U.S. Treasury Shatters Records Again: $10 Billion Debt Buyback Shocks Nation!

Treasury debt buyback strategy, U.S. government financial policy, bond market liquidity measures

—————–

U.S. Treasury’s Historic Debt Buyback: A Deep Dive into Recent Developments

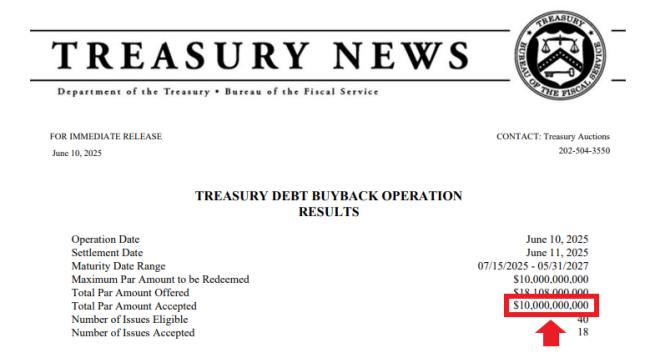

The financial landscape is constantly changing, with governments and institutions making significant moves that can affect economies worldwide. A recent announcement from the United States Treasury has captured the attention of financial analysts and economists alike: the Treasury has executed another $10 billion debt buyback, marking a historic moment as it matches the largest Treasury buyback in history, which occurred just the previous week. This article delves into the implications of this action, the potential impact on the economy, and what it means for the future of U.S. fiscal policy.

Understanding the Debt Buyback Mechanism

A debt buyback occurs when a government repurchases its own bonds or securities from the open market before they reach maturity. This strategy is often employed to manage debt levels, reduce interest expenses, and stabilize financial markets. The U.S. Treasury’s recent buyback aims to decrease the national debt burden while simultaneously providing liquidity to bondholders who may want to sell their holdings.

The Significance of the $10 Billion Buyback

The timing of the U.S. Treasury’s decision to buy back $10 billion in debt is noteworthy. This action not only reflects a proactive approach to managing national debt but also indicates the government’s confidence in its fiscal strategy. By matching the largest buyback in history, the Treasury showcases its commitment to maintaining a stable economic environment, particularly in the face of potential market volatility.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Implications

1. Interest Rates and Inflation Control

One of the primary aims of conducting a debt buyback is to influence interest rates. By reducing the supply of Treasury bonds in the market, the U.S. Treasury can help keep interest rates lower. This is particularly important in the current economic climate, where inflationary pressures are a concern. Lower interest rates can stimulate borrowing and spending, which is vital for economic growth.

2. Investor Confidence

The Treasury’s aggressive buyback strategy signals to investors that the government is committed to sound fiscal management. This can enhance investor confidence, encouraging both domestic and foreign investment in U.S. assets. A stable investment environment is crucial for economic recovery and growth, especially in uncertain times.

3. Debt Management and Fiscal Responsibility

By buying back its own debt, the U.S. Treasury demonstrates a commitment to managing the national debt responsibly. This action can help reduce future interest payments, freeing up resources for other critical government spending areas, such as infrastructure, healthcare, and education. A responsible approach to debt management is essential for long-term economic stability.

Market Reactions

The immediate market reaction to the Treasury’s announcement has been one of cautious optimism. Analysts are closely monitoring bond yields and interest rates to assess the broader impact of the buyback. Historically, significant buybacks have led to higher bond prices and lower yields, which could influence investment strategies moving forward.

Future Considerations

While the recent $10 billion buyback is a significant step, it raises questions about the future of U.S. fiscal policy. Will the Treasury continue to implement large-scale buybacks, or will it reassess its strategy in response to changing economic conditions? These are critical considerations for policymakers and investors alike.

The Broader Context of Debt Management

1. Global Economic Landscape

The U.S. Treasury’s actions do not occur in a vacuum. The global economic environment plays a crucial role in shaping U.S. fiscal policy. With other countries also grappling with high levels of debt and inflation, the U.S. must navigate complex international dynamics that can impact its economic decisions.

2. Long-Term Sustainability

While short-term debt buybacks can provide immediate relief and stabilize markets, long-term sustainability is crucial. The U.S. government must balance its buyback strategies with the need for fiscal responsibility and economic growth. Policymakers will need to evaluate the implications of ongoing debt levels and consider strategies that promote long-term financial health.

Conclusion

The U.S. Treasury’s recent $10 billion debt buyback is a historic move that reflects a proactive approach to managing national debt and stabilizing the economy. By reducing the supply of bonds, the Treasury aims to control interest rates, bolster investor confidence, and demonstrate fiscal responsibility. As analysts and policymakers assess the implications of this action, the broader context of global economic conditions and long-term sustainability will play a critical role in shaping future fiscal strategies. The ongoing developments in U.S. debt management will be closely watched by investors, economists, and policymakers alike, as they navigate the complexities of the modern economic landscape.

Key Takeaways

- The U.S. Treasury executed a historic $10 billion debt buyback, matching a previous record.

- Debt buybacks are used to manage national debt, control interest rates, and stabilize financial markets.

- The recent buyback reflects confidence in U.S. fiscal policy and aims to enhance investor confidence.

- The broader implications of this action will influence future fiscal strategies and economic growth.

