is poised for a recovery or even a new bullish rally.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Current Ethereum Landscape

Ethereum has undergone several significant upgrades and developments in recent years, particularly with the transition to Ethereum 2.0. This upgrade aims to address scalability and energy efficiency by moving from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. As the network evolves, many investors are optimistic about Ethereum’s potential to become the backbone of decentralized finance (DeFi) and non-fungible tokens (NFTs).

Implications of Increased Whale Activity

The recent surge in whale purchases could have several implications for the future of Ethereum and the cryptocurrency market as a whole:

1. Market Sentiment Boost

When whales invest heavily in Ethereum, it can create a ripple effect in market sentiment. Other investors, seeing the confidence of large holders, may be prompted to buy ETH, driving the price higher. This bullish momentum can attract more retail investors, further enhancing demand.

2. Price Volatility

While increased buying activity can drive prices up, it can also lead to increased volatility. Whales can manipulate market conditions by selling large amounts of their holdings, leading to sharp price corrections. This dual-edged sword means that while the current buying spree may indicate bullish sentiment, caution is warranted.

3. Long-Term Confidence

The fact that whales are making significant purchases suggests a long-term confidence in Ethereum’s potential. These investors typically conduct thorough research and analysis before making large investments, indicating that they foresee substantial growth in the future.

Why You Should Be Bullish on Ethereum

The tweet from CryptoGoos emphasizes that "YOU’RE NOT BULLISH ENOUGH!" This statement serves as a rallying cry for investors to reconsider their positions on Ethereum. Here are a few reasons why many believe that bullish sentiment is warranted:

1. Technological Advancements

Ethereum’s ongoing upgrades, including the transition to Ethereum 2.0, aim to improve the network’s efficiency and scalability. These advancements make Ethereum a more attractive option for developers and businesses looking to build decentralized applications (dApps).

2. DeFi and NFT Growth

The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has propelled Ethereum into the spotlight. As more projects and platforms are built on Ethereum, the demand for ETH is likely to increase, further driving its value.

3. Institutional Adoption

Institutional interest in cryptocurrencies has been steadily rising. With major financial institutions and corporations investing in Ethereum, the legitimacy and acceptance of ETH as a valuable asset continue to grow.

Conclusion: A Call for Attention

The recent surge in whale purchases of Ethereum is a noteworthy development that merits attention from investors and analysts alike. While the historical context of 2018 serves as a cautionary tale, the current market conditions, technological advancements, and increasing adoption suggest a potential bullish trajectory for Ethereum.

As the crypto landscape evolves, staying informed and adapting to market changes is crucial. The confidence displayed by whales, as highlighted in the tweet from CryptoGoos, signals a potential turning point for Ethereum. Whether you’re a seasoned investor or a newcomer to the space, now may be the time to take a closer look at Ethereum and consider its place in your investment strategy.

Final Thoughts

In the ever-changing world of cryptocurrency, keeping a pulse on market trends is essential. The actions of Ethereum whales serve as a powerful indicator of market sentiment and potential future movements. As you navigate the complexities of the crypto market, remember that the insights gained from whale activity can provide valuable context for your investment decisions. The time to be bullish may indeed be now, as Ethereum continues to capture the attention of the crypto community and beyond.

BREAKING $ETH WHALES MAKE BIGGEST BUYS SINCE 2018

YOU’RE NOT BULLISH ENOUGH! pic.twitter.com/CN8V0WK16K

— CryptoGoos (@crypto_goos) June 16, 2025

BREAKING

In the ever-evolving world of cryptocurrency, few events generate as much excitement as significant movements by large holders, commonly referred to as “whales.” Recently, reports have surfaced indicating that $ETH whales have made the biggest buys since 2018. This news has sent ripples through the crypto community, sparking conversations about what it means for the future of Ethereum and the broader market. If you’ve been following the trends, you might be asking yourself: are you bullish enough?

$ETH WHALES MAKE BIGGEST BUYS SINCE 2018

The term “whales” refers to individuals or entities that hold substantial amounts of cryptocurrency. Their buying and selling behaviors can heavily influence market trends and price movements. The recent whale activity concerning Ethereum has caught the attention of investors, traders, and analysts alike. According to a report by CoinDesk, these transactions mark a significant uptick in confidence among large holders. With Ethereum consistently proving its utility and resilience, many are wondering if this could be a precursor to another bull run.

