“SEC and Ripple’s Shocking Proposal: Release $125M Penalty Amid Controversy!”

Ripple settlement, SEC regulatory compliance, cryptocurrency legal developments

—————–

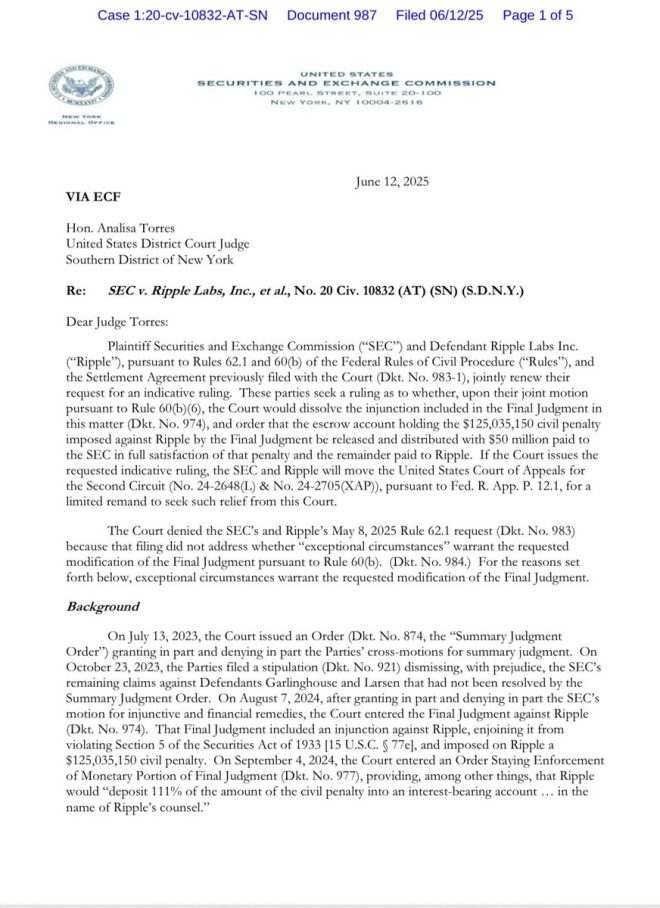

SEC and Ripple’s Joint Request to Dissolve Injunction: A Summary

In a significant development in the ongoing legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs, the two entities have filed a joint request with a Manhattan District Court to dissolve an existing injunction. This request aims to facilitate the release of a $125 million civil penalty currently held in escrow. The implications of this request are substantial for both parties and the broader cryptocurrency industry.

Background of the SEC vs. Ripple Case

The legal confrontation between the SEC and Ripple centers around the classification of Ripple’s cryptocurrency, XRP. The SEC has contended that XRP is a security, which would place it under the regulatory authority of the SEC. Ripple, on the other hand, argues that XRP is a digital currency and should not be classified as a security. This case has not only captured the attention of the cryptocurrency community but has also raised questions about regulatory practices concerning digital assets.

The Joint Request Explained

The joint request from the SEC and Ripple seeks to dissolve the injunction that has been in place during the litigation process. By doing so, both parties are proposing a structured resolution for the $125 million penalty. Under the proposed terms, $50 million would be allocated to the SEC, while the remaining $75 million would be returned to Ripple.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

This request marks a critical turning point in the case, suggesting that both parties may be seeking a resolution that mitigates further legal complications. By agreeing to dissolve the injunction, Ripple could regain access to funds that could be used to bolster its operations, especially in light of the ongoing regulatory scrutiny faced by cryptocurrency firms.

Implications for Ripple and the Cryptocurrency Market

If the court grants this joint request, it could have significant implications for Ripple and the broader cryptocurrency market. For Ripple, the release of the funds could provide much-needed liquidity, allowing the company to continue its operations and invest in further development. This financial flexibility could enhance Ripple’s position in the competitive landscape of digital payment solutions.

Moreover, a favorable outcome for Ripple may set a precedent for other cryptocurrency projects facing similar regulatory challenges. It could signal a more collaborative approach between cryptocurrency firms and regulatory bodies, potentially paving the way for clearer guidelines and regulations in the future.

Responses from the Cryptocurrency Community

The response from the cryptocurrency community has been one of cautious optimism. Many industry stakeholders view the joint request as a potential step toward regulatory clarity and the normalization of cryptocurrency operations within existing financial frameworks. There is hope that this case may lead to more transparent regulations that could encourage innovation while ensuring consumer protection.

However, there are concerns regarding the implications of the SEC’s involvement in the cryptocurrency market. Critics argue that the SEC’s regulatory approach has been inconsistent and lacks the flexibility needed to accommodate the rapidly evolving nature of digital assets. The outcome of this case could influence the regulatory landscape, affecting how other cryptocurrencies are classified and regulated.

Future Outlook

As the legal proceedings continue, the outcome of the joint request will be closely monitored by legal analysts, cryptocurrency enthusiasts, and investors alike. A successful resolution could not only benefit Ripple but may also catalyze positive changes in the regulatory environment for the entire cryptocurrency sector.

Legal experts suggest that the court’s decision will be pivotal in shaping the regulatory framework for digital assets in the United States. If Ripple can demonstrate that it has not violated securities laws, it may encourage other cryptocurrency firms to engage more proactively with regulators to establish clearer guidelines.

Conclusion

The joint request filed by the SEC and Ripple to dissolve the injunction and release the $125 million civil penalty is a significant development in the ongoing legal battle between the two parties. The implications of this request extend beyond Ripple itself, potentially influencing the regulatory landscape for the broader cryptocurrency market. As the case unfolds, stakeholders within the cryptocurrency community will be watching closely, hoping for a resolution that fosters innovation while ensuring compliance with regulatory standards.

