GameStop’s $2.25B Offering Sparks Debate: Is This the Future of Retail?

GameStop private offering news, $GME stock conversion strategy, 2025 investment opportunities in gaming

—————–

GameStop Announces Private Offering: A Comprehensive Overview

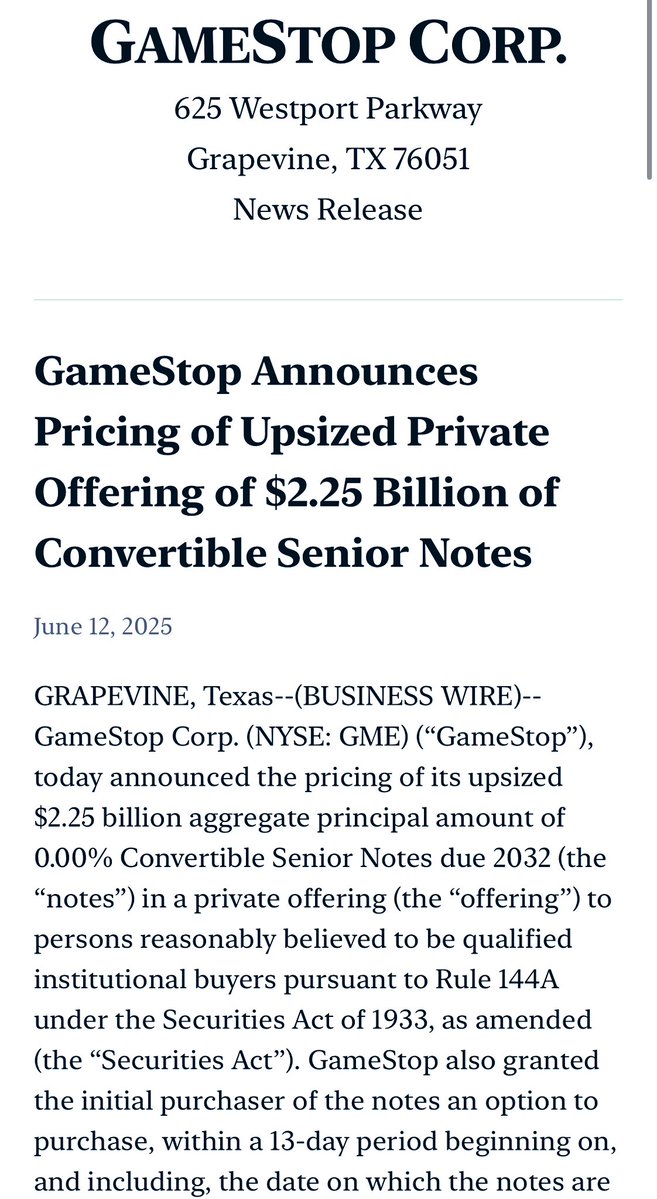

In a significant financial move, GameStop, the video game retail giant, has announced the pricing of an upsized private offering totaling $2.25 billion, with the potential to reach $2.7 billion. This announcement has generated considerable buzz in the financial markets and among investors, particularly those invested in the stock known by its ticker symbol, $GME. The conversion price for this offering has been set at $28.91. This summary will delve into the implications of this announcement, the context surrounding GameStop’s financial strategies, and what it means for investors.

Understanding GameStop’s Private Offering

GameStop’s decision to initiate a private offering of $2.25 billion is a strategic move aimed at raising capital. This funding can serve various purposes, including paying down debt, investing in new technologies, or expanding its business model beyond traditional retail. The potential increase to $2.7 billion indicates a strong interest from investors, showcasing confidence in the company’s future prospects.

