Gold Soars to Unprecedented Heights: What This Means for the Global Economy!

gold market trends, all-time high gold prices, investment opportunities in gold

—————–

Gold has reached a significant milestone, recording its highest daily and weekly close ever. This unprecedented achievement highlights the precious metal’s ongoing appeal as a safe-haven asset amidst fluctuating economic conditions and geopolitical tensions. In this summary, we will explore the factors contributing to this surge in gold prices, the implications for investors, and the broader economic context surrounding this development.

### The Significance of Gold’s Record Close

Gold has long been considered a reliable store of value, particularly during times of uncertainty. Its recent highs indicate not only a strong demand for gold but also reflect broader market sentiments. As investors seek stability, gold serves as an attractive alternative to more volatile assets like stocks and cryptocurrencies. The surge in gold prices suggests that market participants are increasingly worried about inflation, currency devaluation, and global instability.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### Factors Driving Gold Prices Higher

Several key factors have contributed to gold’s record-breaking performance:

#### 1. Economic Uncertainty

Economic indicators have shown signs of volatility, prompting investors to flock to gold as a hedge against potential downturns. Concerns over inflation, rising interest rates, and supply chain disruptions have all played a role in driving gold prices upward. As central banks around the world implement monetary policies to stabilize their economies, gold remains a go-to asset.

#### 2. Geopolitical Tensions

Ongoing geopolitical tensions, including conflicts and diplomatic strains, have further bolstered gold’s appeal. Investors often turn to gold during times of crisis, viewing it as a safe haven that can withstand market fluctuations. This heightened demand amid uncertainty has contributed significantly to the recent price increases.

#### 3. Currency Fluctuations

The value of major currencies, particularly the U.S. dollar, has a direct impact on gold prices. As the dollar weakens, gold becomes more attractive to international buyers, further driving up demand. Recent trends in currency markets have influenced gold’s upward trajectory, making it a favored investment during times of currency instability.

### Implications for Investors

The record close of gold has important implications for investors across various sectors. Understanding these dynamics is crucial for those looking to capitalize on the current market conditions.

#### 1. Diversification Strategies

Investors are increasingly recognizing the importance of diversifying their portfolios to mitigate risk. With gold reaching new heights, many are exploring options to include gold-related assets in their investment strategy. This can range from physical gold purchases to investing in gold ETFs and mining stocks, providing multiple avenues for exposure to the precious metal.

#### 2. Long-Term Outlook

While the current surge in gold prices is noteworthy, investors should also consider the long-term outlook for the commodity. Analysts suggest that as economic challenges persist, gold could maintain its strength. Understanding market trends and economic indicators will be essential for making informed investment decisions in the coming months.

#### 3. Inflation Hedge

Gold has historically been viewed as a hedge against inflation. As inflation rates rise, the value of currency can erode, making gold a more appealing investment. Investors concerned about long-term inflation may find solace in gold, further boosting its value in uncertain economic climates.

### The Broader Economic Context

Gold’s record close does not exist in a vacuum; it is part of a larger economic landscape influenced by various factors.

#### 1. Central Bank Policies

Central banks around the world are adjusting their monetary policies in response to economic challenges. Low interest rates and quantitative easing have driven investors to seek alternative assets, with gold emerging as a preferred choice. Understanding the policies of central banks can provide insights into future gold price movements.

#### 2. Market Sentiment

Investor sentiment plays a crucial role in shaping market trends. As confidence in traditional markets fluctuates, gold’s stability becomes increasingly attractive. Monitoring market sentiment and investor behavior can help anticipate future movements in gold prices.

#### 3. Technological Advances

Technological advancements in mining and production have also influenced gold supply, impacting prices. As mining companies adopt more efficient techniques, the overall supply of gold can increase, potentially affecting its market value. Investors should keep an eye on these developments as they can have significant implications for the gold market.

### Conclusion

Gold’s highest daily and weekly close ever is a testament to its enduring appeal as a safe-haven asset. Driven by economic uncertainty, geopolitical tensions, and currency fluctuations, gold’s remarkable performance underscores its role as a reliable investment choice. For investors, understanding the implications of this milestone is crucial for navigating the evolving market landscape.

As we move forward, the dynamics surrounding gold will continue to evolve. By staying informed about economic indicators, central bank policies, and market sentiment, investors can make strategic decisions that align with their financial goals. Whether viewed as a hedge against inflation or a diversification strategy, gold remains a pivotal asset in uncertain times, and its record-breaking close serves as a reminder of its lasting value in the investment world.

In summary, the recent surge in gold prices reflects broader economic trends and investor sentiment, making it an essential focus for anyone involved in financial markets. As we look to the future, gold’s role as a safe haven and a valuable investment will likely continue to grow, warranting close attention from investors everywhere.

BREAKING

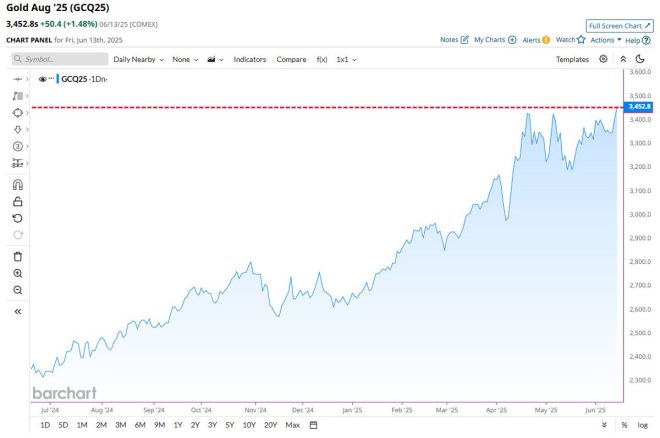

Gold records its highest daily and weekly close ever. https://t.co/gqxJi7oLGD

BREAKING

Gold has officially recorded its highest daily and weekly close ever, marking a pivotal moment in the financial markets. This surge in gold prices is making waves among investors, analysts, and enthusiasts alike. As the world grapples with economic uncertainties, the allure of gold as a safe haven has never been more pronounced. In this article, we’ll delve into the reasons behind this record-breaking surge, its implications for investors, and what it might mean for the future of gold prices.

