Senator Lummis Sparks Controversy with Bold Demands for Bitcoin Tax Reform!

cryptocurrency legislation changes, digital currency tax regulation, blockchain asset compliance

—————–

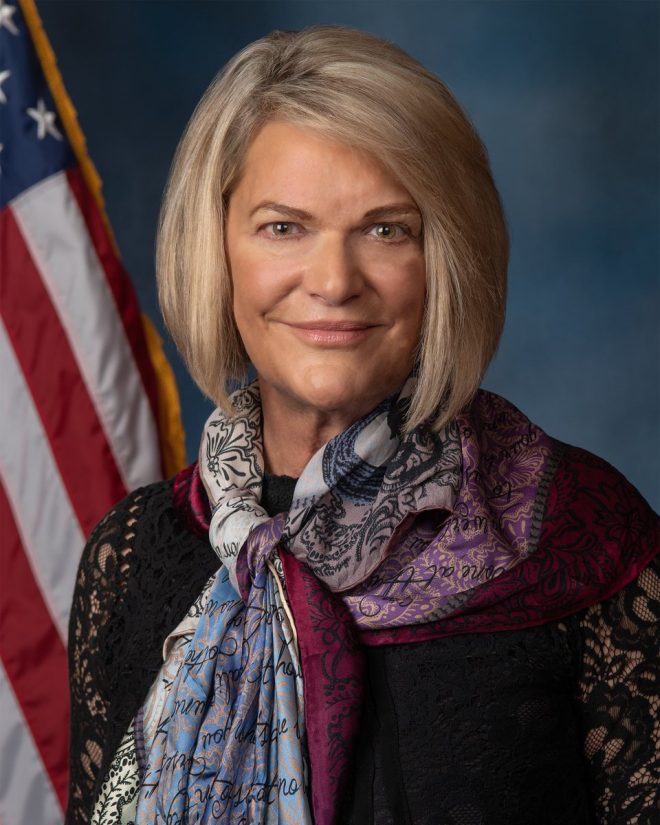

Senator Cynthia Lummis Demands Overhaul of Tax Laws Discriminating Against Bitcoin

Senator Cynthia Lummis has taken a strong stance against tax laws that she argues unfairly discriminate against Bitcoin and other digital assets. Her advocacy for reform is grounded in the belief that existing tax regulations inhibit the growth and widespread adoption of cryptocurrencies in the United States. Lummis is calling for a comprehensive review and revision of the current tax framework to better support the burgeoning crypto industry.

Key Issues with Current Crypto Taxation

In a recent tweet shared by Watcher.Guru, Senator Lummis stated, “Bitcoin and digital assets are being unfairly targeted because of flawed tax rules. We need crypto revisions.” This assertion underscores her commitment to addressing the complexities and challenges posed by the current taxation system. Presently, the IRS categorizes cryptocurrencies as property, meaning that capital gains tax is applied to any profits realized from buying and selling digital assets. This treatment has led to confusion among cryptocurrency users, who often find it cumbersome to navigate the intricacies of tax compliance related to their transactions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Need for Reform: Lummis’ Vision

Senator Lummis’ push for revisions to cryptocurrency tax laws reflects a broader initiative to create a more favorable regulatory environment for digital assets. She believes that by amending the current tax structure, barriers to cryptocurrency adoption can be lowered, thereby promoting innovation and investment within the sector. Lummis’ background as a senator from Wyoming, a state recognized for its crypto-friendly legislation, positions her uniquely to advocate for these changes effectively.

Impact on the Cryptocurrency Community

The cryptocurrency community is rallying around Lummis’ initiative, expressing support for her efforts to reform tax laws. Many stakeholders within the space contend that the existing regulations are outdated and do not accurately represent the dynamic nature of digital currencies. Lummis’ call to action has sparked a renewed sense of urgency among crypto enthusiasts, developers, and investors, encouraging them to advocate for reforms that will benefit the entire ecosystem.

Broader Implications for Blockchain Technology

Beyond her focus on tax laws, Senator Lummis has consistently championed the potential of blockchain technology to transform traditional industries. She emphasizes the importance of decentralized finance (DeFi) and smart contracts, arguing for increased government support to foster blockchain innovation. Lummis’ advocacy not only reflects her belief in the transformative power of digital assets but also highlights her commitment to ensuring that the United States remains a competitive player in this rapidly evolving landscape.

Conclusion: The Future of Cryptocurrency Taxation

Senator Cynthia Lummis’ demand for an overhaul of tax laws that unfairly target Bitcoin and digital assets represents a pivotal moment in the ongoing discourse surrounding cryptocurrency regulation. By pushing for changes to the current tax framework, Lummis aims to cultivate a more supportive environment for the crypto industry, ultimately positioning the United States as a leader in blockchain innovation. As the dialogue around tax revisions progresses, it is crucial for individuals and businesses within the cryptocurrency sector to remain engaged and informed. The outcome of these discussions could significantly influence the future landscape of digital assets and their role in the broader economy.

In summary, Senator Lummis’ efforts to revise cryptocurrency tax laws highlight a crucial development in the fight for fair treatment of digital assets. Her advocacy signifies a growing recognition of the importance of cryptocurrencies in the global financial system and a commitment to fostering an environment that promotes innovation and adoption.