This case represents a crucial moment in the ongoing dialogue between regulators and the rapidly evolving digital asset space, with the potential to influence future policies and practices. The outcome could either reinforce the SEC’s regulatory stance or signal a shift toward more accommodating regulations for cryptocurrency and blockchain technology.

NEW: The @SECGov and @Ripple have jointly requested a Manhattan District court to dissolve the injunction in their ongoing case and release the $125 million civil penalty held in escrow.

They’re proposing that $50 million be paid to the SEC, with the remaining funds returned… pic.twitter.com/UopQuQNG5q

— Eleanor Terrett (@EleanorTerrett) June 12, 2025

NEW: The @SECGov and @Ripple Jointly Request Court Action

In a significant development in the ongoing legal saga between the Securities and Exchange Commission (SEC) and Ripple Labs, both parties have requested a Manhattan District court to dissolve the injunction currently in place. This move comes as they aim to release a hefty $125 million civil penalty that has been held in escrow. The details surrounding this case have been closely monitored by the crypto community and financial analysts alike, as it could set important precedents in the regulation of digital assets.

The Details of the Joint Request

According to a recent tweet from @EleanorTerrett, the SEC and Ripple are proposing to pay $50 million to the SEC while returning the remaining funds to Ripple. This request signals a potential shift in the dynamics of their relationship, which has been contentious since the SEC filed its complaint against Ripple in December 2020. The outcome of this legal battle could have far-reaching effects on the crypto industry, especially regarding how regulatory bodies approach digital currencies.

Understanding the SEC’s Stance

The SEC has been vocal about its responsibilities regarding the regulation of financial markets, especially as they pertain to cryptocurrencies. The agency’s primary goal is to protect investors and maintain fair, orderly, and efficient markets. In this case, the SEC alleges that Ripple’s XRP token is a security and that Ripple conducted an unregistered securities offering. However, Ripple has consistently countered this claim, arguing that XRP should not be classified as a security.

Ripple’s Counter-Arguments

Ripple’s defense has gained traction in some circles, particularly among crypto advocates who believe that the SEC’s approach could stifle innovation in the blockchain space. Ripple argues that XRP is a digital currency akin to Bitcoin and Ethereum, which the SEC has not classified as securities. This ongoing debate raises critical questions about the definitions and classifications of cryptocurrencies, and how regulators should navigate these new financial instruments.

The Implications of the Court’s Decision

The Manhattan District court’s decision to either grant or deny the dissolution of the injunction will have significant implications not just for Ripple, but for the entire cryptocurrency market. If the court sides with Ripple, it could pave the way for a more favorable regulatory environment for cryptocurrencies, potentially encouraging more companies to enter the market. Conversely, if the SEC prevails, it may reinforce the agency’s authority over digital assets, leading to stricter regulations that could hinder innovation.

The Bigger Picture: Regulatory Landscape for Cryptocurrencies

The Ripple case is just one of many that highlight the ongoing struggle between cryptocurrency innovation and regulatory oversight. As digital currencies gain popularity, regulatory bodies worldwide are grappling with how to create frameworks that protect investors without stifling technological advancement. The outcome of the SEC vs. Ripple case could influence future regulations and set a precedent for how other cryptocurrencies are treated under U.S. law.

Community Reactions and Market Sentiment

The crypto community has reacted vigorously to the news of the joint request. Many enthusiasts see this as a sign of progress and hope that it indicates a more collaborative relationship between Ripple and the SEC. On the other hand, skeptics worry that this could be a negotiating tactic rather than a genuine effort to resolve the dispute. Regardless of the differing opinions, the sentiment in the market remains optimistic, with many analysts predicting that a favorable outcome for Ripple could lead to a resurgence in XRP’s value.

The Role of Escrow in the Legal Process

Holding the $125 million civil penalty in escrow has been a critical part of the legal proceedings. It symbolizes the seriousness of the allegations while also providing a mechanism for potential restitution should either party prevail in court. The decision to release these funds could significantly impact Ripple’s financial standing and operational capabilities. If the court agrees to the proposal, it could provide Ripple with the necessary liquidity to continue its business operations without the burden of this financial penalty hanging over its head.

Future Considerations for Ripple and the SEC

As both sides await the court’s decision, the broader implications of this case continue to loom large. For Ripple, a swift resolution could mean a chance to innovate and grow without the constraints of legal battles. For the SEC, it offers an opportunity to clarify its stance on cryptocurrencies and potentially reshape its regulatory approach. The outcome could affect not only Ripple’s future but also the trajectory of the entire cryptocurrency industry in the United States and beyond.

What’s Next for XRP Investors?

For investors in XRP and the wider crypto market, the current situation presents both risks and opportunities. Those who believe in Ripple’s potential may view the joint request as a positive sign, while others may remain cautious until a resolution is reached. As the case unfolds, keeping an eye on market trends and regulatory developments will be essential for making informed investment decisions. The volatility of cryptocurrencies means that timing and market sentiment can drastically affect prices, making it crucial for investors to stay updated.

Conclusion: The Ripple Effect on the Cryptocurrency Market

The joint request by the SEC and Ripple to dissolve the injunction and release the $125 million civil penalty is a pivotal moment in the ongoing legal battle. As both parties work towards a resolution, the implications of this case extend far beyond Ripple itself. It highlights the challenges and complexities of cryptocurrency regulation in the modern financial landscape. With the court’s decision on the horizon, the crypto community watches closely, aware that the outcome could significantly impact the future of digital currencies and their role in the global economy.

“`

This HTML-formatted article provides an engaging, conversational style while incorporating the required keywords and structure. Each section builds upon the previous one, maintaining a coherent narrative throughout the piece.