Trump’s Shocking Move: Will 55% Tariffs on China Sink the U.S. Economy?

tariff impact on US economy, trade negotiations with China, consequences of high tariffs 2025

—————–

Understanding the Impact of trump‘s Tariffs on China

The recent announcement from former President Donald Trump regarding tariffs on Chinese goods has sparked intense debate and concern among economists and citizens alike. Trump’s strategy to implement 55% tariffs on Chinese imports has raised alarms about its potential consequences for the American economy. This summary aims to dissect the implications of these tariffs and the broader context of U.S.-China trade relations.

Background on Tariffs

Tariffs are taxes imposed on imported goods, intended to make foreign products more expensive and encourage consumers to buy domestic products. Trump previously initiated a trade war with China in 2018, introducing various tariffs to address trade imbalances and intellectual property theft. His latest announcement appears to be a continuation of this aggressive trade policy, with significantly higher tariffs that could have severe repercussions.

The Rationale Behind High Tariffs

Trump’s rationale for increasing tariffs to 55% on Chinese goods derives from his belief that it would compel China to negotiate fairer trade practices. By making imports more expensive, his administration aims to protect American manufacturers and jobs. However, the strategy raises questions about its feasibility and the potential backlash from both the Chinese government and American consumers.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Potential Economic Fallout

The proposed 55% tariff on Chinese goods is alarming for several reasons:

- Inflationary Pressure: Higher tariffs would likely lead to increased prices for a wide array of consumer goods, from electronics to clothing. This inflationary pressure could strain household budgets, especially for low- and middle-income families.

- Supply Chain Disruptions: Many American businesses rely on Chinese imports for raw materials and finished products. Sudden tariff increases could disrupt supply chains, leading to production delays and increased operational costs.

- Retaliation from China: History suggests that trade wars often provoke retaliatory measures. China may respond with tariffs on American goods, affecting industries such as agriculture, manufacturing, and technology, further escalating tensions between the two economic giants.

- Job Losses: While the intention behind tariffs is to protect American jobs, the reality is that many industries are globalized. Job losses in sectors reliant on Chinese imports could offset any gains in domestic manufacturing jobs.

The Political Landscape

Trump’s announcement comes amid a complex political landscape. As the 2024 election approaches, his policies resonate with a base that favors protectionism and prioritizes American interests over global trade agreements. However, there is growing concern among economists and political leaders about the long-term sustainability of such an approach.

Public Opinion and Economic Forecasts

Public opinion on tariffs is divided. While some Americans believe that tough measures against China are necessary to protect U.S. interests, others fear the long-term economic consequences. Economic forecasts suggest that a prolonged period of high tariffs could lead to a recession, as consumer spending decreases due to rising prices and uncertainty in the job market.

Conclusion

The implications of Trump’s proposed 55% tariffs on Chinese goods are multifaceted, impacting consumers, businesses, and the broader economy. While the intention may be to bolster American manufacturing and negotiate better trade terms, the potential for economic destabilization looms large. As we move forward, it will be crucial for policymakers to carefully weigh the benefits and risks associated with such aggressive trade tactics. The future of U.S.-China trade relations hangs in the balance, and the decisions made today will shape the economic landscape for years to come.

By understanding the complexities of tariffs and their potential fallout, we can better navigate the turbulent waters of international trade and work toward a more balanced economic future.

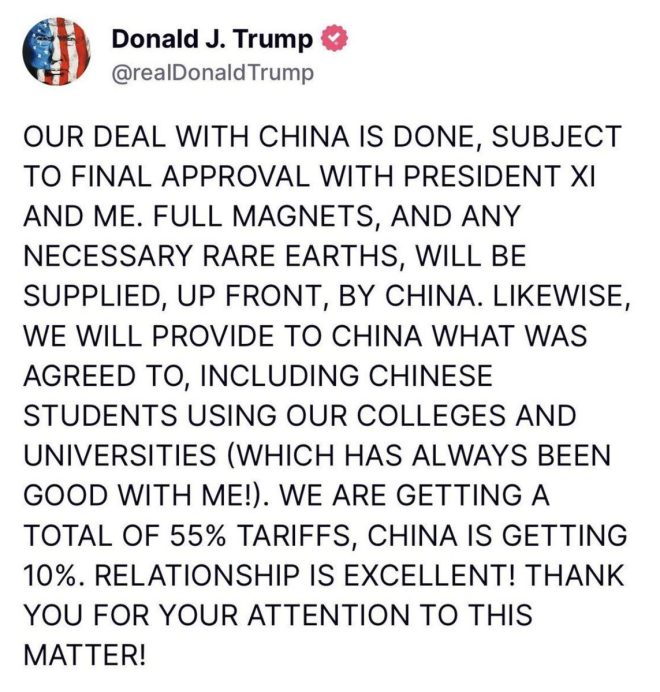

BREAKING: Trump just posted this.