Senator Cynthia Lummis demands overhaul of tax laws discriminating against Bitcoin.

Senator Cynthia Lummis Bitcoin tax reform, Crypto tax laws review, Digital assets taxation update

Senator Cynthia Lummis has recently spoken out against tax laws that she believes unfairly target Bitcoin and digital assets. Lummis argues that these assets are being treated unfairly due to flawed tax rules and is calling for revisions to the current system. She believes that the current tax laws are hindering the growth and adoption of cryptocurrencies and is advocating for changes to support the crypto industry.

In a tweet posted by Watcher.Guru, Senator Lummis is quoted as saying, “Bitcoin and digital assets are being unfairly targeted because of flawed tax rules. We need crypto revisions.” This statement highlights Lummis’ stance on the issue and her call to action for reform.

Lummis’ position on cryptocurrency taxation is significant as she is a vocal advocate for the crypto industry in the United States. As a senator from Wyoming, a state known for its crypto-friendly regulations, Lummis has been a strong supporter of digital assets and blockchain technology. Her push for revisions to the tax laws surrounding cryptocurrencies reflects her commitment to fostering innovation and growth in the industry.

The debate over the taxation of cryptocurrencies is a complex and evolving issue. Currently, the IRS treats cryptocurrencies as property for tax purposes, which means that capital gains tax is applied to any profits made from buying and selling digital assets. This has led to confusion and frustration among cryptocurrency users, who argue that the tax laws are outdated and do not accurately reflect the nature of digital currencies.

Lummis’ call for revisions to the tax laws targeting Bitcoin and digital assets is part of a larger effort to create a more favorable regulatory environment for the crypto industry. By advocating for changes to the tax rules, Lummis hopes to remove barriers to adoption and encourage innovation in the space. She believes that a more supportive regulatory framework will help drive growth and investment in cryptocurrencies, benefiting both individual users and the broader economy.

In addition to her work on tax laws, Lummis has been a strong proponent of blockchain technology and its potential to revolutionize various industries. She has highlighted the benefits of decentralized finance (DeFi) and smart contracts, and has called for greater government support for blockchain innovation. Lummis’ advocacy for the crypto industry reflects her belief in the transformative power of digital assets and her commitment to ensuring that the United States remains a leader in this emerging field.

Overall, Senator Cynthia Lummis’ call for revisions to tax laws targeting Bitcoin and digital assets is a significant development in the ongoing debate over cryptocurrency regulation. By pushing for changes to the current system, Lummis is working to create a more supportive environment for the crypto industry and to ensure that the United States remains at the forefront of blockchain innovation. Her efforts reflect a broader trend towards greater acceptance and adoption of digital assets, and highlight the growing influence of cryptocurrencies in the global economy.

JUST IN: Senator Cynthia Lummis calls to revise tax laws unfairly targeting Bitcoin and digital assets.

“Bitcoin and digital assets are being unfairly targeted because of flawed tax rules. We need crypto revisions.” pic.twitter.com/EK3hyfTUob

— Watcher.Guru (@WatcherGuru) June 10, 2025

In a recent development, Senator Cynthia Lummis has called for a revision of tax laws that unfairly target Bitcoin and digital assets. This move has sparked a debate within the cryptocurrency community and raised questions about the future of digital currencies in the United States.

The Issue at Hand: Unfair Taxation of Bitcoin and Digital Assets

Senator Lummis has highlighted the fact that Bitcoin and digital assets are being unfairly targeted due to flawed tax rules. This has created a challenging environment for individuals and businesses operating in the cryptocurrency space. The current tax laws make it difficult for individuals to accurately report their crypto transactions and comply with tax obligations.

The Need for Crypto Revisions: Addressing the Flaws in Tax Laws

Senator Lummis’s call for revisions to the tax laws governing Bitcoin and digital assets is a step in the right direction. By addressing the flaws in the current system, policymakers can create a more conducive environment for the growth and adoption of cryptocurrencies. Revising tax laws will not only provide clarity to individuals and businesses but also encourage innovation and investment in the crypto sector.

Impact on the Cryptocurrency Community: A Call to Action

The cryptocurrency community has been vocal in its support for Senator Lummis’s efforts to revise tax laws. Many believe that the current system is outdated and does not reflect the true nature of digital assets. By advocating for change, Senator Lummis has ignited a sense of urgency within the community to push for reforms that will benefit all stakeholders.

Looking Ahead: The Future of Bitcoin and Digital Assets

As discussions around tax revisions continue, it is important for the cryptocurrency community to stay informed and engaged in the process. By working together and advocating for change, individuals and businesses can help shape the future of Bitcoin and digital assets in the United States. With the right regulatory framework in place, cryptocurrencies can thrive and contribute to a more inclusive and innovative financial system.

In Conclusion

Senator Cynthia Lummis’s call to revise tax laws targeting Bitcoin and digital assets is a significant development that has sparked a much-needed conversation within the cryptocurrency community. By addressing the flaws in the current system, policymakers can create a more conducive environment for the growth and adoption of cryptocurrencies. As the debate continues, it is important for individuals and businesses to stay informed and engaged in shaping the future of Bitcoin and digital assets in the United States.

