Coinshares Sparks Controversy with S-1 Filing for $SOL ETF: What’s Next?

Coinshares cryptocurrency investment, Solana exchange-traded fund, blockchain asset management trends

—————–

CoinShares Files S-1 for a $SOL ETF: What You Need to Know

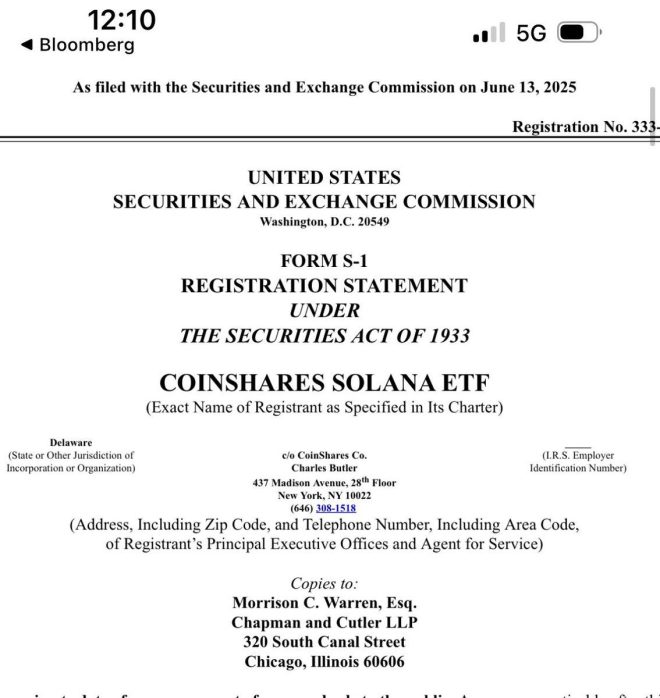

In a significant development in the cryptocurrency investment landscape, CoinShares has officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for a Solana (SOL) Exchange-Traded Fund (ETF). This announcement, made on June 16, 2025, by Cointelegraph, marks a pivotal moment for both Solana and the broader cryptocurrency market, as it signals increasing institutional interest in digital assets.

Understanding CoinShares and Its Role in the Crypto Market

CoinShares is a prominent digital asset investment firm that specializes in providing investment products and services related to cryptocurrencies. Founded in 2014, the firm has been at the forefront of cryptocurrency investments, offering various products such as exchange-traded products (ETPs) and other investment solutions that allow traditional investors to gain exposure to digital currencies.

The filing of an S-1 form is essential for companies looking to launch an ETF in the United States. This document provides the SEC with detailed information about the investment strategy, the underlying assets, and the risks associated with the ETF. In this case, the CoinShares $SOL ETF aims to provide investors with exposure to Solana, an increasingly popular blockchain platform known for its high-speed transactions and scalability.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Why Solana? The Rise of $SOL

Solana has gained considerable attention and popularity in the crypto space due to its unique architecture, which allows for fast transaction speeds and low fees. As the demand for decentralized applications (dApps) and non-fungible tokens (NFTs) continues to grow, Solana’s ability to handle a high volume of transactions efficiently has made it a preferred choice among developers and investors alike.

The $SOL token serves as the native cryptocurrency of the Solana blockchain, playing a crucial role in the network’s operations, including transaction validation and governance. The increasing use cases for Solana, combined with its robust performance, have contributed to its rising market capitalization and prominence in the cryptocurrency market.

The Significance of an ETF for $SOL

The introduction of an ETF focused on $SOL is significant for several reasons:

- Accessibility for Investors: An ETF allows traditional investors to gain exposure to $SOL without needing to navigate the complexities of cryptocurrency wallets and exchanges. This can lead to increased participation from institutional and retail investors alike.

- Legitimacy and Trust: The approval of an ETF by the SEC lends credibility to the underlying asset. It signals that the regulatory body recognizes the asset as compliant with financial regulations, which can instill confidence in potential investors.

