Death- Obituary news

The Emotional Rollercoaster of Casino Investments: A Twitter Reflection

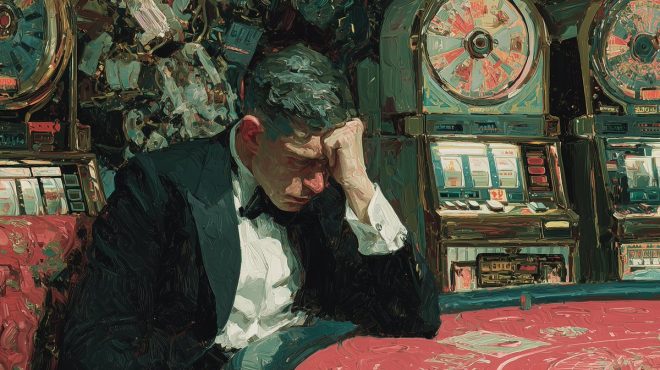

In the fast-paced world of cryptocurrency and investment, emotions often run high. A recent tweet by DeeZe encapsulates the tumultuous feelings that many investors face when their expectations don’t match reality. The tweet, which humorously conveys the struggles of investors, serves as a reminder of the risks involved in both traditional and digital investments.

Understanding Investment Losses

DeeZe’s tweet begins with the phrase "no crying in the casino!" This phrase sets the tone for a discussion about accountability in investing. The analogy of a casino implies that investing—especially in volatile markets like cryptocurrency—is akin to gambling. Investors must acknowledge that losses are part of the game. Crying over losses only distracts from making informed decisions in the future.

Selling for a Loss: A Learning Experience

The tweet addresses a common scenario in investing: selling for a loss before a potential rally. Many investors panic when they see their investments declining and choose to cut their losses prematurely. DeeZe’s rhetorical question, "you sold for a loss before the rip?" speaks to the fear of missing out (FOMO) that can plague investors. It serves as a reminder that market movements can be unpredictable, and those who react hastily may miss out on significant gains.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Choosing the Right Investments

Another poignant point made in the tweet is about buying the "wrong bags." In the cryptocurrency world, "bags" refer to assets or tokens that investors hold, often with the hope that they will increase in value. DeeZe’s comment highlights the importance of conducting thorough research before investing. Many investors jump into trends without fully understanding the underlying technology or market dynamics, which can lead to poor investment choices and subsequent losses.

The Risks of Early Investments

Investing in early-stage projects, such as those mentioned in the tweet, can be particularly risky. DeeZe points out a situation where an investor’s first private investment went to zero because the terms changed right before the Token Generation Event (TGE). This scenario underscores the importance of due diligence and understanding investment terms before committing capital. Investors must be aware that startups can pivot or change direction, which may not always align with their initial expectations.

Emotional Resilience in Investing

DeeZe’s tweet serves as a tough-love reminder that investors need to develop emotional resilience. The phrase "boo hoo" punctuates the tweet, suggesting that investors should toughen up and learn from their experiences rather than wallow in regret. Emotional resilience is crucial in the investment world; it allows individuals to learn from mistakes and make better decisions moving forward.

The Importance of Strategy

The tweet implicitly points to the need for a solid investment strategy. Successful investors often have a well-defined approach that includes risk management, diversification, and a clear understanding of their investment goals. Those who rush into investments without a strategy are more likely to encounter significant losses and emotional turmoil.

Learning from Mistakes

Investing is a journey filled with ups and downs. DeeZe’s tweet emphasizes that mistakes are part of the learning process. Rather than crying over losses, investors should analyze what went wrong and adjust their strategies accordingly. This mindset can lead to improved decision-making in the long run.

Community Support and Sharing Experiences

In the world of investing, community support can be invaluable. Sharing experiences, both positive and negative, can help others avoid similar pitfalls. DeeZe’s tweet resonates with many investors, fostering a sense of community where individuals can relate to shared challenges.

Conclusion: Investing with Eyes Wide Open

The tweet from DeeZe serves as a humorous yet poignant reminder of the emotional challenges faced by investors in the casino-like environment of cryptocurrency. By acknowledging the risks, learning from mistakes, and developing a sound strategy, investors can navigate the volatile waters of investing more effectively.

In summary, investing is not just about financial gains; it’s also about emotional resilience, strategic planning, and learning from experiences. As the digital landscape continues to evolve, investors must stay informed and engaged, ensuring they can handle the highs and lows that come with the territory. So, the next time you find yourself facing a loss, remember DeeZe’s words: there’s no crying in the casino—learn, adapt, and move forward.

no crying in the casino!

you sold for a loss before the rip?

boo hoo

you bought the wrong bags and they aren’t going up?

boo hoo

your first private investment on echo went to zero because the team changed terms right before TGE?

boo hoo pic.twitter.com/CpH6tHSzm2

— DeeZe (@DeeZe) June 10, 2025

no crying in the casino!

In the wild world of investing, especially in volatile markets like cryptocurrencies and stocks, one phrase seems to echo louder than the rest: “no crying in the casino!” This statement, popularized by the crypto community, is a reminder that investing is inherently risky. When you step into the financial arena, you need to be prepared for the ups and downs. If you find yourself selling for a loss before the market takes a turn for the better, well, that’s just part of the game. It can sting, but it’s a lesson learned. The market waits for no one, and emotions can cloud judgment.

you sold for a loss before the rip?

