Japanese Company Remixpoint Makes Bold Move, Acquires 50 Bitcoin Worth ¥793.9 Million, Holding over 925 BTC

Japanese public company, Remixpoint, cryptocurrency investment, significant Bitcoin purchase, 2025 financial strategy, digital asset acquisition, SEO-optimized transaction, high-search volume investment, blockchain technology integration, strategic investment decision.

—————–

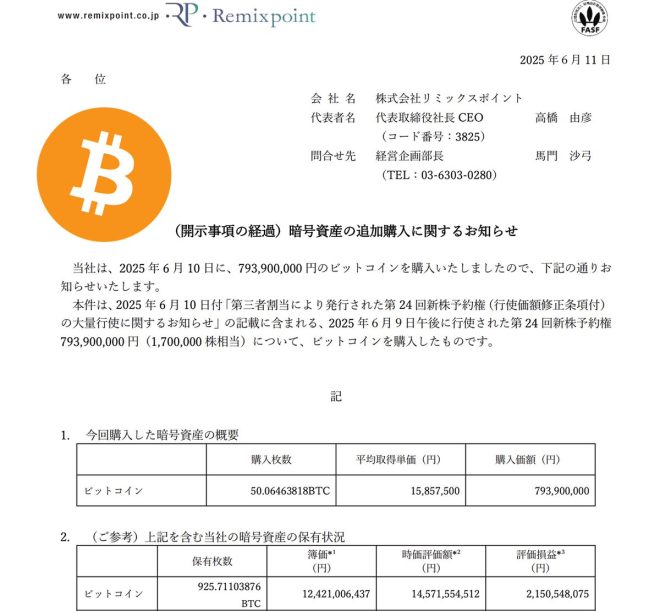

Japanese public company Remixpoint has made headlines by announcing its purchase of 50 Bitcoin for ¥793.9 Million. This move has increased their total Bitcoin holdings to over 925 BTC. The news was shared on Twitter by Bitcoin Magazine on June 11, 2025.

This acquisition by Remixpoint underscores the growing interest and adoption of Bitcoin by traditional financial institutions and public companies. As one of the largest cryptocurrencies in the world, Bitcoin has gained significant traction as a store of value and investment asset.

The decision to invest such a substantial amount in Bitcoin demonstrates Remixpoint’s confidence in the long-term potential of the cryptocurrency. With ongoing economic uncertainties and inflation concerns, many institutional investors are turning to alternative assets like Bitcoin to diversify their portfolios and hedge against market risks.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The purchase of Bitcoin by Remixpoint could also have a ripple effect on the cryptocurrency market, potentially influencing other companies to follow suit and increase their exposure to digital assets. As more mainstream institutions enter the crypto space, it could help legitimize and stabilize the market, driving further adoption and growth.

Overall, Remixpoint’s acquisition of Bitcoin signals a significant milestone in the mainstream acceptance of cryptocurrencies as a legitimate asset class. It also highlights the increasing role that Bitcoin and other digital assets are playing in the global economy, as traditional financial players recognize their value and potential for long-term investment.

JUST IN: Japanese public company Remixpoint announces it bought 50 #Bitcoin for ¥793.9 Million.

They now hold over 925 BTC pic.twitter.com/xY9VKtP9cC

— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

In a groundbreaking move, a Japanese public company, Remixpoint, has just announced a massive acquisition of 50 Bitcoins for ¥793.9 Million, bringing their total Bitcoin holdings to over 925 BTC. This news has sent shockwaves through the cryptocurrency world, solidifying Remixpoint’s position as a major player in the digital asset space.

The decision to invest such a significant amount in Bitcoin showcases Remixpoint’s confidence in the future of cryptocurrency. As the world becomes increasingly digital, many companies are looking to diversify their portfolios and hedge against traditional market volatility. Bitcoin, as the leading cryptocurrency, has proven to be a reliable store of value and a lucrative investment opportunity for those willing to take the plunge.

With this latest acquisition, Remixpoint joins a growing list of companies that have embraced Bitcoin as a legitimate asset class. From institutional investors to tech giants, more and more entities are recognizing the potential of cryptocurrencies to revolutionize the financial landscape.

But what exactly does this mean for the average investor? Well, for one, it highlights the growing mainstream acceptance of Bitcoin as a viable investment option. As more companies like Remixpoint enter the market, the overall legitimacy and stability of the cryptocurrency space are bolstered, paving the way for increased adoption and value appreciation.

Moreover, Remixpoint’s move could potentially signal a shift in how traditional financial institutions view cryptocurrencies. As more companies with public profiles invest in Bitcoin, it becomes harder for skeptics to dismiss digital assets as mere speculative instruments. Instead, cryptocurrencies are increasingly being seen as legitimate assets worthy of consideration in any well-rounded investment strategy.

For those who have been following the rise of Bitcoin, Remixpoint’s acquisition is a clear indicator of the cryptocurrency’s staying power. Despite periodic market fluctuations, Bitcoin has consistently demonstrated resilience and long-term growth potential. As more companies and individuals flock to the digital currency, its value is likely to continue on an upward trajectory.

In conclusion, Remixpoint’s purchase of 50 Bitcoins for ¥793.9 Million is a significant milestone in the ongoing evolution of the cryptocurrency market. It underscores the increasing mainstream acceptance of Bitcoin as a valuable asset and paves the way for further growth and adoption in the future. As more companies follow in Remixpoint’s footsteps, the cryptocurrency landscape is set to undergo a profound transformation, with Bitcoin leading the charge towards a more decentralized and digitized financial ecosystem.

Source: Bitcoin Magazine