“Bitcoin and digital assets are being unfairly targeted because of flawed tax rules. We need crypto revisions.”

Senator Lummis Demands Overhaul of Biased Bitcoin Tax Laws

Senator Cynthia Lummis has recently stepped into the spotlight, advocating for significant changes to the tax laws that she believes unfairly target Bitcoin and other digital assets. This isn’t just a matter of numbers or spreadsheets for her; it’s about fostering an environment where innovation can thrive. Lummis argues that the current tax regulations are outdated and hinder the growth of the cryptocurrency sector, which is why she is rallying for reforms that will support the burgeoning crypto industry.

Senator Cynthia Lummis Bitcoin Tax Reform

In a recent tweet shared by Watcher.Guru, Lummis articulated her position clearly, stating, “Bitcoin and digital assets are being unfairly targeted because of flawed tax rules. We need crypto revisions.” This assertion is powerful, reflecting her commitment to reforming the system that she feels is stifling potential in the cryptocurrency market. As a senator representing Wyoming, a state known for its progressive stance on crypto regulations, Lummis has consistently been an advocate for digital assets and blockchain technology.

Lummis’s push for change comes at a critical time. The ongoing debate over how cryptocurrencies should be taxed is complex and often confusing. Currently, the IRS categorizes cryptocurrencies as property rather than currency. This classification means that any profit made from buying and selling digital assets is subject to capital gains tax, which can feel overwhelming for everyday users trying to navigate their tax obligations. Many in the crypto community argue that this approach is not only cumbersome but also fails to recognize the unique nature of digital currencies.

Crypto Tax Laws Review and Digital Assets Taxation Update

Senator Lummis’s call for revisions to the tax laws is part of a broader effort aimed at creating a favorable regulatory environment for cryptocurrencies. By advocating for changes, she hopes to dismantle the barriers that currently impede the adoption of digital currencies. Her vision is that a more supportive regulatory framework will drive investment and foster innovation, benefiting both individual users and the overall economy.

In her push for tax reform, Lummis is not just focused on high-level policy changes; she is also a strong proponent of blockchain technology itself. She sees the potential of decentralized finance (DeFi) and smart contracts to revolutionize various industries. By calling for greater government support for blockchain innovation, she aims to ensure that the United States remains a leader in this rapidly evolving field. Lummis’s advocacy is a testament to her belief in the transformative power of digital assets.

The Debate Over Cryptocurrency Taxation

The debate surrounding cryptocurrency taxation is a hot topic not only among lawmakers but also within the broader financial community. Many cryptocurrency users feel disenfranchised by existing tax laws, believing they do not accurately reflect the realities of how digital assets function. The current system has led to confusion, frustration, and even fear among users who want to comply with tax regulations but find them overly complicated.

Senator Lummis’s efforts to revise these laws are not just about making things easier for crypto enthusiasts; they also aim to align the law with the fast-paced growth of the digital asset market. The call for reform has sparked discussions across various sectors, encouraging individuals and businesses to engage in dialogues about how best to shape the future of cryptocurrency taxation.

Impact on the Cryptocurrency Community: A Call to Action

The response from the cryptocurrency community has been overwhelmingly positive. Many individuals and organizations support Lummis’s push for tax reform, viewing it as a critical step towards a more equitable and understanding regulatory environment. This collective voice has ignited a sense of urgency within the community, motivating stakeholders to advocate for changes that will benefit everyone involved.

As discussions surrounding tax revisions continue, staying informed and engaged is essential. The cryptocurrency community must unite to voice their opinions and push for reforms that reflect the true nature of digital assets. By working together, they can help ensure that the future of Bitcoin and other digital currencies is bright and promising.

Looking Ahead: The Future of Bitcoin and Digital Assets

The future of Bitcoin and digital assets hangs in the balance as discussions about tax reforms progress. The potential for cryptocurrencies to transform the financial landscape is immense, but how they are regulated will play a crucial role in shaping their trajectory. With leaders like Senator Lummis advocating for change, there is hope that the regulatory environment will evolve to promote growth and innovation.

As we look ahead, it is vital that individuals and businesses continue to engage in these conversations. By remaining active participants in the discussion, they can help influence the direction of cryptocurrency regulations, ensuring that the laws are not only fair but also conducive to growth.

In Conclusion

Senator Cynthia Lummis’s advocacy for revisions to tax laws targeting Bitcoin and digital assets is a significant and timely development. By addressing the flaws in the current system, she is paving the way for a more conducive environment for the growth and adoption of cryptocurrencies. As the debate unfolds, it is crucial for everyone involved in the cryptocurrency space to stay informed and engaged. The future of Bitcoin and digital assets depends on it.

JUST IN: Senator Cynthia Lummis calls to revise tax laws unfairly targeting Bitcoin and digital assets.

“Bitcoin and digital assets are being unfairly targeted because of flawed tax rules. We need crypto revisions.” pic.twitter.com/EK3hyfTUob

— Watcher.Guru (@WatcherGuru) June 10, 2025