Trump’s Shocking Call for Fed Rate Cut: Is This a Market Game-Changer?

Trump economic policies, Federal Reserve interest rates, CPI data analysis

—————–

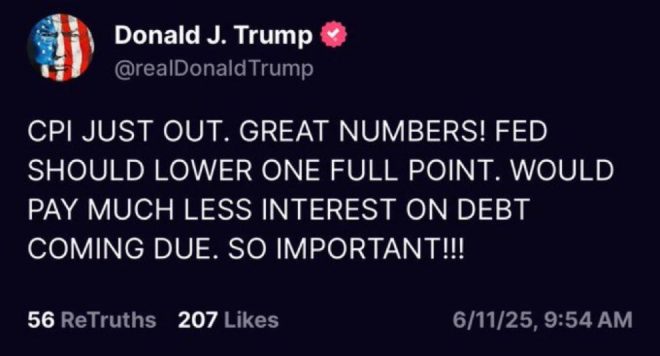

Breaking news: Trump Advocates for a Full Point Rate Cut Following Positive CPI Data

In a surprising turn of events, former President Donald trump has made headlines by suggesting that the latest Consumer Price Index (CPI) data appears favorable, and he is advocating for the Federal Reserve to implement a full one-point cut in interest rates. This announcement has sent ripples through financial markets, with many analysts and investors interpreting it as bullish news for the economy.

Understanding CPI and Its Importance

The Consumer Price Index is a critical economic indicator that measures the average change over time in the prices paid by urban consumers for a basket of goods and services. It serves as a primary gauge for inflation and helps policymakers, including the Federal Reserve, to make informed decisions regarding monetary policy.

When CPI data indicates a decrease or stabilization in inflation, it often leads to speculation about potential rate cuts by the Federal Reserve. Lower interest rates can stimulate economic growth by making borrowing cheaper for consumers and businesses, which in turn can lead to increased spending and investment.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Trump’s Statement and Market Reactions

Trump’s statement on June 11, 2025, has been interpreted as a signal for a more accommodative monetary policy. By suggesting a full one-point rate cut, he is aligning with those who believe that the economy requires further support to maintain momentum.

This bullish outlook has been received positively in the markets, with stock indices reacting favorably. Investors often view lower interest rates as a catalyst for higher stock prices, as they can lead to increased corporate earnings and consumer spending.

Implications for Markets and Investors

- Stock Market Rally: Following Trump’s announcement, many analysts anticipate a rally in the stock market. Historically, periods of low-interest rates have been associated with bullish trends in equities. Investors may flock to stocks, expecting higher returns as borrowing costs decline.

- Impact on Bonds: A move by the Federal Reserve to lower interest rates would also influence the bond market. Bond prices typically rise when interest rates fall, as existing bonds with higher yields become more attractive. This could lead to a surge in demand for bonds, particularly those with longer maturities.

- Real Estate Sector Boost: The real estate market could also benefit from a rate cut. Lower mortgage rates can make home purchases more affordable, potentially leading to increased demand in housing markets across the country.

- Consumer Confidence: Trump’s endorsement of a rate cut could bolster consumer confidence, encouraging spending. When consumers feel secure about their financial situation, they are more likely to make significant purchases, contributing to overall economic growth.

- Cryptocurrency Market Reaction: Interestingly, the cryptocurrency market has been known to react to macroeconomic news, including interest rate changes. A rate cut could spur interest in cryptocurrencies as alternative investments, particularly if fiat currencies weaken.

Broader Economic Context

Trump’s comments come at a time when economic indicators are being closely monitored. With ongoing discussions about inflation, employment rates, and global economic stability, the Federal Reserve’s decisions regarding interest rates carry significant weight.

Market analysts will be closely watching the upcoming Fed meetings and economic data releases to gauge the central bank’s stance. If the CPI data continues to show positive trends, it could increase the likelihood of the Fed acting on Trump’s suggestions.

Conclusion

In conclusion, Donald Trump’s recent remarks regarding the positive CPI data and his call for a full point interest rate cut have sparked considerable interest and optimism in financial markets. Investors are likely to respond favorably to the possibility of lower borrowing costs, which can stimulate economic growth and bolster market performance.

As we move forward, the implications of these statements will unfold, particularly as the Federal Reserve assesses economic conditions and inflation trends. For investors, staying informed and ready to adapt to these changes will be crucial in navigating the evolving financial landscape.

For those looking to capitalize on potential market movements, keeping abreast of economic indicators, including CPI data and Federal Reserve announcements, will be essential. The intersection of politics and economics continues to shape market dynamics, making it an exciting time for investors and analysts alike.

BREAKING:

TRUMP SAYS CPI DATA LOOKS GOOD & FED SHOULD CUT RATES WITH A FULL POINT

BULLISH FOR MARKETS! pic.twitter.com/ECYpHppxLx

— Crypto Rover (@rovercrc) June 11, 2025

BREAKING:

In a surprising twist that has sent shockwaves through the financial markets, former President Donald Trump has declared that the latest Consumer Price Index (CPI) data looks promising. He emphasizes that the Federal Reserve should consider cutting interest rates by a full point. This statement has sparked discussions among economists and market analysts, with many interpreting it as a bullish signal for the markets. But what does this really mean for investors and the economy at large? Let’s dive into the details.

