“Market Shock: $1 Billion Liquidation Sparks Outrage Among Crypto Traders!”

cryptocurrency market crash, margin trading risks, liquidation events analysis

—————–

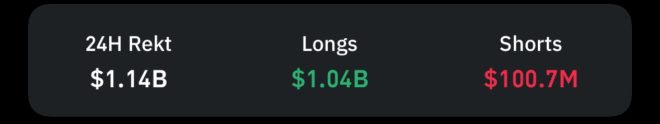

Breaking news: Over $1 Billion in Long Positions Liquidated in 24 Hours

In a dramatic turn of events within the cryptocurrency market, reports indicate that more than $1 billion in long positions were liquidated in just a 24-hour period. This significant liquidation has sent shockwaves throughout the trading community, raising concerns over market stability and investor sentiment. The sudden surge in liquidations highlights the volatile nature of cryptocurrency trading and the potential risks that traders face when engaging in leveraged positions.

Understanding Liquidations in Cryptocurrency Trading

Liquidations occur when a trader’s position is forcibly closed by an exchange due to insufficient margin. This typically happens when the market moves against a trader’s position, and they are unable to meet the required margin to maintain their trade. In the case of long positions, which are bets that the price of an asset will rise, a liquidation can lead to substantial financial losses.

The recent liquidation of over $1 billion in long positions suggests a rapid downturn in cryptocurrency prices, likely triggered by a combination of factors including market sentiment, regulatory news, or macroeconomic influences. Traders who were overly leveraged found themselves unable to sustain their positions, leading to a cascading effect where forced selling contributed further to declining prices.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact of Liquidations on Market Sentiment

The mass liquidation of long positions can create a fear-driven atmosphere among traders. When large amounts of capital are wiped out in a short period, it often leads to panic selling, further exacerbating the price decline. This phenomenon can create a vicious cycle where fear and uncertainty lead to more liquidations, driving prices down even further.

Market sentiment plays a crucial role in the health of the cryptocurrency ecosystem. The recent liquidation event may lead to increased caution among investors, with many re-evaluating their strategies and risk management practices. Additionally, it may deter new investors from entering the market, further impacting liquidity and price stability.

Factors Contributing to the Liquidation Event

Several factors may have contributed to the recent liquidation of over $1 billion in long positions:

- Market Volatility: The cryptocurrency market is known for its extreme volatility. Sudden price fluctuations can trigger liquidations, especially when traders utilize high leverage.

- Regulatory News: Regulatory developments can have profound effects on market sentiment. If traders anticipate negative regulatory actions or announcements, they may rush to close their positions, leading to liquidations.

- Technical Indicators: Traders often rely on technical analysis to make decisions. A breakdown below key support levels can trigger stop-loss orders, resulting in a wave of liquidations.

- Macroeconomic Factors: Broader economic conditions, such as inflation rates, interest rates, or geopolitical events, can impact investor confidence and lead to market sell-offs.

Strategies for Managing Risk in Cryptocurrency Trading

In light of recent events, it is crucial for traders to implement effective risk management strategies. Here are some tips to consider:

1. Limit Leverage: High leverage can amplify both gains and losses. Traders should consider using lower leverage to protect their capital from significant downturns.

2. Set Stop-Loss Orders: Implementing stop-loss orders can help limit losses by automatically selling a position once it reaches a predetermined price.

3. Diversify Investments: Spreading investments across different cryptocurrencies or assets can help mitigate risk and reduce exposure to any single asset’s volatility.

4. Stay Informed: Keeping abreast of market news and developments can help traders make informed decisions and react proactively to potential market changes.

5. Regularly Review Strategies: The cryptocurrency market is constantly evolving. Traders should regularly assess their strategies to ensure they align with current market conditions.

Conclusion: Navigating the Aftermath of Liquidations

The liquidation of over $1 billion in long positions serves as a stark reminder of the risks associated with cryptocurrency trading. As the market continues to grapple with volatility, investors must remain vigilant and adopt prudent risk management practices.

The cryptocurrency ecosystem is inherently unpredictable, and while it offers significant opportunities for profit, it also poses substantial risks. By understanding the factors that contribute to liquidations and implementing effective strategies, traders can better navigate the complexities of the market.

As the situation unfolds, market participants will be watching closely for signs of recovery or further decline. The recent events underscore the importance of resilience and adaptability in the ever-changing landscape of cryptocurrency trading.

BREAKING:

MORE THAN $1 BILLION IN LONG POSITIONS WERE LIQUIDATED IN THE LAST 24 HOURS. pic.twitter.com/FcY2XqIccR

— DustyBC Crypto (@TheDustyBC) June 13, 2025

BREAKING:

MORE THAN $1 BILLION IN LONG POSITIONS WERE LIQUIDATED IN THE LAST 24 HOURS.

When you wake up to the news that more than $1 billion in long positions were liquidated in just 24 hours, it’s hard not to feel a jolt of adrenaline. The cryptocurrency market is notorious for its volatility, but these kinds of numbers can really make your head spin. So, what does this mean for traders, investors, and the wider market? Let’s dive into the details and unpack the implications of this massive liquidation event.

