“Unveiled: Secret Tax Returns of Soros’ Foundations Now Online—What’s Inside?”

historical tax records, nonprofit transparency, digital archival research

—————–

Historical Tax Returns of George Soros’ Open Society Foundations Now Digitized

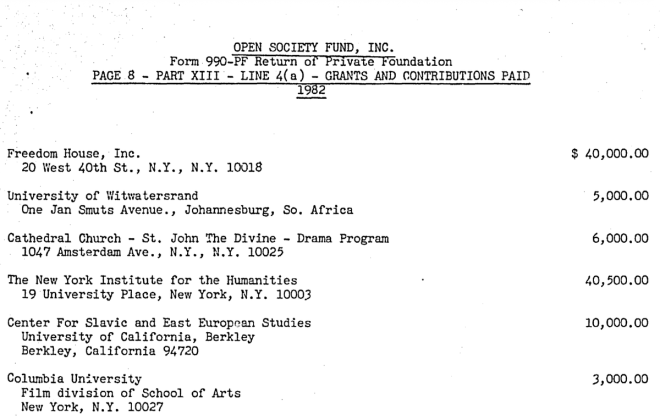

In a groundbreaking announcement, the Indiana University librarian team has successfully scanned and digitized historical 990-PF tax returns for George Soros’ Open Society Foundations (OSF). This initiative marks a significant milestone in making previously inaccessible financial documents available to the public for the first time on the Internet. The digitization of these tax returns provides an unprecedented opportunity for researchers, journalists, and the general public to delve into the financial activities of one of the world’s most influential philanthropic organizations.

The Importance of 990-PF Tax Returns

990-PF tax returns are essential documents that provide insights into the financial activities of private foundations. These forms contain detailed information about a foundation’s income, expenditures, grants, and investments, which can help illuminate the impact and direction of philanthropic efforts. For George Soros’ Open Society Foundations, which have played a pivotal role in supporting various social, political, and economic initiatives worldwide, the availability of these documents is particularly significant.

A First in Digital Access

The announcement made by the Twitter account @DataRepublican highlights the importance of making these historical documents available online. As the first time these tax returns have been digitized and shared publicly, this initiative opens new avenues for transparency and accountability within the realm of philanthropy. Researchers and analysts can now access these records to study the foundation’s funding patterns, strategic priorities, and the overall impact of its contributions to various causes.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Indiana University’s Librarian Team

The digitization project was spearheaded by the dedicated librarians at Indiana University, who have been instrumental in preserving and providing access to historical documents. Their expertise in archiving and digital preservation has enabled the successful scanning of these 990-PF tax returns. This project not only enhances the university’s commitment to open access and transparency but also serves as a model for similar initiatives in the future.

Implications for Research and Public Discourse

The availability of George Soros’ Open Society Foundations’ historical tax returns is likely to have significant implications for research and public discourse. Scholars studying philanthropy, social movements, and political activism will find invaluable resources in these documents. Journalists can leverage this information to inform their reporting on the influence of philanthropy in shaping public policy and societal change.

Furthermore, the digitization of these records fosters a culture of transparency within philanthropic organizations. By making their financial activities accessible, foundations like OSF can build trust with the communities they serve and encourage other organizations to follow suit.

Transparency and Accountability in Philanthropy

The digitization of historical tax returns aligns with a growing demand for transparency and accountability in the philanthropic sector. As public scrutiny of charitable organizations increases, foundations are recognizing the importance of being open about their financial practices and impact. This initiative sets a precedent for other foundations to consider digitizing their records and making them accessible to the public.

Future Prospects for Digital Archives

The successful digitization of George Soros’ Open Society Foundations’ 990-PF tax returns may pave the way for similar projects involving other philanthropic organizations. As technology continues to advance, more historical documents can be scanned and made available online, enriching the public’s understanding of philanthropy and its role in society.

In addition, this initiative underscores the significance of collaboration between academic institutions and philanthropic organizations. By working together, they can ensure that important historical documents are preserved and made accessible to future generations.

Conclusion

The digitization of George Soros’ Open Society Foundations’ historical 990-PF tax returns by Indiana University’s librarian team represents a significant advancement in the transparency and accessibility of philanthropic information. This initiative not only enhances public understanding of the foundation’s financial activities but also serves as a catalyst for ongoing discussions about accountability in philanthropy. As these documents become available online, they will undoubtedly contribute to a richer dialogue about the role of philanthropy in addressing societal challenges and shaping public policy.

This landmark project highlights the importance of making historical documents accessible to the public and sets a precedent for future digital archiving efforts. As more organizations recognize the value of transparency, we can expect to see a shift towards greater openness in the philanthropic sector, ultimately benefiting society as a whole.

Just in! With major thanks to the amazing @IndianaUniv librarian team…

We’ve now scanned never-before-digitized historical 990-PF tax returns of George Soros’ Open Society Foundations.

This is a first. These documents have never been available on the Internet …… pic.twitter.com/QW1c8uD84H

— DataRepublican (small r) (@DataRepublican) June 13, 2025

Just in! Major Announcement from Indiana University

Exciting news has just dropped, thanks to the dedicated librarian team at [Indiana University](https://twitter.com/IndianaUniv)! They’ve achieved something remarkable: the scanning of never-before-digitized historical 990-PF tax returns related to George Soros’ Open Society Foundations. This is groundbreaking because these documents have never been available on the Internet before. Imagine the wealth of information that these tax returns might hold about one of the most influential philanthropic organizations in the world!

