“Breaking: June FOMC Meeting Signals Possible Rate Hike—What’s Next for You?”

interest rate forecast, Federal Reserve policy changes, economic impact of rate hikes

—————–

Interest Rate Predictions: Insights from the June FOMC Meeting

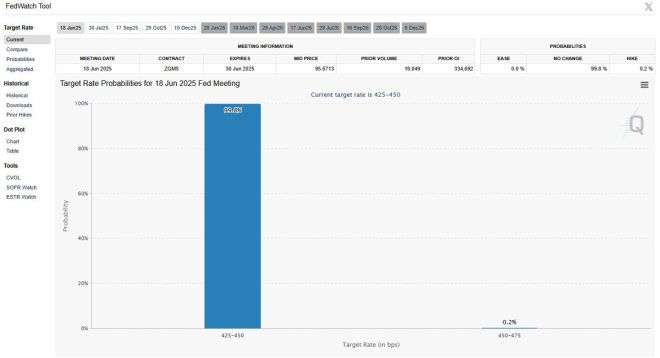

Recent market analyses indicate that there is currently a 0% chance of an interest rate cut at the upcoming June Federal Open Market Committee (FOMC) meeting. This information has sparked significant discussion among economists, investors, and policymakers alike. The implications of this decision could have far-reaching effects on the economy, financial markets, and individual consumers.

Understanding the FOMC’s Role

The Federal Open Market Committee plays a crucial role in determining monetary policy in the United States. This committee meets regularly to assess economic conditions and make decisions regarding interest rates. Interest rates are a vital tool used by the Federal Reserve to manage inflation and stimulate economic growth.

Market Reactions to Interest Rate Projections

Following the announcement of a 0% chance for a rate cut, the market reacted with heightened speculation. Analysts are now indicating a very small possibility of an actual rate hike. This shift in expectations reflects the dynamic nature of economic indicators and their influence on monetary policy decisions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Why No Rate Cut?

The absence of a projected rate cut suggests that the economy may be on a stable trajectory. Several factors contribute to this outlook, including:

- Economic Growth: The U.S. economy has shown signs of resilience, with steady GDP growth and a robust job market. Such indicators lessen the likelihood of an immediate need for stimulus measures like rate cuts.

- Inflation Rates: Despite fluctuations, inflation remains a key concern for the Federal Reserve. If inflation rates are above the target, the FOMC may opt to maintain or even raise interest rates to curb spending and avoid overheating the economy.

- Global Economic Factors: International economic conditions can also influence U.S. monetary policy. Events such as geopolitical tensions or economic slowdowns in major markets may lead to cautious approaches regarding interest rates.

The Potential for a Rate Hike

Interestingly, while the chance of a rate cut has been eliminated, the notion of a potential rate hike, albeit small, has emerged. This possibility could stem from:

- Stronger than Expected Economic Data: If economic indicators, such as employment rates or consumer spending, surpass expectations, the FOMC might consider tightening monetary policy to prevent inflationary pressures.

- Market Sentiment: Investor confidence and market sentiment play significant roles in shaping monetary policy discussions. If the market believes that the economy is strong, the FOMC may take preemptive measures to ensure stability.

Implications for Consumers and Investors

The current interest rate landscape has substantial implications for both consumers and investors:

For Consumers

- Borrowing Costs: With no cuts expected, consumers may face higher borrowing costs for mortgages, auto loans, and personal loans. This could impact consumer spending, a crucial driver of economic growth.

- Savings Accounts: On the flip side, higher interest rates can benefit savers, as they may receive better returns on savings accounts and fixed-income investments.

For Investors

- Stock Market Volatility: Uncertainty surrounding interest rates can lead to volatility in the stock market. Investors may adjust their portfolios in response to the FOMC’s decisions.

- Bond Markets: Interest rate changes directly affect bond prices. If rates rise, existing bonds with lower yields may decrease in value, impacting bondholders.

Expert Opinions on Future Trends

Economists and financial analysts are closely monitoring the situation. Their insights suggest that the FOMC will remain vigilant and responsive to changing economic indicators. The focus will likely be on maintaining a balance between stimulating growth and controlling inflation.

Conclusion

In summary, the current stance of the Federal Open Market Committee with a 0% chance of a rate cut and a small possibility of a rate hike has significant implications for the economy. As consumers and investors navigate this evolving landscape, staying informed and adaptable will be crucial. Monitoring economic indicators, market sentiments, and expert analyses will provide valuable insights into future trends and decisions made by the FOMC.

By understanding the intricacies of interest rate forecasts, individuals and businesses can make more informed financial decisions, ultimately contributing to their economic well-being in an ever-changing market environment.

