“SHOCKING: Trump’s Oil Prices Surge Past 97% of Biden’s Tenure—What Gives?”

oil price comparison, Biden economic policies, Trump administration energy costs

—————–

Understanding the Current Oil Prices Under trump and Their Comparison to Biden’s Presidency

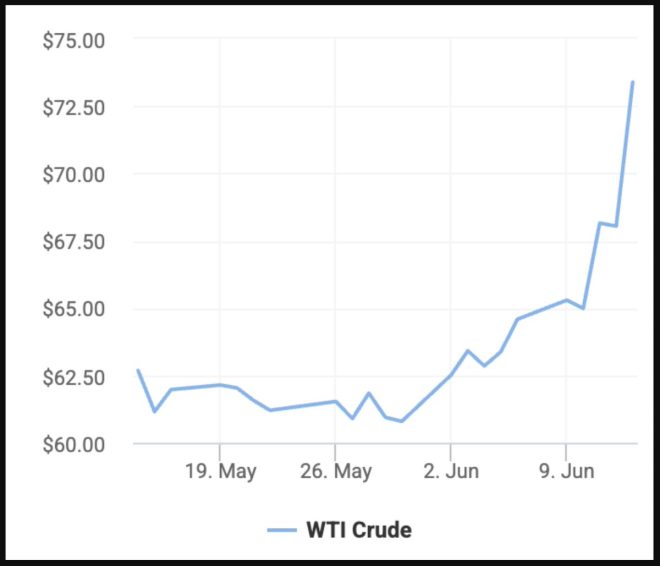

In a recent tweet by Brian Krassenstein, a notable political commentator, a striking observation was made regarding the current oil prices under the Trump administration compared to the Biden administration. This tweet has sparked considerable discussion, especially among political commentators and economic analysts. The core of the tweet highlights that oil prices are currently higher under Trump than they were during 97% of Biden’s presidency. This analysis invites us to explore the dynamics of oil prices, the factors influencing them, and the implications of such fluctuations on the general economy and the political landscape.

The Current Oil Price Landscape

As of mid-June 2025, oil prices have experienced significant fluctuations due to various geopolitical and economic factors. The tweet from Krassenstein illustrates a scenario that many find surprising; the notion that oil prices are higher now than during most of Biden’s presidency raises questions about the effectiveness of current policies and the overall state of the economy. The oil market is notoriously volatile, influenced by supply chain disruptions, OPEC decisions, and international relations, particularly in oil-rich regions.

Oil Prices During Trump’s Presidency

When Donald Trump was president from January 2017 to January 2021, the oil market saw a mix of highs and lows. Early in his term, prices were relatively stable, but they began to fluctuate significantly due to various factors, including his administration’s foreign policies and trade agreements. Trump’s approach to energy independence and deregulation aimed to bolster domestic oil production, which had mixed results on prices.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

However, the tweet suggests that despite the challenges faced during Trump’s presidency, the current oil prices are still higher. This raises questions about the sustainability of oil prices and what economic policies are currently in play.

The Biden Administration and Oil Prices

Biden’s presidency, which began in January 2021, has also been marked by significant challenges in the oil market. The early months of Biden’s administration saw a rise in oil prices, driven by post-pandemic recovery, increased demand, and international supply chain issues. Biden’s focus on renewable energy and a transition away from fossil fuels might have influenced market perceptions, impacting oil investments and prices. However, the assertion that prices were lower during 97% of his presidency compared to current Trump-era prices indicates a complex relationship between political leadership and market dynamics.

Factors Influencing Oil Prices

Several factors contribute to the fluctuations in oil prices, including:

- Geopolitical Tensions: Conflicts in oil-producing regions often lead to supply disruptions, causing prices to surge. The ongoing geopolitical landscape heavily influences market sentiment, impacting prices dramatically.

- Supply and Demand: The basic economic principle of supply and demand plays a significant role in oil pricing. As economies recover post-pandemic, demand for oil has surged, leading to increased prices.

- OPEC Decisions: The Organization of the Petroleum Exporting Countries (OPEC) plays a crucial role in controlling oil production levels to stabilize prices. Their decisions directly impact global oil prices.

- Economic Policies: Government regulations, trade agreements, and environmental policies can either support or hinder oil production, thus affecting prices.

- Market Speculation: Traders in the oil market often speculate on future price movements, which can lead to volatility in the short term.

Implications of Rising Oil Prices

Rising oil prices have far-reaching implications for the economy and everyday consumers:

- Consumer Impact: Higher oil prices lead to increased costs for consumers, impacting transportation, heating, and the overall cost of goods and services.

- Inflation: As oil prices rise, the costs of goods and services increase, contributing to overall inflation rates. This can lead to economic strain on households and businesses alike.

- Energy Policy: Rising prices can influence energy policy decisions, pushing governments to reconsider their approaches to energy independence and sustainability.

- Political Ramifications: Economic issues, especially those affecting everyday consumers, often lead to political consequences. Politicians may face backlash if oil prices are perceived as being influenced by their policies.

Conclusion: The Political and Economic Landscape

The observation made by Krassenstein about current oil prices under Trump raises critical discussions about the interplay between political leadership and economic realities. As oil prices continue to fluctuate, understanding the factors at play is essential for both consumers and policymakers. The comparison between the Trump and Biden administrations illustrates the complexity of oil pricing and the broader implications for economic policy and political strategy.

As we continue to monitor oil prices and their impact on the economy, it’s crucial to remain informed about both the immediate and long-term consequences of these fluctuations. For consumers, businesses, and policymakers alike, understanding the dynamics of the oil market is vital in navigating the challenges and opportunities that arise from changing prices.