- Increased Demand: With the launch of an ETF, there is the potential for a surge in demand for $SOL, as investment firms and funds may allocate capital to the asset. This increased demand could positively impact the price of $SOL.

- Market Maturity: The establishment of ETFs focused on cryptocurrencies indicates a maturing market. It demonstrates that cryptocurrencies are becoming more mainstream, attracting the attention of regulators and institutional investors.

Regulatory Environment and Challenges

While the filing for the $SOL ETF is a positive development, it is essential to recognize the regulatory hurdles that CoinShares and other companies may face in the approval process. The SEC has historically been cautious regarding cryptocurrency ETFs, often citing concerns over market manipulation, investor protection, and the overall stability of the cryptocurrency market.

CoinShares will need to address these concerns in its S-1 filing, providing comprehensive data and analysis on the Solana network and the $SOL token. This includes demonstrating the liquidity of the token, the security measures in place to protect investors, and how the ETF will operate in compliance with existing regulations.

The Future of Cryptocurrency ETFs

The filing of the $SOL ETF is part of a broader trend in the cryptocurrency market, where various companies are actively seeking to launch ETFs for different digital assets. As the SEC continues to evaluate these filings, the future of cryptocurrency ETFs remains uncertain but promising.

If approved, the CoinShares $SOL ETF could pave the way for other cryptocurrencies to follow suit. This could lead to a more extensive array of investment products available to investors, further legitimizing the cryptocurrency market and encouraging broader adoption.

Conclusion

The filing of an S-1 for a $SOL ETF by CoinShares is a significant milestone in the evolution of cryptocurrency investments. It highlights the growing interest in Solana and the potential for increased institutional investment in digital assets. As the regulatory landscape continues to evolve, the future of cryptocurrency ETFs looks increasingly bright, promising greater accessibility and legitimacy for investors looking to diversify their portfolios with digital assets.

Whether you are an experienced investor or just beginning to explore the world of cryptocurrencies, keeping an eye on developments like the CoinShares $SOL ETF filing can provide valuable insights into the future of investment opportunities in this dynamic market.

BREAKING: Coinshares files S-1 for a $SOL ETF. pic.twitter.com/Q9Z698NVwx

— Cointelegraph (@Cointelegraph) June 16, 2025

BREAKING: Coinshares files S-1 for a $SOL ETF

Big news hit the crypto market recently when Coinshares announced that it has filed an S-1 with the SEC for a $SOL ETF. This significant move has sent ripples through the financial community, as it opens the door for institutional investors to gain exposure to Solana, a blockchain known for its high-speed transactions and burgeoning ecosystem. If you’re wondering what this means for you and the broader crypto space, you’re in the right place. Let’s dive into what an ETF is, why Solana matters, and the potential implications of this filing.

Understanding ETFs: What They Are and How They Work

Before we get into the specifics of the Coinshares filing, let’s break down what an ETF (Exchange-Traded Fund) is. An ETF is a type of investment fund that holds a collection of assets, which can include stocks, commodities, or in this case, cryptocurrencies. The beauty of ETFs is that they allow investors to buy shares of a fund that tracks the performance of an underlying asset without needing to own the asset directly.

Investing in an ETF can be a great way to diversify your portfolio while also mitigating risks. For instance, if you think Solana is on the rise but don’t want to deal with the complexities of buying and storing SOL directly, investing in a Solana ETF could provide you with the exposure you seek without the hassle.

Why Solana? The Blockchain That’s Making Waves

So, why is Solana becoming a focal point for ETF filings? Solana is a high-performance blockchain that has gained significant traction for its fast transaction speeds and low fees. With its ability to handle thousands of transactions per second, Solana has attracted a growing number of decentralized applications (dApps) and projects, making it a strong contender in the blockchain space.