The Conversion Price: What It Means for Investors

The conversion price of $28.91 is a critical figure that investors need to understand. This price is the rate at which investors can convert their securities into shares of GameStop’s common stock. A conversion price set at this level suggests that GameStop is valuing its shares based on its recent performance and market conditions. For current shareholders, this is a pivotal moment, as it can affect the stock’s price and overall market sentiment.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reaction and Investor Sentiment

GameStop’s announcement has likely stirred mixed reactions among investors. On one hand, the successful upsizing of the private offering indicates strong confidence in the company’s financial health and future growth prospects. On the other hand, the conversion price may raise concerns about dilution of shares. When new shares are issued, existing shareholders can see their ownership percentage decrease unless the company uses the capital effectively to grow its business.

GameStop’s Business Model and Future Outlook

To fully grasp the significance of this private offering, it’s essential to consider GameStop’s evolving business model. Traditionally known for its brick-and-mortar stores selling video games and consoles, GameStop has been undergoing a transformation in recent years. The company has been pivoting towards e-commerce, digital downloads, and collectibles, aiming to adapt to the rapidly changing retail landscape. This shift has been part of a broader strategy to revitalize the brand and attract a new generation of gamers.

The Role of Institutional Investors

The upsized offering may attract significant interest from institutional investors, further legitimizing GameStop’s financial strategy. Institutional investors often bring not only capital but also expertise and credibility to a company. Their involvement can enhance GameStop’s visibility in the market and potentially stabilize its stock price in the long run.

The Influence of Retail Investors

GameStop has a unique position in the market, particularly due to the strong community of retail investors that rallied behind the stock during the infamous short squeeze in early 2021. The company’s stock has become a symbol of retail investor power, and this latest announcement is likely to be closely watched by this demographic. Retail investors often share insights and analysis on platforms like Reddit, Twitter, and other social media, creating a vibrant discussion around the stock.

Financial Strategy and Long-Term Goals

GameStop’s management has indicated that the funds raised through this private offering will be strategically allocated to enhance the company’s long-term growth potential. This could include investments in technology, supply chain improvements, or even acquisitions that align with its new business direction. By positioning itself for the future, GameStop aims to become more resilient in an increasingly competitive market.

Conclusion: What Lies Ahead for GameStop

In summary, GameStop’s announcement regarding the upsized private offering of $2.25 billion, with a conversion price of $28.91, marks a pivotal moment for the company as it navigates the evolving landscape of retail and gaming. This financial strategy aims not only to raise capital but also to solidify investor confidence in the company’s future.

As both institutional and retail investors closely monitor developments, the outcome of this offering will be crucial in determining GameStop’s trajectory. The company’s ability to leverage this capital effectively could pave the way for sustainable growth and a stronger market position. With the gaming industry continuing to expand and evolve, GameStop’s commitment to innovation and adaptation will play a critical role in its success.

Investors should remain vigilant and informed as this situation develops, keeping an eye on market trends, company performance, and potential shifts in investor sentiment. The landscape surrounding GameStop is as dynamic as ever, and its future will undoubtedly be shaped by the decisions made in the coming months.

JUST IN: GAMESTOP ANNOUNCES PRICING OF UPSIZED PRIVATE OFFERING FOR $2.25B — CAN BECOME $2.7B — CONVERSION PRICE SET: $28.91$GME pic.twitter.com/uklS58sru1

— Reese Politics (@ReesePolitics) June 12, 2025

JUST IN: GAMESTOP ANNOUNCES PRICING OF UPSIZED PRIVATE OFFERING FOR $2.25B

Big news has just dropped from the world of GameStop. The company has announced an upsized private offering that could raise up to $2.25 billion. This could potentially increase to as much as $2.7 billion if demand is strong enough. So, why is this significant? Let’s dive into the details and explore what this means for investors, the company, and the future of $GME.

Understanding the Offering

GameStop’s decision to announce this private offering is a strategic move aimed at bolstering its financial position. The conversion price has been set at $28.91, which is noteworthy in the context of how GameStop’s stock has been performing. Investors who are keen on $GME should pay close attention to this offering, as it could significantly influence the stock’s future trajectory.