Gold Records Its Highest Daily and Weekly Close Ever

So, what does it mean when we say that gold has hit its highest daily and weekly close? Essentially, this signifies that the price of gold has reached unprecedented levels in both daily trading and week-long metrics. Investors keep a keen eye on these figures as they reflect market sentiment and economic conditions. The latest records indicate a robust demand for gold, driven by various factors, which we will explore in detail.

Understanding the Surge in Gold Prices

There are several factors contributing to this remarkable rise in gold prices. One of the primary drivers is the ongoing global economic uncertainty. With inflation rates fluctuating and geopolitical tensions escalating, many investors are turning to gold as a hedge against potential downturns. According to a report by Bloomberg, gold has historically been viewed as a safe asset during turbulent times, and this trend continues to hold true today.

Moreover, the recent monetary policies enacted by central banks around the globe have also played a crucial role. Low interest rates and expansive quantitative easing measures make holding gold more attractive compared to traditional interest-bearing assets. As central banks increase their gold reserves, the demand continues to rise, creating upward pressure on prices.

Market Reactions and Investor Sentiment

The announcement of gold reaching its highest daily and weekly close has triggered a flurry of activity in the markets. Investors are optimistic, with many considering adding gold to their portfolios as a form of insurance against economic instability. This sentiment is reflected in the trading volumes and the conversations happening across financial platforms and news outlets.

Social media has also been buzzing with discussions around gold’s price movements. Many analysts and traders are sharing their insights and predictions, which can significantly influence market dynamics. Platforms like Twitter have become a hub for real-time updates and analysis, allowing investors to stay informed and make strategic decisions.

The Implications for Future Gold Prices

As gold continues to soar, what can we expect in the coming months? While it’s challenging to predict future price movements with certainty, several indicators suggest that the demand for gold may remain strong. If inflation persists and economic uncertainties continue, gold could maintain its upward trajectory.

However, it’s essential to approach gold investment with caution. Market corrections can happen, and prices can be volatile. Diversifying your investment portfolio and consulting with financial advisors can help mitigate risks associated with gold investments. Resources like Investopedia provide valuable insights into market trends and investment strategies.

How to Invest in Gold

If you’re considering investing in gold following this record-breaking moment, you have several options. You can buy physical gold in the form of coins or bars, which many investors prefer for its tangibility. Alternatively, you may opt for gold ETFs, which offer exposure to gold prices without the hassle of storing physical assets. Mutual funds and mining stocks are also popular options for those looking to diversify their investments further.

Regardless of the method you choose, it’s crucial to conduct thorough research and understand the associated risks. Websites like Kitco provide real-time gold prices and valuable market insights to help you make informed decisions.

The Historical Context of Gold Prices

To better understand the significance of gold’s recent record highs, let’s take a quick look back at its historical performance. Gold has been a valuable asset for thousands of years, often referred to as a “safe haven” during times of economic distress. Historical events, such as the 2008 financial crisis and the COVID-19 pandemic, have seen spikes in gold prices as investors flock to the commodity.

Gold’s ability to retain value over time makes it an attractive option for long-term investors. In fact, many financial experts recommend allocating a portion of your investment portfolio to gold as a form of diversification. This strategy can help safeguard your assets against market volatility.

Expert Opinions on the Current Gold Market

With gold hitting its highest daily and weekly close ever, it’s no surprise that experts are weighing in on the current market conditions. Analysts from major financial institutions have shared their insights, with many suggesting that gold could continue to rise in response to ongoing economic challenges. According to a recent analysis by GoldSilver, the combination of inflationary pressures and geopolitical tensions may keep gold prices elevated for the foreseeable future.

On the other hand, some analysts caution against overly optimistic predictions, emphasizing the importance of monitoring market trends and news. Keeping abreast of global economic developments is crucial for any investor looking to navigate the gold market successfully.

Gold as Part of a Diversified Investment Strategy

Incorporating gold into your investment strategy can provide a layer of protection against economic downturns. However, it’s essential to balance your portfolio with a mix of asset classes. Stocks, bonds, and other commodities can complement your gold investments, helping you achieve a more resilient financial position.

As you consider your investment options, take the time to educate yourself about the various factors influencing gold prices. Resources like MarketWatch can provide you with up-to-date information and analysis, helping you make informed decisions.

Conclusion

The recent record-breaking surge in gold prices highlights the ongoing appeal of this precious metal as a safe haven asset in uncertain times. With economic challenges on the horizon, many investors are turning to gold for stability and protection. Whether you’re a seasoned investor or a newcomer to the world of gold, understanding the market dynamics and trends can help you make smart investment choices. Stay informed, diversify your portfolio, and keep an eye on the ever-evolving landscape of gold prices.

“`

This article uses HTML headings and incorporates relevant links to provide readers with additional resources, all while maintaining an engaging and conversational tone.