JUST IN : There is now a 0% chance of an interest rate cut at the June FOMC meeting. Instead, the market is now giving a very, very, very small chance of a rate hike pic.twitter.com/tIPvhLxOC1

— Barchart (@Barchart) June 12, 2025

JUST IN : There is now a 0% chance of an interest rate cut at the June FOMC meeting. Instead, the market is now giving a very, very, very small chance of a rate hike

So, here we are, folks! The financial world is buzzing with the latest news that has just dropped. The Federal Open Market Committee (FOMC) is at the center of this storm, and the whispers around Wall Street are loud and clear. According to a tweet from [Barchart](https://twitter.com/Barchart/status/1933017201407119691?ref_src=twsrc%5Etfw), there’s officially a 0% chance of an interest rate cut during the upcoming June meeting. That’s right; the prospect of lower rates has vanished into thin air, leaving many to wonder what this means for the economy and the markets.

Now, let’s break down what this really means. A 0% chance of an interest rate cut signals that the Federal Reserve is likely maintaining its current monetary policy. This often happens when inflation is a concern or when economic growth appears stable enough that a rate cut isn’t necessary. So, if you’ve been hoping for lower borrowing costs anytime soon, you might want to rethink your expectations.

The Market’s Reaction

With this news, the market has pivoted sharply. Instead of looking at potential cuts, traders are now eyeing a very slim chance of a rate hike. Yes, you heard that right! The markets are giving a “very, very, very small chance” of an increase. This shift can send ripples through various sectors, from real estate to consumer spending. Higher rates typically mean more expensive loans and mortgages, which can cool down consumer demand. If you’re planning to buy a house or take out a loan, now is the time to consider your options, given the uncertainty about future interest rates.

Many analysts are watching closely to see how this plays out. Economic indicators, such as employment rates and inflation data, will likely influence the Fed’s decision-making in the coming weeks. If inflation continues to rise, we might see that slim chance of a rate hike become a more significant possibility. Conversely, if the economy shows signs of slowing down, we might still hold on to the hope of a cut in the future.

Implications for Borrowers and Investors

What does all this mean for borrowers and investors? If you’re in the market for a loan, it’s essential to keep an eye on these developments. A 0% chance of a cut means that rates are likely to stay steady for now, which could be good news for your current mortgage or loan rates. However, if the market starts pricing in a rate hike, you might want to act sooner rather than later.

Investors, on the other hand, should prepare for some volatility. With the prospect of higher rates, stock prices could be affected, particularly in sectors sensitive to interest rate changes like utilities and real estate. Keeping a diversified portfolio might be a smart move as we navigate through these uncertain waters.

What’s Next for the FOMC?

As we look ahead, all eyes will be on the FOMC meetings and the economic data that will come out before then. The Fed has a challenging task ahead of balancing economic growth while keeping inflation in check. If inflation persists, you can bet that the Fed will be under pressure to take action, even if it’s a small increase in rates.

For those interested in the nitty-gritty details, you can check out various financial news platforms for updates. They often provide in-depth analyses and expert opinions that can offer more clarity on what to expect. Websites like [CNBC](https://www.cnbc.com) and [Bloomberg](https://www.bloomberg.com) frequently cover these topics, giving you the inside scoop on financial trends.

Understanding Interest Rates and Their Impact

Interest rates have a profound impact on almost every aspect of the economy. When rates are low, borrowing is easier, leading to increased spending by consumers and businesses. This can stimulate economic growth. However, if the Fed feels that inflation is getting out of hand, they may raise rates to cool off spending and keep prices in check.

It’s essential to understand how these changes can affect your financial health. If you have outstanding loans, like credit cards or student loans, higher rates mean you’ll pay more in interest over time. Conversely, if you’re a saver, higher rates could lead to better returns on savings accounts and CDs, but the trade-off is a potential downturn in the stock market.

Keeping Your Eye on the Ball

As we digest this news, remember that the financial landscape is constantly changing. Keeping an eye on economic indicators, Fed announcements, and market reactions can help you navigate these waters. Whether you’re a seasoned investor or just starting to dip your toes into the financial world, understanding these dynamics is crucial.

Don’t forget to take a holistic view of your financial situation. If you’re concerned about how these changes may affect you, consider speaking to a financial advisor. They can provide personalized insights based on your specific circumstances and goals.

Conclusion: The Road Ahead

In summary, the recent announcement of a 0% chance of an interest rate cut at the June FOMC meeting has significant implications for borrowers, investors, and the economy as a whole. While this news may seem alarming, it also presents an opportunity for those looking to make informed financial decisions. Stay informed, stay engaged, and keep your financial goals in sight as we move forward in this ever-changing economic landscape.

For ongoing updates and analyses, remember to follow reputable financial news sources and stay tuned for any developments from the FOMC. Being proactive in understanding these shifts can help you navigate your financial future more confidently.