As we move forward, the Treasury’s strategies will be pivotal in shaping the economic landscape. Stakeholders at all levels—individual investors, large financial institutions, and policymakers—must remain vigilant and informed about these developments to navigate the evolving financial environment effectively.

BREAKING : United States Treasury

THEY DID IT AGAIN! U.S. Treasury just bought back another $10 Billion of its own debt, matching the largest Treasury buyback in history (and that was from last week)! pic.twitter.com/15G6tNwBGr

— Barchart (@Barchart) June 12, 2025

BREAKING : United States Treasury

In a significant move that has the financial world buzzing, the United States Treasury has made headlines once again. They just bought back another $10 billion of their own debt, marking a milestone as it matches the largest Treasury buyback in history. This is particularly noteworthy as it follows closely on the heels of a similar buyback from just last week. This bold action raises intriguing questions about the state of the economy, government debt, and the implications of such maneuvers for the future.

THEY DID IT AGAIN! U.S. Treasury Just Bought Back Another $10 Billion of Its Own Debt

The U.S. Treasury’s decision to buy back $10 billion of its own debt is part of a broader strategy to manage the national debt and stabilize the economy. This buyback is not merely a financial maneuver; it reflects the government’s ongoing efforts to assure markets and investors that it can manage its liabilities effectively. But what does this really mean for the average American?

When the Treasury buys back its debt, it essentially reduces the amount of money it owes. This can lead to lower interest rates and increased confidence among investors. In a time when economic uncertainty looms, such actions can serve to bolster market stability. Moreover, these buybacks can also help to control inflation, a critical factor in today’s economic climate.

Matching the Largest Treasury Buyback in History

This latest buyback is significant not just because of the amount involved, but also because it matches the largest Treasury buyback recorded just a week prior. It’s a rare occurrence and indicates a strong commitment by the Treasury to manage its debt proactively. According to sources, this move is designed to enhance liquidity in the market and ensure that the government can meet its financial obligations without causing disruption.

For those wondering how these buybacks work, they are essentially repurchases of government bonds from investors. By doing so, the Treasury reduces the outstanding debt on its books, which can positively impact the nation’s credit rating over time. It’s a strategic approach that can have long-term benefits, not just for the government, but for the economy as a whole.

Understanding the Implications of Debt Buybacks

Now, let’s break down why this buyback might matter to you. First and foremost, the U.S. Treasury’s decision to buy back its debt can lead to lower interest rates on government bonds. This is crucial as it can influence everything from mortgage rates to personal loans. Lower interest rates can stimulate borrowing and spending, which is vital for economic growth.

Additionally, with the government actively managing its debt, it sends a strong signal to investors about stability. Investors are more likely to have confidence in a government that takes proactive steps to manage its finances. This, in turn, can lead to increased investment in the U.S. economy, which benefits everyone.

The Role of the U.S. Treasury in Economic Stabilization

The U.S. Treasury plays a pivotal role in shaping economic policy and maintaining financial stability. By executing debt buybacks, the Treasury is not just reacting to current economic conditions but is also anticipating future challenges. It’s a delicate balancing act that requires foresight and strategic planning.

For instance, in times of economic downturn, a proactive approach to debt management can help alleviate some of the pressures faced by the economy. It can provide a cushion during tough times, allowing for recovery and growth. The recent buyback is a testament to the Treasury’s commitment to this ongoing process.

What This Means for Investors

If you’re an investor, you might be wondering how this impacts your portfolio. Generally, when the Treasury buys back its debt, it can lead to a decrease in yields on government bonds. This can make other investments, such as stocks, more attractive. As the bond market adjusts, savvy investors might pivot their strategies to capitalize on the shifting landscape.

Moreover, lower yields on government bonds can also influence corporate borrowing rates. Companies may find it cheaper to borrow money, which can lead to increased capital investments, hiring, and expansion. This can create a ripple effect throughout the economy, benefiting various sectors and potentially leading to a robust recovery.

The Future of U.S. Debt Management

As we look ahead, the question on everyone’s minds is, what’s next for U.S. debt management? The recent Treasury buyback highlights a proactive approach to managing national debt, but it also raises questions about sustainability. How long can the government continue to buy back its own debt without incurring larger deficits?

Experts suggest that while these buybacks can provide short-term relief, they need to be part of a broader strategy that includes fiscal responsibility and economic growth initiatives. The government must find a balance between stimulating the economy and maintaining a manageable level of debt.

Public Reaction and Economic Outlook

The public reaction to the Treasury’s latest action has been mixed. While some view it as a positive sign of government intervention and economic management, others are concerned about the long-term implications of increasing national debt. It’s a complex issue that requires careful consideration and discussion.

As for the economic outlook, many analysts believe that proactive measures like these can pave the way for a more stable financial future. By effectively managing debt and providing liquidity to the markets, the Treasury can help foster an environment conducive to growth and stability.

In Conclusion

The recent $10 billion buyback by the U.S. Treasury is a significant event that speaks volumes about the current economic climate and the government’s approach to managing its debt. It’s a bold move that reflects a commitment to stability and proactive fiscal management. For the average American, this could mean lower interest rates and a more robust economy. As we navigate through these uncertain times, it’s essential to stay informed and understand the implications of such actions on our financial landscape.

For more insights and updates on economic trends, follow reliable financial news sources and stay engaged in discussions about fiscal policy and its impact on your financial well-being.