The Significance of 990-PF Tax Returns

So, what exactly are 990-PF tax returns? These are forms that private foundations, like the Open Society Foundations, file with the Internal Revenue Service (IRS) in the United States. They provide detailed information on the foundation’s finances, including income, expenses, and grants made to other organizations or individuals. For researchers, journalists, and the public, these documents are vital for understanding how foundations operate and where their money goes.

Having access to these historical documents opens up a treasure trove of information. Scholars and journalists can dive deep into the financial activities of the Open Society Foundations, exploring how they allocate funds and influence various social causes. It’s an invaluable resource for those looking to study the impact of philanthropy on society.

Why George Soros and the Open Society Foundations Matter

George Soros is a name that often comes up in discussions about philanthropy, finance, and politics. The Open Society Foundations, which he founded, aim to promote democracy, human rights, and social justice globally. Soros’s approach to philanthropy is unique; it’s not just about giving money but also about effecting change in societal structures.

Many people have mixed feelings about Soros. He’s hailed as a champion of progressive causes by some, while others criticize his influence in politics and media. Access to these historical tax returns could provide more clarity on the foundations’ spending patterns and priorities, shedding light on Soros’s philanthropic strategies.

Unlocking Historical Data: The Role of Digitization

The digitization of historical documents is crucial in our information-driven world. It democratizes access to knowledge, allowing anyone with an internet connection to explore previously hidden information. Thanks to Indiana University’s librarian team, researchers can now sift through the scanned 990-PF returns and draw insights that were once buried in archives.

Digitization also helps preserve these documents for future generations. Physical copies can degrade over time, but digital files can be archived indefinitely, ensuring that this important information remains accessible.

What Can We Expect from These Documents?

With the release of these tax returns, many questions arise. What specific projects has the Open Society Foundations funded? How have their financial strategies evolved over the years? And what impact have their contributions had on various issues, from education to civil rights?

Researchers are likely to analyze patterns in funding, looking for correlations between financial support and social outcomes. For instance, they might examine how funding in specific areas, such as education reform or immigration rights, aligns with changes in policies or public opinion.

This newfound transparency can also spark discussions about accountability and ethics in philanthropy. As more information becomes available, it’s essential to ask how foundations like Soros’s can be held accountable for their impact on society.

Community Reactions and Implications

The announcement has already generated a buzz on social media. Many are excited about the potential insights these documents could provide, while others are wary of how the information might be used. There’s a fine line between transparency and sensationalism, and it’s crucial for the discourse around these documents to remain grounded in facts.

For journalists, these tax returns could serve as a powerful resource for investigative reporting. With the ability to back up claims with hard data, reporters can paint a more complete picture of the Open Society Foundations’ activities. This could lead to more informed discussions about philanthropy’s role in society, as well as its ethical implications.

How to Access the Scanned Documents

If you’re wondering how you can access these newly scanned 990-PF tax returns, it’s relatively simple. Indiana University is likely to have a dedicated platform or repository where these documents are hosted. You can start by visiting the [Indiana University Libraries](https://libraries.indiana.edu/) website, where they may provide links to the scanned files or further instructions on accessing them.

The beauty of this digitization effort is that anyone interested in exploring these documents can do so, whether you’re a scholar, journalist, or simply a curious individual. The democratization of information is a powerful tool for fostering understanding and promoting accountability.

The Bigger Picture: Philanthropy and Society

The release of these documents invites us to reflect on the broader implications of philanthropy in our society. Foundations like the Open Society Foundations wield significant influence, and understanding their finances can help us grasp their role in shaping social policies and priorities.

Philanthropy is often seen as a force for good, but it’s essential to scrutinize how these funds are used. Are they genuinely addressing the root causes of social issues, or are they merely offering band-aid solutions? This is where access to financial documents becomes critical.

Future Research Opportunities

As researchers dive into the details of these tax returns, we can expect to see a wave of studies and articles exploring the implications of Soros’s philanthropic efforts. This could lead to a more nuanced understanding of the relationship between wealth, power, and social change.

Moreover, the findings could spark conversations about the role of private money in public life. Should wealthy individuals have the power to influence societal change through their donations? Or should we focus on strengthening public institutions to address social issues more effectively?

These questions are not just academic; they resonate with everyday citizens who experience the impacts of philanthropy and government decisions on their lives.

Conclusion: A Step Towards Transparency

The digitization of George Soros’s Open Society Foundations’ historical 990-PF tax returns marks a significant step toward transparency in philanthropy. Thanks to the hard work of the Indiana University librarian team, we now have access to a wealth of information that can enhance our understanding of how philanthropy operates and its contributions to society.

As we delve into these documents, let’s maintain a critical lens and engage in meaningful discussions about the implications of such financial disclosures. The world of philanthropy is complex, and it’s vital that we scrutinize it to ensure it serves the common good. So, buckle up! The journey into these newly available documents promises to be enlightening and thought-provoking.