BlackRock’s Bold Move: $282M Bitcoin Bet Ignites Market Controversy!

Bitcoin investment strategies, cryptocurrency market trends, institutional asset allocation 2025

—————–

BlackRock’s Major Bitcoin Acquisition: A Game-Changer for Cryptocurrency

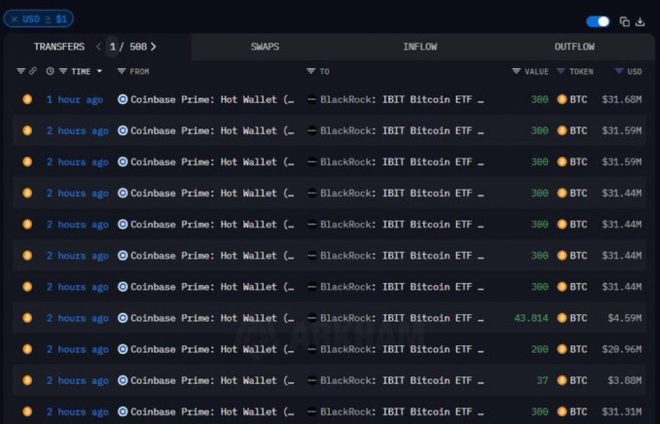

In a significant move that has sent ripples through the cryptocurrency market, investment giant BlackRock has reportedly acquired 2,680 Bitcoin (BTC) valued at approximately $282.9 million. This strategic buying decision, made in June 2025, is seen as a clear indication of BlackRock’s confidence in Bitcoin’s long-term potential, especially during a market dip. This summary delves into the implications of BlackRock’s investment, the current market landscape, and what this means for both institutional and retail investors.

The Basics of BlackRock’s Investment

BlackRock, known for managing assets worth trillions, has been gradually increasing its interest in the cryptocurrency space. The recent acquisition of 2,680 BTC marks a pivotal moment, showcasing the company’s proactive approach to capitalize on market fluctuations. This purchase highlights BlackRock’s strategy to "buy the dip," a common practice among savvy investors who seek to take advantage of lower prices during market corrections.

Why BlackRock is Buying Bitcoin

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Institutional Confidence in Bitcoin

The decision by BlackRock to invest heavily in Bitcoin is an endorsement of the cryptocurrency’s resilience and potential for future growth. Institutional investors have increasingly recognized Bitcoin as a legitimate asset class, often likening it to digital gold. BlackRock’s confidence could signal to other investment firms that now is an opportune time to enter the Bitcoin market, potentially leading to further institutional adoption.

Diversification of Investment Portfolio

BlackRock’s purchase is also a strategic move for diversification. By allocating funds to Bitcoin, the firm aims to hedge against inflation and market volatility. As traditional markets face uncertainties, Bitcoin’s decentralized nature and limited supply make it an attractive alternative for institutional investors seeking stability and growth.

The Current state of the Cryptocurrency Market

The cryptocurrency market has experienced significant volatility in recent years. Following a period of rapid growth, many digital assets, including Bitcoin, faced substantial corrections. However, BlackRock’s investment comes at a time when the overall sentiment in the market is recovering. Increased institutional interest, regulatory developments, and technological advancements are contributing to a more robust environment for cryptocurrencies.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is influenced by various factors, including supply and demand dynamics, macroeconomic trends, and geopolitical events. The recent dip in Bitcoin’s price may have presented an attractive buying opportunity for BlackRock and other institutional investors. The firm’s large purchase could also act as a stabilizing force, potentially mitigating further price declines.

Implications for Retail Investors

Increased Market Confidence

BlackRock’s significant investment in Bitcoin is expected to enhance market confidence among retail investors. When major financial institutions show faith in an asset, it often encourages individual investors to follow suit. This influx of capital from both institutional and retail investors could lead to a more stable and bullish market trajectory for Bitcoin.

Potential for Price Appreciation

As institutional adoption continues to grow, the demand for Bitcoin may increase, leading to potential price appreciation. Retail investors who recognize this trend may find themselves in a favorable position as the market evolves. However, it’s essential for investors to conduct thorough research and consider their risk tolerance before making investment decisions.

The Future of Bitcoin and Institutional Investment

Growing Acceptance of Cryptocurrencies

The landscape of cryptocurrencies is rapidly changing, with more institutions recognizing the value of digital assets. BlackRock’s acquisition of Bitcoin could pave the way for other financial institutions to enter the market, further legitimizing cryptocurrencies as a viable asset class.

Regulatory Developments

As institutional interest in Bitcoin grows, regulatory scrutiny is also expected to increase. Regulatory clarity can play a crucial role in shaping the future of cryptocurrency investments. BlackRock’s involvement may encourage regulators to establish more defined guidelines, fostering a healthier environment for both institutional and retail investors.

Conclusion

BlackRock’s recent purchase of 2,680 Bitcoin for $282.9 million marks a significant milestone in the evolving landscape of cryptocurrency investment. By demonstrating confidence in Bitcoin during a market dip, BlackRock is not only reinforcing its status as a leader in the investment world but also encouraging other institutions and retail investors to consider the potential of digital assets.

As the market continues to recover and grow, BlackRock’s strategic move may herald a new era of institutional involvement in cryptocurrencies. This development underscores the importance of staying informed and understanding the dynamics of the cryptocurrency market, particularly as it becomes increasingly intertwined with traditional finance. Investors should remain vigilant, recognizing both the opportunities and risks associated with Bitcoin and other digital assets in the years to come.

In summary, BlackRock’s acquisition of Bitcoin is a noteworthy event that highlights the growing acceptance of cryptocurrencies in mainstream finance. As institutional interest grows, the future of Bitcoin looks promising, and investors should keep a close eye on market trends and developments in the crypto space.