Moreover, Solana’s ecosystem has been expanding rapidly, with various DeFi projects, NFTs, and gaming applications leveraging its technology. This growth indicates a robust future, making it an appealing option for institutional and retail investors alike.

The Implications of Coinshares’ S-1 Filing

Coinshares filing an S-1 for a $SOL ETF is a game-changer in many respects. Firstly, it signals a growing acceptance of cryptocurrencies in traditional financial markets. This move could pave the way for other investment firms to follow suit, potentially leading to a flood of new capital into the Solana ecosystem.

Moreover, ETFs can provide a level of legitimacy to the assets they represent. When a reputable company like Coinshares files for an ETF, it serves as an endorsement of Solana’s potential, which may inspire confidence among hesitant investors. This could be a crucial factor in attracting more institutional money into the crypto space.

What Does This Mean for Retail Investors?

For everyday investors, the potential launch of a $SOL ETF could be a golden opportunity. With an ETF, you’d have a straightforward way to invest in Solana without needing to worry about wallets, private keys, or other technical aspects of crypto investing. This ease of access could democratize investing in Solana and bring in a new wave of retail participants.

If you’re already invested in Solana, the ETF could provide an additional layer of security. As ETFs are regulated, they typically come with a level of oversight that can help protect investors. So, for those who are wary of the traditional crypto market’s volatility and risks, an ETF might just be the perfect compromise.

Looking Ahead: The Future of Solana ETFs

The filing is just the beginning. The approval process for ETFs can be lengthy and complex, but if Coinshares’ S-1 is accepted, it could set the stage for a new era of investment in Solana. Imagine the possibilities if more firms start to recognize the potential of Solana and follow in Coinshares’ footsteps.

This could lead to increased liquidity in the Solana market, making it easier for investors to enter and exit positions. Additionally, as more institutional investments flow into Solana, the price could be positively impacted, benefiting existing holders and attracting new buyers.

How to Prepare for the Potential Launch of a $SOL ETF

If you’re excited about the prospect of investing in a $SOL ETF, here are some steps you can take to prepare:

1. **Stay Informed**: Follow updates from Coinshares and other financial news outlets. Understanding the timeline and regulatory hurdles can provide insight into when the ETF might launch.

2. **Evaluate Your Investment Strategy**: Consider how a $SOL ETF fits into your overall investment strategy. Are you looking for long-term growth, or are you more focused on short-term gains?

3. **Diversify Your Portfolio**: While investing in a Solana ETF could be enticing, it’s essential to maintain a diversified portfolio. Don’t put all your eggs in one basket, even if Solana seems like a great opportunity.

4. **Consult a Financial Advisor**: If you’re unsure about how to proceed, seeking advice from a financial advisor can help you make informed decisions that align with your financial goals.

The Broader Impact on the Cryptocurrency Market

The potential approval of a $SOL ETF could have broader implications for the cryptocurrency market as a whole. It could signal an increasing trend of institutional investment in cryptocurrencies, which has been a hot topic over the past few years.

Additionally, it could encourage more companies to consider launching their own ETFs, leading to a more diverse range of investment products for crypto enthusiasts. This diversification can help stabilize the market, making it less susceptible to the extreme volatility we’ve seen in the past.

Final Thoughts

Coinshares filing an S-1 for a $SOL ETF is a significant step forward for both the company and the cryptocurrency market. It opens new avenues for investment and could bring more legitimacy to the space. As Solana continues to grow and evolve, the potential for an ETF could attract a new wave of investors looking to diversify their portfolios.

This filing is not just a win for Coinshares; it’s a win for Solana and the broader crypto ecosystem. Whether you’re a seasoned investor or just dipping your toes into the world of cryptocurrencies, keeping an eye on this development could be crucial for your investment strategy.

Stay tuned for updates as this story unfolds, and prepare yourself for what could be a monumental moment in the world of crypto investing. Whether you’re looking to invest in Solana directly or through an ETF, the future looks bright.