“Blackrock’s Bold Bitcoin Bet: What Secrets Drive Their Massive $129M Purchase?”

Bitcoin investment trends, institutional crypto adoption, large-scale BTC purchases

—————–

BlackRock’s Major Bitcoin Acquisition: What It Means for the Market

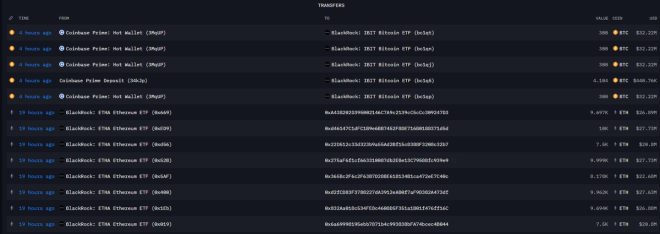

In a significant move that has sent ripples through the cryptocurrency market, investment giant BlackRock has acquired 1,205 Bitcoin (BTC) for a staggering $129 million. This latest development marks a critical point in the ongoing dialogue about institutional investment in cryptocurrencies, particularly Bitcoin, which continues to gain traction among large financial entities.

The Impact of Institutional Investment in Bitcoin

BlackRock’s purchase is not just a routine investment; it signifies a growing trend of institutional adoption of Bitcoin. As one of the world’s largest asset management firms, BlackRock’s decision to buy Bitcoin reflects a shift in how traditional finance views cryptocurrency. Institutions are increasingly recognizing Bitcoin as a legitimate asset class, leading to greater acceptance and integration into mainstream investment portfolios.

The implications of this development are profound. Institutional buying power can significantly influence Bitcoin’s price and overall market dynamics. With BlackRock’s substantial investment, many analysts speculate that this could pave the way for additional institutional players to enter the market, potentially driving demand and prices higher.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Why Is BlackRock Investing in Bitcoin?

The question on many investors’ minds is: What does BlackRock know that the average investor does not? The firm’s strategic move points to a few key factors:

- Hedge Against Inflation: With inflation concerns on the rise, many institutions are looking for assets that can serve as a hedge. Bitcoin, often referred to as "digital gold," is increasingly seen as a store of value. BlackRock’s investment could be a strategic decision to diversify its portfolio against potential economic downturns.

- Growing Adoption: As more companies and financial institutions begin to accept Bitcoin as a form of payment and investment, its legitimacy continues to grow. BlackRock’s investment is a vote of confidence in the future of Bitcoin, signaling that it may become a standard part of investment portfolios.

- Technological Advancements: The underlying technology of Bitcoin, blockchain, has garnered attention for its potential to revolutionize various industries. BlackRock may be positioning itself to benefit from the technological advancements and innovations stemming from cryptocurrency.

The Broader Cryptocurrency Market Reaction

Following the news of BlackRock’s acquisition, the cryptocurrency market has reacted positively. Bitcoin’s price has seen a noticeable uptick, and other cryptocurrencies have also benefited from the increased interest in digital assets. This reaction underscores the interconnectedness of institutional investments and market performance.

Investors often look to the moves of large institutions as indicators of market trends. As BlackRock continues to accumulate Bitcoin, it could spark similar actions from other financial institutions, creating a domino effect that drives further investment into the cryptocurrency space.

What This Means for Retail Investors

For retail investors, BlackRock’s significant investment in Bitcoin could present both opportunities and challenges. On one hand, the influx of institutional capital can lead to price appreciation, providing retail investors with profitable opportunities. On the other hand, increased institutional interest can also lead to heightened market volatility, which retail investors should be prepared for.

It’s essential for retail investors to stay informed about market trends and institutional activities. Understanding the motivations behind large-scale investments can provide valuable insights into potential market movements. Additionally, as institutions like BlackRock continue to invest in Bitcoin, retail investors may want to consider diversifying their portfolios to include cryptocurrencies.

The Future of Bitcoin and Institutional Investment

As we look to the future, BlackRock’s acquisition of Bitcoin raises several questions about the long-term trajectory of Bitcoin and other cryptocurrencies. Will more institutions follow suit? How will regulatory developments impact institutional investment in digital assets? These questions remain at the forefront of discussions among investors and analysts.

The trend of institutional investment in Bitcoin is likely to continue, especially as more firms recognize the potential of digital assets. As Bitcoin becomes more integrated into traditional finance, we may see a shift in how it is perceived by the general public and investors alike.