BREAKING:

BLACKROCK JUST BOUGHT 2,680 BTC WORTH $282.9 MILLION.

THEY’RE BUYING THE DIP! pic.twitter.com/c3EauyiOAs

— Crypto Rover (@rovercrc) June 13, 2025

BREAKING:

When it comes to the world of cryptocurrency, few names command as much attention as BlackRock. Recently, they made headlines by purchasing an impressive 2,680 BTC, worth approximately $282.9 million. This bold move has sent ripples through the crypto community and raised eyebrows among investors and analysts alike. But what does this mean for the broader crypto market? Let’s dive into the details and implications of this significant acquisition.

BLACKROCK JUST BOUGHT 2,680 BTC WORTH $282.9 MILLION.

BlackRock, the world’s largest asset manager, has a history of making strategic investments that often set market trends. Their recent acquisition of Bitcoin is no exception. By buying 2,680 BTC, BlackRock is signaling its confidence in the future of cryptocurrency, particularly Bitcoin, which has been a rollercoaster ride in terms of price volatility. This purchase comes at a time when many investors are looking for signs of stability in the crypto markets, especially with prices fluctuating dramatically.

THEY’RE BUYING THE DIP!

The phrase “buying the dip” is often thrown around in investing circles, and it seems BlackRock is taking this strategy to heart. With Bitcoin’s price experiencing dips, savvy investors recognize these moments as opportunities. BlackRock’s purchase indicates that they believe the current price of Bitcoin is undervalued and poised for a rebound. This not only reflects their faith in Bitcoin’s long-term potential but also potentially sets a precedent for other institutional investors to consider similar moves.

The Impact of BlackRock’s Purchase on Bitcoin

BlackRock’s significant investment could have several implications for Bitcoin and the broader cryptocurrency market. First and foremost, their entry into the Bitcoin space could lead to increased legitimacy for cryptocurrencies as a whole. As a trusted name in finance, BlackRock’s involvement may inspire confidence among more traditional investors who have been hesitant to dive into the crypto waters.

Furthermore, this purchase may also lead to increased demand for Bitcoin. When institutional players like BlackRock enter the market, they often bring substantial capital, which can drive prices higher. As more companies follow suit, we could see a surge in Bitcoin’s price, benefiting those who invested early or during dips.

Understanding Bitcoin’s Volatility

Bitcoin’s price has always been a topic of discussion, often characterized by extreme volatility. This pattern can be intimidating for new investors but also presents opportunities for seasoned traders. BlackRock’s move to buy Bitcoin during a dip suggests a calculated risk on their part; they see potential for significant returns as the market stabilizes. Understanding this volatility is crucial for any investor considering entering the crypto space.

What Does This Mean for Retail Investors?

For retail investors, BlackRock’s purchase could serve as a powerful signal. Many might wonder if they should follow suit and invest in Bitcoin. While it’s tempting to mimic the moves of institutional giants, it’s essential for individual investors to conduct their own research and understand their risk tolerance. Investing in Bitcoin and other cryptocurrencies can be rewarding, but it also carries inherent risks.

Retail investors should consider diversifying their portfolios, investing only what they can afford to lose, and keeping an eye on market trends and developments. Following news about large purchases, like BlackRock’s, can provide insights into market sentiment and potential future movements.

BlackRock’s Strategy: A Long-Term Vision

It’s crucial to recognize that BlackRock’s investment strategy is often long-term. They are not merely looking at short-term gains; instead, they are positioning themselves for the future of finance. By investing in Bitcoin, BlackRock is acknowledging the potential of digital assets to reshape the financial landscape. This perspective is increasingly shared by other financial institutions, suggesting a broader shift toward embracing cryptocurrencies.

Potential Risks and Challenges

As with any investment, there are risks associated with Bitcoin. Regulatory scrutiny, technological challenges, and market competition can all impact Bitcoin’s price and stability. BlackRock’s significant investment may also attract the attention of regulators, leading to discussions on how cryptocurrencies should be managed and monitored. Investors must stay informed about these developments, as they can influence market dynamics.

Analyzing the Current Crypto Market Landscape

The cryptocurrency market is currently experiencing a mix of enthusiasm and caution. While many are excited about Bitcoin’s potential, others are wary due to its historical price fluctuations. BlackRock’s purchase could be the catalyst that brings more institutional investors into the space, potentially stabilizing the market. However, it remains crucial for investors to remain vigilant and informed, as the market can change rapidly.

How to Get Involved in Cryptocurrency

For those intrigued by the latest developments, getting involved in cryptocurrency has never been easier. Various exchanges allow users to buy, sell, and trade Bitcoin and other digital assets. However, it’s essential to choose a reputable platform and understand the fees and security measures in place. Additionally, investors should educate themselves about the technology behind cryptocurrencies, such as blockchain, to make informed decisions.

The Future of Bitcoin and Institutional Investment

As more institutional investors like BlackRock enter the cryptocurrency space, the future of Bitcoin looks promising. Their confidence in Bitcoin may encourage other companies to explore similar investments, leading to increased market liquidity and interest. This could also influence regulatory bodies to adopt more favorable policies towards cryptocurrencies, further legitimizing them in the eyes of the public and investors alike.

Conclusion: The Bigger Picture

BlackRock’s purchase of 2,680 BTC worth $282.9 million is a significant event in the cryptocurrency market. As they buy the dip, they are not only making a financial investment but also signaling their belief in the future of Bitcoin and digital assets. For investors, this could be a moment to watch closely, as it may indicate broader trends in the market. Whether you’re a seasoned trader or a curious newcomer, staying informed about these developments will help you navigate the evolving landscape of cryptocurrency.