Understanding Liquidation in Crypto Trading

Before we get into the nitty-gritty, let’s clarify what we mean by “liquidation.” In the world of crypto trading, liquidation happens when a trader’s position is automatically closed by the exchange because they can no longer meet the required margin. Essentially, when the market moves against a trader’s bet, and their losses exceed their initial investment, the exchange steps in to protect itself and closes the position. This is particularly common in leveraged trading, where traders borrow funds to increase their exposure.

The Impact of $1 Billion Liquidation

Seeing a figure like $1 billion in liquidated long positions is a stark reminder of just how quickly fortunes can change in the crypto space. For many traders, being on the wrong side of a market move can translate into significant financial loss. This massive liquidation can also trigger a cascading effect, leading to further price declines. As more positions get liquidated, it can create panic selling, driving prices down even further and leading to even more liquidations.

In the aftermath of such an event, traders might feel hesitant to re-enter the market. The fear of facing another dramatic swing can lead to a more cautious approach, impacting overall trading volume and liquidity.

Why Do Liquidations Happen?

Liquidations often occur during periods of high volatility and can be attributed to several factors. One major driver is market sentiment. If traders collectively feel that a significant downward movement is imminent, they might rush to close their positions, leading to a wave of liquidations. This sentiment can be influenced by news events, macroeconomic factors, or even social media trends.

For instance, a negative announcement regarding regulatory actions can lead to a sudden drop in prices, prompting traders to panic. Furthermore, during bull markets, excessive leverage can be a double-edged sword. As traders take on more risk to maximize profits, they can also set themselves up for catastrophic losses if the market turns.

The Role of Margin Trading

Margin trading allows traders to borrow funds to amplify their investment, but it comes with its own set of risks. While it can lead to higher profits, it can also lead to equally higher losses. When the market moves against a trader’s position, they get margin calls, forcing them to either add more funds to their account or risk liquidation.

Many traders underestimate the potential for loss when using leverage, believing that the market will always bounce back. However, as we saw in this case, the reality can be starkly different.

Market Response to Liquidation Events

The market’s reaction to such large-scale liquidations can be unpredictable. In the short term, you might see a sharp decline in prices as traders rush to offload their assets, fearing further drops. However, in the longer term, the market can stabilize as it finds a new equilibrium.

It’s not unusual for prices to rebound after a significant liquidation event, as the excess selling creates opportunities for buyers who see value at lower prices. This kind of rebound can sometimes lead to a “buying frenzy,” where traders jump back in, hoping to capitalize on the dip.

Strategies for Traders During Volatile Times

So, how should you navigate these tumultuous waters? Here are a few strategies to consider:

1. **Manage Risk**: Always use stop-loss orders to protect your investments. This way, you can limit potential losses and avoid being liquidated.

2. **Avoid Over-Leverage**: While it might be tempting to amplify your position, be cautious with leverage. A smaller, more manageable position can often lead to better long-term results.

3. **Stay Informed**: Keep an eye on market trends and news. Understanding what’s driving the market can help you make more informed decisions.

4. **Diversify Your Portfolio**: Don’t put all your eggs in one basket. Spreading your investments across different assets can help mitigate risk.

5. **Take a Break**: If the market is too volatile, consider stepping back for a bit. Sometimes, the best move is to sit on the sidelines until the storm passes.

Lessons Learned from Liquidation Events

Every liquidation event serves as a learning opportunity, not just for individual traders but for the entire market. Understanding the dynamics of liquidations helps traders better prepare for future volatility.

It’s crucial to recognize that markets are driven by human emotions—fear, greed, hope, and uncertainty. By maintaining a level-headed approach and sticking to your trading strategy, you can navigate through these challenging situations more effectively.

Looking Ahead: What Comes Next?

After a significant liquidation event, many traders wonder what’s next for the market. Will prices continue to tumble, or will there be a recovery? The truth is that predicting market movements is never straightforward, especially in the fast-paced world of cryptocurrencies.

Keep an eye on the broader market trends, regulatory developments, and technological advancements within the crypto space. These factors can all influence how the market reacts in the aftermath of such events.

Additionally, community sentiment plays a huge role. If traders feel confident and optimistic about future prospects, they may be more likely to re-enter the market sooner rather than later.

Conclusion

In summary, witnessing over $1 billion in long positions liquidated within 24 hours is a significant event that highlights the risks inherent in crypto trading. Understanding the mechanics of liquidation, the impact of leverage, and the importance of risk management can empower traders to make more informed decisions moving forward.

Whether you’re a seasoned trader or just starting, staying educated and adaptable in the face of market volatility is essential for long-term success. The crypto landscape is ever-changing, and those who can navigate its ups and downs will continue to thrive.

For ongoing updates and insights into the crypto market, make sure to follow reputable sources like [DustyBC Crypto](https://twitter.com/TheDustyBC/status/1933422837500387548?ref_src=twsrc%5Etfw).