But what exactly is a private offering? In simple terms, this is when a company sells its shares directly to a limited number of investors rather than through a public offering. This method can be quicker and less expensive, allowing the company to raise funds without the extensive regulatory hurdles associated with public offerings. GameStop’s choice of an upsized offering suggests that they see a strong appetite from investors willing to support their future endeavors.

The Financial Landscape of GameStop

To truly grasp the implications of this private offering, we need to consider GameStop’s recent financial history. The company has been navigating a challenging retail environment while also trying to transition into a technology-driven business model. The upsized offering can provide the necessary capital to fuel this transition, whether it’s investing in e-commerce, enhancing their digital presence, or even exploring new revenue streams.

In a nutshell, this funding could provide GameStop with the resources it needs to adapt and thrive in an increasingly digital world. For $GME investors, this is a crucial moment. The company’s ability to successfully execute its plans will likely impact stock prices in the coming months.

Why the Conversion Price Matters

The conversion price of $28.91 is a key figure here. This is the price at which the investors in this offering can convert their notes into shares. It’s essential to analyze this number in the context of GameStop’s current stock price. If the stock performs well and exceeds this conversion price, then the investors stand to gain significantly.

Conversely, if the stock struggles to maintain or exceed this price, it could lead to challenges for both the company and its investors. This delicate balance makes understanding the market sentiment surrounding GameStop even more critical. Investors should keep an eye on market trends, public perception, and the company’s performance leading up to and following this offering.

The Impact on $GME Stock

So, how might this private offering affect $GME stock? Historically, GameStop has been a stock that generated considerable volatility, largely due to its meme status and the fervent support from retail investors. An announcement of this magnitude could lead to fluctuations in stock prices as traders react to the news.

Some may view the offering as a positive sign, indicating that GameStop is taking proactive steps to strengthen its financial position. Others might see it as a potential red flag, fearing dilution of existing shares. This dichotomy is common in the stock market, especially for a company like GameStop that has been at the center of so much hype and speculation.

Investor Sentiment and Market Reactions

Investor sentiment plays a crucial role in how stocks like $GME behave. With an announcement of a $2.25 billion upsized private offering, market reactions can range from enthusiasm to skepticism. Some investors may feel encouraged, viewing this as an opportunity to buy in before the stock potentially rises. Others may be cautious, especially if they fear that the offering could dilute their current holdings.

It’s important to stay informed and consider various perspectives when analyzing reactions to news like this. Social media platforms, investor forums, and financial news outlets will be buzzing with opinions, and it’s wise for investors to sift through the noise and make informed decisions based on thorough research.

What’s Next for GameStop?

Looking forward, what can we expect from GameStop after this announcement? The company has a lot on its plate, and how it utilizes the funds from this offering will be pivotal. Whether it’s investing in technology, enhancing customer experience, or expanding its product offerings, the next steps will be closely watched by analysts and investors alike.

Moreover, how GameStop manages investor relations during this period will also be critical. Transparency will be key in maintaining investor confidence and ensuring that the market reacts positively to the news. Stakeholders will want to see a clear plan on how the company intends to use these funds to propel growth and innovation.

Conclusion: Staying Informed and Engaged

In the fast-paced world of stock trading, staying informed is crucial. GameStop’s announcement of a $2.25 billion upsized private offering is a significant moment, and it’s essential for investors to understand the implications. Whether you are a seasoned investor or new to the GameStop saga, keeping an eye on developments, market reactions, and strategic decisions will help you make informed choices regarding $GME.

As always, this is just one piece of an ongoing puzzle. The world of investing is complex, and the performance of stocks can be influenced by a myriad of factors. Whether you are bullish or bearish on GameStop, being proactive and engaged will serve you well in this ever-evolving landscape.

For more details and updates, you can check out the original announcement on [Twitter](https://twitter.com/ReesePolitics/status/1933305062371054016?ref_src=twsrc%5Etfw) for continuous updates and reactions from the community.