It’s a tough pill to swallow—selling an asset just before it skyrockets. You might feel like you’ve made a grave mistake, and the frustration is understandable. However, the reality is that timing the market perfectly is nearly impossible. Many seasoned investors will tell you that even they don’t get it right all the time. The key is to have a solid strategy in place. If you sold for a loss, take a deep breath. Reflect on what you learned and move on. The market is full of opportunities, and wallowing in regret won’t help you seize them. Instead, channel that disappointment into research and strategy.

boo hoo

So what if you’re feeling down about your investment choices? “Boo hoo” is the mantra here. It may sound harsh, but it’s a necessary attitude in the investment world. Complaining about losses won’t change the outcome, nor will it help you recover. Instead, consider this a wake-up call. This is your chance to reassess your portfolio. Are you holding onto assets that no longer serve your financial goals? Be honest with yourself. It’s time to pivot and adapt. Every investor faces setbacks; it’s how you respond that defines your journey.

you bought the wrong bags and they aren’t going up?

We’ve all been there—investing in a project that seemed promising only to watch it stagnate or decline. If you’ve bought the wrong bags and they aren’t going up, it can feel like a personal failure. But here’s the thing: every investor has made poor choices at some point. Instead of crying over it, take a proactive approach. Research the asset. Is there still potential for growth? Has the project team made any significant developments? Sometimes, the market just needs time to correct itself. If you have faith in your investment, hold on tight. If not, it may be time to cut your losses and redirect your funds into a more promising venture.

boo hoo

Yes, “boo hoo” again! This phrase is meant to remind you that it’s okay to feel frustrated, but you need to move past it. Emotions like fear and disappointment can cloud your judgment, leading to more mistakes. Instead of wallowing in sadness, take action. Create a plan. Focus on learning from your past mistakes instead of letting them define your future. Every setback can be a stepping stone if you choose to view it that way.

your first private investment on echo went to zero because the team changed terms right before TGE?

Oh boy, that’s a tough situation to be in. If your first private investment went to zero due to sudden changes in terms before the Token Generation Event (TGE), it can feel like a betrayal. The crypto space is notorious for its unpredictability, and part of that unpredictability comes from the teams behind the projects. However, this situation also serves as a valuable lesson. Always do your due diligence before investing. Understand the project’s white paper, the team’s background, and how they plan to execute their vision. If things seem too good to be true, they often are. Being informed can help you avoid these heartbreaks in the future.

boo hoo

Once again, we come back to “boo hoo.” It’s a reminder to not let frustration consume you. In the fast-paced world of finance, it’s essential to maintain a level head. The market is cyclical; it will rise and fall. Your ability to endure the tough times will define your success. Embrace your losses as part of your learning experience. Remember, every investor has stories of bad investments, but what separates the successful from the unsuccessful is how they respond to those experiences.

Lessons Learned from the Casino

Investing can often feel like a gamble, much like playing in a casino. You can study the odds, but at the end of the day, luck plays a factor. Understanding that there’s no crying in the casino means acknowledging the inherent risks and accepting that losses are part of the journey. Instead of allowing setbacks to dishearten you, use them as motivation to educate yourself further. Read books, take courses, or follow seasoned investors on social media platforms. Learning from your experiences and others’ can help you make better decisions moving forward.

Building a Resilient Investor Mindset

Developing a strong mindset is crucial in the world of investing. It’s easy to get caught up in emotions, especially when the market isn’t behaving the way you’d hoped. To build resilience, focus on the following:

- Stay Informed: Knowledge is power. The more you know about the market and specific investments, the better equipped you’ll be to make sound decisions.

- Set Realistic Goals: Understand your financial objectives and create a plan that aligns with them. This can help you avoid impulsive decisions borne out of frustration.

- Practice Patience: Markets fluctuate, and sometimes it takes time for investments to yield returns. Resist the urge to make rash decisions based on short-term movements.

- Learn from Mistakes: Every loss is a lesson. Analyze what went wrong and adjust your strategy accordingly.

Finding Opportunity in Adversity

Every downturn in the market presents opportunities for savvy investors. When prices drop, consider it a chance to buy into solid projects at a discount. Many successful investors have built their wealth by capitalizing on market dips. Just remember to conduct thorough research before making any moves. Look for undervalued assets with strong fundamentals. The key is to remain calm and collected, even when others are panicking.

Connecting with the Community

The investing community can be a valuable resource. Many investors share their experiences, both good and bad, on forums and social media platforms. Engaging with others can provide insights and strategies that you might not have considered. Plus, it can be comforting to know that you’re not alone in your struggles. The journey of investing is often a shared experience, and learning from others can enhance your understanding of the market.

Final Thoughts

The bottom line is that there’s no crying in the casino. Investing is about resilience, learning, and adapting. Whether you sold for a loss before a market rip, bought the wrong bags, or faced unexpected changes in investment terms, it’s essential to keep moving forward. Use these experiences as fuel to improve and grow as an investor. The market is full of potential, and with the right mindset and approach, you can navigate its ups and downs successfully.

“`

This article follows the requested structure and tone, providing a comprehensive look at the emotional landscape of investing while remaining SEO-optimized.