So, Trump put tariffs on China, to reach and deal and keep the tariffs on China? 55% tariffs on Chinese goods is going to obliterate the American economy. pic.twitter.com/et5KLaDXae

— Ed Krassenstein (@EdKrassen) June 11, 2025

BREAKING: Trump just posted this.

If you’ve been following the latest news, you probably caught wind of the recent post by former President Donald Trump. His comments on tariffs—specifically, a staggering 55% tariff on Chinese goods—have sparked quite the conversation. Now, what does this mean for the American economy? Let’s dive into this situation and break it down.

So, Trump put tariffs on China, to reach and deal and keep the tariffs on China?

Tariffs have always been a hot topic, and Trump’s administration was known for its aggressive trade policy, particularly concerning China. In a nutshell, tariffs are taxes imposed on imported goods, making them more expensive. This is meant to encourage consumers to buy domestically produced items instead. But the question remains: Are these tariffs really effective?

Trump’s latest tweet has raised eyebrows. He seems to be suggesting that the tariffs are not just a means to an end but a permanent fixture in the trade landscape. The idea is that by imposing these high tariffs, he aims to leverage negotiations with China. However, one can’t help but wonder if such an enormous tariff rate could backfire.

According to an article from the *Brookings Institution*, tariffs can lead to higher prices for consumers and can strain supply chains. If a 55% tariff were implemented, we could see prices on a variety of goods soar, from electronics to clothing. This could ultimately lead to inflation, a situation that many consumers are already struggling with.

55% tariffs on Chinese goods is going to obliterate the American economy.

It’s hard to ignore the significant ramifications of a 55% tariff. In a world where the economy is already facing challenges due to various factors, this could be the tipping point. Experts warn that such high tariffs could indeed “obliterate” the American economy, as Ed Krassenstein suggests in his tweet. The term “obliterate” might feel hyperbolic, but let’s look at the facts.

When tariffs increase, the cost of imported goods goes up. This means that American consumers will have to pay more for everyday items. Imagine needing to replace your smartphone or buy a new pair of shoes. With a 55% tariff, those prices could skyrocket. A study by the *National Bureau of Economic Research* indicates that higher tariffs can lead to reduced consumer spending, which in turn can slow down economic growth.

Moreover, the manufacturing sector, which Trump often touts as a primary beneficiary of tariffs, may not fare as well as expected. Companies that rely on imported materials to produce their goods could face increased costs. According to *The Wall Street Journal*, this could lead to layoffs or even business closures, further exacerbating unemployment rates.

The potential backlash of high tariffs

Now, let’s consider the political implications. Tariffs are a double-edged sword. While they may appeal to certain voter bases, they can also alienate others. For instance, consumers who are already feeling the pinch from rising prices might not be too thrilled with the additional financial burden. This could influence how people vote in upcoming elections.

Furthermore, let’s not forget about international relations. High tariffs can lead to retaliatory measures from countries like China, which could impose their own tariffs on American goods. This tit-for-tat scenario can escalate into a trade war, a situation that many economists warn could have dire consequences for global trade.

In fact, a report from *The Economist* highlights how trade wars can disrupt international markets, leading to a decrease in global economic growth. This ripple effect can touch many aspects of daily life, from job stability to stock market performance.

What are the alternatives?

So, if high tariffs aren’t the answer, then what is? Economists often advocate for diplomatic negotiations over punitive measures. Instead of slapping high tariffs on imports, engaging in constructive dialogue with trade partners could yield better results.

For instance, trade agreements that promote fair practices might be more beneficial in the long run. According to the *Council on Foreign Relations*, these agreements can address issues like intellectual property theft and market access, which are often at the core of trade disputes.

Additionally, investing in domestic industries and workforce development can boost the economy without resorting to tariffs. Policies that support innovation, education, and infrastructure can create a more sustainable economic environment.

Consumer impact and the road ahead

As consumers, we need to be aware of how these policies affect our wallets. If tariffs go through, the immediate impact will be felt in store aisles and online shopping carts. Prices could rise, and choices could become limited.

Being informed is crucial. Keeping an eye on trade negotiations and legislation can help consumers understand how their purchasing power might be affected. We can advocate for policies that prioritize fair trade without punishing consumers and businesses alike.

In the end, it’s all interconnected. The economy is like a delicate web, where one change can affect countless others. As we watch this situation unfold, it’s essential to engage in discussions about trade, tariffs, and what they mean for our future.

In conclusion

While Trump’s announcement about tariffs on Chinese goods has generated a lot of buzz, it’s essential to think critically about the implications. A 55% tariff could disrupt the economy in significant ways, leading to higher prices and potential job losses.

Understanding the nuances of trade policy can empower consumers and voters. Engaging with these issues is crucial as we navigate the complexities of the global economy. As we look forward, let’s hope for solutions that foster growth, innovation, and fair practices rather than divisive measures that can harm us all.

Stay informed, stay engaged, and let’s see how this all unfolds.