“US Treasury Secretary Warns: Crypto Stablecoins Threaten Global Currency Domination”

Treasury Secretary Bessent, crypto stablecoins, US Dollar dominance

Blockchain technology, financial stability, cryptocurrency market

Government regulation, digital assets, global economy

—————–

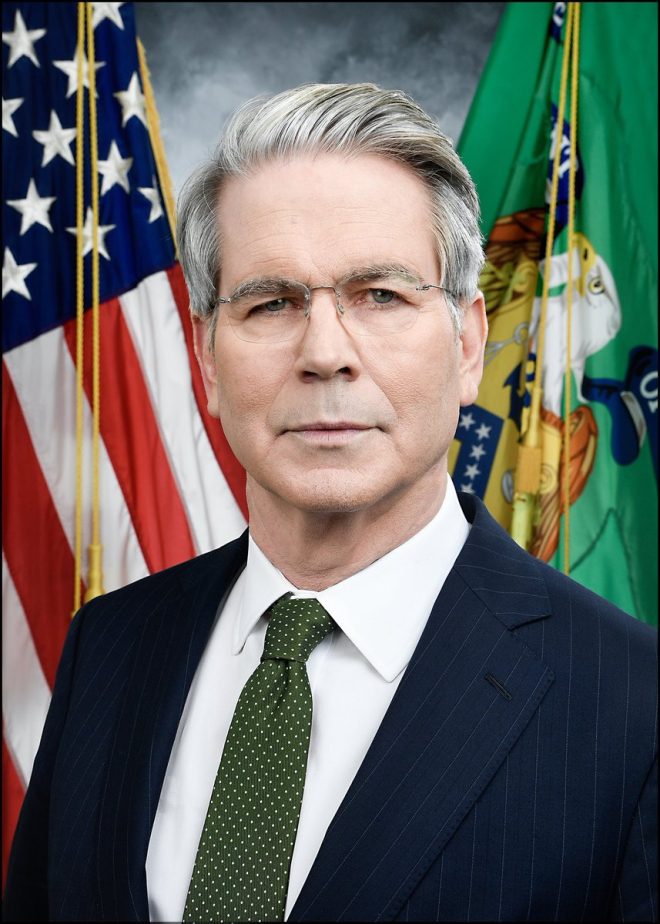

The tweet from Watcher.Guru on June 11, 2025, announces that US Treasury Secretary Bessent believes that crypto stablecoins could potentially solidify the dominance of the US Dollar. This statement has significant implications for the future of cryptocurrency and the global financial system.

Stablecoins are a type of digital currency that is pegged to a stable asset, such as the US Dollar, to minimize price volatility. They are designed to provide the benefits of cryptocurrencies, such as fast and low-cost transactions, while also offering the stability of traditional fiat currencies.

The US Dollar has long been the world’s dominant reserve currency, with many countries holding large amounts of US Dollars in their foreign exchange reserves. This dominance gives the US a significant amount of power and influence in the global economy.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

By suggesting that stablecoins could lock in US Dollar dominance, Secretary Bessent is highlighting the potential for stablecoins to further entrench the US Dollar’s position as the world’s primary currency. This could have far-reaching implications for the future of international trade, finance, and geopolitics.

If stablecoins become widely adopted as a means of transacting in digital assets, it could lead to increased demand for US Dollars, as stablecoins are typically backed by USD reserves. This could strengthen the US Dollar’s position in the global financial system and reinforce its status as the preferred currency for trade and investment.

However, there are also potential risks and challenges associated with stablecoins. Regulatory authorities have raised concerns about the potential for stablecoins to be used for illicit activities, such as money laundering and terrorist financing. There are also questions about the stability and security of stablecoin issuers and their reserves.

Overall, Secretary Bessent’s comments underscore the evolving nature of the cryptocurrency landscape and the potential impact of stablecoins on the future of the US Dollar. As the use of stablecoins continues to grow, it will be important for policymakers, regulators, and market participants to carefully monitor and assess the implications of this trend on the global financial system.

In conclusion, the statement from US Treasury Secretary Bessent regarding the potential for stablecoins to lock in US Dollar dominance highlights the growing importance of digital currencies in the global economy. This development has the potential to reshape the financial landscape and reinforce the position of the US Dollar as the world’s primary reserve currency.

JUST IN: Treasury Secretary Bessent says crypto stablecoins could lock in US Dollar dominance. pic.twitter.com/Teui8cqEi3

— Watcher.Guru (@WatcherGuru) June 11, 2025

Cryptocurrency has been a hot topic in the financial world for quite some time now, with many experts debating its potential impact on the global economy. In a recent tweet by Watcher.Guru, it was revealed that the United States Treasury Secretary Bessent believes that crypto stablecoins could play a significant role in maintaining the dominance of the US Dollar. This statement has sparked a lot of interest and speculation within the financial community, as stablecoins are becoming increasingly popular in the world of digital assets.

The concept of stablecoins is relatively simple – they are digital currencies that are pegged to a stable asset, such as the US Dollar or gold. This means that their value remains relatively constant, unlike other cryptocurrencies like Bitcoin, which are known for their extreme price volatility. By using stablecoins, users can enjoy the benefits of cryptocurrencies, such as fast and secure transactions, without having to worry about price fluctuations.

One of the main advantages of stablecoins is their ability to provide stability in a market that is often characterized by extreme price swings. This makes them an attractive option for both investors and everyday users who want to take advantage of the benefits of blockchain technology without being exposed to the risks associated with traditional cryptocurrencies. Additionally, stablecoins can also serve as a gateway for people who are new to the world of digital assets, as they provide a familiar and stable value proposition.

The endorsement of stablecoins by the US Treasury Secretary is a significant development, as it could potentially pave the way for greater adoption of these digital assets in the mainstream financial sector. By acknowledging the potential of stablecoins to lock in the dominance of the US Dollar, Bessent is signaling that the government recognizes the importance of embracing new technologies in order to stay competitive in the global economy.

It is worth noting that stablecoins are not without their challenges. One of the main concerns surrounding these digital assets is regulatory scrutiny, as governments around the world are still trying to figure out how to classify and regulate them. Additionally, there is also the risk of stablecoins not being as stable as they claim to be, as there have been instances in the past where some stablecoins have deviated from their pegged value.

Despite these challenges, the potential benefits of stablecoins are hard to ignore. With the backing of the US Treasury Secretary, it is likely that we will see more developments in this space in the coming years. Whether stablecoins will indeed lock in the dominance of the US Dollar remains to be seen, but one thing is for sure – they are here to stay and will continue to play a significant role in the future of finance.

In conclusion, the statement made by the US Treasury Secretary regarding the potential of stablecoins to lock in the dominance of the US Dollar is a clear indication of the growing importance of digital assets in the global economy. As technology continues to evolve, it is crucial for governments and financial institutions to adapt and embrace these changes in order to stay relevant and competitive. Stablecoins represent a new frontier in the world of finance, and their impact is only just beginning to be felt. It will be interesting to see how this space develops in the coming years and what role stablecoins will play in shaping the future of money.