Conclusion

BlackRock’s acquisition of 1,205 BTC for $129 million is a landmark moment in the cryptocurrency landscape. It highlights the growing acceptance of Bitcoin as a legitimate investment asset and signals a shift in the financial industry’s approach to digital currencies. As institutions increasingly invest in Bitcoin, the market dynamics are likely to change, presenting both opportunities and challenges for retail investors.

In this evolving landscape, staying informed about institutional movements and market trends will be crucial for all investors. BlackRock’s strategic investment serves as a reminder of the potential of Bitcoin and the broader cryptocurrency market, urging investors to consider the implications of institutional interest in their investment strategies.

The future of Bitcoin is bright, but it will be shaped by the actions of both institutions and retail investors. As we witness this historic shift, one thing is clear: the world of finance is changing, and digital assets like Bitcoin are at the forefront of that transformation.

BREAKING:

Today Blackrock bought 1,205 BTC for $129M

They’re starting to accumulate heavy now

What do they know? https://t.co/jzjJJWuerl

BREAKING:

Today, Blackrock bought 1,205 BTC for $129M. This move has sent shockwaves through the cryptocurrency world, sparking curiosity and speculation about what might be driving this significant investment. With such a hefty purchase, it’s clear that Blackrock is starting to accumulate heavy now. But the question on everyone’s mind is: what do they know?

Understanding Blackrock’s Recent Purchase

Blackrock, one of the largest investment firms in the world, seems to be making a bold statement with this latest acquisition. By investing $129 million into Bitcoin, they are signaling confidence in the cryptocurrency market. But why Bitcoin? Why now? These questions are crucial as they reveal the underlying strategies of one of the most influential players in the financial sector.

Why Is Blackrock Investing in Bitcoin?

One reason could be the growing acceptance of Bitcoin as a legitimate asset class. Over the past few years, Bitcoin has gained traction not just among individual investors but also institutional ones. With companies like Tesla and Square adding Bitcoin to their balance sheets, it’s no surprise that Blackrock sees potential here. Additionally, Bitcoin has been lauded for its scarcity and potential as a hedge against inflation, especially in times of economic uncertainty.

The Implications of Heavy Accumulation

When a giant like Blackrock starts to accumulate Bitcoin heavily, it can have ripple effects throughout the market. Other institutional investors may follow suit, leading to a surge in demand and, consequently, a rise in Bitcoin’s price. This kind of momentum can attract more retail investors, creating a positive feedback loop that further drives up the price. It’s a classic case of the rich getting richer, but it also signals growing confidence in the cryptocurrency sector.

Market Reactions to Blackrock’s Acquisition

Since the announcement, the market has seen increased volatility. Bitcoin’s price has danced around the investment threshold, showcasing both optimism and skepticism among traders. Social media platforms are buzzing with opinions, analyses, and predictions about the future of Bitcoin in light of this big buy. The general sentiment is a mix of excitement and caution, as many people wonder whether this signals the start of a new bull run.

What Do Analysts Think?

Many analysts are weighing in on Blackrock’s significant investment. Some believe that this could be the beginning of a new phase for Bitcoin, where it becomes more than just a speculative asset. They argue that institutions are starting to see Bitcoin as a viable long-term investment, comparable to gold. Others caution that while Blackrock’s move is bullish, it doesn’t guarantee a price surge. They emphasize the need for careful analysis and a balanced portfolio.

What Should Retail Investors Do?

If you’re a retail investor, you might be feeling a mix of excitement and anxiety right now. Should you jump on the Bitcoin bandwagon? It’s essential to approach this with a level head. While Blackrock’s purchase can signify that Bitcoin is becoming mainstream, individual investment decisions should be based on your financial goals, risk tolerance, and market research.

The Future of Bitcoin

Blackrock’s acquisition could very well be a turning point for Bitcoin and cryptocurrencies in general. With institutional interest growing, Bitcoin might solidify its place in the investment world. However, it’s crucial to keep an eye on regulatory developments and market trends. The cryptocurrency landscape is known for its rapid changes, and staying informed is key.

Potential Risks Involved

Investing in Bitcoin is not without its risks. The price can be incredibly volatile, and market sentiment can shift on a dime. Regulatory scrutiny is also a concern, as governments around the world are still figuring out how to handle cryptocurrencies. Before diving in, make sure you’ve done your homework and are aware of the risks involved.

Conclusion: Navigating the Crypto Waters

In summary, Blackrock’s recent purchase of 1,205 BTC for $129M is a significant development in the world of cryptocurrency. Their heavy accumulation raises questions about the future of Bitcoin and its acceptance as a legitimate asset class. While this move may inspire confidence among investors, it’s essential to approach the market with caution and awareness. With the right research, you can navigate these waters effectively and make informed decisions about your investments.