TRUMP SAYS CPI DATA LOOKS GOOD & FED SHOULD CUT RATES WITH A FULL POINT

When Trump mentions that the CPI data looks good, he’s referring to the metrics that measure inflation by tracking the prices of a basket of consumer goods and services. A favorable CPI indicates that inflation is under control, which can lead to a more stable economic environment. This is crucial, especially after the tumultuous economic climate we’ve seen in recent years.

But why does Trump believe the Federal Reserve should cut rates? Lowering interest rates can stimulate economic growth by making borrowing cheaper. When rates are lower, businesses are more likely to invest in expansion, and consumers might feel more inclined to spend. This can lead to increased economic activity, which is something we all want to see.

As we analyze this statement, it’s essential to remember that interest rate cuts can also have various implications for different sectors of the economy. For instance, lower rates might benefit the housing market as mortgage rates drop, making homes more affordable for buyers. Additionally, sectors like technology and consumer goods often thrive in a low-interest environment because of increased consumer spending.

BULLISH FOR MARKETS!

The immediate reaction to Trump’s announcement has been a surge in market optimism. Investors often look for cues from influential figures, and Trump’s call for a rate cut has been interpreted as a signal that better times might be ahead. Financial markets thrive on certainty, and if investors believe that the Fed will take action to support the economy, they are more likely to invest.

However, it’s important to approach this news with a balanced perspective. While it’s easy to get caught up in the excitement surrounding potential rate cuts, it’s crucial to consider the broader economic context. The Federal Reserve will likely assess various factors before making a decision, including unemployment rates, wage growth, and overall economic stability. Investors should keep an eye on these indicators as they navigate their investment strategies.

Understanding CPI and Its Importance

The Consumer Price Index is a crucial economic indicator that reflects the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Understanding CPI is vital for making informed financial decisions. If the CPI shows an increase, it may indicate rising inflation, which can erode purchasing power. Conversely, a stable or declining CPI can signify a healthy economy.

For investors, CPI data can guide decisions on asset allocation. For instance, during periods of high inflation, investors might consider shifting towards assets that traditionally perform well in inflationary environments, such as real estate or commodities. On the other hand, in a low-inflation environment, equities might be more attractive due to their potential for growth.

The Federal Reserve’s Role in Economic Stability

The Federal Reserve, often referred to as the Fed, plays a crucial role in maintaining economic stability through its monetary policy decisions. When the economy shows signs of slowing down, the Fed can lower interest rates to encourage borrowing and spending. Conversely, if inflation rises too quickly, the Fed may increase rates to cool off the economy.

In light of Trump’s comments, many are curious about how the Fed will respond. Historically, the Fed has been cautious about making drastic changes to interest rates, especially in response to political statements. They rely on data and analysis to guide their decisions. Therefore, while Trump’s call for a rate cut may resonate with a segment of the market, it’s essential to consider that the Fed will make its decisions based on a comprehensive assessment of the economic landscape.

The Impact of Interest Rate Cuts on Various Sectors

Interest rate cuts can have a ripple effect across different sectors of the economy. Understanding these impacts can help investors make strategic decisions. Here are a few sectors that often react positively to lower interest rates:

- Real Estate: Lower mortgage rates can boost home sales and construction activity, benefiting real estate developers and homebuilders.

- Consumer Discretionary: Lower rates can lead to increased consumer spending, benefiting retail and hospitality sectors.

- Financials: While lower rates can compress bank margins on loans, an overall economic boost can lead to increased lending activity.

- Utilities: These companies often carry significant debt, and lower rates can reduce their financing costs, improving profitability.

Challenges and Risks Ahead

While the prospect of interest rate cuts might be exciting, it’s crucial to acknowledge the potential challenges and risks. For instance, if the Fed cuts rates too aggressively, it could lead to an overheating economy, resulting in higher inflation down the line. Additionally, if the rate cuts fail to stimulate economic activity, it could lead to increased skepticism among investors and further market volatility.

Another risk to consider is the global economic landscape. The interconnectedness of economies means that events in other countries can impact the U.S. economy. For example, if other major economies are struggling, it could dampen demand for U.S. exports, countering the positive effects of domestic rate cuts.

Staying Informed and Strategic in Investment Decisions

As we navigate this evolving economic landscape, staying informed is paramount. Investors should regularly review economic indicators, including CPI data, and monitor the Fed’s statements and actions. Following reliable financial news sources and analysis can provide insights into market trends and help shape investment strategies.

Moreover, it’s essential to have a diversified investment portfolio to mitigate risks. By spreading investments across various asset classes, investors can cushion against market volatility and position themselves for long-term growth.

Conclusion

Trump’s assertion that the CPI data looks good and his call for the Federal Reserve to cut rates by a full point has undoubtedly stirred the financial markets. While this news brings a sense of optimism, it’s vital to approach it with a balanced understanding of the broader economic context. The potential impacts on various sectors and the Fed’s cautious approach to monetary policy should guide investors in their decision-making processes. Remember, staying informed and strategic is key in today’s dynamic market environment.