YOU’RE NOT BULLISH ENOUGH!

As the excitement builds, it’s crucial to analyze what this whale activity means for everyday investors. You might think, “Why should I care about what whales are doing?” Well, the actions of these large holders often indicate future market trends. When whales are buying, it typically suggests they believe the asset will appreciate in value over time. This bullish sentiment can create a positive feedback loop, encouraging smaller investors to jump on board. If you’re not feeling bullish after hearing this news, it might be time to reassess your investment strategy.

The Implications of Whale Activity

Whale transactions are often seen as a barometer for market sentiment. When these large holders make significant purchases, it can signal to the market that they expect prices to rise. As noted on Investing.com, this kind of activity can lead to increased buying pressure, lifting the price of Ethereum and potentially triggering a broader market rally.

However, it’s essential to tread carefully. While whale activity can indicate bullish sentiment, it can also lead to increased volatility. Large sales by these holders can rapidly decrease prices, creating a challenging environment for traders and investors. Understanding the balance of whale activity is key to navigating the crypto market effectively.

The Historical Context

To fully grasp the significance of the current whale activity, let’s take a quick look back at history. In 2018, the crypto market experienced an explosion of interest, with Ethereum reaching new heights. However, it was also a year of significant market corrections. The actions of whales during that time played a crucial role in shaping the market dynamics. Fast forward to today, and we’re seeing a repeat of whale activity that could signal a new chapter for Ethereum.

According to data from The Block, the volume of Ethereum traded by whales has surged, reminiscent of previous bull runs. This suggests that large investors are confident in Ethereum’s potential, and their actions could pave the way for a more bullish market sentiment.

Understanding Ethereum’s Value Proposition

So, what’s driving this renewed interest in Ethereum? The answer lies in its underlying technology and use cases. Ethereum is more than just a cryptocurrency; it’s a decentralized platform that enables smart contracts and decentralized applications (dApps). This functionality has led to the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs), which have exploded in popularity.

As more developers and companies explore the possibilities of Ethereum’s blockchain, the demand for $ETH is likely to increase. This creates a compelling case for why whales are making significant purchases now. They recognize that Ethereum’s potential is far from fully realized, and they’re positioning themselves to capitalize on future growth.

The Role of Market Sentiment

Market sentiment plays a significant role in the crypto landscape. The enthusiasm generated by whale activity can lead to a broader bullish sentiment among retail investors. As more individuals become aware of the significant purchases being made by whales, they may feel compelled to invest, further driving demand for Ethereum.

Social media platforms, particularly Twitter, have become a hotbed for crypto discussions. Many traders and investors turn to platforms like Twitter for real-time updates and insights. The recent tweet by CryptoGoos, highlighting the whale activity, is a perfect example of how social media can influence market perception and investor behavior.

How to Navigate the Market as a Retail Investor

For retail investors, the key takeaway from the recent whale activity is to stay informed and proactive. Here are some tips to consider:

- Stay Updated: Follow reliable sources and market analysts to keep track of whale activity and market trends.

- Diversify Your Portfolio: While Ethereum may be gaining traction, consider diversifying your investments across various cryptocurrencies to mitigate risk.

- Set Realistic Goals: Understand your investment goals and risk tolerance. Set achievable targets and stick to your plan.

- Engage with the Community: Join online forums and communities to share insights and strategies with other investors.

The Future of Ethereum

Looking ahead, the future of Ethereum appears promising. As more whales enter the market, the potential for price appreciation is significant. Ethereum’s transition to a proof-of-stake mechanism, coupled with its growing ecosystem of dApps and DeFi projects, positions it well for sustained growth.

As reported by Forbes, analysts are optimistic about Ethereum’s long-term prospects. The combination of increased whale activity and technological advancements could lead to a bullish market environment, making it an exciting time for both seasoned and new investors.

Final Thoughts

In summary, the recent whale activity in Ethereum is a significant event that shouldn’t be overlooked. It highlights a growing confidence among large holders and could signal an impending bullish trend for the cryptocurrency. As investors, it’s essential to stay informed and adapt to the ever-changing landscape of the crypto market. Whether you’re a seasoned trader or just starting, now is the time to consider your investment strategy in light of these developments. Are you ready to embrace the bullish sentiment?