In summary, while the tweet highlights a surprising statistic regarding oil prices, it opens up a broader conversation about energy policy, economic stability, and the political landscape. As we move forward, it will be interesting to see how these factors continue to evolve and influence the economy and the lives of citizens across the nation.

BREAKING: Oil Prices right now under Trump are HIGHER than they were under 97% of Biden’s Presidency.

What happened MAGA? pic.twitter.com/xeeGnXg4n7

— Brian Krassenstein (@krassenstein) June 13, 2025

BREAKING: Oil Prices Right Now Under Trump Are HIGHER Than They Were Under 97% of Biden’s Presidency

It’s a headline that certainly grabs attention, right? The tweet by Brian Krassenstein sent shockwaves through social media, and for good reason. The claim that oil prices under Trump are currently higher than they were during 97% of Biden’s presidency raises a lot of questions. How did we get here? What are the factors at play? And what does this mean for the average American? Let’s dive into this topic and explore the dynamics of oil prices, political leadership, and what it all means for you.

Understanding the Oil Price Landscape

Oil prices are influenced by a multitude of factors, including global demand, geopolitical tensions, and domestic production levels. When we talk about oil prices being higher now than under the Biden administration, we need to consider the nuances of the market. For instance, during the early months of Biden’s presidency, oil prices were recovering from a significant drop due to the COVID-19 pandemic. As economies began to reopen, demand surged, leading to fluctuating prices.

However, it’s essential to remember that the prices aren’t solely dictated by the sitting president. They are also influenced by OPEC decisions, climate policies, and even unexpected events like natural disasters or political unrest in oil-producing regions. So, when Krassenstein mentions that oil prices are higher now under Trump, it’s a reflection of a complex system rather than a straightforward comparison.

What Happened MAGA?

This phrase resonates with many on social media, especially within the MAGA community. There’s a palpable frustration when people see rising oil prices, as it impacts everything from gas station bills to the overall cost of living. But what exactly has happened to lead us to this point?

During Trump’s presidency, oil production in the U.S. reached record levels, thanks in part to policies that favored fossil fuels. The push for energy independence saw the U.S. become one of the world’s top oil producers. However, as we transitioned into Biden’s presidency, there was a noticeable shift toward renewable energy and a push for greener policies. While these moves are important for long-term sustainability, they can also create short-term volatility in oil prices.

The question of “What happened MAGA?” opens up a dialogue about the trade-offs between environmental policies and economic outcomes. Supporters of Trump often argue that his administration’s approach led to lower prices, while Biden’s focus on environmental issues has inadvertently driven prices up.

The Impact of Global Events

When analyzing oil prices, you can’t ignore the global context. Events like the Russia-Ukraine war have drastically altered the energy landscape. As sanctions against Russia came into effect, European countries found themselves scrambling for alternative oil sources, pushing prices higher. This is a classic case of how interconnected our global economy is; a conflict in one part of the world can have immediate repercussions on fuel prices here at home.

Additionally, we can look at the impact of COVID-19 as a significant factor. The pandemic led to a dramatic drop in demand for oil, resulting in prices plummeting. As recovery began, the market faced a supply-demand imbalance. The sudden surge in demand caught many producers off guard, leading to higher prices.

Domestic Production and Policy Changes

One of the key elements in the discussion about oil prices is domestic production. Under Trump, the U.S. ramped up oil production to levels never seen before. The administration’s pro-drilling policies allowed for greater exploration and extraction of fossil fuels, which kept prices relatively stable and lower during much of his term.

In contrast, Biden’s presidency has seen a shift toward renewable energies, with policies aimed at reducing fossil fuel dependency. While this is a long-term strategy aimed at combating climate change, it can lead to instability in oil prices as markets adjust. The question many are asking is whether these policies are worth the short-term pain of higher prices.

What This Means for the Average American

So, what does all this mean for you? Higher oil prices translate to increased costs at the pump, which affects everyone. Whether you’re commuting to work, running a business, or planning a road trip, rising fuel costs can put a strain on your budget.

Moreover, higher oil prices have a domino effect on other areas of the economy. Everything from food prices to shipping costs can rise as businesses pass on their increased operational costs to consumers. In essence, when oil prices go up, it can feel like a tax on everyday life.

This reality leads to the crucial question of how voters perceive these changes. Will the rising prices influence opinions on current leadership? How will it affect the political landscape moving forward? These questions are vital as we approach future elections, where economic performance often plays a pivotal role in shaping voter sentiment.

The Road Ahead

Looking ahead, predicting oil prices is an uncertain game. Analysts will tell you that the market can be volatile, influenced by a myriad of factors. While some expect prices to stabilize as global supply chains adjust and production ramps up, others warn of potential spikes due to ongoing geopolitical tensions or natural disasters.

What’s important, however, is that consumers stay informed and adapt. Understanding the reasons behind fluctuating oil prices can help demystify the issue for many. It’s also crucial for citizens to engage in discussions about energy policies and their impacts, both immediate and long-term.

Engaging in the Conversation

As the discourse surrounding oil prices continues to evolve, it’s essential for individuals to engage in conversations, whether online or in person. Social media platforms are buzzing with opinions and analyses that can help shape your understanding of the situation.

For those interested in the economic implications, following reputable news sources and economic analysts can provide insight into what the future may hold. The conversation is not just about politics; it’s about our everyday lives and how we can navigate the complexities of a changing energy landscape.

In summary, the claim that “oil prices right now under Trump are higher than they were under 97% of Biden’s presidency” is a multifaceted topic that merits a closer look. It encapsulates the interplay of policy, global events, and market dynamics. Understanding these factors can empower you to make informed decisions and engage in meaningful discussions around energy policy and its implications for our daily lives.